Concurrent C$12.5 Million Bought Deal Equity

Financing

Not for distribution to U.S. newswire services

or dissemination in the United States

Nighthawk Gold Corp. (“Nighthawk”) (TSX: NHK;

OTCQX: MIMZF) and Moneta Gold Inc. (“Moneta”) (TSX:

ME; OTCQX: MEAUF; FSE: MOPA) (together, the “Companies”) are

pleased to announce that they have entered into an arrangement

agreement for an at-market merger (the “Arrangement

Agreement”) whereby Moneta will acquire all of the issued and

outstanding common shares of Nighthawk (the “Nighthawk

Shares”), in exchange for common shares of Moneta (the

“Moneta Shares”) by way of a plan of arrangement (the

“Transaction”, with the resulting entity referred to

“MergeCo”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231127415202/en/

Pursuant to the terms of the Arrangement Agreement, Nighthawk

shareholders will receive 0.42 Moneta Shares (on a pre-Moneta

Consolidation basis) for each Nighthawk Share held (the

“Exchange Ratio”). Existing Nighthawk and Moneta

shareholders will own approximately 34% and 66%,

respectively, of MergeCo on a fully diluted in-the-money basis

(prior to the completion of the Concurrent Financing, which is

further described below).

In connection with the Transaction, Nighthawk has entered into

an agreement with SCP Resource Finance LP, on behalf of a syndicate

of underwriters (collectively, the “Underwriters”), pursuant

to which the Underwriters have agreed to purchase, on a “bought

deal” basis, 36,765,000 subscription receipts of Nighthawk (the

“Subscription Receipts”) at a price of C$0.34 per

Subscription Receipt for aggregate gross proceeds of C$12,500,100

(the “Concurrent Financing”). The net proceeds of the

Concurrent Financing are expected to be used by MergeCo to fund the

exploration and advancement of the Tower Gold Project and Colomac

Gold Project (together, the “Projects”) and for working

capital and general corporate purposes.

Keyvan Salehi, President, CEO and Director of Nighthawk,

and Josef Vejvoda, Interim CEO & Chairman of Moneta,

jointly commented: “We believe that the Transaction presents an

exciting opportunity to create a leading gold development company

by bringing together two cornerstone assets in Canada. The combined

company will benefit from a strong balance sheet, led by a skilled

leadership team, and a high-quality portfolio anchored by two

robust, large-scale assets in established and emerging mining

camps. We believe that MergeCo offers a truly unique value

proposition, and we look forward to working towards unlocking

significant value for shareholders of the MergeCo.”

Transaction Highlights

- Creating a Stronger Canadian Gold Developer – The

combined portfolio consists of two large-scale, cornerstone,

Canadian gold projects with robust project economics. MergeCo will

be underpinned by a considerable mineral resource of 7.8 million

gold ounces in the Indicated category and 10.0 million gold ounces

in the Inferred category1.

- Tower Gold Project Preliminary Economic Assessment2 (“Tower

PEA”) outlined economics of C$1.1 billion after-tax net

present value at 5% discount rate (“NPV5%”) and 32%

after-tax internal rate of return (“IRR”) (based on a

US$1,600/oz gold price assumption), with an average potential

production profile of 261,000 ounces per year over the first 11

operating years.

- Colomac Gold Project Preliminary Economic Assessment3

(“Colomac PEA”) outlined economics of C$1.2 billion

NPV5% and 35% IRR (based on a US$1,600/oz gold price

assumption) with an average potential production profile of 290,000

ounces per year over its 11.2-year life of mine.

- Pipeline Optionality & Opportunities with Near Term

Catalysts – The Transaction eliminates single asset risk for

both companies and enables a differentiated strategy to focus on

improved economics and efficient capital deployment with

achievable, value-creation milestones from the advancement of the

Projects.

- Tower Gold Project: Opportunity to focus on

higher-grade, open-pit mineralization to potentially deliver a more

robust mine plan. Potential to utilize excess mill capacity in

proximity to the Tower Gold Project and accelerate towards

near-term cash flow.

- Colomac Gold Project: Opportunity to fast-track a

medium-scale project towards a Feasibility Study that can be

potentially phased into a larger project in the future.

