Osisko Gold Royalties Ltd (the “

Corporation” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

provide an update on its first quarter 2024 deliveries, revenues

and cash margin, as well as on its cash and debt positions as of

March 31st, 2024. In addition, Osisko is excited to provide some

select asset updates. All monetary amounts included in this report

are expressed in Canadian dollars, unless otherwise noted.

PRELIMINARY Q1 2024 RESULTS

Osisko earned 22,259 attributable gold

equivalent ounces1 (“GEOs”) in the first quarter of 2024.

Osisko recorded preliminary revenues from

royalties and streams of $60.7 million during the first quarter and

preliminary cost of sales (excluding depletion) of $1.8 million,

resulting in a quarterly cash margin2 of approximately $58.9

million (or 97%).

As of March 31st, 2024, Osisko’s cash position

was approximately $70.6 million, following a $43.6 million

repayment on the Corporation's revolving credit facility during the

first quarter. The Corporation’s revolving credit facility was

drawn by $151.9 million at the end of March 2024, with an

additional amount of $398.1 million available to be drawn plus the

uncommitted accordion of up to $200.0 million.

SELECT ASSET UPDATES

Canadian Malartic Complex (operated by Agnico

Eagle Mines Limited)

Agnico Eagle Mines Limited (“Agnico”) continues

to advance studies on optimizing its Abitibi platform, where the

Canadian Malartic mill is expected to play a central processing

role. Macassa's AK deposit has now been incorporated into Agnico’s

production guidance for 2024 to 2026. At Upper Beaver, Agnico is

conducting a trade-off analysis comparing transporting and

processing ore at its LaRonde mill to a standalone central mill for

Upper Beaver and other satellite deposits. An exploration ramp and

shaft are being considered at Upper Beaver in order to upgrade and

further explore the deeper portions of the deposit. At Wasamac,

Agnico is assessing hauling alternatives and the optimal mining

rate for transporting and processing ore at the Canadian Malartic

mill. Agnico expects to complete internal technical evaluations for

both Upper Beaver and Wasamac, all as part of a group of studies on

optimizing the company’s Abitibi platform, in the first half of

2024. In February, Agnico declared an initial Probable Mineral

Reserves of 5.17 million ounces of gold (47.0 million tonnes

grading 3.42 g/t gold) in the central portion of the East Gouldie

deposit.

In addition to the 5% net smelter return (“NSR”)

royalty on the Canadian Malartic Mine, Osisko also holds a 5% NSR

royalty on the East Gouldie and Odyssey South deposits, a 3% NSR

royalty on the Odyssey North deposit and a 3-5% NSR royalty on the

East Malartic deposit, which are located adjacent to the Canadian

Malartic Mine. Osisko also holds a C$0.40/tonne royalty on any ore

sourced from outside the royalty boundaries processed through the

Canadian Malartic mill, such as Wasamac. Osisko owns 2% NSR

royalties that cover most of Agnico’s Kirkland Lake regional

properties, including AK and Upper Beaver deposits.

CSA Mine (operated by Metals Acquisition

Limited)

In late March 2024, Metals Acquisition Limited

(“MTAL”) announced the filing of its 2023 annual report. MTAL

replaced the second grinding mill and subsequently operated at

target rates without issue and completed the ventilation and

cooling upgrades for CSA. On the financial front, and subsequent to

year-end 2023, MTAL successfully raised A$325 million through its

listing on the Australian Stock Exchange. Proceeds from the ASX

listing were used to repay in full the deferred consideration

facility to Glencore in connection with MTAL’s acquisition of CSA,

and the balance is expected to be used to: increase working capital

to facilitate operational flexibility and potential production

growth, and also to provide additional funding for exploration

programs and mine development at the CSA mine.

Osisko owns a 100% silver stream on the CSA mine

as well as a 3.0-4.875% copper stream having an economic effective

date of June 15th, 2024. Osisko also owns a minimum seven-year

Right of First Refusal over future royalties / streams sold on any

asset owned or purchased by MTAL.

