Horizonte Minerals Plc, (AIM: HZM, TSX: HZM)

(‘Horizonte’ or the ‘Company’) the nickel development company

focused in Brazil, announces its unaudited financial results for

the six months ended 30 June 2019 and the Management Discussion and

Analysis for the same period.

Both of the above have been posted on the

Company's website at www.horizonteminerals.com and are also

available on SEDAR at www.sedar.com.

Chairman’s Statement

The first six months of 2019 have seen continued

progress on both the Araguaia Ferronickel (“Araguaia”) and Vermelho

Nickel-Cobalt (“Vermelho”) projects, with both advancing in line

with our planned strategy of creating a platform for the

development of two world class projects and optionality to deliver

ferronickel product to the stainless steel market and nickel

sulphate and cobalt to the rapidly growing electric vehicle battery

market.

Araguaia FeNi project

Following on from the publication of the

Araguaia FS in October 2018 we began 2019 with a further positive

milestone, being the award of the construction licence for the

development of Araguaia. The award of the Construction Licence,

Licença de Instalação ("LI"), was granted by SEMAS, the Brazilian

Pará State Environmental Agency. The granting of the LI allows

Horizonte to construct the Araguaia rotary kiln electric furnace

("RKEF") processing plant and associated infrastructure and

represents a major de-risking step for the Araguaia project.

Subject to funding, Araguaia is now in a

position to commence construction with the necessary environmental

permits approved, including water abstraction permits issued in

April 2018 together with the newly issued LI.

The award of the LI was delivered on time and on

budget with the Horizonte team working closely with SEMAS, other

State agencies and the local communities. Consistent with our

objective to provide long-term sustainable value for our

shareholders, employees and communities, we developed integrated

solutions focused on environmental protection, water efficiency and

socio-economic development.

The first half of 2019 also saw the award of the

Energy Decree which guarantees Horizonte access to the national

grid with the required electrical energy demand for the commercial

ferronickel operation at Araguaia. This is another important

milestone as we move towards the implementation phase. The

availability of energy for mining projects is a risk in many

countries, and this Energy Decree guarantees the Company has access

to the national grid for the full-scale Stage 1 commercial

operation with nameplate capacity of 14,500 tonnes of nickel per

year.

Ongoing discussions continue with various

parties regarding the project financing of Araguaia and we are

pleased with the continued level of interest we have received from

a range of commercial banks and industry specialists regarding debt

and potential offtake and other non-equity sources of finance. The

remainder of 2019 will be spent continuing those discussions and

given the recent increase in nickel price we are optimistic that a

full finance package can be secured. We look forward to

updating the market with progress on the financing in due

course.

Vermelho Ni Co project

The focus on Vermelho since the start of the

year has been to advance the various work streams that feed into

the Pre-Feasibility Study (“PFS”).

Positive metallurgical test work undertaken on

Vermelho saprolite samples returned an average ferronickel grade of

31.8% nickel, which was of high quality, being low in trace

elements and meeting the commercial requirement of stainless-steel

manufacturers. This is a critical element for the success of

the project as it demonstrates the suitability of the conventional

Rotary Kiln Electric Furnace ("RKEF") for processing Vermelho

saprolite ore, thereby enabling the Vermelho resource to provide

high grade feed material for the RKEF plant at Araguaia.

Additional metallurgical test work on samples of

limonite ore produced high purity Cobalt Sulphate product

containing 21.8% cobalt, exceeding the reference grade used for

sulphate pricing. Nickel sulphate was also produced as a solution

ready for purification to final EV battery grade product.

These results confirm the suitability of the Pressure

Acid Leach ('PAL') Process and subsequent purification stages

for processing Vermelho limonite ore to produce high purity

cobalt and nickel sulphate suitable to supply the ever increasingly

important EV battery markets.

The production of high purity nickel and

cobalt sulphate from the Vermelho project of suitable quality and

grade for use in EV battery production is a key step in moving the

project forward. The Vermelho project is an additional significant

value driver for the Company. It is a high-grade scalable

resource, with good infrastructure and has the potential to be fast

tracked to development.

