Kelt Reports Reserves at December 31, 2013, Provides Production

Update and Announces Non-Core Property Disposition

CALGARY, ALBERTA--(Marketwired - Feb 11, 2014) - Kelt

Exploration Ltd. ("Kelt" or the "Company") (TSX:KEL) has released

its reserves and operating results for the year ended December 31,

2013. A summary of results is as follows:

| Reserves |

|

|

Weighting |

|

|

Oil [mbbls] |

11,808 |

|

20% |

|

|

NGLs [mbbls] |

5,002 |

|

8% |

|

|

Gas [mmcf] |

254,329 |

|

72% |

|

|

Combined [MBOE] |

59,198 |

|

100% |

|

|

|

|

| Finding, development & acquisition ("FD&A")

costs |

|

|

Recycle Ratio |

|

|

Proved, including future development capital ("FDC") [$/BOE] |

$ 18.82 |

|

1.3 x |

|

|

Proved plus probable, including FDC [$/BOE] |

$ 13.23 |

|

1.8 x |

|

|

|

|

| Drilling Activity |

Gross Wells |

|

Net Wells |

|

|

Wells drilled |

19 |

|

12.1 |

|

|

Success rate |

100% |

|

100% |

|

|

|

|

| Land Holdings |

Gross Acres |

|

Net Acres |

|

|

Developed |

255,320 |

|

113,273 |

|

|

Undeveloped |

299,142 |

|

184,082 |

|

|

Total |

554,462 |

|

297,355 |

|

|

|

|

| 2013 Average Production |

Calendar year (365 days) |

|

Since commencement of active operations (308 days) |

|

|

Oil [bbls/d] |

516 |

|

611 |

|

|

NGLs [bbls/d] |

297 |

|

352 |

|

|

Gas [mmcf/d] |

18,888 |

|

22,384 |

|

|

Combined [BOE/d] |

3,961 |

|

4,694 |

|

|

|

|

| Q4 2013 Average Production |

|

|

Weighting |

|

|

Oil [bbls/d] |

809 |

|

14% |

|

|

NGLs [bbls/d] |

487 |

|

8% |

|

|

Gas [mmcf/d] |

26,660 |

|

78% |

|

|

Combined [BOE/d] |

5,739 |

|

100% |

|

|

|

|

|

P&NG Reserves |

|

P&NG Reserves |

|

discounted @ 8% |

|

discounted @ 10% |

| Net asset value [$M] |

$ 706,405 |

|

$ 640,905 |

| Fully diluted common shares outstanding [000's] |

114,069 |

|

114,069 |

|

|

Net asset value per share [$] |

$ 6.19 |

|

$ 5.62 |

Production

Kelt achieved production levels that exceeded its public

guidance. Average production for 2013 was 3,961 BOE per day (4,694

BOE per day for the 308 operating day period commencing on February

27, 2013) and production for the fourth quarter was 5,739 BOE per

day. After giving effect to the Pouce Coupe/Spirit River

acquisition that was completed on December 20, 2013, exit 2013

production was approximately 9,800 BOE per day (29% oil and NGLs

and 71% gas).

Reserves

Kelt retained Sproule Associates Limited ("Sproule"), an

independent qualified reserve evaluator to prepare a report on 100%

of its oil and gas reserves. The Company has a Reserves Committee

which oversees the selection, qualifications and reporting

procedures of the independent engineering consultants. Reserves as

at December 31, 2013 were determined using the guidelines and

definitions set out under National Instrument 51-101 ("NI

51-101").

At December 31, 2013, Kelt's proved plus probable reserves were

59.2 million BOE. The Company's net present value of proved plus

probable reserves at December 31, 2013, discounted at 10% before

tax, was $557.4 million. Forecasted commodity prices for 2014 used

to determine the present value of the Company's reserves were

US$94.65/bbl for WTI oil and CA$3.79/GJ for AECO gas. Forecasted

commodity prices for future years are shown in the table below.

The reserve life index for proved plus probable reserves was

13.9 years. At December 31, 2013, the weighting of proved plus

probable reserves was 20% oil, 8% NGLs and 72% gas.