- Synergies – Potential to unlock both G&A and

operational efficiencies with seasonal workflow sequencing,

staggered and phased development of the Projects. The management

team plans on leveraging cross-project experiences to collaborate

on studies advancement, permitting and project de-risking.

- Robust Financial Position – Concurrent Financing and

existing cash balances provide significant funding to advance key

milestones at both Projects.

- Seasoned Team Ready to Execute – Considerable expertise

in engineering, geology, finance, capital markets and ESG.

- Immense Exploration Potential – Significant combined

land package of more than 1,000 km2 of regional greenfield

greenstone exploration opportunities.

- Greater Value Creation Potential for Shareholders – A

thoughtful and sequenced development strategy has the potential to

result in greater valuation creation for Nighthawk and Moneta

shareholders that would not be available on a standalone

basis.

Each of the Tower PEA and Colomac PEA are preliminary in nature

and include inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the either PEA will be

realized. Mineral resources that are not mineral reserves do not

have demonstrated economic viability.

MergeCo Leadership

The Board of Directors of MergeCo will consist of seven (7)

directors, comprised of four (4) nominees from Moneta and three (3)

nominees from Nighthawk. The key senior management team and

directors will include:

- Josef Vejvoda – Non-executive Chairman of the Board

- Keyvan Salehi – President, CEO and Director

Board of Directors’

Recommendations

The Arrangement Agreement has been unanimously approved by the

Board of Directors of each of the Companies after consultation with

their respective financial and legal advisors. Both Boards of

Directors recommend that their respective shareholders vote in

favour of the Transaction.

The Board of Directors of Moneta has received separate opinions

from Maxit Capital LP and Evans & Evans, Inc. to the effect

that, based upon and subject to the assumptions, limitations, and

qualifications stated in each such opinions, the consideration to

be paid by Moneta pursuant to the Transaction is fair, from a

financial point of view, to Moneta.

The Board of Directors of Nighthawk has received an opinion from

Laurentian Bank Securities Inc. to the effect that, based upon and

subject to the assumptions, limitations, and qualifications stated

in such opinion, the consideration to be received by Nighthawk

shareholders pursuant to the Transaction is fair, from a financial

point of view, to Nighthawk shareholders.

Transaction Summary

The Transaction will be completed pursuant to a plan of

arrangement under the Business Corporations Act (Ontario). The

Transaction will require approval by 66⅔% of the votes cast by

Nighthawk shareholders. The issuance of shares by Moneta pursuant

to the Transaction is also subject to approval by the majority of

votes cast by Moneta shareholders. In addition to shareholder and

court approvals, the Transaction is subject to applicable

regulatory approvals including TSX approval, the completion of the

Concurrent Financing and the satisfaction of certain other closing

conditions customary in transactions of this nature.

Senior Officers and Directors of Nighthawk, along with

Northfield Capital Corp., which hold approximately 14.8% of the

outstanding Nighthawk Shares, have entered into voting support

agreements pursuant to which they have agreed, among other things,

to vote their Nighthawk Shares in favour of the Transaction. Senior

Officers and Directors of Moneta, along with O3 Mining Inc. and K2

Principal Fund L.P., which hold approximately 29.4% of the

outstanding Moneta Shares, have entered into voting support

agreements pursuant to which they have agreed, among other things,

to vote their Moneta Shares in favour of the Transaction.

The Arrangement Agreement includes customary provisions

including reciprocal non-solicitation provisions, a reciprocal

C$4.5 million termination fee and an expense reimbursement payable

under certain circumstances.

Full details of the Transaction will be contained in the joint

management information circular of Nighthawk and Moneta and are

expected to be mailed to each company’s respective shareholders in

due course. It is anticipated that both shareholder meetings and

closing of the Transaction will take place in the first quarter of

2024.

Proposed Name Change & Consolidation

Subject to receipt of requisite approvals including Moneta

shareholder approval of 66⅔% of the votes cast by Moneta

shareholders, MergeCo intends to change its name to a name to be

determined by the parties to reflect the new strategic direction of

the company (the “Name Change”).