The successful completion of this sulphate test

work confirms that the PAL process flow sheet is suitable to treat

the Vermelho ore and when combined with the earlier successful RKEF

test work demonstrates that alternate process routes exist for the

project. This gives Horizonte considerable flexibility, which

combined with one of the largest undeveloped nickel resources

globally, makes the Vermelho-Araguaia nickel district a truly

exciting development opportunity.

Solid progress has been made on the PFS for

Vermelho and I am pleased to confirm that it is nearing completion

with the anticipation that the results of the study will be

announced later this quarter.

Nickel Market

As Horizonte has advanced both of its 100% owned

projects, nickel has continued to be the best performing metal on

LME this year and stands at around US$15,500/t Ni at the date of

this report. The long-term consensus pricing for Nickel remains

around $16,400/t Ni which shows some further upside to the current

price environment. There remains a significant concern amongst many

market commentators and end users of nickel regarding the future

availability of supply, especially with the anticipated widespread

adoption of Electric Vehicles and the impact this is likely to have

on already constrained nickel supplies. Wood Mackenzie forecast a

long-term incentive price of $21,400/t Ni, which represents the

price environment which would incentivise enough production to come

online to satisfy expected future demand.

It is worth reiterating that our FS for Araguaia

was undertaken at a conservative base case price assumption of

$14,000 /t Ni which demonstrated the robust nature of the project

and its ability to work at lower nickel prices. The backdrop of

rising prices positions your company very well with Araguaia’s

expansion case estimated to have an NPV of $1.1billion and an NPV

of 30% using $16,000/t Ni.

I would like to thank all of our stakeholders,

including shareholders, advisers, consultants and particularly our

team in both the UK and Brazil for their continued hard work at

what is set to be an exciting time for Horizonte. We look forward

to updating the market on progress on both of our world class

projects in the near future.

David Hall Chairman 13 August

2019

For further information, visit

www.horizonteminerals.com or contact:

|

Horizonte Minerals plc |

|

|

Jeremy Martin (CEO) / Simon Retter (CFO) |

+44 (0) 203 365 2901 |

|

|

|

|

Numis Securities Ltd (NOMAD & Joint

Broker) |

|

|

John Prior / Paul Gillam |

+44 (0) 207 260 1000 |

|

|

|

|

Shard Capital (Joint Broker) |

|

|

Damon Heath / Erik Woolgar |

+44 (0) 20 7186 9952 |

About Horizonte Minerals:

Horizonte Minerals plc is an AIM and TSX-listed

nickel development company focused in Brazil. The Company is

developing the Araguaia project, as the next major ferronickel mine

in Brazil, and the Vermelho nickel-cobalt project, with the aim of

being able to supply nickel and cobalt to the EV battery market.

Both projects are 100% owned.

