Stingray Group Inc. (TSX: RAY.A; RAY.B) (the “Corporation”;

“Stingray”), a leading distributor of audio and video music brands

in the world, announced today its financial results for the third

quarter of fiscal 2022, ended December 31, 2021.

|

Financial Highlights(in thousands of dollars,

except per share data) |

Three months endedDecember

31 |

|

|

Q3-2022 |

Q3-2021 |

% |

|

Revenues |

76,040 |

72,565 |

4.8 |

| Adjusted

EBITDA(2) |

28,504 |

33,993 |

(16.1) |

| Net

income |

12,546 |

14,118 |

(11.1) |

|

Per share – diluted ($) |

0.18 |

0.19 |

(5.3) |

| Adjusted

Net income(3) |

17,048 |

21,054 |

(19.0) |

|

Per share – diluted ($)(3) |

0.24 |

0.29 |

(17.2) |

| Cash flow

from operating activities |

24,762 |

16,333 |

51.6 |

| Adjusted

free cash flow(4) |

14,731 |

19,645 |

(25.0) |

|

|

|

|

|

|

(1) |

Recurring Commercial Music revenues include subscriptions and usage

in addition to fixed fees charged to our customers on a monthly,

quarterly and annual basis for continuous music services and

excludes credits to clients related to the COVID-19 pandemic.

Non-recurring revenues mainly include advertising, support,

installation, equipment, one-time fees and discontinued

operations. |

|

(2) |

Adjusted EBITDA is a non-IFRS measure and is defined as net income

(loss) before net finance expense (income), change in fair value of

investments, income taxes, depreciation and write-off of property

and equipment, depreciation of right-of-use assets, amortization of

intangible assets, share-based compensation, performance and

deferred share unit expense, and acquisition, legal, restructuring

and other expenses (income). |

|

(3) |

Adjusted Net income is a non-IFRS measure and is defined as net

income before change in fair value of investments, mark-to-market

losses (gains) on derivative instruments, amortization of

intangible assets, share-based compensation, performance and

deferred share unit expense, and acquisition, legal, restructuring

and other expenses (income), net of related income taxes. |

|

(4) |

Adjusted free cash flow is a non-IFRS measure and is defined as

cash flow from operating activities less capital expenditures,

interest paid and repayment of lease liabilities, plus acquisition,

legal, restructuring and other expenses (income), and adjusted for

unrealized gain or loss on foreign exchange and for the net change

in non-cash working capital items. |

|

(5) |

Pro Forma Adjusted EBITDA is calculated as the Corporation’s last

twelve months Adjusted EBITDA, plus synergies and pro forma

Adjusted EBITDA for the months prior to the acquisitions which are

not already reflected in the results |

Reporting on third quarter performance,

Stingray’s President, co-founder and CEO Eric Boyko stated: “I am

pleased with our solid organic growth of 5% in the third quarter of

2022, including more than 28% year-over-year in the United States.

Adjusted EBITDA decreased year over year mainly due to a one-time

gain from a settlement with SOCAN in the third quarter of last

year, and significant incremental investments in this quarter to

support strategic growth initiatives in the US and to accelerate

the Corporation’s pivot to digital streaming, with results expected

to materialize in subsequent quarters.”

“From a pure operational standpoint, adjusted

EBITDA of $28.5 million would have been relatively stable compared

to the same period last year with higher revenues of 4.8% mostly

offsetting lower margins caused by increased investments in the

U.S. and differences in product mix.”

“During the third quarter of 2022, Broadcasting

and Commercial Music revenues grew by 2.3% to $41.1 million mostly

due to higher advertising revenues. Adjusted EBITDA decreased to

$14.6 million in the third quarter due to higher costs related to

the gradual return to normal business operations, increased U.S.

investments and a lower gross margin impacted by product mix.”

“For its part, Radio revenues improved 7.9%

year-over-year to $34.9 million in the third quarter, while

Adjusted EBITDA increased 9.0% to $15.0 million. These financial

results, outperforming those of Radio peers in Canada, represent

our strongest quarterly performance in the last two years. The

outlook for our Radio business remains favourable with end-market

recovery still not having reached pre-pandemic levels.”