The following table outlines a summary of the Company's reserves

at December 31, 2013:

| Summary of Reserves |

|

|

Oil [mbbls] |

NGLs [mbbls] |

Gas [mmcf] |

Combined [MBOE] |

|

Proved Developed Producing |

4,500 |

1,082 |

75,873 |

18,228 |

|

Proved Developed Non-producing |

180 |

28 |

966 |

369 |

|

Proved Undeveloped |

1,990 |

1,531 |

78,857 |

16,664 |

|

Total Proved ("1P") |

6,670 |

2,641 |

155,696 |

35,260 |

|

Probable Additional |

5,138 |

2,361 |

98,633 |

23,938 |

|

Total Proved plus Probable ("2P") |

11,808 |

5,002 |

254,329 |

59,198 |

Future development capital ("FDC") expenditures of $219.6

million included in the reserve evaluation for total proved

reserves are expected to be spent as follows: $64.2 million in

2014, $89.5 million in 2015 and $41.9 million in 2016 and $24.0

million thereafter. FDC of $331.3 million included for proved plus

probable reserves are expected to be spent as follows: $114.1

million in 2014, $108.9 million in 2015, $75.4 million in 2016 and

$32.9 million thereafter.

The following table outlines FDC expenditures by major prospect

included in the December 31, 2013 reserve evaluation:

| FDC Expenditures |

|

|

2P FDC ($M) |

2P Gross Drills |

2P Net Drills |

|

Inga/Fireweed - Doig/Montney |

142,318 |

50 |

21.3 |

|

Karr - Montney |

60,869 |

8 |

8.0 |

|

Pouce Coupe - Montney |

113,210 |

15 |

15.0 |

|

Spirit River - Charlie Lake |

9,080 |

2 |

2.0 |

|

Other costs |

5,823 |

- |

- |

|

Total FDC Expenditures |

331,300 |

75 |

46.3 |

The WTI oil price during the years 2011 to 2013 were range bound

averaging between US$94.19 and US$97.98 per barrel. After a

precipitous decline in natural gas prices in 2012 during which

AECO-C averaged $2.30 per GJ, prices increased to average $2.97 per

GJ in 2013. Significantly higher prices have been realized to date

in 2014.

Sproule is forecasting WTI oil prices to average US$91.95 per

bbl over the next five years,7% higher than the average price of

US$85.65 per bbl over the past five years. For natural gas, AECO-C

natural gas prices are forecasted to average $4.16 per GJ over the

2014 to 2018 period, an increase of 25% from the average price of

$3.34 per GJ during the 2009 to 2013 period.

The following table outlines forecasted future prices that

Sproule has used in their evaluation of the Company's reserves at

December 31, 2013:

| Future Commodity Price Forecast |

|

|

WTI Cushing Crude Oil [US$/bbl] |

USD/CAD Exchange [US$] |

|

AECO-C Natural Gas [$/GJ] |

|

2014 |

94.65 |

0.940 |

|

3.79 |

|

2015 |

88.37 |

0.940 |

|

3.78 |

|

2016 |

84.25 |

0.940 |

|

3.79 |

|

2017 |

95.52 |

0.940 |

|

4.67 |

|

2018 |

96.96 |

0.940 |

|

4.75 |

|

Five Year Average |

91.95 |

0.940 |

|

4.16 |

The Company's net present value of proved plus probable

reserves, discounted at 10% before tax was $557.4 million. The

undiscounted future net cash flow, before tax, was $1.1

billion.

The following table is a net present value summary (before tax)

as at December 31, 2013:

| Net Present Value Summary (before tax) |

|

|

Undiscounted [$000's] |

NPV 5% BT [$000's] |

NPV 8% BT [$000's] |

NPV 10% BT [$000's] |

|

Proved Developed Producing |

379,455 |

306,367 |

275,300 |

258,152 |

|

Total Proved |

584,807 |

428,854 |

366,000 |

332,214 |

|

Total Proved plus Probable |

1,097,640 |

749,914 |

622,900 |

557,361 |

The Company's net present value of proved plus probable

reserves, discounted at 10% after tax was $437.2 million. The

undiscounted future net cash flow, after tax, was $860.3

million.

