illumin Holdings Inc. (TSX: ILLM) (“illumin” or the “Company”), a

journey advertising technology company that empowers marketers to

make smarter decisions about communicating with online consumers,

today announced its financial results for the third quarter ended

September 30, 2023.

Third Quarter 2023

Highlights

- Third quarter 2023 revenue was

$29.6 million up 2.4% year-over-year, reflecting growth in our

self-serve business.

- illumin self-serve revenue was up

348% to $5.1 million, compared to $1.2 million in the year ago

period and represented 17% of total revenue, up from 16% in Q2

2023. Self-serve growth was driven by an increase in new customers

and platform utilization.

- The Company onboarded 33 net new

self-serve clients during the quarter, reflecting sales initiatives

targeting higher-spend clients and positioning the Company for

continued illumin self-serve revenue growth in Q4 2023.

- Third quarter 2023 gross margin was

47%, compared to 51% for the same period in 2022, reflecting

changes in both geographic mix and an increasing proportion of

self-service revenue.

- Net revenue or gross profit

(revenue less media costs) for the three months ended September 30,

2023 was $13.9 million, compared with $14.8 million in the same

quarter in the prior year.

- Adjusted EBITDA was $0.2 million

for the third quarter, compared to $1.6 million in the prior year

period, primarily due to ongoing strategic investments in R&D,

sales and marketing to support our growth as well as lower margin

revenue outside of North America.

- Q3 2023 net income was $0.8

million, compared to net income of $3.2 million in Q3 2022, the

decrease was primarily a result of lower Adjusted EBITDA and

foreign exchange impact due to a weakened US dollar compared to the

prior year period.

- At September 30, 2023, the Company

had cash and cash equivalents of $60 million, compared to $86

million as of December 31, 2022. This decrease was attributable to

positive cash flow from operations ($1.3 million), which was more

than offset by a combination of share repurchases ($14.6 million),

net loan repayments ($4.4 million), lease payments ($2.4 million),

and strategic investments in our business ($5.5 million).

- At the conclusion of the previously

announced substantial issuer bid (“SIB”) on August 31, 2023,

the Company repurchased 4.6 million of its outstanding common

shares at a purchase price of $2.65 per share for an aggregate

purchase price of approximately $12.2 million.

- On September 11, we voluntarily

delisted and ceased trading on the Nasdaq Capital Market. illumin’s

shares continue to be listed on the Toronto Stock Exchange under

the trading symbol “ILLM”.

- On October 26,

the Company announced the planned transition of its Chief Executive

Officer, Tal Hayek. Once a new CEO is appointed, Mr. Hayek will

transition from his current CEO role to that of Non-Executive Vice

Chairman on the Board of Directors of illumin.

Tal Hayek, Co-Founder and Chief Executive

Officer of illumin, stated, “During the third quarter, we generated

substantial year-over-year growth in illumin self-serve revenue. We

also continued to enhance the illumin brand by establishing a fully

integrated connection with Meta to provide new Facebook and

Instagram capabilities, allowing end-to-end Social Advertising, and

thereby providing marketers with additional connected journey

advertising intelligence.”

Mr. Hayek added, “We are encouraged by the

year-over-year growth generated by our illumin self-serve offering

and together with very positive and ongoing customer feedback, we

will look to refine our sales efforts and identify additional

strategic opportunities within the marketplace for this offering.

We have also bolstered our efforts aimed at signing long-term

self-serve contracts, including guaranteed revenue minimums with

terms greater than one year”.

“Finally, regarding my intention to transition

my role as a co-founder of illumin - I’m extremely proud of what we

have accomplished together with this incredibly talented team. We

have brought a revolutionary illumin journey advertising platform

to life. I am committed to working closely with the Board and my

eventual successor for a smooth transition and to ensure we take

the Company to the next level,” concluded Mr. Hayek.

Elliot Muchnik, illumin’s Chief Financial

Officer, commented, “In addition to sales growth, we achieved

positive Adjusted EBITDA in the quarter despite a challenging

macroeconomic environment. Moreover, our planned normal course

issuer bid (“NCIB”), following the completion of our SIB, shows our

unwavering belief in illumin’s potential.

In addition, the Company generated positive cash

from operations of $1.3 million for the nine months ended, an

improvement of $2.5 million from the prior year. This further

bolsters our exceptionally strong balance sheet and allows us to

continue investing in illumin’s future and to build upon our

market-leading status.”

