(PIPE – TSX) Pipestone Energy Corp.

(“

Pipestone” or the “

Company”)

today reminded Pipestone shareholders

(“

Shareholders”) that time is running out to vote

their proxies FOR the proposed arrangement (the

“

Arrangement”) with Strathcona Resources Ltd.

(“

Strathcona”) that would see Pipestone and

Strathcona combine to become one of Canada’s largest energy

producers.

To ensure their votes are counted at the special

meeting of Shareholders (the "Meeting") being held

to approve the Arrangement, Shareholders must submit their proxies

by 10:00 a.m. (Calgary Time) on Monday, September

25, 2023. The Meeting is scheduled for 10:00 a.m. (Calgary

Time) on Wednesday, September 27, 2023.

The Arrangement is expected to enable

Shareholders to fully participate in the upside of

- a much larger and more diversified

producer with 185,000 boe/d average daily production;

- a well-positioned reserves base and

much longer reserves life at over 38 years;

- better access to, and lower cost

of, capital;

- an extended tax shelter (by over

two years); and

- a potential

positive re-rating by markets.

The independent committee (the “Special

Committee”) of the board of directors of Pipestone (the

“Board”) and the Board have determined that the

Arrangement is in the best interests of Pipestone and the

Shareholders. The determinations of the Special Committee and the

Board came after a rigorous 18-month strategic review process that

began in early 2022 and evaluated over 75 potential counterparties.

The Arrangement is also fully supported by management of Pipestone

and Riverstone Holdings LLC, a significant and highly sophisticated

shareholder in Pipestone, each of whom have entered into support

agreements with Strathcona to vote their shares in favour of the

Arrangement.

Leading proxy advisory firms Institutional

Shareholder Services (“ISS”) and Glass, Lewis

& Co., LLC (“Glass Lewis”) have both

recommended that Shareholders vote “FOR” the Arrangement. ISS

reaffirmed its recommendation upon review of the dissident proxy

circular of GMT Capital Corp. (“GMT”) dated

September 15, 2023, stating:

“Upon review, the dissident arguments do not

appear well supported and there is no clear indication as to

whether a rejection of the deal would enhance shareholder value or

lead to an enduring improvement in PIPE's share price. As such, ISS

continues to recommend shareholders vote FOR the transaction.”

Click here to read Pipestone’s

news release on ISS’s and Glass Lewis' recommendations dated

September 20, 2023, and click here to access

copies of the management information circular and related meeting

materials (“Meeting Materials”) as well as

Pipestone’s investor presentation, which provides in-depth

rebuttals to GMT’s arguments.

Copies of the Meeting Materials are also

available at www.pipestonestrathcona.com

and under Pipestone’s SEDAR+ profile at

www.sedarplus.ca.

Pipestone thanks Shareholders for the

strong support they have shown so far by voting FOR the Arrangement

and encourages all Shareholders to vote FOR the Arrangement by

10:00 a.m. (Calgary Time) on Monday, September 25, 2023.

Details on how to do so can be found below.

PIPESTONE SPECIAL SHAREHOLDER

MEETING

Shareholders must take action to vote by proxy

by 10:00 a.m. (Calgary time) on Monday, September 25, 2023

On August 28, 2023, Pipestone filed Meeting

Materials in connection with the Meeting. The Meeting is scheduled

to be held at 10:00 a.m. (Calgary time) on Wednesday, September 27,

2023 and will be held in a virtual-only format that will be

conducted via live audio webcast accessible at

https://web.lumiagm.com/218234565.

The sole purpose of the Meeting is for the

Shareholders to consider and, if deemed advisable, approve the

Arrangement. Further details regarding the Meeting are set forth in

the Meeting Materials.

The Board has approved the Arrangement and

recommends that Shareholders vote FOR the Arrangement.

HOW TO VOTE

Pipestone has retained Kingsdale Advisors as its

proxy solicitation agent and strategic shareholder and

communications advisor in connection with the Meeting. Shareholders

with questions are encouraged to contact Kingsdale Advisors by

email or at one of the numbers below:

North America (Toll-Free):

1-877-659-1824 Outside of North America (Collect

Calls): 416-623-2514 Email: contactus@kingsdaleadvisors.com Visit:

www.pipestonestrathcona.com

VOTE “FOR” NOW

Details on how to vote can also be found in the

Circular under “Voting Information”. All Shareholders are

encouraged to vote in advance of the Meeting by proxy, whether or

not a Shareholder is intending to attend the Meeting in person

(virtually).

Media Contact

Martin Cej, PartnerLongview Communications and

Public Affairs(403) 512-5730mcej@longviewcomms.ca

Pipestone Company Contact

Dustin Hoffman, Chief Operating Officer and

Interim President and Chief Executive Officer(587)

392-8423dustin.hoffman@pipestonecorp.com

Forward-Looking Information

This news release contains certain

forward-looking statements and forward-looking information

(collectively "forward-looking information") within the meaning of

applicable securities laws, which are based on Pipestone's current

internal expectations, estimates, projections, assumptions and

beliefs. The use of any of the words "believe", "estimate",

"anticipate", "expect", "plan", "predict", "outlook", "target",

"project", "plan", "may", "could", "will", "shall", "should",

"intend", "potential" and similar expressions are intended to

identify forward-looking information. These statements are not

guarantees of future performance, and involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking information.

