Stingray Group Inc (TSX: RAY.A; RAY.B)

(“

Stingray”), a leading music, media and

technology company, today announced that the Toronto Stock Exchange

(“

TSX”) has approved the renewal of its normal

course issuer bid (“

NCIB”), authorizing Stingray

to repurchase up to an aggregate 3,222,901 subordinate voting

shares and variable subordinate voting shares (collectively,

“

Subordinate Shares”), representing approximately

10% of the public float of Subordinate Shares as at September 13,

2021.

The net average daily trading volume for the

six-month period preceding September 1, 2021 represents 48,521

Subordinate Shares. In accordance with TSX requirements, Stingray

is entitled to purchase, on any trading day, up to a total of

12,130 Subordinate Shares representing 25% of this average daily

trading volume.

Stingray believes that the purchase of up to

3,222,901 Subordinate Shares under the NCIB is an appropriate use

of its funds and a desirable investment for Stingray and,

therefore, would be in the best interests of Stingray. By making

such repurchases, the number of Subordinate Shares in circulation

will be reduced and the proportionate interest of all remaining

shareholders in the share capital of Stingray will be increased on

a pro rata basis.

Stingray may repurchase Subordinate Shares on

the open market through the facilities of the TSX as well as

through other alternative Canadian trading systems, from time to

time, over the course of twelve months commencing September 27,

2021 and ending at the latest on September 26, 2022.

The actual number of Subordinate Shares

purchased under the NCIB, the timing of purchases and the price at

which the Subordinate Shares are bought will depend upon management

discretion based on factors such as market conditions. All shares

repurchased under the NCIB will be cancelled upon their

repurchase.

In connection with the NCIB, Stingray has

established an automatic securities purchase plan with a designated

broker whereby shares may be repurchased at times when such

purchases would otherwise be prohibited pursuant to regulatory

restrictions or self-imposed blackout periods. Under the automatic

securities purchase plan, before entering a self-imposed blackout

period, Stingray may, but is not required to, ask the designated

broker to make purchases under the NCIB. Such purchases will be

made at the discretion of the designated broker, within parameters

established by Stingray prior to the blackout periods. Outside the

blackout periods, purchases are made at the discretion of

Stingray’s management. The automatic securities purchase plan

constitutes an “automatic plan” for purposes of applicable Canadian

securities legislation and has been pre-cleared by the TSX.

As of September 13, 2021, Stingray had

repurchased a total of 2,508,180 Subordinate Shares pursuant to its

last NCIB (which will expire on September 24, 2021 and allows the

repurchase of up to 3,485,155 Subordinate Shares) at a weighted

average price of $6.9355 per share. As of the close of business on

September 13, 2021, there were an aggregate of 53,259,202

Subordinate Shares issued and outstanding.

About StingrayMontreal-based

Stingray Group Inc. is a leading global music, media and technology

company with over 1,000 employees worldwide. Stingray is a premium

provider of curated direct-to-consumer and B2B services, including

audio television channels, over 100 radio stations, SVOD content,

4K UHD television channels, FAST channels, karaoke products,

digital signage, in-store music, and music apps, which have been

downloaded over 160 million times. Stingray reaches 400 million

subscribers (or users) in 160 countries. For more information:

www.stingray.com.

Forward-Looking InformationThis

news release contains forward-looking information within the

meaning of applicable Canadian securities law. Such forward-looking

information includes, but is not limited to, information with

respect to Stingray's goals, beliefs, plans, expectations,

anticipations, estimates and intentions. Forward-looking

information is identified by the use of terms and phrases such as

"may", "would", "should", "could", "expect", "intend", "estimate",

"anticipate", "plan", "foresee", "believe", and "continue", or the

negative of these terms and similar terminology, including

references to assumptions. Please note, however, that not all

forward-looking information contains these terms and phrases.

Forward-looking information is based upon a number of assumptions

and is subject to a number of risks and uncertainties, many of

which are beyond Stingray's control. These risks and uncertainties

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, the risk

factors identified in Stingray's Annual Information Form for the

year ended March 31, 2021, which is available on SEDAR at

www.sedar.com. Consequently, all of the forward-looking information

contained herein is qualified by the foregoing cautionary

statements, and there can be no guarantee that the results or

developments that Stingray anticipates will be realized or, even if

substantially realized, that they will have the expected

consequences or effects on Stingray's business, financial condition

or results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and Stingray does not

undertake to update or amend such forward-looking information

whether as a result of new information, future events or otherwise,

except as may be required by applicable law.

Contact Information:

Mathieu PéloquinSenior Vice-President, Marketing and

CommunicationsStingray Group Inc.(514) 664-1244, ext.

2362mpeloquin@stingray.com

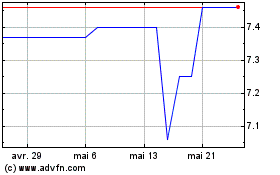

Stingray (TSX:RAY.B)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stingray (TSX:RAY.B)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024