Horizonte Minerals plc

Condensed Consolidated Interim Financial Statements for

the six months ended 30 June 2019

Condensed consolidated statement of comprehensive

income

| |

|

6 months ended30 June |

3 months ended30 June |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

|

|

Unaudited |

|

Unaudited |

|

Unaudited |

|

Unaudited |

|

|

|

Notes |

£ |

|

£ |

|

£ |

|

£ |

|

| Continuing

operations |

|

|

|

|

|

| Revenue |

|

- |

|

- |

|

- |

|

- |

|

| Cost of

sales |

|

- |

|

- |

|

- |

|

- |

|

| |

|

|

|

|

|

| Gross

profit |

|

- |

|

- |

|

- |

|

- |

|

| |

|

|

|

|

|

| Administrative expenses |

|

(968,917 |

) |

(785,348 |

) |

(450,930 |

) |

(494,155 |

) |

| Charge for share options

granted |

|

(237,171 |

) |

(294,706 |

) |

(107,178 |

) |

(181,031 |

) |

| Change in value of contingent

consideration |

|

192,201 |

|

(194,474 |

) |

(118,847 |

) |

(294,549 |

) |

| Gain/(Loss) on foreign

exchange |

|

(4,049 |

) |

92,798 |

|

52,192 |

|

137,972 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Loss from

operations |

|

(1,017,936 |

) |

(1,181,730 |

) |

(624,763 |

) |

(831,763 |

) |

| |

|

|

|

|

|

| Finance income |

|

33,791 |

|

21,875 |

|

20,840 |

|

16,249 |

|

| Finance

costs |

|

(146,837 |

) |

(140,322 |

) |

(73,589 |

) |

(68,703 |

) |

| |

|

|

|

|

|

| Loss before

taxation |

|

(1,130,982 |

) |

(1,300,177 |

) |

(677,512 |

) |

(884,217 |

) |

| |

|

|

|

|

|

|

Taxation |

|

- |

|

- |

|

- |

|

- |

|

| |

|

|

|

|

|

|

Loss for the year from continuing operations |

|

(1,130,982 |

) |

(1,300,177 |

) |

(677,512 |

) |

(884,217 |

) |

| |

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

| Items that may be

reclassified subsequently to profit or lossChange in value

of available for sale financial assets |

|

|

|

|

|

|

Currency translation differences on translating foreign

operations |

|

465,523 |

|

(4,055,213 |

) |

1,560,085 |

|

(2,948,200 |

) |

|

Other comprehensive income for the

period, net of tax |

|

465,523 |

|

(4,055,213 |

) |

1,560,085 |

|

(2,948,200 |

) |

| Total comprehensive

income for the period |

|

|

|

|

|

|

attributable to equity holders of the Company |

|

(665,459 |

) |

(5,355,390 |

) |

882,573 |

|

(3,832,417 |

) |

| |

|

|

|

|

|

| Earnings per share

from continuing operations attributable to the equity holders of

the Company |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted (pence per

share) |

9 |

(0.078 |

) |

(0.091 |

) |

(0.047 |

) |

(0.062 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

Condensed consolidated statement of financial

position

|

|

|

30 June 2019 |

|

31 December2018 |

|

|

|

|

Unaudited |

|

Audited |

|

|

|

Notes |

£ |

|

£ |

|

| Assets |

|

|

|

| Non-current

assets |

|

|

|

| Intangible assets |

6 |

37,484,232 |

|

35,737,901 |

|

| Property, plant &

equipment |

|

865 |

|

1,186 |

|

|

|

|

37,485,097 |

|

35,739,087 |

|

| Current

assets |

|

|

|

| Trade and other

receivables |

|

27,518 |

|

24,244 |

|

| Cash

and cash equivalents |

|

4,322,699 |

|

6,527,115 |

|

|

|

|

4,350,217 |

|

6,551,359 |

|

|

Total assets |

|

41,835,314 |

|

42,290,446 |

|

| Equity and

liabilities |

|

|

|

| Equity attributable to

owners of the parent |

|

|

|

| Issued capital |

7 |

14,463,773 |

|

14,325,218 |

|

| Share premium |

7 |

41,785,306 |

|

41,664,018 |

|

| Other reserves |

|

(1,574,468 |

) |

(2,039,991 |

) |

|

Accumulated losses |

|

(17,884,102 |

) |

(16,990,290 |

) |

|

Total equity |

|

36,790,509 |

|

36,958,955 |

|

|

Liabilities |

|

|

|

| Non-current

liabilities |

|

|

|

| Contingent consideration |

|

3,106,152 |

|

3,461,833 |

|

|

Deferred tax liabilities |

|

231,786 |

|

228,691 |

|

|

|

|

3,337,938 |

|

3,690,524 |

|

| Current

liabilities |

|

|

|

|

Trade and other payables |

|

294,764 |

|

280,175 |

|

|

Deferred consideration |

|

1,412,100 |

|

1,360,792 |

|

|

|

|

1,706,864 |

|

1,640,967 |

|

|

Total liabilities |

|

5,044,805 |

|

5,331,491 |

|

|

Total equity and liabilities |

|

41,835,314 |

|

42,290,446 |

|

| |

|

|

|

| |

|

|

|

Condensed statement of changes in shareholders’