MergeCo also intends to consolidate the Moneta Shares on the

basis of one (1) post-consolidation Moneta Share for every two (2)

pre-consolidation Moneta Shares (the “Consolidation”) and

the Exchange Ratio will be adjusted accordingly.

It is expected that the Name Change and Consolidation will take

effect at the time of the completion of the Transaction. Closing of

the Transaction is not contingent on the Name Change or

Consolidation.

Concurrent Financing

Nighthawk has entered into an agreement with the Underwriters as

part of the Concurrent Financing for gross proceeds to MergeCo of

C$12.5 million. Nighthawk has also granted the Underwriters an

option, exercisable, in whole or in part, for a period of up to two

(2) business days prior to closing of the Concurrent Financing, to

sell up to an additional 15% of the Subscription Receipts sold (the

“Over-Allotment Option”).

Each Subscription Receipt shall represent the right of a holder

to receive, upon satisfaction or waiver of certain release

conditions (including the satisfaction of all conditions precedent

to the completion of the Transaction other than the issuance of the

consideration shares to shareholders of Nighthawk) (the “Escrow

Release Conditions”), without payment of additional

consideration, one Nighthawk Share and one half of one (1/2)

Nighthawk common share purchase warrant (each whole warrant, a

“Warrant”), subject to adjustments and in accordance with

the terms and conditions of a subscription receipt agreement to be

entered into upon closing of the Concurrent Offering (the

“Subscription Receipt Agreement”). Each Warrant will be

exercisable by the holder thereof for one common share of Nighthawk

(each, a “Warrant Share”) at an exercise price of $0.46 per

Warrant Share for a period of 3 years following the date of

issuance, subject to adjustments in certain events. The Nighthawk

Shares and Warrants issued under the Concurrent Financing will be

exchanged for common shares and warrants of MergeCo in connection

with the Transaction.

The net proceeds from the sale of the Subscription Receipts, net

of 50% of the Underwriters’ cash commission and all of the

Underwriters’ expenses, will be deposited and held in escrow

pending the satisfaction or waiver of the Escrow Release Conditions

by an escrow agent acceptable to Nighthawk, as subscription receipt

and escrow agent under the Subscription Receipt Agreement (the

“Subscription Receipt Agent”). Upon closing of the

Concurrent Financing, Nighthawk will pay 50% of the Underwriters’

cash commission and all of the expenses of the Underwriters

incurred in connection with the Concurrent Financing.

The Escrow Release Conditions are as follows:

- the Arrangement Agreement shall have been entered into by

Nighthawk and Moneta;

- written confirmation from Nighthawk and Moneta of the

completion or irrevocable waiver or satisfaction of all conditions

precedent to the Transaction (except such conditions that can only

be satisfied at the effective time);

- the receipt of all required regulatory, and shareholder

approvals, as applicable, for the Transaction and the Concurrent

Financing, including, without limitation, the common shares of

MergeCo being approved for listing on the Toronto Stock Exchange,

including the listing of the common shares and warrant shares

issuable by MergeCo in connection with the Concurrent Financing;

and

- Nighthawk, Moneta and the lead Underwriter (on its own behalf

and on behalf of the Underwriters) having delivered a joint notice

to the Subscription Receipt Agent confirming that the conditions

set forth in (a) to (d) above have been satisfied or waived (to the

extent such waiver is permitted).

In the event that: the Escrow Release Conditions are not

satisfied on or before the date which is 75 days following the

closing of the Concurrent Financing (the “Escrow Release

Deadline”), or if prior to such time, Nighthawk advises the

lead Underwriter or announces to the public that it does not intend

to or will be unable to satisfy the Escrow Release Conditions or

that the Transaction has been terminated or abandoned, the net

escrowed proceeds under the Concurrent Financing (plus any interest

accrued thereon) will be returned to the holders of the

Subscription Receipts on a pro rata basis and the Subscription

Receipts will be cancelled without any further action on the part

of the holders. To the extent that the escrowed proceeds are not

sufficient to refund the aggregate issue price paid to the holders

of the Subscription Receipts, Nighthawk will be responsible and

liable to contribute such amounts as are necessary to satisfy any

shortfall.

The Concurrent Financing is expected to close on or about

December 19, 2023 and is subject to TSX and other necessary

regulatory approvals.

