Melcor REIT Announces Acquisition of Coast Home Centre

12 Septembre 2013 - 2:30PM

Marketwired

Acquisition Highlights

-- Retail centre located in Edmonton, Alberta with total gross leasable

area of 59,725 sq. ft. on 4.21 acres

-- Well-maintained buildings with 100% occupancy and future re-development

potential

-- Strategically located on the 170thStreet traffic corridor in a strong

sub-market

-- Positioned to benefit from new development and re-development in the

area

Melcor REIT (TSX:MR.UN) today announced that it has completed

the acquisition of Coast Home Centre in Edmonton, Alberta for $12.3

million (excluding closing costs).

Darin Rayburn, Chief Executive Officer of Melcor REIT, commented

on the acquisition: "We are pleased to add Coast Home Centre to our

portfolio. This acquisition fits well with our strategy of growing

in the markets that we know best in order to leverage existing

market knowledge. Coast is a quality asset in a prime, high traffic

location."

Management expects that the acquisition will be accretive to

AFFO by $0.02 per unit on an annualized basis. The acquisition was

funded through the REIT's line of credit and available cash.

Following the acquisition the REIT's Debt to Gross Book Value ratio

remains at 47%.

Rayburn continued: "We continue to look at potential

acquisitions that fit our acquisition strategy."

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate

investment trust. Melcor REIT owns, acquires, manages and leases

quality retail, office and industrial income-generating properties

with exposure to high growth western Canadian markets. Its

portfolio is currently made up of interests in 28 properties

representing approximately 1.63 million square feet of gross

leasable area located in and around Edmonton, Calgary, and

Lethbridge, Alberta; Regina, Saskatchewan; and Kelowna, British

Columbia. For more information, please visit www.MelcorREIT.ca.

Forward-Looking Statements

This press release may contain forward-looking information

within the meaning of applicable securities legislation, which

reflects the REIT's current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the REIT's control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, general and local

economic and business conditions; the financial condition of

tenants; the REIT's ability to refinance maturing debt; leasing

risks, including those associated with the ability to lease vacant

space; and interest rate fluctuations. The REIT's objectives and

forward-looking statements are based on certain assumptions,

including that the general economy remains stable, interest rates

remain stable, conditions within the real estate market remain

consistent, competition for acquisitions remains consistent with

the current climate and that the capital markets continue to

provide ready access to equity and/or debt. All forward-looking

information in this press release speaks as of the date of this

press release. The REIT does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise.

Additional information about these assumptions and risks and

uncertainties is contained in the REIT's filings with securities

regulators.

Contacts: Business Contact: Melcor REIT Darin Rayburn Chief

Executive Officer 780.423.6931info@melcorREIT.ca Investor

Relations: Melcor REIT Jonathan Chia, CA Chief Financial Officer

780.423.6931ir@melcorREIT.ca www.MelcorREIT.ca

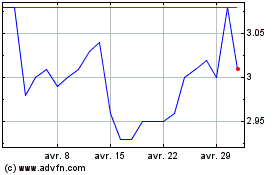

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024