MAG Silver Reports First Quarter Financial Results

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 15, 2014) - MAG

Silver Corp. (TSX:MAG)(NYSEMKT:MVG) ("MAG" or the "Company")

announces the Company's unaudited financial results for the three

months ended March 31, 2014. For complete details of the first

quarter unaudited Condensed Interim Consolidated Financial

Statements and related Management's Discussion and Analysis, please

see the Company's filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov). All amounts herein are reported in United States

dollars unless otherwise specified.

At March 31, 2014, the Company had working capital of

$21,149,446 (compared to $37,917,231 at March 31, 2013), including

cash of $20,072,036 (compared to $37,790,974 at March 31, 2013).

The Company currently has sufficient working capital to maintain

all of its properties and currently planned programs extending

beyond the next 12 months. The primary use of cash during the

quarter ended March 31, 2014 was for advances to Minera Juanicipio

S.A. de C.V. ("Minera Juanicipio"), which along with MAG's

Juanicipio expenditures on its own account, totaled $1,755,906

(2013: $77,536). The Company also expended $1,374,424 (2013: Nil)

on the Salamandra earn in option, and $357,726 (2013: $1,559,977)

on its other exploration and evaluation properties.

The Company's net loss for the three months ended March 31, 2014

amounted to $1,093,162 (March 31, 2013: $1,658,073) or $0.02/share

(March 31, 2013: $0.03/share). The net loss decreased in the

current quarter compared to prior period, primarily as a result of

lower share based payment expense of $434,408 (March 31, 2013:

636,600), and no placement fees incurred in the current quarter

(March 31, 2013: 143,900). In the quarter ended March 31, 2014, the

Company granted no stock options (March 31, 2013: 100,000 stock

options) but recorded $434,408 (March 31, 2013: $636,600) of share

based payment expense (a non-cash item) relating to stock options

vesting to employees and consultants in the period. The fair value

of all share-based payment compensation is estimated using the

Black-Scholes-Merton option valuation model.

Project Updates

At Minera Juanicipio, the proposed 2014 development budget is

$11.4 million (MAG's 44% share is $5 million), and is designated

primarily for the ramp advancement and some detailed engineering.

The Juanicipio ramp decline is currently advancing with

conventional drill and blast cycles as well as with the continuous

miner. In addition to the planned Juanicipio development work,

exploration is also planned in 2014 to seek new veins and trace

structures and veins in neighbouring parts of the district onto the

Minera Juanicipio joint venture ground. The proposed 2014

exploration budget for Minera Juanicipio is US$3.6 million (MAG's

44% share is US$1.6 million). As at March 31, 2014 Minera

Juanicipio had $4.3 million in cash available for 2014 budgeted

exploration and development.

An updated independent mineral resource estimate for the

Juanicipio property is currently in progress, and is expected in

the second quarter of 2014.

No active exploration is currently being undertaken on the Cinco

de Mayo property, as the Company remains in the process of

negotiating a renewed surface access agreement with the local

Ejido. The overall timeline to successful resolution and renewed

surface access is not determinable at this time, and will depend

upon various factors including but not limited to: the ability of

the Company to arrive at a settlement agreement that would be fully

supported by the majority of the Ejido; and, the ability of the

Ejido to conduct a properly constituted Assembly meeting, with

quorum, and favourable outcome.

At Salamadra, where the Company has an option to earn up to 70%

of the property, the system remains open in all directions. The

Phase II drill program is currently ongoing with two drill rigs and

assays pending, as the Company continues to delineate the system

while fleshing out the best intercepts.

About MAG Silver Corp. (www.magsilver.com)

MAG Silver Corp. (TSX:MAG)(NYSEMKT:MVG) is focused on advancing

two significant projects located within the Mexican Silver Belt.

Our mission is to become one of the premier companies in the silver

mining industry. Currently, we are advancing the underground

decline towards the high grade Valdecañas Silver vein and

delineating the Desprendido and Juanicipio discoveries in Zacatecas

State, all within the joint venture between MAG Silver (44%) and

Fresnillo PLC (56%). In addition, we are negotiating surface access

in order to further delineate our district scale, 100% owned Cinco

de Mayo property in Chihuahua state, where two new silver, lead,

zinc discoveries are opening up further growth opportunities for

MAG Silver Corp.

On behalf of the Board of MAG SILVER CORP.

Larry Taddei, Chief Financial Officer

Neither the Toronto Stock Exchange nor the NYSEMKT has

reviewed or accepted responsibility for the accuracy or adequacy of

this press release, which has been prepared by management.

This release includes certain statements that may be deemed

to be "forward-looking statements" within the meaning of the US

Private Securities Litigation Reform Act of 1995. All statements in

this release, other than statements of historical facts are forward

looking statements, including statements that address future

mineral production, reserve potential, exploration drilling,

exploitation activities and events or developments. Forward-looking

statements are often, but not always, identified by the use of

words such as "seek", "anticipate", "plan", "continue", "estimate",

"expect", "may", "will", "project", "predict", "potential",

"targeting", "intend", "could", "might", "should", "believe" and

similar expressions. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Although MAG believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to, changes

in commodities prices, changes in mineral production performance,

exploitation and exploration successes, continued availability of

capital and financing, and general economic, market or business

conditions, political risk, currency risk and capital cost

inflation. In addition, forward-looking statements are subject to

various risks, including that data is incomplete and considerable

additional work will be required to complete further evaluation,

including but not limited to drilling, engineering and

socio-economic studies and investment. The reader is referred to

the Company's filings with the SEC and Canadian securities

regulators for disclosure regarding these and other risk factors.

There is no certainty that any forward looking statement will come

to pass and investors should not place undue reliance upon

forward-looking statements.

Please Note:

Investors are urged to consider closely the disclosures in

MAG's annual and quarterly reports and other public filings,

accessible through the Internet at www.sedar.com and

www.sec.gov/edgar/searchedgar/companysearch.html.

MAG Silver Corp.Michael J. CurlookVP Investor Relations and

Communications(604) 630-1399 or Toll free: (866) 630-1399(604)

681-0894info@magsilver.comwww.magsilver.com

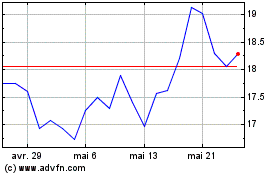

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

MAG Silver (TSX:MAG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024