Logan International Inc. (TSX:LII) ("Logan" or the "Company") today announced

the results of its third quarter ended September 30, 2013. Revenue in the third

quarter was $46.7 million as compared to $44.6 million in the prior year's third

quarter. Net earnings were $4.9 million or $.14 per diluted share in this year's

third quarter, as compared to $15.5 million or $.46 per diluted share in last

year's third quarter. In last year's third quarter, the Company recorded a gain

of approximately $11 million or $.33 per diluted share from the change in the

fair value of contingent consideration relating to the acquisition of Xtend

Energy Services Inc. ("Xtend"). This year's third quarter Modified EBITDA (a

non-GAAP measure) increased to $11.3 million from $10.7 million in last year's

third quarter. The increases in revenue and in Modified EBITDA are mostly

attributable to the operating performance of Logan Oil Tools, Xtend and Logan

SuperAbrasives, formerly known as Dennis Tool Company.

Logan recorded year to date revenue of $148.5 million in 2013 as compared to

$125.7 million in the corresponding period of last year and reported net

earnings of $14.9 million in 2013 or $.44 per diluted share, as compared to

$20.7 million or $.61 per diluted share in the corresponding period last year.

Current year-to-date Modified EBITDA was $36.6 million as compared to prior

year-to-date Modified EBITDA of $27.6 million.

The interim financial reports for the three and nine month periods ended

September 30, 2013 include the operating results of the Sup-R-Jar business,

which was acquired in April 2013. In addition, the interim financial reports for

the three and nine month periods ended September 30, 2012 include the

post-acquisition operating results of Xtend, which was acquired on March 1,

2012.

Logan's Chief Executive Officer Gerald Hage stated, "We are pleased to report

increases in our quarterly revenue and Modified EBITDA, despite a slight decline

in drilling rig activity in North America and a slower than expected recovery

from the Canadian break-up. Logan Oil Tools' quarterly sales and operating

profit both grew by approximately 8% from the prior year, mostly on the strength

of the Eagle Ford and Permian basins. Order flow continued at a steady pace

throughout the quarter. Xtend also recorded solid gains over the prior year

quarter as revenue increased by 7% and operating profit by over 10%. The

improvement in Xtend's quarterly performance was due mostly to continued gains

in the US. We are in the process of combining the Xciter tool and the Sup-R-Jar

under one sales and management team - we believe that these tools are very

complementary and will benefit from the combination. Logan Completion Systems

("LCS") recorded declines in revenue and operating profit for this year's

quarter as compared to last year. The declines were mostly due to adverse

weather conditions in Canada, a slower recovery from the Canadian break-up and

start-up costs incurred in the opening of the US location in Longview, Texas.

During the quarter, we also finalized a supply agreement with a Chinese service

company for the sale of completion products into China and we initiated

negotiations of a similar arrangement with a Russian service company. We expect

to close the Russian agreement in the fourth quarter. As we develop new

geographic markets, we may experience greater unevenness in our quarterly

revenue and profits as customer orders can be large. Combined operating results

for Kline Oilfield Equipment, Inc. ("Kline"), Logan SuperAbrasives and Scope

Production Developments included a slight improvement in operating profit,

despite a small decline in sales. During the quarter, Kline manufactured and

sold completion products, including packers and composite bridge plugs, to LCS,

providing not only a cost savings but also quality assurance. We also

reorganized certain manufacturing processes at Dennis Tool Company and changed

its name to Logan SuperAbrasives. Finally, we reduced total debt by over $3

million in the quarter. Looking to the fourth quarter, we expect to close the

year with another positive quarter, due to continued industry strength and

market share gains. As we have disclosed in prior reports, our Board of

Directors is conducting a strategic review process to enhance shareholder value

that has not yet been completed."

Logan manufactures and sells a comprehensive line of quality fishing and

intervention tools, including retrieving, surface, stroking and remedial tools

for a variety of well workover, intervention, drilling, and completion

activities (Logan Oil Tools, Inc.); manufactures and sells high-performance

poly-crystalline diamond compact ("PDC") cutters and bearings (Logan

SuperAbrasives), manufactures and sells packers, bridge plugs, and other

completion products (Kline Oilfield Equipment, Inc.); provides proprietary

multi-zonal completion technology and conventional completion production

products and services (Logan Completion Systems Inc.); provides proprietary

products, services and technologies to enhance production in sand-laden heavy

oil wells (Scope Production Development Ltd.); and rents a proprietary tool that

improves horizontal drilling effectiveness by reducing well-bore friction (Xtend

Energy Services Inc.) and rents drilling jars in North America (Logan Jar, LLC).

Common shares of Logan are traded on the Toronto Stock Exchange (TSX) under the

ticker symbol "LII".