“Following the quarter-end, we completed the

transformative acquisition of InStore Audio Network, the largest

retail audio network in the U.S. reaching 16,000 pharmacies and

grocery stores. By combining this strategic asset with our existing

platform, our Stingray Business is extremely well positioned to

target 250,000 locations in the U.S. and Canada. For Stingray, the

revenue potential per location can increase exponentially and

generate significantly higher margins, since we are helping our

customers generate additional revenue.”

“Finally, SVOD subscribers surged past 691,000

in Q3 2022, an increase of 34% over the same period last year and

13% sequentially. We expect to hit our one-million-sub goal within

the next two years. As for advertising revenues, the run-rate for

the third quarter was in excess of $10 million, supported by

significant growth over last year. The acquisition of InStore Audio

Network will further step-up advertising revenues going

forward.”

“In short, the pivot in our business towards

strategic digital revenues is in full motion and gaining traction

with accelerated growth in new revenue streams outpacing the drop

in our traditional sources of revenue,” concluded Mr. Boyko.

Third Quarter Results

Revenues increased $3.4 million, or 4.8%, to

$76.0 million in Q3 2022 from $72.6 million for Q3 2021. The

increase was primarily due to the gradual easing of COVID-19

restrictions and the return to normal commercial operations as well

as an increase in advertising revenues in the Broadcast and

Commercial Music segment.

For the third quarter of 2022, revenues in

Canada grew $2.0 million, or 4.2%, to $49.4 million from

$47.4 million for Q3 2021. The growth mainly reflects the

gradual easing of COVID-19 restrictions and the return to normal

commercial operations. Revenues in the United States improved $2.7

million, or 25.7%, to $13.4 million in Q3 2022 from $10.7 million

in the same period last year. The revenue growth is mainly due to

an increase in subscription revenues and organic growth in

advertising revenues. Revenues in Other countries decreased $1.3

million, or 8.8%, to $13.2 million in Q3 2022 from $14.5 million

for Q3 2021 with the variation attributable to a decrease in audio

channel revenues and a negative foreign exchange rate impact.

Broadcasting and Commercial Music revenues

increased $0.9 million, or 2.3%, to $41.1 million in Q3 2022 from

$40.2 million for Q3 2021. The improvement was mainly due to an

increase in advertising revenues. Radio revenues grew $2.5 million,

or 7.9%, to $34.9 million in Q3 2022 from $32.4 million in the same

period last year. This increase was largely due to the gradual

easing of COVID-19 restrictions and the return to normal commercial

operations.

Adjusted EBITDA(2) amounted to $28.5 million, or

37.5% of sales, in Q3 2022 compared to $34.0 million, or 46.8% of

sales, in Q3 2021. The decrease is mainly due to a gain related to

a settlement with SOCAN in Q3 2021 and to higher operating costs

caused by the gradual easing of COVID-19 restrictions and the

return to normal commercial operations. These items were partially

offset by a special bonus given to employees in Q3 2021.

Net income totaled $12.5 million, or $0.18 per

share, in Q3 2022 compared to $14.1 million, or $0.19 per share, in

Q3 2021. The decrease was mainly related to lower operating

results, partially offset by a positive change in fair value of

investments following the loss related to the sale of securities

held in AppDirect Inc. in Q3 2021.

Adjusted Net income(3) reached $17.0 million, or

$0.24 per share, in Q3 2022 compared to $21.1 million, or $0.29 per

share, in the same period last year. The decrease was primarily due

to lower operating results and a reduced foreign exchange gain,

partially offset by less income tax and interest expenses.

Cash flow generated from operating activities

amounted to $24.8 million for Q3 2022 compared to $16.3 million for

Q3 2021. The increase was mainly due to a positive change in

non-cash operating working capital items, partially offset by lower

operating results and a smaller gain on foreign exchange. Adjusted

free cash flow(4) generated in Q3 2022 reached $14.7 million in Q3

2022 compared to $19.6 million for Q3 2021. The variation was

mainly due to lower operating results and higher income tax paid,

partially offset by lower interest paid.

As of December 31, 2021, the Corporation had

cash and cash equivalents of $11.3 million, subordinated debt of

$25.4 million and credit facilities of $318.0 million, of which

approximately $120.7 million was available. Net debt to pro forma

adjusted EBITDA(5) ratio stood at 3.01 as of December 31, 2021

compared to 2.81 as of March 31, 2021.

