Verde AgriTech

Plc (TSX: “NPK”) (OTCQB: “AMHPF”)

("

Verde” or the “

Company”) is

pleased to announce its financial results for the third quarter,

ended September 30, 2020 (“

Q3 2020”).

Q3 2020 Financial Highlights

- Sales increased by 68% with a total

of 105,769 tonnes sold, compared to 62,855 tonnes in the third

quarter of 2019 (“Q3 2019”).

- The Company achieved a net profit

of $1,090,046, compared to a net profit of $1,000 in Q3

2019.

- Gross margin increased by 16% to a

gross margin of 67% in Q3 2020, compared to 51% in Q3 2019.

- The Company recognised revenue of

$3,956,341, an increase of 30% compared to $3,054,874 in Q3 2019

despite a 27% decline in the price of potash delivered to Brazil.

The actual increase in revenue in Brazilian Real

(“R$”) was 66%, R$14,815,411 revenue in Q3 2020,

compared to R$8,918,122 in Q3 2019.

- Cash held by the Company increased

by 220% with a total of $2,377,000, compared to $742,000 in Q3

2019.

Subsequent Events

- In November 2020, the Company

secured a bank loan of R$2,000,000 ($473,000) from Santander Bank

for CAPEX investment and working capital. The interest rate for the

loan is 11.11% per annum.

- In November 2020, a 50,000 tonnes

per year (“tpy”) Mining Permit

for Mine Pit 2 was granted by the National Mining Agency.

With this latest Mining Permit, the Company is

fully permitted to mine 482,800 tpy. (i.e. Verde is authorized to

produce such an amount because it holds both mining

Concessions/Permits and Environmental Licenses). The Company has

submitted joint mining and environmental applications for an

additional 5,000,000 tpy.

The amount that is fully permitted supports the

target for 2021 below:

Revised Target for 2020 and Announcement of 2021

Target

“As announced in September 2019, our revenue

target for 2020 was set at R$32 million, representing 76% growth

YoY. We are pleased to announce that Verde has achieved 81% of that

target by Q3 and that makes it possible for the Company to increase

its guidance by approximately 10%. Our new target for 2020 revenue

is set at R$35.2 million, which will represent a 97% growth YoY,

regardless of the 27% drop in potash price delivered to Brazil and

the operating complexities triggered by one of the worst pandemics

in living memory. The Company’s target for 2021 is to achieve R$50

million revenue”, said Cristiano Veloso, Verde’s founder, President

and CEO.

Q3 2020 Financial Results

In Q3 2020 the Company sold 105,769 tonnes of

its multinutrient potassium fertilizer, marketed and sold in Brazil

under the K Forte® brand and internationally as Super Greensand®

(the “Product”), an increase of 68% in comparison

to 62,855 tonnes for Q3 2019. The Company has sold 187,122 tonnes

of the Product up to Q3 2020, which represents 84% of the 222,000

tonnes sales target set for 2020.

The revenue for Q3 2020 increased by 30% with a

total of $3,956,341, compared to $3,054,874 in Q3 2019. Verde’s

average gross margin since 2018, when production started, is 52%1.

The gross margin for Q3 2020 was 67% and the operating profit

before non-cash events was $1,635,179. The Company generated a net

profit of $1,090,045 for Q3 2020.

Technology Launch

As stated in the press release published by the

Company on August 17, 2020, Verde has been working on the

development of a new generation of technologies. The first

technology will be introduced on a conference call hosted by the

Company on Tuesday, December 15, 2020 at 11:30 am Eastern Time

(4:30 pm Greenwich Mean Time).

"Verde is agritech more than in name only. This

upcoming event will introduce a technology that will again combine

enhanced agricultural productivity with strong environmental

credentials. The Company will use its growing market presence and

reputation to synergistically advance towards another

billion-dollar segment of the market", affirmed Mr. Veloso.

____________1 Total gross profit since

production started dived by total sales.

