Clairvest Reports Fiscal 2013 Fourth Quarter and Year-End Results

25 Juin 2013 - 10:35PM

Marketwired Canada

Clairvest Group Inc. (TSX:CVG) today reported results for the quarter and year

ended March 31, 2013. (All figures are in Canadian dollars unless otherwise

stated)

Highlights

-- March 31, 2013 book value was $349.7 million or $23.12 per share versus

$22.41 per share at December 31, 2012 and $20.93 per share at March 31,

2012, an increase of $2.19 per share over the last twelve months. Non-

restricted cash or near cash represented 49.9% of the March 31, 2013

book value, or $11.54 per share

-- Net income for the quarter and for the year was $10.1 million or $0.67

per share and $35.8 million or $2.36 per share respectively

-- Clairvest and CEP III realized a combined $79.8 million through the sale

of PEER 1, a global online IT infrastructure provider, realizing a gain

of $54.6 million

-- Centaur Gaming completed the acquisition of Indiana Grand Casino and

Indiana Downs racetrack. Clairvest, CEP IV, CEP IV-A and co-investors

invested US$30.4 million in support of the acquisition. In conjunction

with the acquisition, Centaur Gaming completed a financing where

Clairvest, CEP IV, CEP IV-A and co-investors received US$91.1 million in

principal repayments

-- Clairvest, CEP IV and CEP IV-A invested a combined $39.5 million in CRS,

an equipment rental company based in Ontario, Canada

-- Clairvest, CEP IV and CEP IV-A invested a combined US$7.0 million in

MAG, a U.S.-based specialty aviation and intelligence, surveillance and

reconnaissance service provider

-- Subsequent to quarter end, Clairvest, CEP IV and CEP IV-A invested a

combined US$15.0 million in County Waste of Virginia, a private regional

solid waste management company based in West Point, Virginia.

-- Subsequent to quarter end, Clairvest declared an annual ordinary

dividend of $1.5 million, or $0.10 per share, and a special dividend of

$2.0 million, or $0.1312 per share

Clairvest's book value was $349.7 million or $23.12 per share at March 31, 2013,

compared with $22.41 per share at December 31, 2012 and $20.93 per share at

March 31, 2012. The increase in book value per share was primarily attributable

to net income for the quarter of $10.1 million, or $0.67 per share. Net income

for the year was $35.8 million or $2.36 per share.

As previously announced, during the quarter ended March 31, 2013, Clairvest and

CEP III sold their interests in PEER 1 Network Enterprises Inc. ("PEER 1"), a

company which was publicly traded on the TSX under symbol PIX, at a price of

$3.85 in cash per share. Clairvest and CEP III received cash proceeds of $79.8

million from the sale. On the initial combined investment of $25.2 million,

Clairvest and CEP III generated a pre-tax return of 3.2 times invested capital,

or a 40% IRR, over the life of this investment. On closing Clairvest realized

$19.9 million on a $6.3 million investment for a $13.6 million gain, $13.5

million of which had been previously recognized.

As previously announced, during the quarter ended March 31, 2013, Centaur Gaming

completed the acquisition of Indiana Grand Casino and Indiana Downs racetrack

("Indiana Grand"). With the acquisition, Centaur Gaming now owns both Hoosier

Park Racing & Casino and Indiana Grand, the only two racinos in the Indianapolis

region. Clairvest, CEP IV, CEP IV-A and other co-investors (the "investors")

invested US$30.4 million in support of the Indiana Grand acquisition. Prior to

this investment, the investors had an aggregate investment in Centaur Gaming of

US$112.6 million. In conjunction with this transaction, Centaur Gaming completed

a financing which resulted in US$91.0 million in principal repayments to the

investors, bringing net investment by the investors in Centaur Gaming at March

31, 2013 to US$52.0 million. Consistent with its ownership, Clairvest had an

investment in Centaur Gaming of US$36.2 million at December 31, 2012 and

invested an additional US$8.4 million in support of the Indiana Grand

acquisition. Clairvest received total principal repayments of US$30.1 million on

the financing bringing Clairvest's net investment in Centaur Gaming at March 31,

2013 to US$14.5 million.

As previously announced, during the quarter ended March 31, 2013, Clairvest, CEP

IV and CEP IV-A invested a combined $39.5 million for a 51.9% ownership interest

in CRS Contractors Rental Supply Limited Partnership ("CRS"), a leading provider

of construction equipment rental and related merchandise across 21 locations in

Ontario, Canada. Clairvest's portion of the investment was $10.6 million for a

13.9% ownership interest in CRS.