Selected Consolidated Financial Information

(in thousands of US dollars, except per share data)

Three month periods Nine month periods

ended ended

September 30, September 30,

--------------------- ---------------------

--------------------- ---------------------

2013 2012 2013 2012

---------- ---------- ---------- ----------

Revenue $ 46,692 $ 44,647 $ 148,488 $ 125,717

Net earnings for the period 4,858 15,529 14,905 20,709

Earnings per share:

Basic $ 0.15 $ 0.46 $ 0.45 $ 0.62

Diluted $ 0.14 $ 0.46 $ 0.44 $ 0.61

EBITDA (1) $ 10,431 $ 21,313 $ 34,349 $ 35,282

Modified EBITDA (1) $ 11,255 $ 10,747 $ 36,638 $ 27,562

---------- ----------

---------- ----------

September December

30, 31,

2013 2012

---------- ----------

---------- ----------

Working Capital $ 87,928 $ 74,295

Total Assets $ 295,776 $ 275,976

Debt (2) $ 68,320 $ 60,192

Shareholders' Equity $ 188,802 $ 175,393

Note: The purchase of Xtend was completed on March 1, 2012 and, accordingly, the

Company's nine month period ended September 30, 2012 operating results included

seven months of Xtend. In addition, the purchase of the Sup-R-Jar product line

occurred on April 17, 2013. All of this product line's operating results after

this date are included in the Company's three and nine month periods ended

September 30, 2013.

(1)

Management calculates: (a) EBITDA as earnings before net finance cost, taxes,

depreciation and amortization ("EBITDA"), and (b) Modified EBITDA as EBITDA

before acquisition accounting adjustments, transaction fees, share-based

compensation payments and severance costs ("Modified EBITDA"). Neither of these

measurements should be considered an alternative to, or more meaningful than,

"net earnings from continuing operations" or "cash flow from operating

activities" as determined in accordance with International Financial Reporting

Standards ("IFRS") as an indicator of the Company's financial performance.

EBITDA and Modified EBITDA do not have standardized definitions as prescribed by

IFRS; therefore, the Company's presentation of these measurements may not

conform to similar presentations by other companies. Management calculates

EBITDA and Modified EBITDA each period and evaluates the Company's operating

performance based on these measurements. Management believes that Modified

EBITDA, which eliminates significant non-cash or non-recurring items of revenue

or cost, more accurately presents the results of the Company's ongoing

operations and its ability to generate the cash required to fund or finance

future growth, acquisitions and capital investments. A reconciliation of EBITDA

and Modified EBITDA with net earnings for each period follows.

Three month periods Nine month periods

ended ended

September 30, September 30,

-------------------------------------------

2013 2012 2013 2012

---------- ---------- ---------- ----------

Net earnings for the period $ 4,858 $ 15,529 $ 14,905 $ 20,709

Addbacks:

Depreciation and amortization 3,399 2,578 9,601 7,646

Finance cost, net 427 900 3,259 2,207

Income tax expense 1,747 2,306 6,584 4,720

---------- ---------- ---------- ----------

EBITDA 10,431 21,313 34,349 35,282

Adjustments:

Contingent consideration gain-

Xtend Energy Services

acquisition - (11,064) - (11,064)

Acquisition accounting

adjustments - - 612 354

Transaction fees 373 63 663 1,272

Severance costs - - 162 -

Share-based compensation 451 435 852 1,718

---------- ---------- ---------- ----------

Modified EBITDA $ 11,255 $ 10,747 $ 36,638 $ 27,562

---------- ---------- ---------- ----------

---------- ---------- ---------- ----------

EBITDA and Modified EBITDA are provided as measures of the Company's operating

performance without regard to financing decisions, share- based compensation,

age and cost of equipment used and income tax impacts, all of which are factors

that are not controlled at the operating management level. The contingent

consideration gain in 2012 is the change in fair value of expected earnout

payments to the former owners of Xtend based on post-closing operating results.

The acquisition accounting adjustments reverse the effect of the increase or

step-up in cost basis of inventories and subsequently sold fixed assets acquired

in business combinations. The transaction fees include professional and other

fees incurred in connection with acquisitions completed in 2012 and 2013, as

well as the Company's previously announced strategic review process. Share-based

compensation relates to expense recognized from the granting of stock

appreciation rights, stock options and restricted share units.

(2) Includes bank and other borrowed debt and capital leases.

Forward-Looking Statements

This press release contains forward-looking statements. These statements relate

to future events or future performance of Logan. When used in this press

release, the words "may", "would", "could", "will", "intend", "plan",

"anticipate", "believe", "estimate", "propose", "expect", "potential",

"continue", and similar expressions, are intended to identify forward-looking

statements. These statements involve known and unknown risks, uncertainties, and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. Such statements reflect

Logan's current views with respect to certain events, including the previously

announced strategic review process and fourth quarter

operating results, and are subject to certain risks, uncertainties and

assumptions. Although Logan believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Many factors could cause

Logan's actual results, performance, or achievements to materially differ from

those described in this press release. Readers are referred to Logan's Annual

Information Form filed on www.sedar.com, which identifies significant risk

factors that could cause actual results to differ from those contained in the

forward-looking statements. Should one or more risks or uncertainties

materialize, or should assumptions underlying forward-looking statements prove

incorrect, actual results may vary materially from those described in this press

release. The forward-looking statements contained in this press release are

expressly qualified in their entirety by this cautionary statement. These

statements speak only as of the date of this press release. Logan does not

intend and does not assume any obligation, to update these forward-looking

statements to reflect new information, subsequent events or otherwise, except as

required by law. This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described herein in any

jurisdiction.

FOR FURTHER INFORMATION PLEASE CONTACT:

Logan International Inc.

Gerald Hage

Chief Executive Officer

281-617-5300 Houston

Logan International Inc.

Larry Keister

Chief Financial Officer

832-386-2534 Houston

www.loganinternationalinc.com

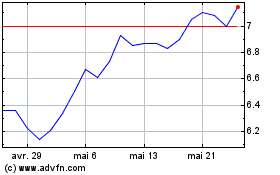

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024