Melcor REIT Announces First Quarter, Twelve Month Results Exceeding Forecast

09 Mai 2014 - 3:00PM

Marketwired Canada

Melcor REIT (TSX:MR.UN) -

----------------------------------------------------------------------------

Quarter Highlights 12-Month Forecast Highlights

- Rental revenue of $10.65 million - Rental revenue of $40.28 million,

for growth of 10% over Q1-2013 exceeding revised forecast by 3%

- Net operating income of $6.73 - Net rental income of $23.85

million for growth of 6% over Q1-2013 million, exceeding revised forecast

by 5%

- Adjusted funds from operations - AFFO of $14.25 million or $0.76 per

(AFFO) of $3.78 million or $0.20 per unit, exceeding forecast by 3%

unit compared to $0.18 per unit in

Q1-2013

- Debt to Gross Book Value (GBV) - Distributions of $0.05625 per unit

ratio of 51%, within our target range were paid in each of the REIT's 11

of 50-55% months of operation (as forecast)

- Gross leasable area increased by We presented a 12-month forecast

12% since IPO through 3 property (April 2013 - March 2014) in the

acquisitions prospectus dated April 19, 2013. The

three months ended March 31, 2014 was

revised on March 10, 2014 to reflect

acquisitions completed throughout the

forecast period. The data presented

above is compared to the revised

forecast.

----------------------------------------------------------------------------

Melcor REIT announced results for the first quarter of 2014, which ended March

31, 2014. These results are also compared to the financial forecast disclosed in

our prospectus dated April 19, 2013 and revised in our annual management's

discussion and analysis dated March 10, 2014, both of which are available on our

website at MelcorREIT.ca and on SEDAR.com.

Darin Rayburn, CEO of Melcor REIT commented: "As we conclude our forecast

period, I'm pleased to report results exceeding forecast on key performance

metrics. Throughout the past year, we've delivered as promised while at the same

time consistently and methodologically executing on our strategy. We have

initiated and completed specific actions on each element of our growth strategy

- acquiring both third party and Melcor properties and making improvements to

our overall portfolio through property management and asset enhancements.

Our team remains committed to executing our strategy and continuing to deliver

solid results."

Financial Highlights for the quarter include:

-- We continue to deliver as promised and exceeded IPO forecast with stable

and sustainable growth on key indicators through Q1-2014. We continued

to execute on our growth strategy of acquiring new properties and

improving our existing properties through both property management and

asset enhancement. Building on the momentum of our first eight months of

operations, we:

-- Achieved strong leasing activity. We completed 45,715 sq. ft. in new

leases during the period and have renewed 66% of the GLA expiring in

2014 as of March 31, 2014.

-- Grew through acquisition. We completed our third property

acquisition with the purchase of LC Industrial, a 67,610 sq. ft.

industrial warehouse in Lethbridge, Alberta, for $5.93 million

(excluding closing costs). GLA has grown by 12% since IPO.

-- The successful execution of these strategies contributed to:

-- Revenue growth of 10% over Q1-2013 as a result of our expanded

portfolio. Weighted average base rent (per sq. ft.) and occupancy

remained consistent with year end. NOI also grew by 6% over Q1-2013.

-- FFO and AFFO 4% and 3% ahead of our twelve-month forecast,

respectively.

-- Direct operating expenses were up by 13% over the comparative period as

a result of timing differences as well as differences in allocations in

the comparative period. Higher snow removal costs in 2014 also

contributed to the increase.

-- Distributions of $0.05625 per trust unit (in line with forecast) were

paid in January, February and March. Distributions made during each of

the eleven months of the REIT's operations represent a payout ratio of

88%.

-- We successfully completed a bought deal issuance of 1,900,000 trust

units at $10.65 for gross proceeds of $20.24 million subsequent to the

quarter. The funds are to be used to fund two property acquisitions from

Melcor, with the remainder intended to pay down our revolving credit

facility, and for future acquisitions and for general trust purposes.

The two pending property acquisitions demonstrate execution on our

growth strategy via our proprietary Melcor pipeline.

