HUDSON RESOURCES INC. (“

Hudson” or the

“

Company”) (TSX Venture Exchange

“

HUD”;

OTC “HUDRF”) and NEO

PERFORMANCE MATERIALS INC. (“

Neo”,

TSX:

NEO.TO) are pleased to announce that the parties have

executed a binding agreement (“

Agreement”) whereby

Neo will acquire from Hudson an exploration license

(“

License”) covering the Sarfartoq Carbonatite

Complex in southwest Greenland (the “

Project”).

The Project hosts a mineral deposit that is enriched in neodymium

and praseodymium, two essential elements for rare earth permanent

magnets used in electric vehicles, wind turbines, and

high-efficiency electric motors and pumps that help reduce

greenhouse gas emissions.

Located just 60 kilometers from the international

airport in Kangerlussuaq, the Project is close to tidewater and a

major port facility and is directly adjacent to some of the best

hydroelectric potential in Greenland.

Neo, through a special purpose entity (“SPE”),

plans to explore and develop the Sarfartoq Project to further

diversify its global sourcing of rare earth ore and to expand the

rare earth supply chains that feed Neo’s rare earth separation

facility in Estonia. That facility was recently awarded a Gold

Medal for its sustainable practices by EcoVadis, the well-respected

global sustainability auditor.

Neo is also pursuing plans to break ground on a

greenfield rare earth permanent magnet manufacturing plant in

Estonia that is intended to provide European manufacturers with the

permanent magnets needed for electric and hybrid vehicles, wind

turbines, and energy-saving electric motors and pumps. The

Sarfartoq Project also is a key element of Neo’s “Magnets-to-Mine”

vertical integration strategy.

Completion of the sale of the license (the

"Transaction”) is subject to various conditions, including approval

from the Government of Greenland for the transfer of the License,

expected to take approximately six months, and approval of the TSX

Venture Exchange (the “TSXV”) on the part of Hudson.

Neo intends to assign its rights under the

Agreement to an SPE controlled by Neo that would hold the License

and continue exploration and ultimately extraction of the rare

earth elements on the Project.

The key terms of the Agreement are as follows:

- Hudson receives a nonrefundable

initial cash payment of US$250,000 upon signing of the

Agreement.

- Upon receipt of approval from the

Greenland government, Hudson will transfer the License to Neo or

the SPE.

- Hudson will receive an additional

US$3,250,000 upon closing of the transaction.

- If within five years from the date of

closing of the transaction (1) the SPE transfers the License, or

there is a change in control of the SPE pursuant to an acquisition

or merger, then Hudson will receive 5% of the total consideration

received by the SPE in connection with such transfer, or (2) the

SPE conducts an initial public offering on a stock exchange

(“IPO”), then Hudson will receive 5% of the fully

diluted equity interests in the SPE immediately prior to the

IPO.

The License covers the large Sarfartoq carbonatite

complex that hosts Hudson’s ST1 REE project and

the Nukittooq Niobium-Tantalum project. The REEs on the Property

have a high ratio of neodymium and praseodymium at 25%-40% of Total

Rare Earth Oxides. Hudson completed a Preliminary Economic

Assessment on the ST1 project in November 2011 (see

NR2011-15) that outlined a National Instrument 43-101 compliant

resource containing 27 million kilograms of neodymium oxide and 8

million kilograms of praseodymium oxide.

Three kilometers east of the ST1 Zone is another

high-grade zone (ST40) that hosts one of the rare earth industry’s

highest-known ratios of neodymium oxide to Total Rare Earth Oxide

(TREO) -- 45% -- as shown by Hudson’s original mineralogical work

(see NR2011-02).

Neo and the SPE expect to conduct additional

exploratory drilling and other work to move the Project forward to

eventual commercial operation. Neo also intends to enter into an

offtake agreement with the SPE with rights to purchase 60% of the

ore or mineral concentrate produced from the Project.

Jim Cambon, Hudson’s President, commented: “We are

very pleased to have signed this agreement with a global leader in

the production of advanced materials. As the world faces critical

shortages of rare earth elements outside of China, we are pleased

to help bring the Sarfartoq project a step closer to commercial

reality. This deal provides a significant cash injection to the

company and importantly, also gives Hudson shareholders potential

significant upside in the future value of the Sarfartoq projects

through equity or additional consideration.”