equity

| |

Attributable to the owners of the parent |

|

|

Sharecapital£ |

|

Sharepremium£ |

|

Accumulatedlosses£ |

|

Otherreserves£ |

|

Total£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at 1 January 2018 |

13,719,343 |

|

40,422,258 |

|

(15,887,801 |

) |

988,015 |

|

39,241,815 |

|

| Comprehensive

income |

|

|

|

|

|

|

| Loss for the period |

- |

|

- |

|

(1,300,177 |

) |

- |

|

(1,300,177 |

) |

| Other comprehensive

income |

|

|

|

|

|

|

|

Currency translation differences |

- |

|

- |

|

- |

|

(4,055,213 |

) |

(4,055,213 |

) |

|

Total comprehensive income |

- |

|

- |

|

(1,300,177 |

) |

(4,055,213 |

) |

(5,355,390 |

) |

| Transactions with

owners |

|

|

|

|

|

|

| Issue of ordinary shares |

605,875 |

|

1,451,724 |

|

- |

|

- |

|

2,057,599 |

|

| Issue costs |

- |

|

(209,964 |

) |

- |

|

- |

|

(209,964 |

) |

| Share

based payments |

- |

|

- |

|

294,706 |

|

- |

|

294,706 |

|

| Total transactions

with owners |

605,875 |

|

1,241,760 |

|

294,706 |

|

- |

|

2,142,341 |

|

|

As at 30 June 2018 (unaudited) |

14,325,218 |

|

41,664,018 |

|

(16,893,272 |

) |

(3,067,198 |

) |

36,028,766 |

|

| |

|

|

|

|

|

|

| |

Attributable to the owners of the parent |

|

|

Sharecapital£ |

|

Sharepremium£ |

|

Accumulatedlosses£ |

|

Otherreserves£ |

|

Total£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at 1 January 2019 |

14,325,218 |

|

41,664,018 |

|

(16,990,291 |

) |

(2,039,991 |

) |

36,958,954 |

|

| Comprehensive

income |

|

|

|

|

|

|

| Loss for the period |

- |

|

- |

|

(1,130,982 |

) |

- |

|

(1,130,982 |

) |

| Other comprehensive

income |

|

|

|

|

|

|

|

Currency translation differences |

- |

|

- |

|

- |

|

465,523 |

|

465,523 |

|

|

Total comprehensive income |

- |

|

- |

|

(1,130,982 |

) |

465,523 |

|

(665,459 |

) |

| Transactions with

owners |

|

|

|

|

|

|

| Issue of ordinary shares |

138,555 |

|

121,288 |

|

- |

|

- |

|

259,843 |

|

| Issue costs |

- |

|

- |

|

|

|

- |

|

| Share

based payments |

|

|

|

237,171 |

|

|

237,171 |

|

| Total transactions

with owners |

138,555 |

|

121,288 |

|

237,171 |

|

- |

|

497,014 |

|

|

As at 30 June 2019 (unaudited) |

14,463,773 |

|

41,785,306 |

|

(17,884,102 |

) |

(1,574,468 |

) |

36,790,509 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statement of Cash