The Subscription Receipts will be offered by way of: (a) private

placement in each of the provinces of Canada pursuant to applicable

prospectus exemptions under applicable Canadian securities laws;

(b) in the United States or to, or for the account or benefit of

U.S. persons, by way of private placement pursuant to the

exemptions from registration provided for under Rule 506(b) and/or

Section 4(a)(2) of the U.S. Securities Act; and (c) in

jurisdictions outside of Canada and the United States as are agreed

to by Nighthawk and the Underwriters on a private placement or

equivalent basis.

The securities being offered pursuant to the Concurrent

Financing have not been, nor will they be, registered under the

U.S. Securities Act and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from the registration

requirements. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. “United States” and “U.S.

person” are as defined in Regulation S under the U.S. Securities

Act.

Advisors and Counsel

SCP Resource Finance LP and Laurentian Bank Securities Inc. are

acting as financial advisors to Nighthawk. Cassels Brock &

Blackwell LLP is acting as Nighthawk’s legal counsel.

Maxit Capital LP and Evans & Evans, Inc. are acting as

financial advisors to Moneta. McCarthy Tetrault LLP is acting as

Moneta’s legal counsel.

Technical Disclosure and Qualified

Persons

John McBride, MSc., P.Geo., Vice President of Exploration for

Nighthawk, who is the Qualified Person as defined by NI 43-101, has

reviewed and approved of the technical disclosure contained in this

news release related to the Colomac Gold Project.

Jason Dankowski (APEGM #35155), Vice President Technical

Services for Moneta, who is a Qualified Person as defined by NI

43-101, has reviewed and approved the technical contents of this

press release related to the Tower Gold Project.

About Nighthawk Gold

Corp.

Nighthawk is a Canadian-based gold exploration and development

company with control of 947 km2 of District Scale Property located

north of Yellowknife, Northwest Territories, Canada. The Company’s

flagship asset is the large-scale, Colomac Gold Project. The

Colomac PEA3 demonstrated the Project’s potential for

290,000oz/year operation over 11.2-year conceptual mine life that

could generate a C$1.2 billion NPV5% and 35% IRR (after taxes)

based on a US$1,600/oz gold price assumption. Nighthawk’s

experienced management team, with a track record of successfully

advancing projects and operating mines, is working towards rapidly

advancing its assets towards a development decision.

About Moneta Gold Inc.

Moneta is a Canadian-based gold exploration company whose

primary focus is on advancing its 100% wholly owned Tower Gold

Project, located in the Timmins region of Northeastern Ontario,

Canada’s most prolific gold producing camp. The Tower PEA2 study

outlined a combined open pit and underground mining and a 7.0

million tonne per annum conventional leach operation over a 24-year

mine life, with 4.6 Moz of recovered gold, generating an after-tax

NPV5% of $1,066M, after-tax IRR of 31.7%, and a 2.6-year payback at

a gold price US$1,600/oz. Tower Gold hosts an estimated gold

mineral resource of 4.5 Moz Indicated1 and 8.3 Moz Inferred1.

Moneta is committed to creating shareholder value through the

strategic allocation of capital and a focus on the current resource

upgrade drilling program, while conducting all business activities

in an environmentally and socially responsible manner.

Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, but is not limited to,

information with respect to the Transaction and its completion,

including the Concurrent Financing, the potential optionality and

synergies as a result of the Transaction, the respective Mineral

Resource Estimates for the Tower Gold Project and Colomac Gold

Project, the Tower PEA and Colomac PEA and the potential

extractability of the open-pit and underground mineralization, the

potential expansion of Mineral Resource Estimates of the Projects,

the potential for the economics of the Projects to be realized and

to improve, the potential for higher-grade assay results for the

Projects, the potential for the Projects to be developed, the

large-scales and robust natures of the Colomac PEA and Tower PEA,

the advancement of the Colomac PEA and Tower PEA towards a

higher-level economic study, the continued exploration and drilling

initiatives and having the necessary funding required to complete

these initiatives, the prospectivity of exploration targets, and

the advancement of the Projects towards a development decision.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “accelerate”, “add” or

