Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”)

("

Verde” or the “

Company”) is

pleased to announce its sales results for the fourth quarter

(“

Q4 2020”) and for the year ended December 31,

2020 (“

FY 2020”). Audited financial results for Q4

2020 and FY 2020 will be reported and filed on SEDAR on March 30,

2021.

In Q4 2020 the Company sold 56,585 tonnes of its

multinutrient potassium fertilizer, marketed and sold in Brazil

under the K Forte® brand and internationally as Super Greensand®

(the “Product”), an increase of 76% in comparison

to the 32,221 tonnes sold in the fourth quarter of 2019

(“Q4 2019”). For the full year 2020, the Company

sold 243,707 tonnes of the Product, an increase of 103% in

comparison to 119,809 tonnes for the year ended December 31, 20219

(“FY 2019”).

In November 2019, the Company had announced a

revenue target of R$32 million for 2020. On November 16, 2020,

Verde revised its target, raising it by 10%. The new target for the

2020 revenue was set at R$35.2 million. The Company is pleased to

announce that it achieved the updated target.

“We know that 2020 was a challenging year for

everyone because of Covid-19, especially in heavily affected

Brazil. It is therefore gratifying to see the continued growth of

Verde, thanks to our renewed and growing client base, as well as

our devoted staff who believe in our purpose,” commented Cristiano

Veloso, Verde's founder, President & CEO.

ALYSSON PAOLINELLI’S NOMINATION FOR THE 2021 NOBEL PEACE

PRIZE

Mr. Alysson Paolinelli, Verde's Board member

since 2014, was nominated for the 2021 Nobel Peace Prize. Over

14,000 people have signed an online petition and over one hundred

letters were sent from representatives of 28 countries, including

several universities and research institutes, in support of Mr.

Paolinelli's nomination.

Mr. Paolinelli had a vital role in

conceptualizing and implementing Tropical Agriculture in Brazil. In

the 1970s, some of the necessary actions to enable the use of land

previously considered unfit for agriculture, such as the Cerrado,

were: hiring more than 1,000 professionals in the first year of the

Brazilian Agricultural Research Corporation

("Embrapa"); building partnerships with

universities and the private sector; sending researchers abroad to

acquire knowledge that could be applied to Brazilian biomes;

investing in science and innovations for agriculture; and expanding

farmers' access to credit.

The development of Tropical Agriculture helped

promote a revolution in terms of the use of natural resources in

Brazil. Through science, farmers could now make the most of the

country's productive capacity to guarantee food security in a

sustainable manner without degrading resources, while guaranteeing

the preservation of 20% of the region's native forest.

“Projections indicate that the world population

is expected to increase by 2.5 billion people by 2050, so the world

will need to produce 60% more to feed its population,” says Mr.

Paolinelli. According to him, “Brazil plays a fundamental role in

guaranteeing world food security.”

Mr. Paolinelli also highlights that, in addition

to quantity, Brazilian agribusiness needs to continue to invest in

the production of quality food, because “people’s increasing demand

for healthier and less dangerous food, without chemical compounds

that are used against diseases and pests or in fertilization, will

be even more pronounced after the Covid-19 pandemic crisis”.

Mr. Paolinelli believes that the nomination

itself is already a victory for Brazilian science. Regardless of

the result, he emphasizes the need to continue searching for more

sustainable and efficient agriculture that offers healthier

food.

Alysson Paolinelli, president of the Brazilian

Association of Corn Producers (“ABRAMILHO”),

former Minister of Agriculture and Secretary of Agriculture of

Minas Gerais, founded Embrapa and received the World Food Award in

2006 for his contribution to advancing human development in

improving the quality, quantity and availability of food in the

world.

VERDE PRAISED AS ONE OF THE BEST

COMPANIES TO WORK FOR IN BRAZIL

The Company has been certified as a Great Place

to Work® ("GPTW"). The GPTW acknowledgment is an

annual certification granted to companies that have most of its

employees with a positive perception of its work environment.

GPTW is a global consultancy that supports

organizations achieving better results through its culture, high

performance, trust and innovation. As part of the certification

process, Verde's employees participated in a survey that assessed

the quality of the work environment and the Company’s

organizational culture, as well as the perception of employees

about their leadership at Verde.