The following table is a net present value summary (after tax)

as at December 31, 2013:

| Net Present Value Summary (after tax) |

|

|

Undiscounted [$000's] |

NPV 5% AT [$000's] |

NPV 8% AT [$000's] |

NPV 10% AT [$000's] |

|

Proved Developed Producing |

323,689 |

265,704 |

240,800 |

226,993 |

|

Total Proved |

477,653 |

351,813 |

300,800 |

273,376 |

|

Total Proved plus Probable |

860,322 |

588,831 |

488,900 |

437,163 |

During 2013, the Company's capital expenditures (unaudited), net

of dispositions, resulted in proved plus probable reserve additions

of 60.6 million BOE, resulting in FD&A costs of $13.23 per BOE,

including FDC costs. Proved reserve additions in 2013 were 36.7

million BOE, resulting in FD&A costs of $18.82 per BOE,

including FDC costs.

During its first year of operations, Kelt has successfully added

high quality reserves at a low FD&A cost per BOE. This has been

primarily a result of the Company's successful exploration and

development drilling programs at Karr in Alberta and Inga in

British Columbia. At Karr, the Company is at an early stage in the

delineation and de-risking of a potential Montney oil (with

associated gas) multi-year development play.

At Inga, Kelt has participated with its partner in developing a

condensate-rich natural gas Doig resource play, and with recent

success, it appears to have extended the size of the resource on

the Company's southern land block. Also at Inga, Kelt, along with

its partner, has commenced exploration drilling on its Montney

lands where initial results have been encouraging.

In addition to its drilling program, Kelt completed a

significant acquisition in the Pouce Coupe and Spirit River area of

Alberta. The acquisition was completed on December 20, 2013 and the

Company has identified 136 gross (112 net) horizontal drilling

locations primarily targeting the Montney, Doig and Charlie Lake

formations. In the December 31, 2013 reserve evaluation, 17 gross

(17 net) horizontal locations are included in future development

capital in this area, leaving the Company with a significant

inventory of potential un-booked reserves.

The recycle ratio is a measure for evaluating the effectiveness

of a company's re-investment program. The ratio measures the

efficiency of capital investment. It accomplishes this by comparing

the operating netback per BOE to that years' reserve FD&A cost

per BOE. Using the operating netback for the December 20th to 31st,

2013 period, which would include operations from the assets

acquired at Pouce Coupe and Spirit River on December 20, 2013, the

proved plus probable recycle ratio was 1.8 times. As the Company

commences development of these acquired assets, it expects to have

a future recycle ratio in excess of 2.0 times.

Kelt's 2013 capital investment program resulted in net reserve

additions that replaced 2013 production by a factor of 25.4 times

on a proved basis and 42.0 times on a proved plus probable

basis.

The following table provides detailed calculations relating to

FD&A costs and recycle ratios for 2013:

|

|

Year ended December 31, 2013 |

|

1P Reserves |

|

|

Capital expenditures [$000's] [unaudited] |

329,143 |

|

Value of assets conveyed from Celtic Exploration Ltd. |

141,961 |

|

Change in FDC costs required to develop reserves [$000's] |

219,600 |

|

Total capital costs [$000's] |

690,704 |

|

Reserve additions, net [MBOE] |

36,705 |

|

FD&A cost, before FDC [$/BOE] |

8.97 |

|

FD&A cost, including FDC [$/BOE] |

18.82 |

|

Operating netback [$/BOE] [unaudited] [1] |

23.74 |

|

Recycle ratio - proved |

1.3 x |

|

|

|

|

2P Reserves |

|

|

Capital expenditures [$000's] [unaudited] |

329,143 |

|

Value of assets conveyed from Celtic Exploration Ltd. |

141,961 |

|

Change in FDC costs required to develop reserves [$000's] |

331,300 |

|

Total capital costs [$000's] |

802,404 |

|

Reserve additions, net [MBOE] |

60,643 |

|

FD&A cost, before FDC [$/BOE] |

5.43 |

|

FD&A cost, including FDC [$/BOE] |

13.23 |

|

Operating netback [$/BOE] [unaudited] [1] |

23.74 |

|

Recycle ratio - proved plus probable |

1.8 x |

[1] Operating netback is for the period from December 20, 2013

to December 31, 2013, as this period reflects production from the

Pouce Coupe/Spirit River acquisition that was completed on December

20, 2013.