Island Gold / Magino (operated by Alamos Gold

Inc.)

In late March 2024, Alamos Gold Inc. (“Alamos”)

announced the friendly acquisition of Argonaut Gold Inc. (“Argonaut

Gold”) and its Magino gold mine and mill, located immediately

adjacent to Alamos’ Island Gold mine. The transaction is expected

to close in the third quarter of 2024. Alamos’ previously planned

Phase 3+ mill expansion construction work at Island Gold will no

longer be required following the announced acquisition of the

10,000 tonnes per day Magino mill, which is located two kilometres

from the Island Gold shaft (currently under construction). The

larger mill and tailings infrastructure at Magino will now also

accommodate the rapidly growing Mineral Reserve and Resource base

at Island Gold.

Alamos’ expanded and accelerated mine plan at

Island Gold is anticipated to transition a greater proportion of

production towards Osisko’s 2% and 3% NSR royalty boundaries

earlier in the mine plan, as opposed to the mineral inventory

covered by Osisko’s 1.38% NSR royalty. A small fraction of the

eastern limit of the Magino pit is covered by a 3% NSR royalty,

with GEOs earned to Osisko expected from 2030 onwards. The

underground exploration potential previously highlighted by

Argonaut Gold on this claim is located less than 300 metres from

the existing Island Gold underground infrastructure.

Tocantinzinho (operated by G Mining Ventures

Corp.)

In early April 2024, G Mining Ventures Corp. (“G

Mining”) announced that construction of its flagship Tocantinzinho

gold project (“TZ”) in Brazil remained on track with the first gold

pour expected to occur during the second half of 2024, and with

commercial production expected soon thereafter. Overall physical

construction at TZ was approximately 83% complete as of February

29th, 2024. Site infrastructure is substantially complete and the

SAG and ball mill components installation is now underway. Mining

and stockpiling of ore commenced in November 2023, and as of

February 29th, 2024, ore stockpiles at TZ totaled 0.8 million

tonnes grading 0.8 grams/tonne gold.

Osisko owns a 0.75% NSR royalty on the

Tocantinzinho project.

Namdini (operated by Cardinal Namdini Mining

Limited)

Cardinal Namdini Mining Limited, a

majority-owned subsidiary of Shandong Gold Mining Co. Ltd.

(“Shandong”) has now officially started mining at the Namdini gold

project in Ghana. In addition, the construction of the processing

plant, the water abstraction and tailings storage facilities, the

161Kv power transmission line, the segment ponds and the road

network, are all nearing completion. A 25-kilometre access road

from the town Balungu to the mine site has been completed and is

now open to the public, connecting over ten communities. As stated

previously by Shandong, first gold at Namdini is expected to be

poured in the fourth quarter of 2024.

Osisko owns a 1% NSR royalty covering the

Namdini gold project.

Copperwood (operated by Highland Copper Company

Inc.)

In March 2024, Highland Copper Company Inc.

(“Highland”) announced that after a year-long review of the

Copperwood copper-silver project, the Michigan Strategic Fund Board

had unanimously approved a performance-based grant of US$50 million

from the Strategic Site Readiness Program (“SSRP”). The SSRP

program is funded through the Strategic Outreach and Attraction

Reserve Fund and provides economic assistance for the purpose of

creating investment-ready sites to attract and promote investment

in the state. The grant funds will be in the form of

performance-based reimbursements for eligible activities relating

to infrastructure development, most notably expenditure on roads,

communications infrastructure and bringing power to site. The

transfer of funds to Highland is pending final approval from the

Appropriations Committees in both the Michigan House and

Senate.

Osisko currently owns a 1.5% NSR royalty on

copper production, and an 11.5% NSR royalty on silver production at

Copperwood. At Osisko’s election, the silver royalty percentage may

be increased to 100% on Copperwood (and on Highland’s White Pine

North project) for a payment of US$23 million.