After evaluating employees' answers, GPTW

compiled the reported perceptions and transformed them into an

average number that indicates how many employees have a positive

perception of the Company.

The average obtained by Verde showed that the

vast majority of its employees share a positive perception, leading

the Company to receive the Great Place to Work® certification. This

achievement consolidates Verde as a sustainable and inspiring

employer and confirms that the Company has created a work

environment that encourages and enables the personal and

professional growth of its employees.

"We are always seeking innovations that empower

our employees while observing the current scenario. A good example

of that is the innovative concept of the "Anywhere Office", adopted

by the Company, which allows us to hire and work with the best

talents anywhere in Brazil," commented Mr. Veloso.

The Company currently counts with employees in 5

states and 35 cities across Brazil. As part of its constant growth

project, Verde continues to look for professionals with innovative

and creative minds, who seek to learn from each other and to grow

along with the Company.

PROJECT UPDATE¹

Mining Concession Application (“Requerimento de Lavra”)

for Mine Pit 2

On March 26, 2020, the National Mining Agency

(“ANM”) approved the Feasibility Study

(“Plano de Aproveitamento Econômico - PAE”) for

the extraction of 25,000,000 tonnes per year

(“tpy”) in Mine Pit 2, as part of the Mining

Concession Application process. On March 30, 2020 Verde applied for

a 2,500,000 tpy Environmental License for Mine Pit 2. The 2,500,000

tpy Environmental License was approved on December 23, 2020.

The next and final stage of the Mining

Concession Application was to present the approved Environmental

License Certificate to the ANM as Verde had already fulfilled all

the other requirements in the process.

The Company currently has full rights to mine

482,800 tpy (i.e. since it holds mining Concessions/Permits and

Environmental Licenses, Verde is authorized to produce the amount

mentioned).

BAKS®

On December 15, 2020, Verde introduced its

newest product, BAKS®, a combination of K Forte® (source of

potassium, silicon and magnesium) plus three other nutrients that

can be chosen by customers according to their crops’ needs.

Plant 1 is in operation with BAKS® production,

which already accounts for approximately 14% of Verde’s sales since

the product was launched and 14% of Verde’s total purchase orders

for 2021 to date.

Verde has developed two new technologies to

enable BAKS® production, also presented on December 15, 2020. Given

its innovative nature, the Company has filed for patent protection

covering these new technologies in addition to BAKS® itself.

3D ALLIANCE®

BAKS® relies on the 3D Alliance® technology,

which was developed to transform the three-dimensional structure of

the raw materials added to the fertilizer.

The materials are subjected to physical

transformations, increasing their specific surfaces and forming

microparticles that release nutrients progressively. The

fertilizers resulting from the mixture are homogeneous and are

distributed evenly in the soil, without segregation.

MICRO S TECHNOLOGY®

BAKS® has an exclusive elemental sulfur

(“S”) micronization technology: Micro S

Technology®.

A study carried out by researchers from the

State University of São Paulo with soybean crops revealed that the

granulometry of the sulfur source is a key factor in making sulfur

available to plants². Four sources of S were tested: pelleted

elemental sulfur, plaster, gypsum and powdered elemental sulfur

(micronized).

The application of micronized sulfur resulted in

a higher number of pods per plant, grains per plant and grain yield

per pod than pelleted sulfur sources. This proved that the smaller

the particle size of S, the greater the contact surface and the

possibility of reaction with the soil.

Very small particles are easily dispersed in the

soil and the larger contact surface facilitates the work of

microorganisms. Therefore, the oxidation rate increases and

nutrients become available to plants more efficiently. This

favours the absorption of sulfur and, consequently, the development

of the plant.

PRE-FEASIBILITY STUDY

Micro S Technology converts widely available

unrefined elemental sulfur into highly efficient micronized

material, as a cost-efficient source of nutrient. Therefore

micronized sulfur can be added to BAKS® to help solve farmers’ main

issues related to the nutrient availability, performance and cost.

The Cerrado Verde Project has a US$ 2 billion

NPV³ and BAKS® makes it potentially possible for the Company

to improve its target market share of the Brazilian potash and

sulfur markets, plus upside from other nutrients.

To correctly assess sulfur’s potential market in

Brazil and the opportunities that come with it, a new

Pre-Feasibility Study will be developed in 2021, which is expected

to be finished by the end of the year.