Reserves Reconciliation

A reconciliation of Kelt's proved reserves is provided in the

table below:

| Proved Reserves |

|

|

|

Oil [mbbls] |

|

NGLs [mbbls] |

|

Gas [mmcf] |

|

Combined [MBOE] |

|

|

Balance, December 31, 2012 |

0 |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Extensions |

1,180 |

|

742 |

|

19,094 |

|

5,104 |

|

|

Infill drilling |

179 |

|

171 |

|

4,463 |

|

1,094 |

|

|

Discoveries |

82 |

|

20 |

|

348 |

|

160 |

|

|

Technical revisions |

0 |

|

0 |

|

0 |

|

0 |

|

|

Economic factors |

0 |

|

0 |

|

0 |

|

0 |

|

|

Acquisitions |

5,417 |

|

1,816 |

|

138,685 |

|

30,347 |

|

|

Dispositions |

0 |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Net additions |

6,858 |

|

2,749 |

|

162,590 |

|

36,705 |

|

|

|

|

|

|

|

|

|

|

|

|

2013 Production |

(188 |

) |

(108 |

) |

(6,894 |

) |

(1,445 |

) |

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2013 |

6,670 |

|

2,641 |

|

155,696 |

|

35,260 |

|

A reconciliation of Kelt's proved plus probable reserves is

provided in the table below:

|

Proved plus Probable Reserves |

|

|

|

|

|

|

|

|

|

|

Oil [mbbls] |

|

NGLs [mbbls] |

|

Gas [mmcf] |

|

Combined [MBOE] |

|

|

Balance, December 31, 2012 |

0 |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Extensions |

3,996 |

|

2,058 |

|

49,616 |

|

14,323 |

|

|

Infill drilling |

234 |

|

220 |

|

5,755 |

|

1,413 |

|

|

Discoveries |

113 |

|

28 |

|

480 |

|

221 |

|

|

Technical revisions |

0 |

|

0 |

|

0 |

|

0 |

|

|

Economic factors |

0 |

|

0 |

|

0 |

|

0 |

|

|

Acquisitions |

7,653 |

|

2,804 |

|

205,372 |

|

44,686 |

|

|

Dispositions |

0 |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Net additions |

11,996 |

|

5,110 |

|

261,223 |

|

60,643 |

|

|

|

|

|

|

|

|

|

|

|

|

2013 Production |

(188 |

) |

(108 |

) |

(6,894 |

) |

(1,445 |

) |

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2013 |

11,808 |

|

5,002 |

|

254,329 |

|

59,198 |

|

Net Asset Value

Kelt's net asset value per share at December 31, 2013 was $6.19

(P&NG reserves discounted at 8% BT) and $5.62 (P&NG

reserves discounted at 10% BT). Details of the calculation are

shown in the table below:

| Net Asset Value per Share |

|

|

NPV discounted @ 8% BT [$ 000's] |

|

NPV discounted @ 10% BT [$ 000's] |

|

Present value of P&NG reserves, discounted, before tax |

622,900 |

|

557,400 |

|

Undeveloped land |

63,384 |

|

63,384 |

|

Working capital surplus [1] [Unaudited] |

2,578 |

|

2,578 |

|

Proceeds from exercise of stock options |

17,543 |

|

17,543 |

|

Net asset value |

706,405 |

|

640,905 |

|

Diluted common shares outstanding (000's) |

114,069 |

|

114,069 |

|

Net asset value per share ($/share) |

6.19 |

|

5.62 |

[1] Working capital excludes assets held for sale and non-cash

items.

Non-core Property Disposition

On February 10, 2014, Kelt completed the disposition of non-core

and non-operated assets that were part of the assets included in

the acquisition that was completed on December 20, 2013 in

northwestern Alberta. The Company received proceeds of $20.0

million, before closing adjustments. Current net production from

these assets is estimated to be approximately 210 barrels per day

of oil. Proved reserves, as at December 31, 2013, were 500,500

barrels and proved plus probable reserves were 635,100 barrels.

Kelt had not assigned any future development capital or future

potential drilling locations to these assets.

Kelt will continue to seek optimization of its asset base by

building on its core properties and monetizing non-core assets.

Kelt remains optimistic about its future prospects. The Company

is opportunity driven and is confident that it can grow its

production base by building on its current inventory of development

projects and by adding new exploration prospects. Kelt will

endeavor to maintain a high quality product stream that on a

historical basis receives a superior price with reasonably low

production and transportation costs. In addition, the Company will

focus its exploration efforts in areas of multi-zone hydrocarbon

potential, primarily in west central Alberta and northeastern

British Columbia.

