Prime Dividend Corp.: Financial Results to November 30, 2008

25 Février 2009 - 11:50PM

Marketwired

Prime Dividend Corp. ("Prime Dividend") announces its annual

financial results for the year ending November 30, 2008.

By the end of 2008, the cumulative impact of the deterioration

in financial and economic conditions created record lows in

business, investor and consumer confidence and resulted in

recessionary conditions throughout the world. In addition, the

de-leveraging of hedge funds and other similar funds during the

final months exacerbated market volatility and losses in financial

markets. Market indices experienced declines not seen since the

Great Depression of the 1930s. In North America, the S&P TSX 60

index declined by -27.65% for the year ending November 30,

2008.

Throughout this difficult environment, the core holdings in the

portfolio have been negatively impacted. The Company met its

distribution objectives during the year for both classes of shares,

but the net asset value per unit declined to $14.56 per unit (a

unit consisting of one Preferred share and one Class A share) as of

November 30, 2008.

Prime Dividend invests in a portfolio of high yielding Canadian

Companies as follows:

Investment Utilities &

Banks Management Life Insurance Other

Bank of AGF Management Ltd. Great-West Lifeco BCE Inc.

Montreal Inc.

The Bank of CI Financial Manulife Financial TransAlta Corp.

Nova Scotia Income Fund Corp.

CIBC IGM Financial Inc. Sun Life Financial TransCanada

Inc. Corp.

National Bank Power Financial

of Canada Corp.

Royal Bank of TSX Group Inc.

Canada

Toronto-Dominion

Bank

Selected Financial Information from the Statement of Financial Operations:

For the year ending November 30, 2008

($ Millions)

Income 1.886

Expenses (0.684)

----------

Net investment income 1.202

Realized option premiums and gain on sale of investments 0.547

Change in unrealized depreciation of investments (22.136)

----------

Decrease in net assets from operations before distributions (20.387)

Comparative financial information is available in documents filed on

www.sedar.com.

Contacts: Prime Dividend Corp. Investor Relations (416) 304-4443

or Toll Free: 1-877-4-Quadra (1-877-478-2372) Website:

www.primedividend.com

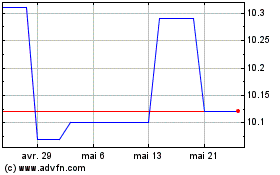

Prime Dividend (TSX:PDV.PR.A)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

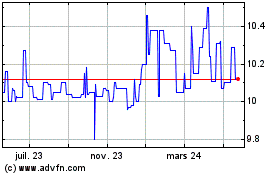

Prime Dividend (TSX:PDV.PR.A)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024