During the quarter ended March 31, 2013, Clairvest, CEP IV and CEP IV-A invested

a combined US$7.0 million for a 30.0% ownership interest in MAG Defense Services

("MAG"), a U.S.-based specialty aviation and intelligence, surveillance and

reconnaissance service provider. Clairvest's portion of the investment was $1.9

million for an 8.0% ownership interest.

"This was a very active quarter for Clairvest. Our proactive investment approach

created three new opportunities and deployed over $90 million of capital to new

and existing investments," said Jeff Parr, Co-Chief Executive Officer and

Managing Director of Clairvest "The returns achieved on the recent sale of PEER

1 and the continued progress of the portfolio are a tribute to our proven

investment strategy of creating intrinsic value within our portfolio companies.

We are pleased with the growth in book value over the last year and will

continue to apply our rigorous standards in identifying, qualifying and closing

on new investment opportunities."

Subsequent to quarter end, Clairvest, CEP IV and CEP-IV-A invested a combined

US$15.0 million for an 46.9% ownership interest in County Waste of Virginia, LLC

("County Waste"), a private regional solid waste management company based in

West Point, Virginia. Clairvest's portion of the investment was US$4.1 million

for a 12.5% ownership in County Waste.

Subsequent to quarter end, Clairvest declared an annual ordinary dividend of

$0.10 per share and a special dividend of $0.1312 per share, such that in

aggregate, the dividends represent 1% of the March 31, 2013 book value. Both

dividends will be payable July 26, 2013 to common shareholders of record as of

July 9, 2013 and are eligible dividends for Canadian income tax purposes.

Summary of Financial Results - Unaudited

----------------------------------------------------------------------------

Financial Performance Measures Quarters ended Year ended

March 31 March 31

------------------------------------

2013 2012 2013 2012

----------------------------------------------------------------------------

($000's, except per share amounts) $ $ $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net realized gains (losses) on corporate

investments (377) 44 9,009 545

----------------------------------------------------------------------------

Net changes in unrealized gains on

corporate investments 9,009 6,404 4,598 16,590

----------------------------------------------------------------------------

Net income 10,111 5,348 35,763 22,416

----------------------------------------------------------------------------

Basic net income per share 0.67 0.35 2.36 1.46

----------------------------------------------------------------------------

Fully diluted net income per share 0.66 0.34 2.32 1.43

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Financial Condition Measures March March

2013 2012

----------------------------------------------------------------------------

($000's, except per share amounts) $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total assets 378,936 338,424

----------------------------------------------------------------------------

Total cash, cash equivalents and temporary investments(1) 174,513 97,553

----------------------------------------------------------------------------

Total corporate investments 176,390 187,876

----------------------------------------------------------------------------

Total liabilities 29,248 21,997

----------------------------------------------------------------------------

Book value 349,688 316,427

----------------------------------------------------------------------------

Book value per share 23.12 20.93

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes restricted temporary investments

Clairvest's annual 2013 financial statements and MD&A are available on the SEDAR

website at www.sedar.com and on the Clairvest website at www.clairvest.com.

About Clairvest

Clairvest Group Inc. is a private equity investor which invests its own capital,

and that of third parties through the Clairvest Equity Partners ("CEP") limited

partnerships, in businesses that have the potential to generate superior

returns. In addition to providing financing, Clairvest contributes strategic

expertise and execution ability to support the growth and development of its

investee partners. Clairvest realizes value through investment returns and the

eventual disposition of its investments.

Forward-looking Statements

This news release contains forward-looking statements with respect to Clairvest

Group Inc., its subsidiaries, its CEP limited partnerships and their

investments. These statements are based on current expectations and are subject

to known and unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Clairvest, its subsidiaries, its

CEP limited partnerships and their investments to be materially different from

any future results, performance or achievements expressed or implied by such

forward-looking statements. Such factors include general and economic business

conditions and regulatory risks. Clairvest is under no obligation to update any

forward-looking statements contained herein should material facts change due to

new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Clairvest Group Inc.

Maria Klyuev

Director, Investor Relations and Marketing

(416) 925-9270

(416) 925-5753 (FAX)

mariak@clairvest.com

www.clairvest.com

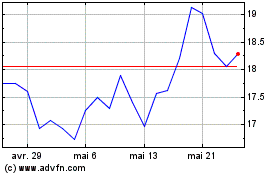

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024