Ermitaño (operated by First Majestic Silver

Corp.)

In early April 2024, First Majestic Silver Corp.

(“First Majestic”) released updated 2023 Mineral Reserve and

Mineral Resource estimates for the Ermitaño underground mine at its

Santa Elena Silver/Gold Mine in Sonora, Mexico. Santa Elena’s

(Ermitaño’s) Proven & Probable Mineral Reserve estimates

remained relatively unchanged despite record production of 9.6

million silver equivalent ounces at Ermitaño in 2023. In terms of

catalysts over the next year, continued Resource expansion

potential at the Ermitaño mine (Luna and Soledad Zones) remains a

core focus for First Majestic, with 22,000 metres of drilling

planned for 2024.

Osisko owns a 2% NSR royalty on the Ermitaño

project and the Cumobabi property, including the Luna and Soledad

Zones.

Q1 2024 RESULTS CONFERENCE AND WEBCAST CALL

DETAILS

Osisko provides notice of the first quarter 2024

results and conference and webcast call details.

|

Results Release: |

Wednesday, May 8th, 2024 after market close |

|

Conference Call: |

Thursday, May 9th, 2024 at 10:00 am ET |

|

Dial-in Numbers:(Option 1) |

North American Toll-Free: 1 (800) 717-1738Local – Toronto: 1 (289)

514-5100Local – New York: 1 (646) 307-1865Conference ID: 35205 |

|

Webcast link:(Option 2) |

https://viavid.webcasts.com/starthere.jsp?ei=1664597&tp_key=79a3a8e207 |

|

Replay (available until Monday, June 10th at 11:59 AM ET): |

North American Toll-Free: 1 (888) 660-6264Local – Toronto: 1 (289)

819-1325Local – New York: 1 (646) 517-3975Playback Passcode:

35205# |

|

|

Replay also available on our website at www.osiskogr.com |

Notes:

The figures presented in this press release,

including revenues and costs of sales, have not been audited and

are subject to change. As the Corporation has not yet finished its

quarter-end procedures, the anticipated financial information

presented in this press release is preliminary, subject to

quarter-end adjustments, and may change materially.

|

(1) |

Gold Equivalent Ounces |

| |

GEOs are calculated on a quarterly basis and include royalties and

streams. Silver earned from royalty and stream agreements are

converted to gold equivalent ounces by multiplying the silver

ounces earned by the average silver price for the period and

dividing by the average gold price for the period. Diamonds, other

metals and cash royalties are converted into gold equivalent ounces

by dividing the associated revenue earned by the average gold price

for the period. |

| |

Average Metal Prices and Exchange Rate |

|

|

Three months ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

| |

|

|

|

|

|

|

Gold(i) |

$2,070 |

$1,890 |

|

|

|

Silver(ii) |

$23.34 |

$22.55 |

|

|

|

|

|

|

|

|

|

Exchange rate (US$/Can$)(iii) |

|

1.3486 |

|

1.3525 |

|

| |

(i) |

The London

Bullion Market Association’s pm price in U.S. dollars. |

| |

(ii) |

The London Bullion Market Association’s price in U.S.

dollars. |

| |

(iii) |

Bank of Canada daily rate. |

|

(2) |

Non-IFRS Measures |

| |

The Corporation has included certain performance measures in this

press release that do not have any standardized meaning prescribed

by IFRS Accounting Standards including cash margin in dollars and

in percentage. The presentation of these non-IFRS measures is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS Accounting Standards.