Flows

|

|

|

6 months ended30 June |

3 months ended30 June |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

|

|

Unaudited |

|

Unaudited |

|

Unaudited |

|

Unaudited |

|

| |

|

£ |

|

£ |

|

£ |

|

£ |

|

|

Cash flows from operating activities |

|

|

|

|

|

| Loss before taxation |

|

(1,130,982 |

) |

(1,300,177 |

) |

(677,512 |

) |

(884,217 |

) |

| Interest income |

|

(33,791 |

) |

(21,875 |

) |

(20,840 |

) |

(16,249 |

) |

| Finance costs |

|

146,837 |

|

140,322 |

|

72,589 |

|

68,703 |

|

| Exchange differences |

|

4,049 |

|

(92,798 |

) |

(52,192 |

) |

(137,972 |

) |

| Employee share options

charge |

|

237,171 |

|

294,706 |

|

107,178 |

|

181,031 |

|

| Change in fair value of

contingent consideration |

|

(192,201 |

) |

194,474 |

|

118,847 |

|

294,549 |

|

|

Depreciation |

|

- |

|

- |

|

- |

|

- |

|

| Operating loss before

changes in working capital |

|

(968,918 |

) |

(785,348 |

) |

(450,931 |

) |

(494,155 |

) |

| Decrease/(increase) in trade

and other receivables |

|

(3,275 |

) |

(42,799 |

) |

10,840 |

|

8,706 |

|

|

(Decrease)/increase in trade and other payables |

|

26,406 |

|

(297,071 |

) |

23,616 |

|

(19,078 |

) |

|

Net cash outflow from operating activities |

|

(945,787 |

) |

(1,125,218 |

) |

(416,475 |

) |

(504,527 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

| Purchase of intangible

assets |

|

(1,289,208 |

) |

(1,285,340 |

) |

(621,873 |

) |

(661,440 |

) |

| Proceeds from sale of

property, plant and equipment |

|

- |

|

- |

|

- |

|

- |

|

|

Interest received |

|

33,791 |

|

21,875 |

|

20,840 |

|

16,249 |

|

|

Net cash used in investing activities |

|

(1,255,417 |

) |

(1,263,465 |

) |

(601,033 |

) |

(645,191 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

| Proceeds form issue of

ordinary shares |

|

- |

|

2,057,599 |

|

- |

|

- |

|

| Issue

costs |

|

- |

|

(209,965 |

) |

- |

|

- |

|

|

Net cash used in financing activities |

|

- |

|

1,847,634 |

|

- |

|

- |

|

| Net decrease in cash

and cash equivalents |

|

(2,201,204 |

) |

(541,049 |

) |

(1,017,508 |

) |

(1,149,719 |

) |

| Cash and cash equivalents at

beginning of period |

|

6,527,115 |

|

9,403,825 |

|

5,288,014 |

|

9,971,253 |

|

|

Exchange gain/(loss) on cash and cash equivalents |

|

(3,212 |

) |

106,896 |

|

52,192 |

|

148,138 |

|

|

Cash and cash equivalents at end of the

period |

|

4,322,699 |

|

8,969,672 |

|

4,322,699 |

|

8,969,672 |

|

Notes to the Financial Statements

1. General

information

The principal activity of the Company and its

subsidiaries (together ‘the Group’) is the exploration and

development of precious and base metals. There is no seasonality or

cyclicality of the Group’s operations.

The Company’s shares are listed on the

Alternative Investment Market of the London Stock Exchange (AIM)

and on the Toronto Stock Exchange (TSX). The Company is

incorporated and domiciled in the United Kingdom. The address of

its registered office is Rex House, 4-12 Regent Street, London SW1Y

4RG.

2. Basis of

preparation

The condensed consolidated interim financial

statements have been prepared using accounting policies consistent

with International Financial Reporting Standards and in accordance

with International Accounting Standard 34 Interim Financial

Reporting. The condensed interim financial statements should be

read in conjunction with the annual financial statements for the

year ended 31 December 2018, which have been prepared in accordance

with International Financial Reporting Standards (IFRS).

The condensed consolidated interim financial

statements set out above do not constitute statutory accounts

within the meaning of the Companies Act 2006. They have been

prepared on a going concern basis in accordance with the

recognition and measurement criteria of International Financial

Reporting Standards (IFRS). Statutory financial statements for the

year ended 31 December 2018 were approved by the Board of Directors

on 28 March 2019 and delivered to the Registrar of Companies. The

report of the auditors on those financial statements was

unqualified.

The condensed consolidated interim financial

statements of the Company have not been audited or reviewed by the

Company’s auditor, BDO LLP.

Going concern

The audited financial statements prepared as at

31 December 2018 include certain disclosures in note 2.4 regarding

a material uncertainty of the Group’s ability to continue as a

going concern. These disclosures remain pertinent and due to the

current operations on the Group not generating any revenues access

to additional funding sources maybe required within the next 12

months in order to continue operations.