“additional”, “advancing”, “anticipates” or “does not anticipate”,

“appears”, “believes”, “can be”, “conceptual”, “confidence”,

“continue”, “convert” or “conversion”, “deliver”, “demonstrating”,

“estimates”, “encouraging”, “expand” or “expanding” or “expansion”,

“expect” or “expectations”, “fast-track”, “forecasts”, “forward”,

“goal”, “improves”, “increase”, “intends”, “justification”,

“plans”, “potential” or “potentially”, “pro-forma”, “promise”,

“prospective”, “prioritize”, “reflects”, “re-rating”, “scheduled”,

“stronger”, “suggesting”, “support”, “updating”, “upside”, “will

be” or “will consider”, “work towards”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might”, or “will be taken”, “occur”, or “be

achieved”.

Forward-looking information is based on the opinions and

estimates of management at the date the information is made, and is

based on a number of assumptions and is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Nighthawk and Moneta to be materially different from those

expressed or implied by such forward-looking information, including

risks associated with required regulatory approvals, the

exploration, development and mining such as economic factors as

they effect exploration, future commodity prices, changes in

foreign exchange and interest rates, actual results of current

exploration activities, government regulation, political or

economic developments, the ongoing wars and their effect on supply

chains, environmental risks, COVID-19 and other pandemic risks,

permitting timelines, capex, operating or technical difficulties in

connection with development activities, employee relations, the

speculative nature of gold exploration and development, including

the risks of diminishing quantities of grades of reserves, contests

over title to properties, and changes in project parameters as

plans continue to be refined as well as those risk factors

discussed in Nighthawk’s and Moneta’s annual information form for

the year ended December 31, 2022, available on www.sedarplus.ca.

Although Nighthawk and Moneta have attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information. Nighthawk and Moneta do not undertake

to update any forward-looking information, except in accordance

with applicable securities laws.

Cautionary Statement regarding Mineral Resource

Estimates

Until mineral deposits are actually mined and processed, Mineral

Resources must be considered as estimates only. Mineral Resource

estimates that are not Mineral Reserves and have not demonstrated

economic viability. The estimation of Mineral Resources is

inherently uncertain, involves subjective judgement about many

relevant factors and may be materially affected by, among other

things, environmental, permitting, legal, title, taxation,

socio-political, marketing, or other relevant risks, uncertainties,

contingencies and other factors described in the Company’s public

disclosure available on SEDAR+ (www.sedarplus.ca). The quantity and

grade of reported “Inferred” Mineral Resource estimates are

uncertain in nature and there has been insufficient exploration to

define “Inferred” Mineral Resource estimates as an “Indicated” or

“Measured” Mineral Resource and it is uncertain if further

exploration will result in upgrading “Inferred” Mineral Resource

estimates to an “Indicated” or “Measured” Mineral Resource

category. The accuracy of any Mineral Resource estimates is a

function of the quantity and quality of available data, and of the

assumptions made and judgments used in engineering and geological

interpretation, which may prove to be unreliable and depend, to a

certain extent, upon the analysis of drilling results and

statistical inferences that may ultimately prove to be inaccurate.

Mineral Resource estimates may have to be re-estimated based on,

among other things: (i) fluctuations in mineral prices; (ii)

results of drilling, and development; (iii) results of future test

mining and other testing; (iv) metallurgical testing and other

studies; (v) results of geological and structural modeling

including block model design; (vi) proposed mining operations,

including dilution; (vii) the evaluation of future mine plans

subsequent to the date of any estimates; and (viii) the possible

failure to receive required permits, licenses and other approvals.

It cannot be assumed that all or any part of a “Inferred” or

“Indicated” Mineral Resource estimate will ever be upgraded to a

higher category. The Mineral Resource estimates disclosed in this

news release were reported using Canadian Institute of Mining,

Metallurgy and Petroleum Definition Standards for Mineral Resources

and Mineral Reserves (the “CIM Standards”) in accordance

with National Instrument 43-101 Standards of Disclosure for Mineral

Projects of the Canadian Securities Administrators (“NI

43-101”).

Cautionary Statement regarding the Tower PEA and Colomac

PEA

The reader is advised that the Tower PEA and Colomac PEA

referenced in this press release are only conceptual studies of the

potential viability of the Projects’ mineral resource estimates,

and the economic and technical viability of the Projects and their

respective estimated mineral resources have not been demonstrated.

