Intact Financial Corporation (TSX:IFC) (“Intact” or the “Company”)

announced today that it has entered into an agreement with a

syndicate of underwriters led by TD Securities Inc. together with

BMO Capital Markets, CIBC Capital Markets, National Bank Financial,

RBC Capital Markets and Scotiabank pursuant to which the

underwriters have agreed to purchase, on a bought deal basis,

4,000,000 Non-Cumulative Class A Shares, Series 11 (the “Series 11

Shares”) from Intact for sale to the public at a price of $25.00

per Series 11 Share (the “Offering Price”), representing aggregate

gross proceeds of $100 million (the “Offering”).

Intact has granted the underwriters an underwriters’ option to

purchase up to an additional 2,000,000 Series 11 Shares at the

Offering Price, which option is exercisable at any time up to 48

hours before closing of the Offering. Should the underwriters’

option be fully exercised, the total gross proceeds of the Offering

will be $150 million.

The Series 11 Shares will yield 5.25% per annum, payable

quarterly, as and when declared by the Board of Directors of the

Company. The Series 11 Shares will not be redeemable prior to

March 31, 2027. On and after March 31, 2027, Intact may, on

not less than 30 nor more than 60 days’ notice, redeem for cash the

Series 11 Shares in whole or in part, at the Company’s option, at

$26.00 per Series 11 Share if redeemed on or after March 31, 2027

and prior to March 31, 2028; $25.75 per Series 11 Share if redeemed

on or after March 31, 2028 and prior to March 31, 2029; $25.50 per

Series 11 Share if redeemed on or after March 31, 2029 and prior to

March 31, 2030; $25.25 per Series 11 Share if redeemed on or after

March 31, 2030 and prior to March 31, 2031; and $25.00 per Series

11 Share if redeemed on or after March 31, 2031, in each case

together with all declared and unpaid dividends up to but excluding

the date of redemption.

The Offering is expected to close on March 15, 2022. The

net proceeds are expected to be used by Intact to fund a portion of

the redemption price of all of the outstanding floating rate

restricted notes (approximately $445 million, based on current

exchange rates) of the Company’s subsidiary, RSA Insurance Group

Limited (formerly RSA Insurance Group plc) and/or for general

corporate purposes.

The Series 11 Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the “U.S.

Securities Act”), and may not be offered or sold in the United

States or to or for the account or benefit of U.S. persons absent

registration or an applicable exemption from the registration

requirements of the U.S. Securities Act. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy the Series 11 Shares in the United States or in any

other jurisdiction where such offer, solicitation or sale would be

unlawful.

About Intact Financial Corporation

Intact Financial Corporation (TSX: IFC) is the

largest provider of property and casualty (P&C) insurance in

Canada, a leading provider of global specialty insurance, and, with

RSA, a leader in the U.K. and Ireland. Our business has grown

organically and through acquisitions to over $20 billion of total

annual premiums.

In Canada, Intact distributes insurance under

the Intact Insurance brand through a wide network of brokers,

including its wholly-owned subsidiary BrokerLink, and directly to

consumers through belairdirect. Intact also provides affinity

insurance solutions through the Johnson Affinity Groups.

In the U.S., Intact Insurance Specialty

Solutions provides a range of specialty insurance products and

services through independent agencies, regional and national

brokers, and wholesalers and managing general agencies.

Outside of North America, the Company provides

personal, commercial and specialty insurance solutions across the

U.K., Ireland, Europe and the Middle East through the RSA

brands.

Media Inquiries: Kate Moseley-Williams Senior

Communications Advisor 416 341-1464 ext. 42515

kate.moseley.williams@intact.net

Investor Inquiries: Shubha Khan Vice President,

Investor Relations 416 341-1464 ext. 41004

shubha.khan@intact.net

Forward-Looking Statements

This press release contains forward-looking statements. When

used in this press release, the words "may", "will", "would",

"should", "could", "expects", "plans", "intends", "trends",

"indications", "anticipates", "believes", "estimates", "predicts",

"likely", "potential" or the negative or other variations of these

words or other similar or comparable words or phrases, are intended

to identify forward-looking statements. This press release contains

forward-looking statements with respect to, among other things, the

use of proceeds of the Offering and the anticipated closing of the

Offering. Unless otherwise indicated, all forward-looking

statements in this press release are made as of March 7, 2022 and

are subject to change after that date.

Forward-looking statements are based on estimates and

assumptions made by management based on management's experience and

perception of historical trends, current conditions and expected

future developments, as well as other factors that management

believes are appropriate in the circumstances. In addition to other

estimates and assumptions which may be identified herein, estimates

and assumptions have been made regarding, among other things, the

anticipated closing of the Offering and the expected use of the net

proceeds thereof. However, the completion of the Offering is

subject to customary closing conditions, termination rights and

other risks and uncertainties, and there can be no assurance that

the Offering will be completed within anticipated timeframes or at

all.

Many factors could cause the Company's actual results,

performance or achievements or future events or developments to

differ materially from those expressed or implied by the

forward-looking statements, including, without limitation, the

following factors: the timing and completion of the Offering.

All of the forward-looking statements included

in this press release are qualified by these cautionary statements,

those made in the section entitled "Risk Management" of the

Company's management's discussion and analysis of operating and

financial results for the year ended December 31, 2021 and those

that may be made in the prospectus supplement to be filed in

respect of the Offering. These cautionary statements are not

intended to represent a complete list of the factors that could

affect the Company. These cautionary statements should, however, be

considered carefully. Although the forward-looking statements are

based upon what management believes to be reasonable assumptions,

the Company cannot assure investors that actual results will be

consistent with these forward-looking statements. Investors should

not rely on forward-looking statements to make decisions, and

investors should ensure the preceding information is carefully

considered when reviewing forward-looking statements made in this

press release. The Company has no intention and undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

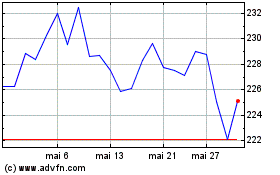

Intact Financial (TSX:IFC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Intact Financial (TSX:IFC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025