Advisory Regarding Forward-Looking Statements

This press release contains forward-looking statements and

forward-looking information within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "objective", "ongoing",

"may", "will", "project", "should", "believe", "plans", "intends"

and similar expressions are intended to identify forward-looking

information or statements. In particular, this press release

contains forward-looking statements concerning the timing of future

development capital expenditures and the extent of the size of

resource. Statements relating to "reserves" or "resources" are

deemed to be forward looking statements as they involve the implied

assessment, based on current estimates and assumptions that the

reserves and resources can be profitably produced in the

future.

Although Kelt believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Kelt cannot give any assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, the

failure to obtain necessary regulatory approvals for planned

operations and risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses; health, safety and

environmental risks; commodity price and exchange rate

fluctuations; and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures).

The forward-looking statements contained in this press release

are made as of the date hereof and Kelt does not undertake any

obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws. Please refer to Kelt's Annual Information Form

dated March 28, 2013 for additional risk factors relating to Kelt

which is available for viewing on www.sedar.com.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding Kelt's reasonable expectations as to the

anticipated results of its proposed business activities for the

periods indicated. Readers are cautioned that the financial outlook

may not be appropriate for other purposes.

Non-GAAP Measures

This document contains certain financial measures, as described

below, which do not have standardized meanings prescribed by GAAP.

As these measures are commonly used in the oil and gas industry,

the Company believes that their inclusion is useful to investors.

The reader is cautioned that these amounts may not be directly

comparable to measures for other companies where similar

terminology is used.

"Operating netback" is calculated by deducting royalties,

production expenses and transportation expenses from oil and gas

revenue. Operating netback is used by Kelt as a key measure of

performance and is not intended to represent operating profits nor

should it be viewed as an alternative to cash provided by operating

activities, profit or other measures of financial performance

calculated in accordance with GAAP. "Finding, development and

acquisition" or "FD&A" cost is the sum of capital expenditures

incurred in the period and the change in future development capital

required to develop reserves. FD&A cost per BOE is determined

by dividing current period net reserve additions into the

corresponding period's FD&A cost. "Recycle ratio" is a measure

for evaluating the effectiveness of a company's re-investment

program. The ratio measures the efficiency of capital investment by

comparing the operating netback per BOE to FD&A cost per

BOE.

"Net asset value per share" is calculated by adding the value of

petroleum and natural gas reserves, undeveloped land value, working

capital surplus and proceeds from exercise of stock options, and

dividing by the diluted number of common shares outstanding.

Measurements and Abbreviations

All dollar amounts are referenced in thousands of Canadian

dollars, except when noted otherwise. Where amounts are expressed

on a barrel of oil equivalent ("BOE") basis, natural gas volumes

have been converted to oil equivalence at six thousand cubic feet

per barrel and sulphur volumes have been converted to oil

equivalence at 0.6 long tons per barrel. The term BOE may be

misleading, particularly if used in isolation. A BOE conversion

ratio of six thousand cubic feet per barrel is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

References to oil in this discussion include crude oil and field

condensate. References to natural gas liquids ("NGLs") include,

pentane, butane, propane, and ethane. References to gas in this

discussion include natural gas and sulphur.

|

bbls |

Barrels |

| mbbls |

thousand barrels |

|

mcf |

thousand cubic feet |

| mmcf |

million cubic feet |

| MBOE |

thousand barrels of oil equivalent |

|

MMBTU |

million British Thermal Units |

|

AECO-C |

Alberta Energy Company "C" Meter Station of the Nova Pipeline

System |

|

WTI |

West

Texas Intermediate |

|

NYMEX |

New York Mercantile Exchange |

| $M |

thousand dollars |

| 1P |

proved reserves |

| 2P |

proved plus probable reserves |

| BT |

before tax |

| AT |

after tax |

| NPV |

net present value |

| P&NG |

petroleum and natural gas |

Kelt Exploration Ltd.David J. WilsonPresident and Chief

Executive Officer(403) 201-5340Kelt Exploration Ltd.Sadiq H.

LalaniVice President, Finance and Chief Financial Officer(403)

215-5310www.keltexploration.com

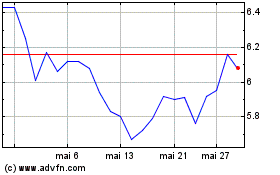

Kelt Exploration (TSX:KEL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Kelt Exploration (TSX:KEL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025