INVESTORS NEWSLETTER

Subscribe to receive the Company’s monthly

updates

at: http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be

accessed at: http://bit.ly/InvestorsNL-January2021

Q4 AND FY 2020 RESULTS CONFERENCE

CALL

The Company will host a conference call on

Wednesday, April 7, 2021 at 11:00 pm Eastern Time (4:00 pm

Greenwich Mean Time), to discuss Q4 and FY 2020 results and provide

an update. Subscribe using the link below and receive the

conference details by email.

|

Date: |

Wednesday, April 7, 2021 |

|

Time: |

11:00 am Eastern Time (4:00 pm Greenwich Mean Time) |

|

Subscription link: |

http://bit.ly/VerdeAgriTech-Q4FY2020 |

The Company’s third quarter financial statements

and related notes for the period ended on September 30, 2020 are

available to the public on SEDAR at www.sedar.com and the Company’s

website at www.investor.verde.ag/.

About Verde AgriTechVerde

AgriTech promotes sustainable and profitable agriculture through

its Cerrado Verde Project. This project is being developed in the

heart of Brazil’s largest agricultural market and has as source a

potassium-rich deposit from which the Company intends to produce

solutions for crop nutrition, crop protection, soil improvement and

increased sustainability.

For additional information please

contact:

Cristiano Veloso, President

& Chief Executive OfficerTel: +55 (31) 3245 0205; Email:

cv@verde.ag

www.investor.verde.ag | www.supergreensand.com

Cautionary Language and Forward Looking

StatementsAll Mineral Reserves' and Mineral Resources'

estimates reported by the Company were calculated in accordance

with the Canadian National Instrument 43-101 and the Canadian

Institute of Mining, Metallurgy, and Petroleum Definition Standards

(May 10, 2014). These standards differ significantly from the

requirements of the U.S. Securities and Exchange Commission.

Mineral Resources, which are not Mineral Reserves, do not have

demonstrated economic viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of Mineral

Resources and Mineral Reserves; (ii) the PFS representing a viable

development option for the Project; (iii) estimates of the capital

costs of constructing mine facilities and bringing a mine into

production, of sustaining capital and the duration of financing

payback periods; (iv) the estimated amount of future production,

both produced and sold; and (v) estimates of operating costs and

total costs, net cash flow, net present value and economic returns

from an operating mine.

Any statement that expresses or involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include:

(i) the presence of and continuity of resources

and reserves at the Project at estimated grades; (ii) the

geotechnical and metallurgical characteristics of rock conforming

to sampled results; including the quantities of water and the

quality of the water that must be diverted or treated during mining

operations; (iii) the capacities and durability of various

machinery and equipment; (iv) the availability of personnel,

machinery and equipment at estimated prices and within the

estimated delivery times; (v) currency exchange rates; (vi) Super

Greensand® and K Forte® sales prices, market size and exchange rate

assumed; (vii) appropriate discount rates applied to the cash flows

in the economic analysis; (viii) tax rates and royalty rates

applicable to the proposed mining operation; (ix) the availability

of acceptable financing under assumed structure and costs; (x)

anticipated mining losses and dilution; (xi) reasonable contingency

requirements; (xii) success in realizing proposed operations;

(xiii) receipt of permits and other regulatory approvals on

acceptable terms; and (xiv) the fulfilment of environmental

assessment commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2019. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

_____________________________________

¹ See the Glossary on page 3 of Q3 2020

Management’s Discussion and Analysis for Technical

Terms.² IBANEZ, Thiago Bergamini et al. Sulfur modulates yield

and storage proteins in soybean grains. Sci. agric. (Piracicaba,

Braz.) [online]. 2021, vol.78, n.1, e20190020. Epub Mar 13, 2020.

ISSN 1678-992X. https://doi.org/10.1590/1678-992x-2019-0020.³

Estimated Net Present Value after tax of US$1.99 billion, with 8%

discount rate and Internal Rate of Return of 287% (see NI 43-101

Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil,

page 207).

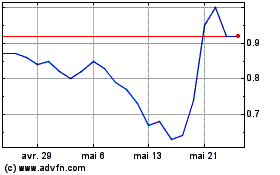

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025