MAG Silver Corp. (TSX:MAG) (NYSE MKT:MVG) ("MAG" or the "Company")

announces the Company's unaudited financial results for the three

and six months ended June 30, 2013. For complete details of the

second quarter unaudited Condensed Interim Consolidated Financial

Statements and related Management's Discussion and Analysis, please

see the Company's filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov). All amounts herein are reported in United States

dollars unless otherwise specified.

At June 30, 2013, the Company had working capital of

$33,874,230, including cash of $33,402,419. The primary use of cash

during the six months ended June 30, 2013 was for exploration and

evaluation expenditures totaling $2,515,625 (June 30, 2012:

$5,790,815) and the Company also expended on its own account and

through advances to Minera Juanicipio $1,301,947 (June 30, 2012:

$2,378,138) on the Juanicipio property. Subsequent to June 30,

2013, the Company advanced $3.74 million to Minera Juanicipio,

representing its 44% share of an $8.5 million cash call to fund

exploration activities and initial ramp development, through

October 2013. The Company currently has sufficient working capital

to maintain all of its properties and currently planned programs

extending beyond the next 12 months.

The Company's net loss for the three and six months ended June

30, 2013 amounted to $10,220,693 and $11,878,766 respectively (June

30, 2012: $1,803,362 and $2,557,733 respectively). The net loss as

compared to prior periods, increased primarily as a result of the

write-off of non-core assets. Given the prevailing market

conditions and the desire to focus on and preserve cash for its

core projects, management has determined that the some of the

Company's non-core assets should be abandoned, and exploration and

evaluation assets totaling $8,422,283 were written off in the

quarter ended June 30, 2013 (June 30, 2012: Nil). Portions of the

Lagartos Properties, specifically the "Lagartos NW" and "Lagartos

V" claims, totaling $4,065,884 were written off, along with the

100% owned Lorena and Nuevo Mundo claims totaling $2,719,689, and

their respective concessions were not renewed subsequent to the

quarter end. The Mojina option earn in agreement was also

terminated subsequent to the quarter end and its associated

exploration and evaluation costs totaling $1,636,710 were written

off. During the three and six months ended June 30, 2013, the

Company also recorded share based payment expense (a non cash item)

of $1,278,548 and $1,915,148 respectively (June 30, 2012: $496,449

and $872,305 respectively) relating to stock options both granted

and vesting to employees during the period.

Juanicipio Project

Based on a National Instrument 43-101 compliant Updated

Preliminary Economic Assessment entitled "Minera Juanicipio

Property, Zacatecas State, Mexico, Technical Report for Minera

Juanicipio S.A de C.V", authored by AMC Mining Consultants (Canada)

Ltd. (the "AMC Study"), filed on SEDAR on July 16, 2012, Minera

Juanicipio had approved an 18 month mine permitting and underground

development budget of $25.4 million (the "Initial Development

Budget"). This program covers mine permitting, surface preparation

and the commencement of the first 2,500 metres of underground

decline development, as well as 35,000 metres of infill drilling at

75 metre centres along the Valdecanas Vein. To December 31, 2012, a

total of $1.3 million of the Initial Development Budget had been

incurred, with the remaining $24.1 million now designated for 2013

($13.1 million) and the first half of 2014 ($11 million). To July

31, 2013, a total 24,628 metres were drilled in 33 holes and a

further 8,167 metres drilled in nine holes of

geotechnical/metallurgical drilling, resulting in a total of 42

holes and 32,785 metres drilled to July 31, 2013. The results to

date have been as expected showing the typical metal zoning of

Fresnillo-style veins in the district.

The development program is being managed by Fresnillo plc

("Fresnillo") as operators of the Joint Venture, and they had

previously reported that they expected the underground decline

ground breaking to commence late in the second quarter of 2013.

However, due to development permitting delays resulting from the

recent Mexican government changeover, it now expects the

underground decline ground breaking to commence in late August or

early September, 2013. Five different contractors from North and

South America had been asked to tender for the decline

construction, and after review of the proposals, the contract has

been awarded.

Cinco de Mayo

In the three and six months ended June 30, 2013, the Company

incurred exploration and evaluation costs of $566,508 and

$1,313,497 respectively (2012: $4,033,817 and $5,990,731

respectively). No drilling has been undertaken in 2013 as the

Company is currently trying to negotiate a renewed surface access

agreement with the local Ejido. The principal focus of work has

been in preparation for these negotiations and has included

meetings with Chihuahua State and Mexican Federal authorities and

Community Public Relations and legal advisors in Mexico. This

process was protracted due to the political transition period as

the new party and Presidency assumed operation of the Mexican

government, coupled with Municipal elections held in July 2013. The

Company maintains the Ejido access issue is a temporary delay and

is working to resolve the issue on a permanent basis with the

Ejido. However, once the surface access permission is renewed and

obtained, the permit approval process may still take up to 3 months

to process. The Company had expected the resumption of drilling on

the property late in 2013, but with protracted political transition

periods (both federally and municipally), it is now expected

drilling will resume in the first half of 2014. The Company has

also initiated preliminary metallurgical testing on assay bulk

rejects in anticipation of a Preliminary Economic Assessment

("PEA") based on the Upper Manto resource.

