Logan International Reports First Quarter 2013 Results

09 Mai 2013 - 10:05PM

Marketwired Canada

Logan International Inc. (TSX:LII) ("Logan" or the "Company") today announced

the financial results for its first quarter of 2013. Revenues for the quarter

were $49.2 million as compared to revenues of $40.9 for the last year's first

quarter. Net earnings were $5.2 million, or $ 0.16 per diluted share, as

compared to $2.8 million, or $0.08 per diluted share, in last year's first

quarter. Modified EBITDA, as defined in the financial table below, increased to

$12.1 million in this year's first quarter from $8.5 million in last year's

first quarter.

The Company completed the acquisition of Xtend Energy Services Inc. ("Xtend")

effective March 1, 2012. Therefore, the first quarter report for 2012 includes

Xtend's operating results from the acquisition date.

Gerald Hage, Chief Executive Officer, stated, "We are pleased with the Company's

quarterly financial results. We are especially pleased with the increase in

Modified EBITDA because this is the metric we use most often to evaluate our

operating performance. In addition, each of our operating units contributed to

the positive comparison, except Logan Completion Systems ("LCS"). Despite a

slight industry slowing, we increased both revenues and Modified EBITDA. Logan

Oil Tools' increase in sales was produced, in part, by the increase in plant

capacity which was completed in 2012. Xtend improved its operating results as a

result of increased U.S. rental revenues. Increased international sales to

Algeria and Russia boosted Dennis Tool's quarterly operating results. Kline

Oilfield Equipment and Scope Production Developments continued to report

consistent sales and operating profits. Finally, the slow startup of Canadian

oilfield operations caused LCS's first quarter financial results to lag last

year's; however, we expect LCS to rebound in the second quarter as sales into

China and planned projects in the U.S. and Mexico will counterbalance the

"Spring Breakup" effect in Canada."

Recent highlights include:

-- Completion of the acquisition of Sup-R-Jar drilling jar product line on

April 17, 2013.

-- LCS successfully completed 6 wells in China and received firm orders for

an additional 42 wells to be completed in 2013.

-- Logan Oil Tools increased sales and reduced delivery times as a result

of the 2012 plant expansion.

Logan manufactures and sells a complete line of quality fishing and intervention

products including retrieving, surface, stroking and remedial tools for a

variety of well work-over, intervention, drilling and completion activities

(Logan Oil Tools, Inc.); provides proprietary multi-zonal completion technology

and conventional completion products and services (Logan Completion Systems

Inc.); manufactures and sells high performance polycrystalline diamond compact

cutters and bearings (Dennis Tool Company); manufactures and sells packers,

bridge plugs and other completion products (Kline Oilfield Equipment, Inc.);

provides proprietary and patented products and services that are focused on

production optimization in sand laden heavy oil wells (Scope Production

Development Ltd.); provides proprietary tools that enhance the effectiveness of

horizontal drilling (Xtend Energy Services Inc.); and rents drilling jars in

North America (Logan Jars, LLC). The common shares of Logan are traded on the

Toronto Stock Exchange under the ticker symbol "LII".

Selected Consolidated Financial Information

(in thousands of US dollars, except per share data)

Three month periods

ended

March 31,

--------------------------

2013 2012

--------------------------

Revenue $ 49,194 $ 40,894

Net earnings for the period 5,238 2,819

Earnings per share:

Basic $ 0.16 $ 0.08

Diluted $ 0.16 $ 0.08

EBITDA (1) $ 11,770 $ 6,805

Modified EBITDA (1) $ 12,139 $ 8,525

--------------------------

March 31, December 31,

2013 2012

--------------------------

Working Capital $ 81,082 $ 74,295

Total Assets $ 281,072 $ 275,976

Debt (2) $ 61,885 $ 60,192

Shareholders' Equity $ 179,759 $ 175,393

Note: The purchase of Xtend was completed on March 1, 2012 and, accordingly,

the Company's three month period ended March 31, 2012 operating results

included one month of Xtend.