The following table presents a

reconciliation of net income (loss) to Adjusted EBITDA for the

periods ended:

|

|

Three months ended |

Nine months ended |

| |

September 30, |

September 30, |

September 30, |

September 30, |

|

|

|

2023 |

|

2022(As restated) |

|

2023 |

|

2022(As restated) |

|

Net income (loss) for the period |

$ |

762 |

|

$ |

3,153 |

|

$ |

(8,409 |

) |

$ |

66 |

|

| Adjustments: |

|

|

|

|

|

Finance costs (income) |

|

(612 |

) |

|

158 |

|

|

(1,594 |

) |

|

430 |

|

|

Foreign exchange loss (gain) |

|

(1,666 |

) |

|

(5,836 |

) |

|

793 |

|

|

(7,228 |

) |

|

Depreciation and amortization |

|

1,433 |

|

|

1,125 |

|

|

4,372 |

|

|

3,527 |

|

|

Income tax expense (benefit) |

|

(1,413 |

) |

|

1,379 |

|

|

(1,177 |

) |

|

1,432 |

|

|

Share-based compensation |

|

1,571 |

|

|

1,544 |

|

|

4,584 |

|

|

4,606 |

|

|

Severance expenses |

|

119 |

|

|

116 |

|

|

367 |

|

|

398 |

|

|

Other expenses |

|

- |

|

|

- |

|

|

- |

|

|

79 |

|

| Total adjustments |

|

(568 |

) |

|

(1,514 |

) |

|

7,345 |

|

|

3,244 |

|

|

Adjusted EBITDA |

$ |

194 |

|

$ |

1,639 |

|

$ |

(1,064 |

) |

$ |

3,310 |

|

Conference Call Details:

Date: Thursday, November 9, 2023Time: 8:30AM Eastern Time

To register for the conference call webcast and presentation,

please visit

https://illumin.com/investor-information/earnings-call/

Please connect 15 minutes prior to the conference call to ensure

time for any software download that may be needed to hear the

webcast.

A recording of the conference call webcast will be available

after the call by visiting the Company’s website at

https://illumin.com/investor-information/

Non-IFRS Measures

This press release makes reference to certain

non-IFRS measures. These measures are not recognized measures under

IFRS, do not have a standardized meaning prescribed by IFRS, and

are therefore unlikely to be comparable to similar measures

presented by other companies. Rather, these measures are provided

as additional information to complement those IFRS measures by

providing further understanding of our results of operations from

management's perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of our

financial information reported under IFRS. We use non-IFRS measures

including “revenue less media costs”, “revenue less media costs

margin”, “Adjusted EBITDA” and “Adjusted Net Income (Loss)” (as

well as other measures discussed elsewhere in this press

release).

The term “revenue less media costs margin”

refers to the amount that “revenue less media costs” represents as

a percentage of total revenue for a given period, while the term

“revenue less media costs” refers to the net amount of revenue

after deducting direct media costs. Revenue less media costs is

used for internal management purposes as an indicator of the

performance of the Company’s solution in balancing the goals of

delivering excellent results to advertisers while meeting the

Company’s margin objectives and, accordingly, the Company believes

it is useful supplemental information.

“Adjusted EBITDA” refers to net income (loss)

after adjusting for finance costs (income), impairment loss, fair

value gain, income taxes, foreign exchange loss (gain),

depreciation and amortization, share-based compensation,

acquisition and related integration costs, severance expenses and

adjustments to the carrying value of investment tax credits

receivable. The Company believes that Adjusted EBITDA is useful

supplemental information as it provides an indication of the

results generated by the Company’s main business activities before

taking into consideration how those activities are financed and

taxed and prior to taking into consideration depreciation of

property and equipment and certain other items listed above. It is

a key measure used by the Company’s management and board of

directors to understand and evaluate the Company’s operating

performance, to prepare annual budgets and to help develop

operating plans.

“Adjusted Net Income (Loss)” refers to net

income (loss) after adjusting for non-cash items such as impairment

loss, fair value gain, depreciation and amortization, share-based

compensation, and foreign exchange loss (gain). The Company

believes that Adjusted Net Income (Loss) is useful supplemental

information as it provides an indication of the results generated

by the Company’s main business activities on a cash basis. It is

another key measure used by the Company’s management and board of

directors to understand and evaluate the Company’s operating

performance, to prepare annual budgets and to help develop

operating plans.

