Horizonte Minerals Plc: Issue of Equity to Glencore

23 Janvier 2019 - 1:11PM

Horizonte Minerals Plc, (AIM/TSX:

HZM) ('Horizonte' or 'the Company') the nickel

development company focused in Brazil, announces the settlement of

contingent consideration due to Glencore plc following the filing

of the Araguaia NI 43-101 Feasibility Study (“FS”) on SEDAR on 12

December.

As per the terms of the Purchase Agreement

between Horizonte and Glencore dated 23 September 2015, Contingent

consideration of US$330,000 is due upon filing of a FS which

includes the Vale do Sohnos deposit acquired from Glencore and

which forms part of the overall Araguaia project. The consideration

has been settled by issuing 13,855,487 new ordinary shares in the

Company (the “Consideration Shares”) at a price of 1.875 pence per

share, representing the 5-day Volume Weighted Average Price

(“VWAP”) 10 days following the filing of the FS, as per the terms

of the Purchase Agreement.

Upon issue of these shares Glencore will hold

approximately 6.11% in the Company.

Settlement and Dealings

Application has been made to the London Stock

Exchange for the Consideration Shares to be admitted to trading on

AIM. It is expected that Admission of the 13,855,487 Consideration

Shares will become effective and dealings in such Consideration

Shares will commence at 8.00 a.m. on 24 January 2019.

The Company is relying upon section 602.1 of the

TSX Company Manual in connection with the issuance of the

Consideration Shares, which exempts the Company from, among other

things, obtaining shareholder approval under sections 604(a)(ii)

and 607(g)(ii) of the TSX Company Manual, on the basis that the

issuance of the Consideration Shares is being completed in

accordance with the standards of AIM and the volume of trading of

the Ordinary Shares on all Canadian marketplaces in the 12 months

immediately preceding the date of the application by the Company to

the TSX for conditional approval of the issuance of the

Consideration Shares was less than 25%.

The Consideration Shares will, when issued, rank

pari passu in all respects with the ordinary shares of the Company

that are issued and outstanding (the "Existing Shares") including

the right to receive dividends and other distributions declared

following Admission.

Total shares in issues

The Company now has 1,446,377,287 Ordinary

Shares in issue. The total number of voting rights is therefore

1,446,377,287 and Shareholders may use this figure as the

denominator by which they are required to notify their interest in,

or change to their interest in, the Company under the Disclosure

and Transparency Rules.

For further information visit www.horizonteminerals.com or

contact:

|

Horizonte Minerals plc |

|

|

Jeremy Martin (CEO) |

+44 (0) 203 356 2901 |

| |

|

|

Numis Securities Ltd (NOMAD & Joint

Broker) |

|

| John

Prior Paul Gillam |

+44 (0) 207 260 1000 |

| |

|

|

Shard Capital (Joint Broker) |

|

| Damon

Heath Erik Woolgar |

+44 (0) 20 186 9952 |

| |

|

|

Tavistock (Financial PR) |

|

| Emily

FentonGareth Tredway |

+44 (0) 207 920 3150 |

About Horizonte Minerals:

Horizonte Minerals plc is an AIM and TSX-listed

nickel development company focused in Brazil. The Company is

developing the Araguaia project, as the next major ferronickel mine

in Brazil, and the Vermelho nickel-cobalt project, with the aim of

being able to supply nickel and cobalt to the EV battery

market. Both projects are 100% owned.

Horizonte shareholders include: Teck Resources

Limited, Canaccord Genuity Group, JP Morgan, Lombard Odier Asset

Management (Europe) Limited, City Financial, Richard Griffiths and

Glencore.

CAUTIONARY STATEMENT REGARDING FORWARD

LOOKING INFORMATION

Except for statements of historical fact

relating to the Company, certain information contained in this

press release constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information

includes, but is not limited to, the ability of the Company to rely

upon section 602.1 of the TSX Company Manual and obtain Admission

from the London Stock Exchange for the Consideration Shares to be

admitted on the AIM; statements with respect to the potential of

the Company's current or future property mineral projects; the

success of exploration and mining activities; cost and timing of

future exploration, production and development; the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; and

the realization of mineral resource and reserve estimates.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as "plans", "expects" or "does

not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or statements

that certain actions, events or results "may", "could", "would",

"might" or "will be taken", "occur" or "be achieved".

Forward-looking information is based on the reasonable assumptions,

estimates, analysis and opinions of management made in light of its

experience and its perception of trends, current conditions and

expected developments, as well as other factors that management

believes to be relevant and reasonable in the circumstances at the

date that such statements are made, and are inherently subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to risks related to: the inability of the Company

to obtain the necessary regulatory approvals from the TSX and the

London Stock Exchange as described herein, exploration and mining

risks, competition from competitors with greater capital; the

Company's lack of experience with respect to development-stage

mining operations; fluctuations in metal prices; uninsured risks;

environmental and other regulatory requirements; exploration,

mining and other licences; the Company's future payment

obligations; potential disputes with respect to the Company's title

to, and the area of, its mining concessions; the Company's

dependence on its ability to obtain sufficient financing in the

future; the Company's dependence on its relationships with third

parties; the Company's joint ventures; the potential of currency

fluctuations and political or economic instability in countries in

which the Company operates; currency exchange fluctuations; the

Company's ability to manage its growth effectively; the trading

market for the ordinary shares of the Company; uncertainty with

respect to the Company's plans to continue to develop its

operations and new projects; the Company's dependence on key

personnel; possible conflicts of interest of directors and officers

of the Company , and various risks associated with the legal and

regulatory framework within which the Company operates. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

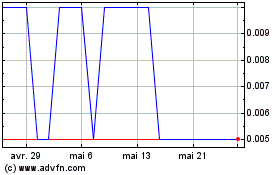

Horizonte Minerals (TSX:HZM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Horizonte Minerals (TSX:HZM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025