Subscribe at the following link and receive the

conference details by email.

|

Date: |

Tuesday, December 15, 2020 |

|

Time: |

11:30 am Eastern Time (4:30 pm Greenwich Mean Time) |

|

Subscription link: |

https://bit.ly/VerdeAgriTech-TechnologyLaunch |

Selected Annual Financial Information

The table below summarizes Q3 2020 financial

results compared to Q3 2019 and provides information about 2020 and

2019 year-to-date (“YTD”).

|

$’000 |

Q3 2020 |

Q3 2019 |

YTD 2020 |

YTD 2019 |

|

Tonnes sold |

105,769 |

|

62,855 |

|

187,122 |

|

87,548 |

|

|

Revenue per tonne sold $ |

37 |

|

49 |

|

37 |

|

52 |

|

|

Production cost per tonne sold $ |

(12) |

|

(24) |

|

(14) |

|

(25) |

|

|

Gross Profit per tonne sold $ |

25 |

|

25 |

|

23 |

|

27 |

|

|

Gross Margin |

67% |

|

51% |

|

63% |

|

51% |

|

|

Revenue |

3,956 |

|

3,055 |

|

6,957 |

|

4,538 |

|

|

Production costs |

(1,316) |

|

(1,496) |

|

(2,602) |

|

(2,205) |

|

|

Gross Profit |

2,640 |

|

1,599 |

|

4,355 |

|

2,333 |

|

|

Gross Margin |

67% |

|

51% |

|

63% |

|

51% |

|

|

Selling and General Administrative expenses |

(1,005) |

|

(984) |

|

(2,799) |

|

(2,255) |

|

|

Operating Profit/(Loss) before non-cash

events |

1,635 |

|

575 |

|

1,556 |

|

78 |

|

|

Share Based and Bonuses Payments/ (Non-Cash Event)

* |

(339) |

|

(446) |

|

(407) |

|

(901) |

|

|

Depreciation and Amortisation * |

(21) |

|

(2) |

|

(36) |

|

(19) |

|

|

Operating Profit/(Loss) after

non-cash events |

1,275 |

|

127 |

|

1,113 |

|

(842) |

|

|

Corporation tax |

(136) |

|

(96) |

|

(252) |

|

(145) |

|

|

Interest Income/Expense |

(49) |

|

(30) |

|

(119) |

|

(108) |

|

|

Net Profit / (Loss) |

1,090 |

|

1 |

|

742 |

|

(1,095) |

|

* - Included in S&GA expenses in Financial Statements.

Revenue

Revenue from sales for Q3 2020 was $3,956,341

from the sale of 105,769 tonnes of the Product ($37.41 per tonne

sold). Average revenue per tonne was lower than Q3 2019 ($48.60 per

tonne sold). The Product price is based on the current US Dollar

Potassium Chloride price. Therefore, the reduction of the average

revenue per tonne was mainly due to the decline of the Potassium

Chloride CFR (Brazil) price, from $324 per tonne in Q3 2019 to $236

per tonne in Q3 2020 (Acerto Limited Report). In addition, the

Company has been selling further afield from its plant in Brazil,

which correspondingly reduces the realized FOB price (please refer

to the Pre-Feasibility Study, chapter 19.5).

Production costs

Production costs include all costs directly from

mining, processing, transportation from the mine to the factory and

supply chain salaries, which are paid in Brazilian Real. Costs per

tonne for the quarter were $12.44 compared to $23.80 for the same

period in 2019. This reduction of 48% was due to cost efficiency of

20% and also due to the devaluation of the Brazilian Real by 28%

versus the Canadian Dollar.

S&GA - Selling & General Administrative

Expenses

|

S&GA Expenses

$’000 |

Q3 2020 |

Q3 2019 |

YTD 2020 |

YTD 2019 |

|

Sales and marketing expenses |

(306) |

|

(501) |

|

(942) |

|

(874) |

|

|

General administrative expenses |

(240) |

|

(246) |

|

(655) |

|

(674) |

|

|

Distribution expenses |

(264) |

|

(109) |

|

(655) |

|

(226) |

|

|

Legal, professional, consultancy and audit costs |

(160) |

|

(100) |

|

(444) |

|

(405) |

|

|

IT/Software expenses |

(26) |

|

(22) |

|

(75) |

|

(46) |

|

|

Taxes and licenses fees |

(9) |

|

(6) |

|

(28) |

|

(30) |

|

|

Total S&GA |

(1,005) |

|

(984) |

|

(2,799) |

|

(2,255) |

|

* - Please refer to Q3 2020 Management’s Discussion and Analysis

for detailed information about S&GA Expenses.

Project Update2

- In August 2020,

a 233,000 tpy Operating Environmental License for Mine Pit 1 was

granted to the Company.

- In August 2020,

a 2,500,000 tpy Preliminary, Installation and Operating

Environmental License Application for Mine Pit 3 was filed by the

Company.

- The Company is

advancing engineering and project studies required for the

construction of Plant 2. The plant capacity is 1,200,000 tpy.

Construction is expected to take place in the second half of

2021.