These non-IFRS measures are used to provide

investors with supplemental measures of our operating performance

and thus highlight trends in our business that may not otherwise be

apparent when relying solely on IFRS measures. We believe that

securities analysts, investors, and other interested parties

frequently use non-IFRS measures in the evaluation of issuers, and

that these non-IFRS measures are relevant to their analysis of the

Company.

About illumin:

illumin is a journey

advertising platform that enables marketers to reach consumers at

every stage of their journey by leveraging advanced machine

learning algorithms and real-time data analytics. The company’s

mission is to illuminate the path for brands to connect with their

customers through the power of data-driven advertising.

Headquartered in Toronto, Canada, illumin serves clients across

North America, Latin America, and Europe.

Disclaimer with regard to forward looking

statements

Certain statements included herein constitute

“forward-looking statements” within the meaning of applicable

securities laws. These statements may relate to the Company’s

future financial outlook, financial position, anticipated events,

results, success of its work from home policies, the Company’s

strategy with respect to the illumin platform. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management at this

time, are inherently subject to significant business, economic and

competitive uncertainties and contingencies. Many factors could

cause the Company’s actual results, level of activity, performance

or achievements or future events or developments to differ

materially from those expressed or implied by the forward-looking

statements, including, without limitation, the factors discussed in

the "Risk Factors" section of the Company's Annual Information Form

dated March 9, 2023 for the fiscal year ended December 31, 2022

(the "AIF") and the Company’s Management Discussion and Analysis

for the three and nine months ended September 30, 2023 dated

November 9, 2023 (the “MD&A”). A copy of the AIF, MD&A and

the Company's other publicly filed documents can be accessed under

the Company's profile on the System for Electronic Data Analysis

and Retrieval + ("SEDAR+") at www.sedarplus.ca and on the

Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”)

at www.sec.gov. The Company cautions that the list of risk factors

and uncertainties described in the AIF and the MD&A are not

exhaustive and other factors could also adversely affect its

results. Readers are urged to consider the risks, uncertainties,

and assumptions carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such

information.

Except as required by law, illumin does not

intend, and undertakes no obligation, to update any forward-looking

statement to reflect, in particular, new information or future

events.

For further information, please contact:

|

Steve HoseinInvestor Relations Coordinatorillumin Holdings

Inc.416-918-5647investors@illumin.com |

Babak PedramInvestor Relations – CanadaVirtus Advisory Group

Inc.416-646-6779bpedram@virtusadvisory.com |

David HanoverInvestor Relations – U.S.KCSA Strategic

Communications212-896-1220dhanover@kcsa.com |

Please note that the following

financial information is an extract from the Company’s Condensed

Interim Consolidated Financial Statements (unaudited) for the

three and nine months ended September 30, 2023 and 2022 (the

“Financial Statements”) provided for readers’

convenience and should be viewed in conjunction with the Notes to

the Financial Statements, which are an integral part of the

statements. The full Financial Statements and MD&A for the

period may be found by accessing SEDAR+ and EDGAR.

illumin Holdings Inc.Condensed Interim

Consolidated Statements of Financial Position(Unaudited; Expressed

in thousands of Canadian dollars)