Constantine Karayannopoulos, Neo’s President and

Chief Executive Officer, commented: “Neo continuously pursues

supply chain optionality in order to ensure that our customers have

a dependable supply of engineered rare earth products. Once in

production, this project will significantly increase the diversity

of global rare earth supply for our processing facilities around

the world. It also is another step in our Magnets-to-Mine vertical

integration strategy. Based on our significant experience in

assessing strategic mineral resources around the world, we believe

the Sarfartoq resource in Greenland is a strategic asset that

uniquely complements Neo’s European rare earth magnet growth

strategy. This resource would supplement our current supply of rare

earth concentrate from Energy Fuels in the United States. We are

very confident and supportive of the Greenlandic Government’s

vision for sustainable-focused mining as the driver of their

economic development, job creation, and growth. We are looking

forward to working with Greenland to responsibly develop this

resource into a producing mine, of which Neo would be the primary

customer.”

Closing of the transaction is subject to

customary regulatory approvals by the TSX-V and the Greenland

government.

QUALIFIED PERSONS

The scientific and technical information in this

news release has been reviewed and approved for disclosure by Dr.

Michael Druecker, a “Qualified Person” of Hudson within the meaning

of NI 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF HUDSON

RESOURCES

“Jim

Cambon”

President and Director

ON BEHALF OF THE BOARD OF DIRECTORS OF NEO

PERFORMANCE MATERIALS

“Constantine

Karayannopoulos”

President and Chief Executive Officer

For More Information:

HUDSON RESOURCES:

Jim CambonPresident604-628-5002 Email:

jcambon@hudsonresourcesinc.com

NEO PERFORMANCE MATERIALS:

Ali MahdaviSVP,

Corporate Development & Capital Markets416-962-3300Email:

a.mahdavi@neomaterials.com

Jim SimsDirector,

Corporate Communications303-503-6203Email:

j.sims@neomaterials.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION:

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of

the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. Generally, but not always, forward-looking information

and statements can be identified by the use of words such as

"plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "believes"

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative connotation thereof. In particular, this

news release contains forward-looking information pertaining to the

following: the likelihood of completion of the Transaction, the

ability to obtain the necessary regulatory authority and government

approvals in connection with the transfer of the License, the

anticipated timing of the transfer of the License, Neo’s

anticipated plans to develop the Project to diversify its global

sourcing of rare earth ore and expand its supply chain; Neo’s

anticipated plans to break ground on a greenfield rare earth

permanent magnet manufacturing plant in Estonia; Neo’s ability to

transfer the License to the SPE; and Neo’s ability to enter into an

offtake agreement in connection with the SPE.

In making the forward-looking information in this

release, each of Hudson and Neo has applied certain factors and

assumptions that are based on the parties’ current beliefs as well

as assumptions made by and information currently available to

Hudson and Neo, as applicable. Although each party considers these

assumptions to be reasonable based on information currently

available to it, they may prove to be incorrect, and the

forward-looking information in this release are subject to numerous

risks, uncertainties and other factors that may cause future

results to differ materially from those expressed or implied in

such forward-looking information. Such factors include, among

others: the inability to obtain the necessary regulatory and

governmental approvals in connection with the transfer of the

License in accordance with the terms or timeline announced or at

all; the occurrence of a material adverse change, disaster, change

of law or other failure to satisfy the conditions to closing of the

Transaction; the inability of the Neo to transfer the License to

the SPE or enter into an offtake agreement with the SPE; the

ability of Neo and Hudson, as applicable, to achieve its corporate

objectives or otherwise advance the progress of the Project; the

ability of Neo to achieve its anticipated business plans, including

diversifying its global sourcing of rare earth ore and expanding

its supply chain; uncertainties relating to the availability

and costs of financing needed in the future; delays in the

development of projects, capital and operating costs varying

significantly from estimates and the other risks involved in the

mineral exploration and development industry; risks related to

the international operations; the timing and content of work

programs; results of exploration activities of mineral properties;

the interpretation of drilling results and other geological

data; failure to convert estimated mineral resources to

reserves; the inability to complete a feasibility study which

recommends a production decision; the preliminary nature of

metallurgical test results; the parties’ inability to obtain

any necessary permits, consents or authorizations required for its

activities; inability to fulfill the duty to accommodate

indigenous peoples; an inability to predict and counteract the

effects of COVID-19 on the business of the parties, including but

not limited to the effects of COVID-19 on the price of commodities,

capital market conditions, restriction on labour and international

travel and supply chains; general market and industry conditions;

and those risks set out in the public documents of Neo and Hudson

filed on SEDAR.

Readers are cautioned not to place undue reliance

on forward-looking information. Each of Hudson and Neo does not

intend, and expressly disclaims any intention or obligation to,

update or revise any forward-looking information whether as a

result of new information, future events or otherwise, except as

required by law.

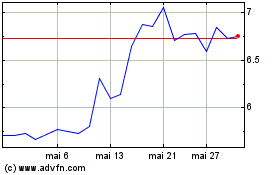

Neo Performance Materials (TSX:NEO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Neo Performance Materials (TSX:NEO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024