(1) Management calculates: (a) EBITDA as earnings before net finance cost,

taxes, depreciation and amortization ("EBITDA"), and (b) Modified EBITDA

as EBITDA before acquisition accounting adjustments, transaction fees,

share-based compensation payments and severance costs. Neither of these

measurements should be considered an alternative to, or more meaningful

than, "net earnings from continuing operations" or "cash flow from

operating activities" as determined in accordance with International

Financial Reporting Standards ("IFRS") as an indicator of the Company's

financial performance. EBITDA and Modified EBITDA do not have

standardized definitions as prescribed by IFRS; therefore, the Company's

presentation of these measurements may not conform to similar

presentations by other companies. Management calculates EBITDA and

Modified EBITDA each period and evaluates the Company's operating

performance based on these measurements. Management believes that

Modified EBITDA, which eliminates significant non-cash or non-recurring

items of revenue or cost, more accurately presents the results of the

Company's ongoing operations and its ability to generate the cash

required to fund or finance future growth, acquisitions and capital

investments. A reconciliation of EBITDA and Modified EBITDA with net

earnings for each period follows.

Three month periods

ended

March 31,

------------------------

2013 2012

------------------------

Net earnings for the period $ 5,238 $ 2,819

Addbacks:

Depreciation and amortization 2,791 2,403

Finance cost, net 1,250 297

Income tax expense 2,491 1,286

------------------------

EBITDA 11,770 6,805

Adjustments:

Acquisition accounting adjustments - 354

Transaction fees 92 649

Share-based compensation payments 277 717

------------------------

Modified EBITDA $ 12,139 $ 8,525

------------------------

------------------------

EBITDA and Modified EBITDA are provided as measures of the Company's

operating performance without regard to financing decisions, share-based

compensation payments, age and cost of equipment used and income tax

impacts, all of which are factors that are not controlled at the operating

management level. The acquisition accounting adjustments reverse the effect

of the increase or step-up in cost basis of inventories acquired in a

business combination. The transaction fees include the professional and

other fees incurred in connection with acquisitions in 2012 and 2013. The

share-based compensation payments relate to expense recognized from stock

appreciation rights as well as the Company's stock option and restricted

share unit plans.

(2) Includes bank and other borrowed debt and capital leases.

Forward-Looking Statements

This press release contains forward-looking statements. These statements relate

to future events or future performance of Logan. When used in this press

release, the words "may", "would", "could", "will", "intend", "plan",

"anticipate", "believe", "estimate", "propose", "expect", "potential",

"continue", and similar expressions, are intended to identify forward-looking

statements. These statements involve known and unknown risks, uncertainties, and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. Such statements reflect

Logan's current views with respect to certain events and are subject to certain

risks, uncertainties and assumptions. Although Logan believes that the

expectations and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the forward-looking

statements because we can give no assurance that they will prove to be correct.

Many factors could cause Logan's actual results, performance, or achievements to

materially differ from those described in this press release. Readers are

referred to Logan's Annual Information Form for the year ended December 31, 2012

filed on www.sedar.com which identifies significant risk factors which could

cause actual results to differ from those contained in the forward-looking

statements. Should one or more risks or uncertainties materialize or should

assumptions underlying forward-looking statements prove incorrect, actual

results may vary materially from those described in this press release. The

forward-looking statements contained in this press release are expressly

qualified in their entirety by this cautionary statement. These statements speak

only as of the date of this press release. Logan does not intend and does not

assume any obligation, to update these forward-looking statements to reflect new

information, subsequent events or otherwise, except as required by law.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy the securities described herein in any jurisdiction.

For more information about Logan International Inc. please visit our website at

www.loganinternationalinc.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Logan International Inc.

Gerald Hage

Chief Executive Officer

403-930-6810 Calgary

832-386-2575 Houston

Logan International Inc.

Larry Keister

Chief Financial Officer

403-930-6810 Calgary

832-386-2534 Houston

www.loganinternationalinc.com

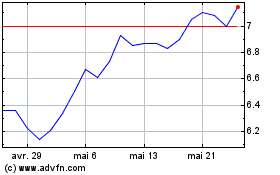

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024