|

|

|

September 30,2023 |

|

December 31,2022 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

59,823 |

|

$ |

85,941 |

|

Accounts receivable |

|

|

28,261 |

|

|

33,792 |

|

Income tax receivable |

|

|

2,405 |

|

|

848 |

|

Prepaid expenses and other |

|

|

5,947 |

|

|

3,153 |

|

|

|

|

|

|

|

|

|

|

96,436 |

|

|

123,734 |

|

Non-current assets |

|

|

|

|

|

Deferred tax asset |

|

|

449 |

|

|

449 |

|

Other assets |

|

|

275 |

|

|

248 |

|

Property and equipment |

|

|

9,171 |

|

|

7,117 |

|

Intangible assets |

|

|

8,186 |

|

|

5,229 |

|

Goodwill |

|

|

4,870 |

|

|

4,870 |

|

|

|

|

|

|

|

|

|

|

119,387 |

|

|

141,647 |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

| |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

24,873 |

|

|

26,545 |

|

Income tax payable |

|

|

215 |

|

|

43 |

|

Borrowings |

|

|

344 |

|

|

4,032 |

|

Lease obligations |

|

|

2,343 |

|

|

2,882 |

|

|

|

|

|

|

|

|

|

|

27,775 |

|

|

33,502 |

|

Non-current liabilities |

|

|

|

|

|

Borrowings |

|

|

79 |

|

|

191 |

|

Deferred tax liability |

|

|

1,035 |

|

|

1,060 |

|

Lease obligations |

|

|

6,561 |

|

|

3,768 |

|

|

|

|

|

|

|

|

|

|

35,450 |

|

|

38,521 |

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

83,937 |

|

|

103,126 |

|

|

|

|

|

|

|

|

|

|

119,387 |

|

|

141,647 |

illumin Holdings Inc.Condensed Interim

Consolidated Statements of Comprehensive Loss(Unaudited; Expressed

in thousands of Canadian dollars)For the three and nine months

ended September 30, 2023 and 2022

| |

Three months ended |

Nine months ended |

| |

|

2023 |

|

2022(As restated) |

|

2023 |

|

2022(As restated) |

| Revenue |

|

|

|

|

| Managed services |

$ |

17,268 |

|

$ |

20,425 |

|

$ |

54,344 |

|

$ |

54,338 |

|

| Self-service |

|

12,360 |

|

|

8,523 |

|

|

34,969 |

|

|

26,691 |

|

| |

|

|

|

|

| |

|

29,628 |

|

|

28,948 |

|

|

89,313 |

|

|

81,029 |

|

| |

|

|

|

|

| Media costs |

|

15,739 |

|

|

14,103 |

|

|

47,066 |

|

|

39,601 |

|

| |

|

|

|

|

| Gross

profit |

|

13,889 |

|

|

14,845 |

|

|

42,247 |

|

|

41,428 |

|

| |

|

|

|

|

| Operating

expenses |

|

|

|

|

| Sales and marketing |

|

6,336 |

|

|

5,904 |

|

|

19,023 |

|

|

16,746 |

|

| Technology |

|

4,471 |

|

|

4,244 |

|

|

14,937 |

|

|

11,765 |

|

| General and

administrative |

|

3,007 |

|

|

3,174 |

|

|

9,718 |

|

|

10,084 |

|

| Share-based compensation |

|

1,571 |

|

|

1,544 |

|

|

4,584 |

|

|

4,606 |

|

| Depreciation and

amortization |

|

1,433 |

|

|

1,125 |

|

|

4,372 |

|

|

3,527 |

|

|

|

|

|

|

|

|

|

|

16,818 |

|

|

15,991 |

|

|

52,634 |

|

|

46,728 |

|

|

|

|

|

|

|

| Loss from

operations |

|

(2,929 |

) |

|

(1,146 |

) |

|

(10,387 |

) |

|

(5,300 |

) |

| |

|

|

|

|

| Finance costs

(income) |

|

(612 |

) |

|

158 |

|

|

(1,594 |

) |

|

430 |

|

| Foreign exchange loss

(gain) |

|

(1,666 |

) |

|

(5,836 |

) |

|

793 |

|

|

(7,228 |

) |

| |

|

|

|

|

| |

|

(2,278 |

) |

|

(5,678 |

) |

|

(801 |

) |

|

(6,798 |

) |

| |

|

|

|

|

| Net income (loss)

