Verde AgriTech Ltd (TSX: “

NPK”)

("OTCMKTS: "

VNPKF") (“

Verde” or

the “

Company”) informs that roadworks it was

performing for increased truck accessibility to and from its second

plant (“

Plant 2”)1 incurred unforeseen groundwater

issues. The solution is already engineered and being implemented.

As a consequence, over the next 4 to 8 weeks, limited delivery of

Plant 2's production will be possible, with an impact to the

Company’s 2022 results.

Plant 2 is ramping up production to 1.2 million

tonnes per year (“Mtpy”) of Verde’s multinutrient

potassium product, K Forte®, sold internationally as Super

Greensand® (the “Product”). As part of Plant 2’s

logistics, the Company has been upgrading road infrastructure,

including 22 kms of roads, 14 kms of asphalting, and the

construction of a new bridge. At its peak, the Company employed 350

people in the construction works of Plant 2 and correlated

infrastructure, currently 125 people are working on the road

foundation to overcome the groundwater issues.

The unforeseen groundwater, which placed in risk

structural stability, was detected in two critical points of the

road. The preceding geotechnical drilling had not uncovered the

risk areas and palliative groundworks proved insufficient to

adequately remediate the situation. The revamped foundation work

will delay the road’s operability. Therefore, the renewed road will

only support Plant 2’s output in Q4 2022.

2022 GUIDANCE

Brazilian agricultural seasonality sees peak

demand for Product in Q3 and early Q4. Plant 1 is operating at

capacity to meet that demand but Plant 2’s delayed output will miss

most of the 2022 season’s peak demand, thereby negatively impacting

the Company’s full year volume. Verde is still in line to meet its

original 2022 Guidance,2 as revised below for Q3 and Q4 in

comparison with the realized results for Q1 and Q2 2022:

|

Period |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

FY 2022 |

|

Guidance |

OriginalJan 2022 |

Achievedin Q1 2022 |

OriginalJan 2022 |

Achievedin Q2 2022 |

OriginalJan 2022 |

RevisedSep2022 |

OriginalJan 2022 |

RevisedSep2022 |

OriginalJan 2022 |

RevisedSep2022 |

|

EPS (C$) |

0.02 |

0.06 |

0.18 |

0.19 |

0.25 |

0.12 |

0.06 |

0.13 |

0.50 |

0.50 |

|

EBITDA (C$’000)3 |

1,358 |

3,678 |

10,155 |

10,765 |

13,414 |

8,040 |

3,506 |

8,808 |

28,433 |

31,291 |

|

Revenue (C$’000) |

10,070 |

11,304 |

21,954 |

24,861 |

27,228 |

24,691 |

13,011 |

25,762 |

72,263 |

86,618 |

|

Sales target (tonnes) |

115,000 |

111,667 |

200,000 |

202,255 |

250,000 |

188,000 |

135,000 |

198,078 |

700,000 |

700,000 |

Following the lower than expected deliveries

from Plant 2 because of logistical issues during Q3 2022, the

original 2022 annual Guidance is expected to be achieved thanks to

Plant 1’s continued operation at capacity and Plant 2’s successful

commissioning and dispatch of Product within the next 4 to 8

weeks.

Client’s demand for Product continues to

outstrip current delivery capacity. The Company is offering

discounts for Q4 2022 and Q1 2023 delivery, in order to maximise

Plant 2 output in those seasonally weak months, as well as to

generate more market penetration.

For 2023, Verde’s sales volume target remains

unchanged at a minimum of 2 Mtpy tonnes of Product. Construction of

Plant 3, which is expected to add a further 10 Mtpy of Product, is

pending government permits and is therefore expected to begin

construction in 2024.

PLANT 1 AND 2 CAPACITY EXPANSION

Over the years, Verde has optimized processing

routes and machinery calibration. Therefore, in light of such

experience, both Plants 1 and 2 are being re-assessed to determine

how equipment and process optimization will enable increased

production volumes beyond their current nominal capacities. To

implement the potential upgrades, Verde will apply for relevant

government licences for total Plant 1 and 2 capacity exceeding 2.8

Mtpy.

PAID FOR GROWTH

Paid for Growth (“P4G”)

strategy, a cornerstone program aimed at distributing gains to

shareholders either through share buyback or dividends,4 will be

withheld for 2022 in order to ensure Verde’s continued accelerated

expansion, including Plant 2 and Plant 3, without issuance of new

shareholder-diluting equity. P4G is expected to distribute Verde’s

first gains to shareholders in 2023.

“While it is disappointing to face a delay at

the very end of what has otherwise been a ‘non-equity

financed’ construction of Plant 2, we are pleased by the overall

pace and safety of the endeavour. Supported by the growing demand

from current and new clients, at Verde we look forward to a future

of sustainable and steadily expanding production. In that spirit,

we celebrate our Plant 2’s commissioning and our 2022 outlook for

over 70% year-on-year growth of production. We hold our heads high

and look forward to advance the P4G strategy and lead our market

segment in Brazil in the near future,” commented Verde’s Founder,

President & CEO, Cristiano Veloso.

BOARD REVISION

Verde is concluding a renewal of its Board of

Directors to better meet the threshold set by certain shareholder

advisory firms, which have deemed part of its Board as

‘non-independent directors’ either because the directors hold too

many shares in the Company or the directors have held extensive

tenures. Therefore, the following directors will gracefully step

down: Mr. Getúlio Fonseca, Mr. Paulo Sérgio Ribeiro and Mr. Michael

St Aldwyn, who have served on the board of Verde over a combined 24

years.