Forward-looking information in this news release

includes, but is not limited to: statements regarding the

anticipated benefit of the Arrangement, particularly that the

Arrangement will offer certain advantages to the Shareholders; the

expectation that the consideration payable to the Shareholders on

completion of the Arrangement will enable the Shareholders to

participate in the update of a much larger and more diversified

producer that will benefit from scale; the expectation that the

combined entity will have longer-lasting and better positioned

reserves and better access to, and lower cost of, capital; the

expectation that the combined entity will benefit from an extended

tax shelter (by over two years) and a potential positive re-rating

by markets and the expectation that following completion of the

Arrangement, Shareholders will continue to participate in the

upside of the combined company.

Pipestone believes the expectations reflected in

the forward-looking information in this news release are

reasonable, but no assurance can be given that these expectations

will prove to be correct, and readers should not place undue

reliance on such forward-looking information. The forward-looking

information is not a guarantee of future performance and is subject

to a number of known and unknown risks and uncertainties that could

cause actual events or results to differ materially, including, but

not limited to: the Arrangement may not be completed and may not

obtain the required shareholder approval; Strathcona, Pipestone and

the combined entity may fail to realize, or may fail to realize in

the expected timeframes, the anticipated benefits resulting from

the Arrangement; risks related to the integration of Strathcona's

and Pipestone's existing businesses, including that the

Shareholders may be exposed to additional business risks not

previously applicable to their investment, as the business mix and

operations of the combined entity will be different than that of

Pipestone; if the Arrangement is not completed, Shareholders will

not realize the anticipated benefits of the Arrangement and

Pipestone's future business and operations could be adversely

affected; the combined entity's ability to realize the anticipated

growth opportunities and synergies from integrating the respective

businesses of Strathcona and Pipestone following completion of the

Arrangement; the ability of the combined business to utilize and

apply, or carry forward, tax losses and other tax attributes in the

future and discrepancies between actual and estimated production of

the combined entity. Such forward-looking information is made as of

the date of this news release and Pipestone does not undertake any

obligation to publicly update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws. The

forward-looking information contained herein is expressly qualified

in its entirety by this cautionary statement.

Production and Reserves

Information

The reserves estimate in this press release is

based on Pipestone's internal evaluation and were prepared by a

member of Pipestone's management who is a qualified reserves

evaluator in accordance with National Instrument 51-101 Standards

of Disclosure for Oil and Gas Activities. The growth potential of

the pro forma entity is based on: (i) in respect of Strathcona, (a)

the report prepared by Sproule Associates Limited dated February

23, 2023 evaluating the petroleum and natural gas reserves and

contingent resources attributable to certain of the assets of

Strathcona as at December 31, 2022, (b) the report prepared by

McDaniel & Associated Consultants Ltd. ("McDaniel") dated

February 1, 2023 evaluating the bitumen reserves and contingent

resources attributable to certain of the assets of Strathcona as at

December 31, 2022, and (c) the report prepared by McDaniel dated

February 14, 2023 evaluating the heavy oil reserves and contingent

resources attributable to certain of the assets of Strathcona as at

December 31, 2022, and (ii) in respect of Pipestone, report

prepared by McDaniel dated February 13, 2023 evaluating the crude

oil, natural gas and natural gas liquids reserves attributable to

Pipestone's properties as at December 31, 2022. Such estimates

constitute forward-looking statements, which are based on values

that Pipestone's management believes to be reasonable. For further

information regarding the reserves of Strathcona and Pipestone, see

the Meeting Materials and the annual information form of Pipestone

dated March 8, 2023 for the year ended December 31, 2022, a copy of

which is available on Pipestone's SEDAR+ profile at

www.sedarplus.ca, respectively.

Barrels of Oil Equivalent

This press release contains references to "boe"

(barrels of oil equivalent). Pipestone has adopted the standard of

six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 bbl)

when converting natural gas to boes. Boe may be misleading,

particularly if used in isolation. The foregoing conversion ratio

is based on an energy equivalency conversion method primarily

applicable at the burner tip and do not represent a value

equivalency at the wellhead. Given that the value ratio based on

the current price of oil as compared to natural gas is

significantly different from the energy equivalent of 6:1,

utilizing a conversion on a 6:1 basis may be misleading.

About Pipestone Energy

Corp.

Pipestone is an oil and gas exploration and

production company focused on developing its large contiguous and

condensate rich Montney asset base in the Pipestone area near

Grande Prairie. Pipestone is committed to building long term value

for our shareholders while maintaining the highest possible

environmental and operating standards, as well as being an active

and contributing member to the communities in which it operates.

Pipestone has achieved certification of all its production from its

Montney asset under the Equitable Origin EO100TM Standard for

Responsible Energy Development. Pipestone shares trade under the

symbol PIPE on the Toronto Stock Exchange. For more information,

visit www.pipestonecorp.com.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6b4c13ee-aeaf-4834-a812-196880fac2a2

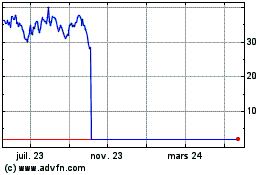

Pipestone Energy (TSX:PIPE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Pipestone Energy (TSX:PIPE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025