The Directors have a reasonable expectation that

the Group has the ability to raise additional funds required in

order to continue in operational existence for the foreseeable

future and they therefore continue to adopt the going concern basis

of accounting in preparing these Financial Statements. However,

given the uncertainty surrounding the ability and likely timing of

securing such investment finance, the Directors are of the opinion

that there exists a material uncertainty that may cast significant

doubt on the Group and Parent Company’s ability to continue as a

going concern. The financial statements do not include the

adjustments that would result if the Group and Parent Company were

unable to continue as a going concern.

Risks and uncertainties

The Board continuously assesses and monitors the

key risks of the business. The key risks that could affect the

Group’s medium term performance and the factors that mitigate those

risks have not substantially changed from those set out in the

Group’s 2018 Annual Report and Financial Statements, a copy of

which is available on the Group’s website:

www.horizonteminerals.com and on Sedar: www.sedar.com The key

financial risks are liquidity risk, foreign exchange risk, credit

risk, price risk and interest rate risk.

Critical accounting

estimates

The preparation of condensed consolidated

interim financial statements requires management to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the end of the reporting period. Significant items subject to such

estimates are set out in note 4 of the Group’s 2018 Annual Report

and Financial Statements. The nature and amounts of such estimates

have not changed significantly during the interim period.

3. Significant accounting

policies

The condensed consolidated interim financial

statements have been prepared under the historical cost convention

as modified by the revaluation of certain of the subsidiaries’

assets and liabilities to fair value for consolidation

purposes.

The same accounting policies, presentation and

methods of computation have been followed in these condensed

consolidated interim financial statements as were applied in the

preparation of the Group’s Financial Statements for the year ended

31 December 2018.

4. Segmental

reporting

The Group operates principally in the UK and

Brazil, with operations managed on a project by project basis

within each geographical area. Activities in the UK are mainly

administrative in nature whilst the activities in Brazil relate to

exploration and evaluation work. The reports used by the chief

operating decision maker are based on these geographical

segments.