Declaration of DividendOn

February 8, 2022, the Corporation declared a dividend of $0.075 per

subordinate voting share, variable subordinate voting share and

multiple voting share. The dividend will be payable on or around

March 15, 2022, to shareholders on record as of February 28,

2022.

The Corporation’s dividend policy is at the

discretion of the Board of Directors and may vary depending upon,

among other things, our available cash flow, results of operations,

financial condition, business growth opportunities and other

factors that the Board of Directors may deem relevant.

The dividends paid are designated as "eligible"

dividends for the purposes of the Income Tax Act (Canada) and any

corresponding provisions of provincial and territorial tax

legislation

Business Highlights and Subsequent

EventsOn January 5, 2022, the Corporation announced that

it had acquired InStore Audio Network, the largest in-store audio

advertising network in the United States, reaching 100 million

shoppers each week in over 16,000 grocery retailers and pharmacies

across the US for total consideration of up to approximately $59.0

million, subject to a specific earnout mechanism set forth in the

purchase agreement.

On December 22, 2021, the Corporation announced

that Canadian value retailer Dollarama has joined the Stingray

Retail Media Network. Under the agreement, Stingray will produce

and dynamically insert digital audio advertisements within

Dollarama stores connected to the retail audio network powered by

Stingray’s proprietary streaming media technology.

On December 20, 2021, the Corporation announced

the launch of Alexa Karaoke featured by Yokee on Echo Show and Fire

TV devices in the United Kingdom and Spain.

On November 30, 2021, the Corporation signed a

channel carriage deal for North America and the United Kingdom with

View TV Group for broadcast on their Kapang CTV platform. The

carriage deal makes Stingray’s premium music themed channels

available on the Kapang CTV platform.

On November 29, 2021, the Corporation announced

that it had partnered with Hivestack to power Audio Out of Home

(AOOH) in Canada. The integration of Stingray's proprietary

streaming media player into Hivestack's suite of supply side

technology, including the Ad Server and Supply-side Platform will

allow for AOOH inventory to be available programmatically for the

first time in Canada.

On November 9, 2021, the Corporation declared a

dividend of $0.075 per subordinate voting share, variable

subordinate voting share and multiple voting share. The dividend

has been paid on December 15, 2021 to shareholders on record as of

November 30, 2021.

On October 19, 2021, the Corporation announced

that it had successfully completed the increase and extension of

its existing credit facilities, providing additional liquidity for

operations and M&A activities. The $442.5 million credit

facilities consist of a $375.0 million revolving credit facility

and a $67.5 million term loan, both maturing in October 2026. The

renewed terms include incremental commitments up to $100.0 million

upon request, subject to predetermined conditions. The pre-existing

sub debt of $32.0 million maturing in October 2023 combined with

the credit facilities described above accounts for total

flexibility of up to $574.5 million.

Conference CallThe Corporation

will hold a conference call to discuss these results on Wednesday,

February 9, 2022, at 10:00 AM (ET). Interested parties can join the

call by dialing 647-788-4922 (Toronto) or 1-877-223-4471 (toll

free). A rebroadcast of the conference call will be available until

midnight, March 23, 2022, by dialing (800) 585-8367 or (416)

621-4642 and entering passcode 4597153.

About StingrayMontreal-based

Stingray Group Inc. (TSX: RAY.A; RAY.B) is a leading music, media,

and technology company with over 1,000 employees worldwide.

Stingray is a premium provider of curated direct-to-consumer and

B2B services, including audio television channels, more than 100

radio stations, SVOD content, 4K UHD television channels, FAST

channels, karaoke products, digital signage, in-store music, and

music apps, which have been downloaded over 160 million times.

Stingray reaches 400 million subscribers (or users) in 160

countries.

Forward-Looking InformationThis

news release contains forward-looking information within the

meaning of applicable Canadian securities law. Such forward-looking

information includes, but is not limited to, information with

respect to Stingray's goals, beliefs, plans, expectations,

anticipations, estimates and intentions. Forward-looking

information is identified by the use of terms and phrases such as

"may", "would", "should", "could", "expect", "intend", "estimate",

"anticipate", "plan", "foresee", "believe", and "continue", or the

negative of these terms and similar terminology, including

references to assumptions. Please note, however, that not all

forward-looking information contains these terms and phrases.