These measures are not necessarily indicative of operating profit

or cash flow from operations as determined under IFRS Accounting

Standards. As Osisko’s operations are primarily focused on precious

metals, the Corporation presents cash margins as it believes that

certain investors use this information, together with measures

determined in accordance with IFRS Accounting Standards, to

evaluate the Corporation’s performance in comparison to other

companies in the precious metals mining industry who present

results on a similar basis. However, other companies may calculate

these non-IFRS measures differently.Cash margin (in dollars)

represents revenues less cost of sales (excluding depletion). Cash

margin (in percentage) represents the cash margin (in dollars)

divided by revenues. |

| |

(In thousands of dollars) |

Three months endedMarch 31, 2024 |

|

| |

|

|

| |

Revenues |

$60,751 |

|

| |

Less: Cost of sales (excluding depletion) |

__($1,833 |

) |

| |

Cash margin (in dollars) |

$58,918 |

|

|

|

Cash margin (in percentage of revenues) |

|

97.0% |

|

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

About Osisko Gold Royalties Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 185

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 3-5% net smelter return

royalty on the Canadian Malartic Complex, which is home to one of

Canada’s largest gold mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact

Osisko Gold Royalties Ltd:

|

Grant MoentingVice President, Capital MarketsTel: (514) 940-0670

x116Cell: (365) 275-1954 Email: gmoenting@osiskogr.com |

Heather TaylorVice President, Sustainability and CommunicationsTel:

(514) 940-0670 x105Email: htaylor@osiskogr.com |

Forward-looking Statements

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, that financial

information may be subject to year-end adjustments, the

availability of the uncommitted accordion of the credit facility.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “scheduled” and similar

expressions or variations (including negative variations), or that

events or conditions “will”, “would”, “may”, “could” or “should”

occur. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors, most of which are beyond

the control of Osisko, and actual results may accordingly differ

materially from those in forward-looking statements. Such risk

factors include, without limitation, (i) with respect to properties

in which Osisko holds a royalty, stream or other interest; risks

related to: (a) the operators of the properties, (b) timely

development, permitting, construction, commencement of production,

ramp-up (including operating and technical challenges), (c)

differences in rate and timing of production from resource

estimates or production forecasts by operators, (d) differences in

conversion rate from resources to reserves and ability to replace

resources, (e) the unfavorable outcome of any challenges or

litigation relating title, permit or license, (f) hazards and

uncertainty associated with the business of exploring, development

and mining including, but not limited to unusual or unexpected

geological and metallurgical conditions, slope failures or

cave-ins, flooding and other natural disasters or civil unrest or

other uninsured risks, (ii) with respect to other external factors:

(a) fluctuations in the prices of the commodities that drive

royalties, streams, offtakes and investments held by Osisko, (b)

fluctuations in the value of the Canadian dollar relative to the

U.S. dollar, (c) regulatory changes by national and local

governments, including permitting and licensing regimes and

taxation policies, regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

and (e) responses of relevant governments to infectious diseases

outbreaks and the effectiveness of such response and the potential

impact of such outbreaks on Osisko’s business, operations and

financial condition; (iii) with respect to internal factors: (a)

business opportunities that may or not become available to, or are

pursued by Osisko, (b) the integration of acquired assets or (c)

the determination of Osisko’s PFIC status (d) that financial

information may be subject to year-end adjustments. The

forward-looking statements contained in this press release are

based upon assumptions management believes to be reasonable,

including, without limitation: the absence of significant change in

Osisko’s ongoing income and assets relating to determination of its

PFIC status, and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. In this press release, Osisko relies on information

publicly disclosed by other issuers and third parties pertaining to

its assets and, therefore, assumes no liability for such

third-party public disclosure. These statements speak only as of

the date of this press release. Osisko undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, other

than as required by applicable law.

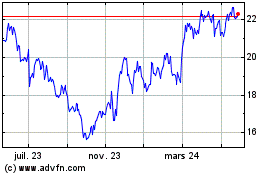

Osisko Gold Royalties (TSX:OR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

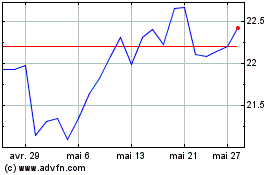

Osisko Gold Royalties (TSX:OR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025