Park Lawn Corporation (TSX: PLC) (“

PLC” or the

“

Company”) is pleased to announce that it has

entered into an agreement with a syndicate of underwriters (the

“

Underwriters”) co-led by CIBC Capital Markets and

National Bank Financial Inc. under which the underwriters have

agreed to purchase $75 million aggregate principal amount of listed

senior unsecured debentures due December 31, 2025 (the

“

Debentures”) at a price of $1,000 per Debenture

(the “

Offering”). PLC has also granted the

underwriters an option to purchase up to an additional $11.25

million aggregate principal amount of Debentures, on the same terms

and conditions, exercisable in whole or in part, for a period of 30

days following closing of the Offering. The Offering is expected to

close on or about July 14, 2020.

The Company intends to use the net proceeds of

the Offering to pay down the Company’s revolving credit facility to

free up capacity to fund potential future acquisition opportunities

and for general corporate purposes.

The Debentures will be direct senior unsecured

obligations of the Company and will rank (i) subordinate to all

existing and future senior secured indebtedness of the Company,

(ii) subordinate to all existing and future secured indebtedness

that is not senior secured indebtedness, but only to the extent of

the value of the assets securing such other secured indebtedness,

(iii) pari passu with each debenture issued under the Indenture and

with all other present and future unsubordinated indebtedness of

the Company that is not senior secured indebtedness, including

trade creditors, (iv) senior in right of payment to indebtedness of

the Company that by its terms is subordinated in right of payment

to the Debentures, and (v) structurally subordinated to all

existing and future obligations, including indebtedness and trade

payables, of the Company’s subsidiaries. The payment of principal

and premium, if any, of, and interest on, the Debentures will be

subordinated in right of payment to all senior secured indebtedness

of the Company, as will be set forth in the Indenture under which

the Debentures will be issued (the “Indenture”).

The Indenture will not restrict the Company or its subsidiaries

from incurring additional indebtedness or from mortgaging, pledging

or charging its properties to secure any indebtedness or

liabilities. None of the Company’s subsidiaries will guarantee the

Debentures.

The Debentures will bear interest at a rate of

5.75% per annum, payable semi-annually in arrears on June 30 and

December 31 of each year, with the first interest payment on

December 31, 2020. The first payment will include accrued and

unpaid interest for the period from Closing to, but excluding,

December 31, 2020. The Debentures will mature on December 31, 2025

(the “Maturity Date”).

The Debentures will not be redeemable by the

Company before December 31, 2023 (the “First Call

Date”). On and after the First Call Date and prior to

December 31, 2024, the Debentures will be redeemable, in whole or

in part, from time to time at the Company’s option at a redemption

price equal to 102.875% of the principal amount of the Debentures

redeemed plus accrued and unpaid interest, if any, up to but

excluding the date set for redemption. On and after December 31,

2024 and prior to the Maturity Date, the Debentures will be

redeemable, in whole or in part, from time to time at the Company’s

option at par plus accrued and unpaid interest, if any, up to but

excluding the date set for redemption. The Company shall provide

not more than 60 nor less than 30 days’ prior notice of redemption

of the Debentures.

A preliminary short form prospectus will be

filed with securities regulatory authorities in all provinces of

Canada. The Offering is subject to customary regulatory approvals,

including the approval of the Toronto Stock Exchange.

The securities to be offered have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of such Act. This news release shall not constitute an

offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

The securities offered pursuant to the Offering

have not been, nor will they be, registered under the United States

Securities Act of 1933, as amended, (the “1933

Act”) and may not be offered, sold or delivered, directly

or indirectly, in the United States, or to, or for the account or

benefit of, “U.S. persons” (as defined in Regulation S under the

1933 Act), except pursuant to an exemption from the registration

requirements of the 1933 Act. This press release does not

constitute an offer to sell or a solicitation of an offer to buy

any securities in the United States or to, or for the account or

benefit of, U.S. persons.

About Park Lawn Corporation

PLC provides goods and services associated with

the disposition and memorialization of human remains. Products and

services are sold on a pre-planned basis (pre-need) or at the time

of a death (at-need). PLC and its subsidiaries own and operate

businesses including cemeteries, crematoria, funeral homes,

chapels, planning offices and a transfer service. PLC operates in

five Canadian provinces and fifteen U.S. states.

Cautionary Statement Regarding

Forward‐Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of PLC and the environment in which it

operates. Forward-looking statements are identified by words such

as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”,

“will”, “may”, “estimate”, “pro-forma” and other similar

expressions. These statements are based on PLC’s expectations,

estimates, forecasts and projections and include, without

limitation, statements regarding the expected completion of the

Offering and use of net proceeds of the Offering. The

forward-looking statements in this news release are based on

certain assumptions, including that including that all conditions

to completion of the Offering will be satisfied or waived, as well

as those regarding present and future business strategies, the

environment in which the PLC will operate in the future, the

anticipated adjustments to operations in the COVID-19 pandemic,

expected revenues, expansion plans and PLC’s ability to achieve its

goals. Forward-looking statements are not guarantees of future

performance and involve risks and uncertainties that are difficult

to control or predict. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements, including, but not limited to, risks

associated with the current COVID-19 pandemic and the other factors

discussed under the heading “Risk Factors” in PLC’s Annual

Information Form and most recent Management’s Discussion and

Analysis available at www.sedar.com. There can be no assurance that

forward-looking statements will prove to be accurate as actual

outcomes and results may differ materially from those expressed in

these forward-looking statements. Readers, therefore, should not

place undue reliance on any such forward-looking statements.

Further, these forward-looking statements are made as of the date

of this news release and, except as expressly required by

applicable law, PLC assumes no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

Contact Information

Joseph Leeder Chief Financial Officer (416) 231-1462, ext.

226

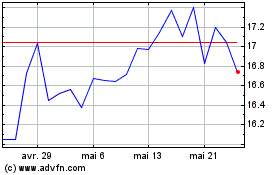

Park Lawn (TSX:PLC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Park Lawn (TSX:PLC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025