Selected Quarter Highlights

Financial Highlights

Three months ended

March 31

----------------------------------------------------------------------------

($000s) 2014 2013 % Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-standard KPIs

Net operating income (NOI) 6,734 6,342 6%

Funds from operations (FFO) 4,288 3,995 7%

Adjusted funds from operations (AFFO) 3,777 3,387 12%

Rental revenue 10,647 9,688 10%

Income before fair value adjustments and taxes 2,139 3,417 (37)%

Fair value adjustment on investment properties 169 2,594 (93)%

Distributions to unitholders 1,541 n/a

Cash flows from operations 2,296 7,036 (67)%

Per unit metrics(1)

Income - diluted 0.10 0.26 (62)%

FFO 0.23 0.21 10%

AFFO 0.20 0.18 11%

Distributions 0.17 n/a

----------------------------------------------------------------------------

($000s) 31-Mar-14 31-Dec-13 % Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total assets ($000s) 458,801 454,743 1%

Equity ($000s)(2) 186,608 186,608 -%

Debt ($000s)(3) 219,496 215,601 2%

Weighted average interest rate on debt 3.99% 3.98% -%

Debt to GBV ratio 51% 51% -%

Finance costs coverage ratio(4) 2.94 2.96 (1)%

Debt service coverage ratio(5) 2.85 2.72 5%

Operational Highlights

----------------------------------------------------------------------------

($000s) 31-Mar-14 31-Dec-13 % Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Number of properties 30 29 3%

Gross leasable area (GLA) (sq. ft.) 1,759,761 1,691,920 4%

Occupancy % (weighted by GLA) 90.1% 90.6% (1)%

Retention % (weighted by GLA) 76.9% 75.5% 2%

Weighted average remaining lease term

(years) 4.52 4.75 (5)%

Weighted average base rent (per sq. ft.) $ 16.23 $ 16.63 (2)%

(1) Calculated as if the trust units and Class B LP Units were outstanding

during the entire current and comparative periods.

(2) Calculated as the sum of trust units and Class B LP Units at their book

value of $10.00.

(3) Calculated as the sum of total amount drawn on revolving credit facility,

mortgages payable and Class C LP Units, excluding unamortized fair value

adjustment on Class C LP Units, unamortized transaction costs and unamortized

discount on bankers acceptance.

(4) Calculated as the sum of FFO and finance costs; divided by finance costs,

excluding distributions on Class B LP Units.

(5) Calculated as FFO; divided by sum of contractual principal repayments on

mortgages payable and distributions of Class C LP Units, excluding amortization

of fair value adjustment on Class C LP Units.

MD&A and Financial Statements

Information included in this press release is a summary of results. This press

release should be read in conjunction with Melcor REIT's Q1-2014 report to

unitholders, including the consolidated financial statements and management's

discussion and analysis for the three-months ended March 31, 2014 which can be

found on the REIT's website at www.MelcorREIT.ca or on SEDAR (www.sedar.com).

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate investment trust.

Melcor REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties with exposure to high growth Canadian

markets. Its portfolio is currently made up of interests in 30 properties

representing approximately 1.76 million square feet of gross leasable area

located across Alberta and in Regina, Saskatchewan and Kelowna, British

Columbia. For more information, please visit www.melcorREIT.ca.

Non-Standard Measures

NOI, FFO and AFFO are key measures of performance used by real estate operating

companies; however, they are not defined by International Financial Reporting

Standards ("IFRS"), do not have standard meanings and may not be comparable with

other industries or income trusts. These non-IFRS measures are more fully

defined and reconciled in the REIT's Management Discussion and Analysis for the

period ended March 31, 2014, which is available on SEDAR at www.sedar.com.

Forward-Looking Statements

This press release may contain forward-looking information within the meaning of

applicable securities legislation, which reflects the REIT's current

expectations regarding future events. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond the REIT's control, that could cause actual results and

events to differ materially from those that are disclosed in or implied by such

forward-looking information. Such risks and uncertainties include, but are not

limited to, general and local economic and business conditions; the financial

condition of tenants; the REIT's ability to refinance maturing debt; leasing

risks, including those associated with the ability to lease vacant space; and

interest rate fluctuations. The REIT's objectives and forward-looking statements

are based on certain assumptions, including that the general economy remains

stable, interest rates remain stable, conditions within the real estate market

remain consistent, competition for acquisitions remains consistent with the

current climate and that the capital markets continue to provide ready access to

equity and/or debt. All forward-looking information in this press release speaks

as of the date of this press release. The REIT does not undertake to update any

such forward-looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is contained in the REIT's filings with securities regulators.

FOR FURTHER INFORMATION PLEASE CONTACT:

Business Contact

Melcor REIT

Darin Rayburn

Chief Executive Officer

780.423.6931

info@melcorREIT.ca

Investor Relations

Melcor REIT

Jonathan Chia, CA

Chief Financial Officer

1.855.673.6931

ir@melcorREIT.ca

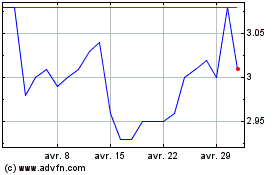

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024