Forward-looking information is based upon a number of assumptions

and is subject to a number of risks and uncertainties, many of

which are beyond Stingray's control. These risks and uncertainties

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, the risk

factors identified in Stingray's Annual Information Form for the

year ended March 31, 2021, which is available on SEDAR

at www.sedar.com. Consequently, all of the forward-looking

information contained herein is qualified by the foregoing

cautionary statements, and there can be no guarantee that the

results or developments that Stingray anticipates will be realized

or, even if substantially realized, that they will have the

expected consequences or effects on Stingray's business, financial

condition or results of operation. Unless otherwise noted or the

context otherwise indicates, the forward-looking information

contained herein is provided as of the date hereof, and Stingray

does not undertake to update or amend such forward-looking

information whether as a result of new information, future events

or otherwise, except as may be required by applicable law.

Non-IFRS MeasuresThe

Corporation believes that Adjusted EBITDA and Adjusted EBITDA

margin are important measures when analyzing its operating

profitability without being influenced by financing decisions,

non-cash items and income taxes strategies. Comparison with peers

is also easier as companies rarely have the same capital and

financing structure. The Corporation believes that Adjusted Net

income and Adjusted Net income per share are important measures as

it shows stable results from its operation which allows users of

the financial statements to better assess the trend in the

profitability of the business. The Corporation believes that

Adjusted free cash flow and Adjusted free cash flow per share are

important measures when assessing the amount of cash generated

after accounting for capital expenditures and non-core charges. It

demonstrates cash available to make business acquisitions, pay

dividend and reduce debt. The Corporation believes that Net debt

and Net debt to Pro Forma Adjusted EBITDA are important to analyse

the company's debt repayment capacity on an annualized basis,

taking into consideration the annualized adjusted EBITDA of

acquisitions made during the last twelve months. Each of these

non-IFRS financial measures is not an earnings or cash flow measure

recognized by International Financial Reporting Standards (IFRS)

and does not have a standardized meaning prescribed by IFRS.

This method of calculating such financial

measures may differ from the methods used by other issuers and,

accordingly, our definition of these non-IFRS financial measures

may not be comparable to similar measures presented by other

issuers. Investors are cautioned that non-IFRS financial measures

should not be construed as an alternative to net income determined

in accordance with IFRS as indicators of our performance or to cash

flows from operating activities as measures of liquidity and cash

flows.

