Melcor REIT Announces Third Quarter Results Exceeding Forecast

01 Novembre 2013 - 11:02PM

Marketwired Canada

Melcor REIT (TSX:MR.UN) announced results for the three and nine months ended

September 30, 2013. For the twelve-month period ending March 31, 2014 we will be

comparing our results to the financial forecast disclosed in our prospectus

dated April 19, 2013, which is available on SEDAR at www.sedar.com.

Darin Rayburn, CEO of Melcor REIT commented: "We are pleased to report third

quarter results that exceeded forecast. The successful acquisition of the Coast

Home retail property in the third quarter demonstrates our commitment to

acquiring immediately accretive third party assets to grow our portfolio. With

the Right of First Offer granted on all properties developed by Melcor

Developments, our growth outlook is strong."

Rayburn continued: "We also continue to improve existing assets, which, combined

with our focus on exceptional customer care, led to increased occupancy in the

quarter. We remain confident in our ability to grow a strong and balanced

portfolio that will provide consistent returns to unitholders."

Highlights for the quarter include:

-- Strong growth in revenue during the third quarter, increasing $0.60

million or 7% over Q3 2012, and $0.40 million or 4% over our Q3 2013

financial forecast. Revenue growth was driven by improved occupancy and

weighted average base rent; in addition to higher other revenues and

straight-line rent adjustment.

-- Positive growth in FFO and AFFO: FFO and AFFO per unit for the third

quarter were 10% and 6% higher than forecast respectively as a result of

higher NOI. Timing of operating expenditures; in conjunction with higher

revenues, were the primary drivers behind increased NOI.

-- Distributions of $0.05625 per trust unit were paid in July, August and

September, providing Unitholders an effective holding period return of

2.81% since our IPO on May 1, 2013. These distributions were inline with

forecast.

-- Fair value gains of $7.47 million year-to-date resulted in a 2% increase

in the fair value of our portfolio over December 31, 2012.

-- Weighted average interest rate on our mortgages and Class C LP Units

decreased by 50 basis points or 10% as a result of lower average

interest rates on the Class C LP Units achieved through refinancing

prior to the IPO.

-- Completed the acquisition of Coast Home Centre, a retail centre in

Edmonton, Alberta for $12.45 million.

Selected Financial Information

Financial Highlights

Three-months Nine-months Financial

ended ended Forecast(i)

----------------------------------------------------------------------------

($000s) Q3 - 2013 2013 Q3 - 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-Standard Key Performance

Indicators(ii)

Rental revenue 9,794 29,255 9,390

Net operating income (NOI) 6,343 19,064 6,007

Same asset NOI 5,738 17,285 n/a

Funds from Operations (FFO) 4,076 12,180 3,713

Adjusted Funds from Operations

(AFFO) 3,577 11,079 3,298

Per unit metrics(1)

FFO 0.22 0.65 0.20

AFFO 0.19 0.59 0.18

Distributions 0.169 0.281 0.169

----------------------------------------------------------------------------

(i)Financial forecast is for the three-months ended September 30, 2013.

(ii)Refer to the following section, Non-IFRS supplemental measures, for

metric information.

----------------------------------------------------------------------------

30-Sept-13 31-Dec-12

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total assets ($000s) 425,320 396,845

Debt ($000s)(2) 194,587 180,002

Debt to GBV ratio 47% 46%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operational Highlights

----------------------------------------------------------------------------

30-Sept-13 31-Dec-12

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Number of properties 28 27

Gross Leasable Area (GLA) (sq. ft.) 1,628,603 1,571,474

Occupancy % (weighted GLA) 91.6% 91.0%

Weighted average base rent (per sq. ft.) $ 16.57 $ 16.35

----------------------------------------------------------------------------

(1) Calculated as if the trust units and Class B LP Units were outstanding

during the entire current and comparative periods.

(2) Calculated as the sum of total amount drawn on revolving credit

facility, mortgages payable and Class C LP Units.

MD&A and Financial Statements

Melcor REIT's consolidated financial statements and management's discussion and

analysis for the three- and nine-months ended September 30, 2013 can be found on

the REIT's website at www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call & Webcast

Unitholders and interested parties are invited to join CEO Darin Rayburn and CFO

Jonathan Chia on a conference call to be held Monday, November 4, 2013 at 9:00

AM ET. Call 416-340-8530 in the Toronto area; 800-769-8320 toll free.

The call will be webcast at http://www.gowebcasting.com/5002. A replay of the

call will be available shortly after the call is concluded at the same address.

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate investment trust.

Melcor REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties with exposure to high growth western

Canadian markets. Its portfolio is currently made up of interests in 28

properties representing approximately 1.63 million square feet of gross leasable

area located in and around Edmonton, Calgary, and Lethbridge, Alberta; Regina,

Saskatchewan; and Kelowna, British Columbia. For more information, please visit

www.MelcorREIT.ca.

Non-IFRS supplemental measures

NOI, FFO and AFFO are key measures of performance used by real estate operating

companies; however, they are not defined by International Financial Reporting

Standards ("IFRS"), do not have standard meanings and may not be comparable with

other industries or income trusts. These Non-IFRS measures are more fully

defined and discussed in the REIT's Management Discussion and Analysis for the

period ended September 30, 2013, which is available on SEDAR at www.sedar.com.

Forward-Looking Statements:

This press release may contain forward-looking information within the meaning of

applicable securities legislation, which reflects the REIT's current

expectations regarding future events. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond the REIT's control, that could cause actual results and

events to differ materially from those that are disclosed in or implied by such

forward-looking information. Such risks and uncertainties include, but are not

limited to, general and local economic and business conditions; the financial

condition of tenants; the REIT's ability to refinance maturing debt; leasing

risks, including those associated with the ability to lease vacant space; and

interest rate fluctuations. The REIT's objectives and forward-looking statements

are based on certain assumptions, including that the general economy remains

stable, interest rates remain stable, conditions within the real estate market

remain consistent, competition for acquisitions remains consistent with the

current climate and that the capital markets continue to provide ready access to

equity and/or debt. All forward-looking information in this press release speaks

as of the date of this press release. The REIT does not undertake to update any

such forward-looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is contained in the REIT's filings with securities regulators.

FOR FURTHER INFORMATION PLEASE CONTACT:

Business Contact: Melcor REIT

Darin Rayburn

Chief Executive Officer

780.423.6931

info@melcorREIT.ca

Investor Relations: Melcor REIT

Jonathan Chia, CA

Chief Financial Officer

780.423.6931

ir@melcorREIT.ca

www.MelcorREIT.ca

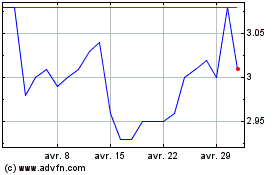

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024