“We are excited to see our environmental and

mining permits being issued in a timely manner. This certainly

helps pave the way toward achieving our target of 25 Mt production,

which represents a NPV per share of $53.81, based on the previously

SEDAR filed Pre-Feasibility Study3”, commented Mr. Veloso.

____________2 See the Glossary on page 3 of Q3

2020 Management’s Discussion and Analysis for Technical

Terms. 3 Based on $2.607 billion NPV after tax divided by

48,444,803 shares outstanding as of September 30, 2020. Estimated

Net Present Value after tax of US$1.99 billion, with 8% discount

rate and Internal Rate of Return of 287% (see NI 43-101

Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil,

page 207). Currency exchange: 1 USD = 1.31 CAD.

Investors Newsletter

“Verde has already had a positive impact for

hundreds of Brazilian farmers who understood, tested and proved

that production yields can be boosted with K Forte while still

reversing the damage caused by years of compounded use of KCl. In

order to give our investors a better picture of our business

scenario and its constant improvements, as of January, our monthly

update newsletter will also contain information about our growing

number of clients and their cumulative planted area”, said Mr.

Veloso.

The last edition of the newsletter can be

accessed at https://bit.ly/InvestorsNL-October2020

Subscription link:

http://cloud.marketing.verde.ag/InvestorsSubscription Q3

Results Conference Call

The Company will host a conference call on

Tuesday, November 24, 2020 at 11:30 am Eastern Time (4:30 pm

Greenwich Mean Time), to discuss Q3 2020 results and provide an

update. Subscribe at the following link and receive the conference

details by email.

|

Date: |

Tuesday, November 24, 2020 |

|

Time: |

11:30 am Eastern Time (4:30 pm Greenwich Mean Time) |

|

Subscription link: |

https://bit.ly/VerdeAgriTechQ3-2020 |

The Company’s third quarter financial statements

and related notes for the period ended September 30, 2020 are

available to the public on SEDAR at www.sedar.com and the Company’s

website at www.investor.verde.ag/.

About Verde

AgriTechVerde AgriTech promotes sustainable and

profitable agriculture through the development of its Cerrado Verde

Project. Cerrado Verde, located in the heart of Brazil’s largest

agricultural market, is the source of a potassium-rich deposit from

which the Company intends to produce solutions for crop nutrition,

crop protection, soil improvement and increased sustainability.

For additional information please

contact:

Cristiano Veloso, President

& Chief Executive OfficerTel: +55 (31) 3245 0205; Email:

cv@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

Cautionary Language and Forward Looking

StatementsAll Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of

Mineral Resources and Mineral Reserves; (ii) the PFS

representing a viable development option for the Project;

(iii) estimates of the capital costs of constructing mine

facilities and bringing a mine into production, of sustaining

capital and the duration of financing payback periods; (iv)

the estimated amount of future production, both produced and sold;

and, (v) estimates of operating costs and total costs, net

cash flow, net present value and economic returns from an operating

mine. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives or future events or performance (often, but not always,

using words or phrases such as "expects", "anticipates", "plans",

"projects", "estimates", "envisages", "assumes", "intends",

"strategy", "goals", "objectives" or variations thereof or stating

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved, or the negative

of any of these terms and similar expressions) are not statements

of historical fact and may be forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include:

(i) the presence of and continuity of

resources and reserves at the Project at estimated grades;

(ii) the geotechnical and metallurgical characteristics of

rock conforming to sampled results; including the quantities of

water and the quality of the water that must be diverted or treated

during mining operations; (iii) the capacities and durability

of various machinery and equipment; (iv) the availability of

personnel, machinery and equipment at estimated prices and within

the estimated delivery times; (v) currency exchange rates;

(vi) Super Greensand® and K Forte® sales prices, market size

and exchange rate assumed; (vii) appropriate discount rates

applied to the cash flows in the economic analysis; (viii)

tax rates and royalty rates applicable to the proposed mining

operation; (ix) the availability of acceptable financing

under assumed structure and costs; (x) anticipated mining

losses and dilution; (xi) reasonable contingency

requirements; (xii) success in realizing proposed operations;

(xiii) receipt of permits and other regulatory approvals on

acceptable terms; and (xiv) the fulfilment of environmental

assessment commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com ) for the year ended December

31, 2019. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

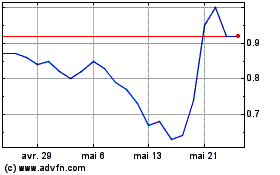

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025