|

2019 |

UK |

|

Brazil |

|

Total |

|

|

|

6 months ended30 June 2019£ |

|

6 months ended30 June 2019£ |

|

6 months ended30 June 2019£ |

|

|

Revenue |

- |

|

- |

|

- |

|

| Administrative expenses |

(639,106 |

) |

(329,811 |

) |

(968,917 |

) |

| Profit on foreign

exchange |

(12,344 |

) |

8,295 |

|

(4,049 |

) |

|

(Loss) from operations per reportable segment |

(651,450 |

) |

(321,516 |

) |

(972,966 |

) |

|

Inter segment revenues |

- |

|

- |

|

- |

|

| Depreciation charges |

- |

|

- |

|

- |

|

| Additions and foreign exchange

movements to non-current assets |

- |

|

1,734,262 |

|

1,734,262 |

|

| Reportable segment assets |

3,435,042 |

|

38,400,272 |

|

41,835,314 |

|

| Reportable segment

liabilities |

4,595,902 |

|

448,902 |

|

5,044,804 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| 2018 |

UK |

|

Brazil |

|

Total |

|

|

|

6 months ended30 June 2018£(Restated) |

|

6 months ended30 June 2018£(Restated) |

|

6 months ended30 June 2018£(Restated) |

|

|

Revenue |

- |

|

- |

|

- |

|

| Administrative expenses |

(595,100 |

) |

(190,248 |

) |

(785,348 |

) |

| Profit/(Loss) on foreign

exchange |

134,070 |

|

(41,272 |

) |

92,798 |

|

|

(Loss) from operations per reportable segment |

(461,030 |

) |

(231,520 |

) |

(692,550 |

) |

|

Inter segment revenues |

- |

|

- |

|

- |

|

| Depreciation charges |

- |

|

- |

|

- |

|

| Additions and foreign exchange

movements to non-current assets |

- |

|

(1,319,706 |

) |

(1,319,706 |

) |

| Reportable segment assets |

8,933,086 |

|

32,867,781 |

|

41,800,867 |

|

| Reportable segment

liabilities |

5,209,572 |

|

562,529 |

|

5,772,101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

UK |

|

Brazil |

|

Total |

|

| |

3 months ended30 June 2019 |

|

3 months ended30 June 2019 |

|

3 months ended30 June 2019 |

|

|

|

£ |

|

£ |

|

£ |

|

|

Revenue |

- |

|

- |

|

- |

|

| Administrative expenses |

(310,048 |

) |

(140,882 |

) |

(450,930 |

) |

| Profit on foreign

exchange |

8,249 |

|

43,943 |

|

52,192 |

|

|

(Loss) from operations per |

(301,799 |

) |

(96,939 |

) |

(398,738 |

) |

|

reportable segment |

|

|

|

| Inter segment revenues |

- |

|

- |

|

- |

|

| Depreciation charges |

- |

|

- |

|

- |

|

| Additions and foreign exchange

movements to non-current assets |

- |

|

2,195,257 |

|

2,195,257 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2018 |

UK |

|

Brazil |

|

Total |

|

| |

3 months ended30 June 2018 |

|

3 months ended30 June 2018 |

|

3 months ended30 June 2018 |

|

|

|

£(Restated) |

|

£(Restated) |

|

£(Restated) |

|

|

Revenue |

- |

|

- |

|

- |

|

| Administrative expenses |

(419,003 |

) |

(75,152 |

) |

(494,155 |

) |

| Profit/(Loss) on foreign

exchange |

170,232 |

|

(32,260 |

) |

137,972 |

|

|

(Loss) from operations per |

(248,771 |

) |

(107,412 |

) |

(356,183 |

) |

|

reportable segment |

|

|

|

| Inter segment revenues |

- |

|

- |

|

- |

|

| Depreciation charges |

- |

|

- |

|

- |

|

| Additions and foreign exchange

movements to non-current assets |

- |

|

(1,721,480 |

) |

(1,721,480 |

) |

|

|

|

|

|

A reconciliation of adjusted loss from operations per reportable

segment to loss before tax is provided as follows:

|

|

6 months ended 30 June 2019 |

|

6 months ended 30 June 2018 |

|

3 months ended30 June 2019 |

|

3 months ended30 June 2018 |

|

|

|

£ |

|

£ |

|

£ |

|

£ |

|

| Loss from operations per

reportable segment |

(972,966 |

) |

(692,550 |

) |

(398,738 |

) |

(356,183 |

) |

| – Change in fair value of

contingent consideration |

192,201 |

|

(194,474 |

) |

(118,847 |

) |

(294,549 |

) |

| – Charge for share options

granted |

(237,171 |

) |

(294,706 |

) |

(107,178 |

) |

(181,031 |

) |

| – Finance income |

33,791 |

|

21,875 |

|

20,840 |

|

16,249 |

|

| – Finance costs |

(146,837 |

) |

(140,322 |

) |

(73,589 |

) |

(68,703 |

) |

|

Loss for the period from continuing operations |

(1,130,982 |

) |

(1,300,177 |

) |

(677,512 |

) |

(884,217 |

) |

| |

|

|

|

|

| |

|

|

|

|

5. Change in Fair Value of

Contingent Consideration

Contingent Consideration payable to Xstrata

Brasil Mineração Ltda.

The contingent consideration payable to Xstrata

Brasil Mineração Ltda has a carrying value of £3,106,152 at 30 June

2019 (30 June 2018: £3,461,833). It comprises US$5,000,000

consideration in cash as at the date of first commercial production

from any of the resource areas within the Enlarged Project area.

The key assumptions underlying the treatment of the contingent

consideration the US$5,000,000 are based on the current rates of

tax on profits in Brazil of 34% and a discount factor of 7.0% along

with the estimated date of first commercial production.

As at 30 June 2019, there was a finance expense

of £100,946 (2018: £97,826) recognised in finance costs within the

Statement of Comprehensive Income in respect of this contingent

consideration arrangement, as the discount applied to the

contingent consideration at the date of acquisition was

unwound.

The change in the fair value of contingent

consideration payable to Xstrata Brasil Mineração Ltda generated a

credit to profit or loss of £197,617 for the six months ended 30

June 2019 (30 June 2018: £112,928 ) due to changes in the exchange

rate of the functional currency in which the liability is

payable.