Adjusted EBITDA and Adjusted Net Income

Reconciliation to Net income

| |

3 months |

|

9 months |

|

(in thousands of Canadian dollars) |

Dec. 31, 2021Q3 2022 |

|

Dec. 31, 2020Q3 2021 |

|

|

Dec. 31, 2021YTD 2022 |

|

Dec. 31, 2020YTD 2021 |

|

| Net income |

12,546 |

|

14,118 |

|

|

28,821 |

|

33,027 |

|

| Net finance expense (income) |

1,999 |

|

(1,290 |

) |

|

6,888 |

|

6,085 |

|

| Change in fair value of

investments |

3 |

|

2,434 |

|

|

(10 |

) |

3,787 |

|

| Income taxes |

4,115 |

|

4,900 |

|

|

8,822 |

|

11,913 |

|

| Depreciation and write-off of

property and equipment |

2,237 |

|

2,894 |

|

|

7,207 |

|

8,571 |

|

| Depreciation of right-of-use

assets |

1,281 |

|

1,399 |

|

|

3,875 |

|

4,224 |

|

| Amortization of intangible

assets |

4,669 |

|

5,478 |

|

|

15,223 |

|

16,076 |

|

| Share-based compensation |

216 |

|

231 |

|

|

576 |

|

616 |

|

| Performance and deferred share

unit expense |

659 |

|

1,780 |

|

|

4,049 |

|

4,408 |

|

|

Acquisition, legal, restructuring and other expenses (income) |

779 |

|

2,049 |

|

|

2,795 |

|

1,923 |

|

|

Adjusted EBITDA |

28,504 |

|

33,993 |

|

|

78,246 |

|

90,630 |

|

| Net finance expense (income),

excluding mark-to-market losses (gains) on derivative financial

instruments |

(2,247 |

) |

(1,727 |

) |

|

(8,135 |

) |

(9,405 |

) |

| Income taxes |

(4,115 |

) |

(4,900 |

) |

|

(8,822 |

) |

(11,913 |

) |

| Depreciation of property and

equipment and write-off |

(2,237 |

) |

(2,894 |

) |

|

(7,207 |

) |

(8,571 |

) |

| Depreciation of right-of-use

assets |

(1,281 |

) |

(1,399 |

) |

|

(3,875 |

) |

(4,224 |

) |

|

Income taxes related to change in fair value of investments,

share-based compensation, performance and deferred share unit

expense, amortization of intangible assets, mark-to-market losses

(gains) on derivative financial instruments and acquisition, legal,

restructuring and other expenses (income) |

(1,576 |

) |

(2,019 |

) |

|

(5,598 |

) |

(5,643 |

) |

|

Adjusted Net income |

17,048 |

|

21,054 |

|

|

44,609 |

|

50,874 |

|

Adjusted Free Cash Flow Reconciliation

to Cash Flow from Operating Activities

| |

3 months |

|

9 months |

|

(in thousands of Canadian dollars) |

Dec. 31, 2021Q3 2022 |

|

Dec. 31, 2020Q3 2021 |

|

|

Dec. 31, 2021YTD 2022 |

|

Dec. 31, 2020YTD 2021 |

|

| Cash flow from operating

activities |

24,762 |

|

16,333 |

|

|

61,536 |

|

79,732 |

|

| Add / Less : |

|

|

|

|

|

| Acquisition of property and

equipment |

(2,181 |

) |

(1,849 |

) |

|

(6,618 |

) |

(3,761 |

) |

| Acquisition of intangible assets

other than internally developed intangible assets |

(276 |

) |

(649 |

) |

|

(779 |

) |

(1,119 |

) |

| Addition to internally developed

intangible assets |

(2,058 |

) |

(1,838 |

) |

|

(6,261 |

) |

(5,061 |

) |

| Interest paid |

(3,868 |

) |

(6,312 |

) |

|

(10,993 |

) |

(12,911 |

) |

| Repayment of lease

liabilities |

(1,130 |

) |

(1,255 |

) |

|

(3,741 |

) |

(3,912 |

) |

| Net change in non-cash operating

working capital items |

(1,533 |

) |

15,858 |

|

|

7,595 |

|

10,976 |

|

| Unrealized loss on foreign

exchange |

236 |

|

(2,692 |

) |

|

1,566 |

|

(5,316 |

) |

|

Acquisition, legal, restructuring and other expenses (income) |

779 |

|

2,049 |

|

|

2,795 |

|

1,923 |

|

|

Adjusted free cash flow |

14,731 |

|

19,645 |

|

|

45,100 |

|

60,551 |

|

Pro Forma Adjusted EBITDA

Reconciliation

|

(in thousands of Canadian dollars) |

December 31, 2021 |

March 31, 2021 |

| LTM Adjusted EBITDA(2) |

101,884 |

114,268 |

| Synergies and Adjusted EBITDA(2)

for the months prior to the business acquisitions and to

investments in associates which are not already reflected in the

results |

19,500 |

190 |

|

COVID-19 credits allocated due to mandated store closures |

3,051 |

1,825 |

|

Pro Forma Adjusted EBITDA(2) |

124,435 |

116,283 |

|

Net debt to Pro Forma Adjusted EBITDA(2) |

3.01 |

2.81 |

Note to readers: Annual

consolidated financial statements and Management’s Discussion &

Analysis of Operating Results and Financial Position are available

on the Corporation’s website at www.stingray.com and on SEDAR at

www.sedar.com.

Contact informationMathieu Péloquin Senior

Vice-President, Marketing and Communications Stingray Group Inc.

(514) 664-1244, ext. 2362 mpeloquin@stingray.com

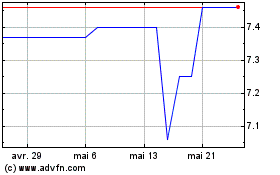

Stingray (TSX:RAY.B)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stingray (TSX:RAY.B)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024