About MAG Silver Corp. (www.magsilver.com)

MAG is focused on district scale projects located within the

Mexican Silver Belt. Our mission is to become one of the premier

companies in the silver mining industry. MAG is conducting ongoing

exploration of its portfolio of 100% owned properties in Mexico

including a silver, lead and zinc discovery and a moly-gold

discovery at its 100% owned Cinco de Mayo property in Chihuahua

State. MAG and Fresnillo plc are jointly developing the Valdecanas

Vein and delineating the Desprendido and Juanicipio discoveries on

the Juanicipio Joint Venture in Zacatecas State. MAG is based in

Vancouver, British Columbia, Canada. Its common shares trade on the

TSX under the symbol MAG and on the NYSE MKT under the symbol

MVG.

On behalf of the Board of MAG SILVER CORP.

Larry Taddei, Chief Financial Officer

Neither the Toronto Stock Exchange nor the NYSE MKT has reviewed

or accepted responsibility for the accuracy or adequacy of this

press release, which has been prepared by management.

This release includes certain statements that may be deemed to

be "forward-looking statements" within the meaning of the US

Private Securities Litigation Reform Act of 1995. All statements in

this release, other than statements of historical facts are

forward-looking statements, including statements that address

future mineral production, reserve potential, exploration drilling,

exploitation activities and events or developments. Forward-looking

statements are often, but not always, identified by the use of

words such as "seek", "anticipate", "plan", "continue", "estimate",

"expect", "may", "will", "project", "predict", "potential",

"targeting", "intend", "could", "might", "should", "believe" and

similar expressions. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Although MAG believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to, changes

in commodities prices, changes in mineral production performance,

exploitation and exploration successes, continued availability of

capital and financing, and general economic, market or business

conditions, political risk, currency risk and capital cost

inflation. In addition, forward-looking statements are subject to

various risks, including that data is incomplete and considerable

additional work will be required to complete further evaluation,

including but not limited to drilling, engineering and

socio-economic studies and investment. The reader is referred to

the Company's filings with the SEC and Canadian securities

regulators for disclosure regarding these and other risk factors.

There is no certainty that any forward-looking statement will come

to pass and investors should not place undue reliance upon

forward-looking statements.

Cautionary Note to Investors Concerning Estimates of Indicated

Resources

This press release uses the term "Indicated Resources". MAG

advises investors that although this term is recognized and

required by Canadian regulations (under National Instrument 43-101

- Standards of Disclosure for Mineral Projects), the U.S.

Securities and Exchange Commission does not recognize this term.

Investors are cautioned not to assume that any part or all of

mineral deposits in this category will ever be converted into

reserves.

Cautionary Note to Investors Concerning Estimates of Inferred

Resources

This press release uses the term "Inferred Resources". MAG

advises investors that although this term is recognized and

required by Canadian regulations (under National Instrument

43-101-Standards of Disclosure for Mineral Projects), the U.S.

Securities and Exchange Commission does not recognize this term.

Investors are cautioned not to assume that any part or all of the

mineral deposits in this category will ever be converted into

reserves. In addition, "Inferred Resources" have a great amount of

uncertainty as to their existence, and economic and legal

feasibility. It cannot be assumed that all or any part of an

Inferred Mineral Resource will ever be upgraded to a higher

category. Under Canadian rules, estimates of Inferred Mineral

Resources may not form the basis of feasibility or pre-feasibility

studies, or economic studies except for Preliminary Assessment as

defined under Canadian National Instrument 43-101. Investors are

cautioned not to assume that part or all of an Inferred Resource

exists, or is economically or legally mineable.

Please Note:

Investors are urged to consider closely the disclosures in MAG's

annual and quarterly reports and other public filings, accessible

through the Internet at www.sedar.com and

www.sec.gov/edgar/searchedgar/companysearch.html.

Contacts: MAG Silver Corp. Michael J. Curlook VP Investor

Relations and Communications (604) 630-1399 or Toll free: (866)

630-1399 (604) 681-0894 (FAX)info@magsilver.com

www.magsilver.com

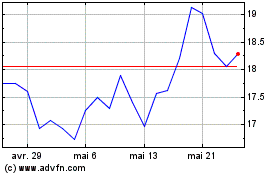

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024