6. Intangible assets

Intangible assets comprise exploration and

evaluation costs and goodwill. Exploration and evaluation costs

comprise internally generated and acquired assets.

|

|

|

|

Exploration |

|

Exploration and |

|

|

|

| |

Goodwill |

|

licences |

|

evaluation costs |

|

Total |

|

|

|

£ |

|

£ |

|

£ |

|

£ |

|

| Cost |

|

|

|

|

|

|

|

|

| At 1 January 2019 |

226,757 |

|

6,130,295 |

|

29,380,849 |

|

35,737,901 |

|

| Additions |

- |

|

- |

|

1,277,722 |

|

1,277,722 |

|

| Exchange rate movements |

3,069 |

|

58,201 |

|

407,339 |

|

468,609 |

|

|

Net book amount at 30 June 2019 |

229,826 |

|

6,188,496 |

|

31,065,910 |

|

37,484,232 |

|

7. Share Capital and Share Premium

|

Issued and fully paid |

Number ofshares |

|

Ordinaryshares£ |

|

Sharepremium £ |

|

Total £ |

|

|

At 1 January 2019 |

1,432,521,800 |

|

14,325,218 |

|

41,664,018 |

|

55,989,236 |

|

|

At 30 June 2019 |

1,446,377,287 |

|

14,463,773 |

|

41,785,306 |

|

56,249,079 |

|

8. Dividends

No dividend has been declared or paid by the

Company during the six months ended 30 June 2019 (2018: nil).

9. Earnings per share

The calculation of the basic loss per share of

0.078 pence for the 6 months ended 30 June 2019 (30 June 2018 loss

per share: 0.091 pence) is based on the loss attributable to the

equity holders of the Company of £ (1,130,982) for the six month

period ended 30 June 2019 (30 June 2018: (£1,300,177)) divided by

the weighted average number of shares in issue during the period of

1,444,616,645 (weighted average number of shares for the 6 months

ended 30 June 2018: 1,429,509,162).

The calculation of the basic loss per share of

0.047 pence for the 3 months ended 30 June 2019 (30 June 2018 loss

per share: 0.062 pence) is based on the loss attributable to the

equity holders of the Company of £ (677,512) for the three month

period ended 30 June 2019 (3 months ended 30 June 2018: (£884,217)

divided by the weighted average number of shares in issue during

the period of 1,432,521,800 (weighted average number of shares for

the 3 months ended 30 June 2018: 1,432,521,800 ).

The basic and diluted loss per share is the

same, as the effect of the exercise of share options would be to

decrease the loss per share.

Details of share options that could potentially

dilute earnings per share in future periods are disclosed in the

notes to the Group’s Annual Report and Financial Statements for the

year ended 31 December 2018 and in note 10 below.

10. Issue of Share

Options

On 12 February 2019, the Company awarded

2,000,000 share options to leading members of the Brazilian

operations team. All of these share options have an exercise price

of 4.80 pence. One third of the options are exercisable from August

2019, one third from February 2019 and one third from August

2020.

On 30 May 2018, the Company awarded 38,150,000

share options to Directors and senior management. All of these

share options have an exercise price of 4.80 pence. One third of

the options are exercisable from 30 November 2018, one third from

31 May 2018 and one third from 30 November 2019.

On 30 May 2018, the Company awarded 1,500,000

share options to a consultant to the Company under the terms of the

prior year’s scheme. These options are exercisable immediately.

11. Ultimate controlling

party

The Directors believe there to be no ultimate

controlling party.

12. Related party

transactions

The nature of related party transactions of the

Group has not changed from those described in the Group’s Annual

Report and Financial Statements for the year ended 31 December

2018.

13. Events after the reporting

period

There are no events which have occurred after

the reporting period which would be material to the financial

statements.

Approval of interim financial

statements

These Condensed Consolidated Interim Financial

Statements were approved by the Board of Directors on 13 August

2019.

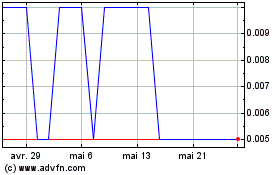

Horizonte Minerals (TSX:HZM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Horizonte Minerals (TSX:HZM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025