before income taxes |

|

(651 |

) |

|

4,532 |

|

|

(9,586 |

) |

|

1,498 |

|

| |

|

|

|

|

| Income tax expense

(benefit) |

|

(1,413 |

) |

|

1,379 |

|

|

(1,177 |

) |

|

1,432 |

|

| |

|

|

|

|

| Net income (loss) for

the period |

|

762 |

|

|

3,153 |

|

|

(8,409 |

) |

|

66 |

|

| |

|

|

|

|

| Basic and diluted net

income (loss) per share |

|

0.01 |

|

|

0.05 |

|

|

(0.15 |

) |

|

0.00 |

|

|

|

|

|

|

|

| Other Comprehensive

Income (Loss) |

|

|

|

|

| Items that may be subsequently

reclassified to net income (loss): |

|

|

|

|

|

Exchange gain (loss) on translating foreign ops |

|

(681 |

) |

|

(224 |

) |

|

(734 |

) |

|

10 |

|

|

|

|

|

|

|

| Comprehensive income

(loss) for the period |

|

81 |

|

|

2,929 |

|

|

(9,143 |

) |

|

76 |

|

illumin Holdings Inc.Condensed Interim

Consolidated Statements of Cash Flows(Unaudited; Expressed in

thousands of Canadian dollars)For the nine months ended September

30, 2023 and 2022

| |

|

|

2023 |

|

|

2022(As restated) |

| Cash provided by (used

in) |

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

| Net income (loss) for the

period |

|

$ |

(8,409 |

) |

|

$ |

66 |

|

| |

|

|

|

|

| Adjustments to reconcile net

loss to net cash flows |

|

|

|

|

|

Depreciation and amortization |

|

|

4,372 |

|

|

|

3,527 |

|

|

Finance costs (income) |

|

|

(1,594 |

) |

|

|

430 |

|

|

Share-based compensation |

|

|

4,584 |

|

|

|

4,606 |

|

|

Foreign exchange loss (gain) |

|

|

793 |

|

|

|

(7,228 |

) |

|

Income tax benefit |

|

|

(1,177 |

) |

|

|

- |

|

| Change in non-cash operating

working capital |

|

|

|

|

|

Accounts receivable |

|

|

4,564 |

|

|

|

2,637 |

|

|

Prepaid expenses and other |

|

|

(2,086 |

) |

|

|

106 |

|

|

Other assets |

|

|

(25 |

) |

|

|

(361 |

) |

|

Accounts payable and accrued liabilities |

|

|

(1,813 |

) |

|

|

(4,296 |

) |

|

Income tax payable |

|

|

- |

|

|

|

(351 |

) |

| Income taxes received |

|

|

133 |

|

|

|

- |

|

| Interest received (paid),

net |

|

|

1,965 |

|

|

|

(328 |

) |

|

|

|

|

|

|

|

|

|

|

1,307 |

|

|

|

(1,192 |

) |

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

| Additions to property and

equipment |

|

|

(443 |

) |

|

|

(162 |

) |

| Additions to intangible

assets |

|

|

(5,072 |

) |

|

|

(2,650 |

) |

| |

|

|

|

|

| |

|

|

(5,515 |

) |

|

|

(2,812 |

) |

| |

|

|

|

|

| Financing

activities |

|

|

|

|

| Repayment of term loans |

|

|

(4,411 |

) |

|

|

(1,680 |

) |

| Proceeds from international

loans |

|

|

638 |

|

|

|

1,136 |

|

| Repayment of international

loans |

|

|

(647 |

) |

|

|

(1,407 |

) |

| Repayment of leases |

|

|

(2,411 |

) |

|

|

(1,535 |

) |

| Repurchase of common shares

for cancellation |

|

|

(14,637 |

) |

|

|

(13,000 |

) |

| Proceeds from the exercise of

stock options |

|

|

7 |

|

|

|

374 |

|

|

|

|

|

|

|

|

|

|

|

(21,461 |

) |

|

|

(16,112 |

) |

|

|

|

|

|

|

| Decrease in cash and

cash equivalents |

|

|

(25,669 |

) |

|

|

(20,116 |

) |

| |

|

|

|

|

| Impact of foreign

exchange on cash and cash equivalents |

|

|

(449 |

) |

|

|

6,141 |

|

| |

|

|

|

|

| Cash and cash

equivalents – beginning of period |

|

|

85,941 |

|

|

|

102,209 |

|

| |

|

|

|

|

| Cash and cash

equivalents – end of period |

|

|

59,823 |

|

|

|

88,234 |

|

| |

|

|

|

|

| Supplemental

disclosure of non-cash transactions |

|

|

|

|

| Additions to property and

equipment under leases |

|

|

4,710 |

|

|

|

3,809 |

|

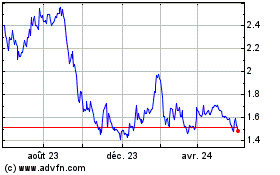

Illumin (TSX:ILLM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

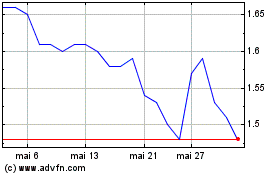

Illumin (TSX:ILLM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025