Mr. Fonseca was appointed to the Board in 2007

and was a contributing member of the Audit Committee and the

Chairman of the Compensation Committee.

Mr. Ribeiro was appointed to the Board in 2017

and was a contributing member of the Corporate Governance &

Nominating Committee.

Mr. St Aldwyn was appointed to the Board in 2018

and was a contributing member of the Audit Committee, and

Compensation Committee, also serving as the Chairman of the

Corporate Governance & Nominating Committee, and as Lead

Independent Director.

"We would like to thank Getúlio Fonseca, Paulo

Sérgio Ribeiro and Michael St Aldwyn for their many years of

service and contribution to Verde’s growth. Their experience and

inputs were invaluable to the Company, for which I thank them on

behalf of Verde’s team, our shareholders and stakeholders,"

commented Mr. Veloso.

The Company will seize the opportunity to

enhance Board diversity and, in light of Verde’s recent move to

Singapore,5 to comply with local regulations that mandate that at

least one board member needs to be a Singaporean resident. The

Board changes are expected to be concluded and announced in the

following weeks, without material impact to Verde’s ongoing

expansionary strategies.

ABOUT VERDE AGRITECH

Verde is an agricultural technology company that produces potash

fertilizers. Our purpose is to improve the health of all people and

the planet. Rooting our solutions in nature, we make agriculture

healthier, more productive, and profitable.

Verde is a fully integrated company, from the mining and

processing its main feedstock from its 100% owned mineral

properties, to the Product sales processes, which also include

direct technical advice for farmers, and distribution.

Verde’s focus on research and development has resulted in one

patent and eight patents pending. Among its proprietary

technologies are Cambridge Tech, 3D Alliance, MicroS Technology, N

Keeper, and Bio Revolution.6 Currently, the Company is fully

licensed to produce up to 2.8 million tonnes per year of its

multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®.7 By the end of 2022, it plans

to become Brazil's largest potash producer by capacity.8 Verde has

a combined measured and indicated mineral resource of 1.47 billion

tonnes at 9.28% K2O and an inferred mineral resource of 1.85

billion tonnes at 8.60% K2O (using a 7.5% K2O cut-off grade).9 This

amounts to 295.70 million tonnes of potash in K2O. For context, in

2021 Brazil’s total consumption of potash in K2O was 7.92

million.10

Brazil ranks second in global potash demand and is its single

largest importer, currently depending on external sources for over

96% of its potash needs. In 2021, potash accounted for

approximately 2% of all Brazilian imports by dollar value.

CORPORATE PRESENTATION

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/7ifqptdkh55cutpk

INVESTOR NEWSLETTER

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

https://bit.ly/InvestorsNewsletter-July2022

CAUTIONARY LANGUAGE AND FORWARD-LOOKING STATEMENTS

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of

Mineral Resources and Mineral Reserves;

(ii) the PFS representing a viable

development option for the Project;

(iii) estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

(iv) the estimated amount of future

production, both produced and sold;

(v) timing of disclosure for the PFS and

recommendations from the Special Committee;

(vi) the Company’s competitive position in

Brazil and demand for potash; and,

(vii) estimates of operating costs and

total costs, net cash flow, net present value and economic returns

from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

(i) the presence of and continuity of

resources and reserves at the Project at estimated grades;

(ii) the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

(iii) the capacities and durability of

various machinery and equipment;

(iv) the availability of personnel,

machinery and equipment at estimated prices and within the

estimated delivery times;

(v) currency exchange rates;

(vi) Super Greensand® and K Forte® sales

prices, market size and exchange rate assumed;

(vii) appropriate discount rates applied

to the cash flows in the economic analysis;

(viii) tax rates and royalty rates

applicable to the proposed mining operation;

(ix) the availability of acceptable

financing under assumed structure and costs;

(x) anticipated mining losses and

dilution;

(xi) reasonable contingency

requirements;

(xii) success in realizing proposed

operations;

(xiii) receipt of permits and other

regulatory approvals on acceptable terms; and

(xiv) the fulfilment of environmental

assessment commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

_____________1 See press release at:

https://investor.verde.ag/verde-announces-commissioning-of-its-plant-2/

2 See press release at:

https://investor.verde.ag/verde-announces-2022-guidance-and-two-year-outlook/

3 Before non-cash events.4 See press release at:

https://investor.verde.ag/verde-announces-plans-for-first-distribution-of-gains-and-restructure/5

See release at:

https://investor.verde.ag/verde-announces-completion-of-redomiciliation-process-to-singapore/6

Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r97 See the release

at:

https://investor.verde.ag/2-5-million-tonnes-per-year-potash-mining-concession-granted-to-verde/8

See the release at:

https://investor.verde.ag/verde-to-reach-3-million-tonnes-potash-production-capacity-in-2022/9

As per the National Instrument 43-101 Standards of Disclosure for

Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR in

2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf10

Union of the Agricultural Fertilizers and Correctives Industry, in

the State of São Paulo (“SIACESP”, from Sindicato da Indústria

de Fertilizantes e Corretivos Agropecuários, no Estado de São

Paulo).

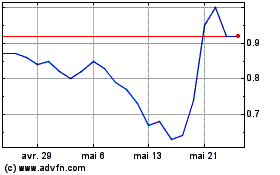

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024