The Tower PEA and Colomac PEA are preliminary in nature and

provides only an initial, high-level review of the Projects’

potential and design options; there is no certainty that the Tower

PEA and Colomac PEA will be realized. The Tower PEA and Colomac PEA

conceptual mine plans and economic models include numerous

assumptions and mineral resource estimates including Inferred

mineral resource estimates. Inferred mineral resource estimates are

too speculative geologically to have any economic considerations

applied to such estimates. There is no guarantee that Inferred

mineral resource estimates will be converted to Indicated or

Measured mineral resources, or that Indicated or Measured resources

can be converted to mineral reserves. Mineral resources that are

not mineral reserves do not have demonstrated economic viability,

and as such there is no guarantee the Projects economics described

herein will be achieved. Mineral resource estimates may be

materially affected by environmental, permitting, legal, title,

taxation, socio-political, marketing, or other relevant risks,

uncertainties, and other factors, as more particularly described in

the Cautionary Statements at the end of this news release.

Cautionary Statement to U.S. Readers

This news release uses the terms “Mineral Resource”, “Indicated

Mineral Resource” and “Inferred Mineral Resource” as defined in the

CIM Standards in accordance with NI 43-101. While these terms are

recognized and required by the Canadian Securities Administrators

in accordance with Canadian securities laws, they may not be

recognized by the United States Securities and Exchange

Commission.

The Mineral Resource estimates and related information in this

news release may not be comparable to similar information made

public by U.S. companies subject to the reporting and disclosure

requirements under the United States federal securities laws and

the rules and regulations thereunder.

1 Combines the respective Projects estimated Indicated mineral

resource ounces (from 221 million tonnes grading 1.10 g/t Au) and

the respective Projects estimated Inferred mineral resource gold

ounces (from 260 million tonnes grading 1.19 g/t Au). For more

information on the Tower Gold Mineral Resource Estimate effective

September 7, 2022, please refer to the NI 43-101 technical report

titled “NI 43-101 Report & Preliminary Economic Assessment of

the Tower Gold Project Northeastern Ontario, Canada” dated November

29, 2022. For more information on the Colomac Gold Project Mineral

Resource Estimate effective February 9, 2023, please refer to the

NI 43-101 technical report titled “NI 43-101 Technical Report and

Update of the Mineral Resource Estimate for the Indin Lake Gold

Property, Northwest Territories, Canada” dated March 16, 2023. Both

technical reports are available on SEDAR+ www.sedarplus.ca. 2 For

more information on the Tower PEA effective September 7, 2022,

please refer to the NI 43-101 technical report titled “NI 43-101

Report & Preliminary Economic Assessment of the Tower Gold

Project Northeastern Ontario, Canada” dated November 29, 2022 which

is available on SEDAR+ www.sedarplus.ca the Moneta’s website

(www.monetagold.com). 3 For more information on the Colomac PEA

effective August 26, 2023, please refer to the NI 43-101 technical

report titled “Colomac Gold Project NI 43-101 Technical Report and

Preliminary Economic Assessment, Northwest Territories, Canada”

dated June 9, 2023 which is available on SEDAR+ www.sedarplus.ca

the Nighthawk’s website (www.nighthawkgold.com).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231127415202/en/

FOR FURTHER INFORMATION PLEASE CONTACT:

MONETA GOLD INC. Tel: +1 (416) 471-5463; Email:

info@monetagold.com Website: www.monetagold.com

NIGHTHAWK GOLD CORP. Tel: +1 (416) 863-2105; Email:

info@nighthawkgold.com Website: www.nighthawkgold.com

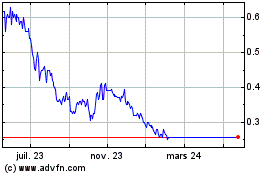

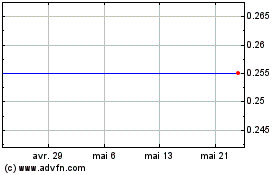

Nighthawk Gold (TSX:NHK)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Nighthawk Gold (TSX:NHK)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025