Saputo Inc. (TSX:SAP) (Saputo or the Company) reported today its financial

results for fiscal 2014, which ended on March 31, 2014. All amounts in this news

release are in Canadian dollars, unless otherwise indicated, and are presented

according to International Financial Reporting Standards (IFRS).

SELECTED ANNUAL FINANCIAL INFORMATION

(in millions of CDN dollars, except per share amounts)

----------------------------------------------------------------------------

Fiscal years 2014 2013 Variance

----------------------------------------------------------------------------

Revenues 9,232.9 7,297.7 26.5%

Adjusted EBITDA(1) 1,020.3 860.8 18.5%

Net earnings 534.0 481.9 10.8%

Acquisition costs(2) 9.2 6.1

Restructuring costs(2) 19.9 22.6

Other costs(2) 3.9 -

Adjusted net earnings(3) 567.0 510.6 11.0%

Attributable to:

Shareholders of Saputo Inc. 566.1 510.6

Non-controlling interest 0.9 -

------------------------

567.0 510.6

------------------------

Per Share:

Adjusted net earnings(3)

Basic 2.90 2.58 12.4%

Diluted 2.87 2.55

Net earnings

Basic 2.73 2.44 11.9%

Diluted 2.70 2.41

----------------------------------------------------------------------------

1. Adjusted EBITDA is a non-IFRS measure and is defined as earnings before

interest, income taxes, depreciation, amortization, acquisition,

restructuring and other costs. Refer to "Measurements not in accordance

with International Financial Reporting Standards" on page 6 of the

Management's Discussion and Analysis, included in the Company's 2014

Annual Report, for the definition of this term.

2. Net of income taxes.

3. Adjusted net earnings and adjusted earnings per share (basic and

diluted) are non-IFRS measures. Adjusted net earnings is defined as net

earnings prior to the inclusion of acquisition, restructuring, and other

costs, net of applicable income taxes, if any. Adjusted earnings per

share is defined as adjusted net earnings attributable to shareholders

of Saputo Inc. per basic and diluted common share. Refer to

"Measurements not in accordance with International Financial Reporting

Standards" on page 6 of the Management's Discussion and Analysis,

included in the Company's 2014 Annual Report, for the definition of

these terms.

-- As of April 1, 2013, the Company realigned its reporting structure

consistent with its operating structure and reports under three

geographic sectors: the Canada Sector, the USA Sector and the

International Sector. The comparative figures have been reclassified to

reflect this reporting structure.

-- During the third quarter, the Company announced a takeover bid to buy

all the shares of Warrnambool Cheese & Butter Factory Company Holdings

Limited (Warrnambool Acquisition), a dairy processor in Australia. At

the closing of the bid on February 12, 2014, the Company held an 87.92%

interest in Warrnambool shares and its operations are consolidated since

January 21, 2014.

-- The acquisition of Morningstar Foods, LLC (Morningstar Acquisition) on

January 3, 2013, renamed Saputo Dairy Foods USA, LLC (Dairy Foods

Division (USA)), contributed to revenues and EBITDA in the USA Sector

for the full fiscal year.

SELECTED SEGMENTED ANNUAL FINANCIAL INFORMATION

(in millions of CDN dollars, except per share amounts)

----------------------------------------------------------------------------

Fiscal years 2014 2013 Variance

(Reclassified)

----------------------------------------------------------------------------

Revenues

Canada 3,653.5 3,578.1 2.1%

USA 4,489.9 2,849.2 57.6%

International 1,089.4 870.4 25.2%

----------------------------------------

9,232.9 7,297.7 26.5%

----------------------------------------

Adjusted EBITDA(1)

Canada 457.4 476.2 (4.0%)

USA 469.8 344.3 36.5%

International 93.2 40.3 131.3%

----------------------------------------

1,020.3 860.8 18.5%

----------------------------------------------------------------------------

1. Adjusted EBITDA is a non-IFRS measure and is defined as earnings before

interest, income taxes, depreciation, amortization, acquisition,

restructuring and other costs. Refer to "Measurements not in accordance

with International Financial Reporting Standards" on page 6 of the

Management's Discussion and Analysis, included in the Company's 2014

Annual Report, for the definition of this term.

FINANCIAL RESULTS FOR THE FOURTH QUARTER OF THE FISCAL YEAR ENDED MARCH 31,

2014

Adjusted net earnings at $152.8 million, up 18.3%

Net earnings at $119.8 million, up 19.2%

Revenues at $2.486 billion, up 21.1%

SELECTED QUARTERLY FINANCIAL INFORMATION

(in millions of CDN dollars, except per share amounts)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 2,485.9 2,343.2 2,230.3 2,173.5

Adjusted EBITDA(1) 277.8 260.0 240.4 242.1

Net earnings 119.8 144.1 133.3 136.7

Acquisition costs(2) 9.2 - - -

Restructuring costs(2) 19.9 - - -

Other costs(2) 3.9 - - -

Adjusted net earnings(3) 152.8 144.1 133.3 136.7

Attributable to:

Shareholders of Saputo

Inc. 151.9 144.1 133.3 136.7

Non-controlling interest 0.9 - - -

------------------------------------------------

152.8 144.1 133.3 136.7

------------------------------------------------

Per Share

Adjusted net earnings(3)

Basic 0.78 0.74 0.68 0.70

Diluted 0.78 0.73 0.67 0.69

Net earnings

Basic 0.61 0.74 0.68 0.70

Diluted 0.61 0.73 0.67 0.69

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 2,053.3 1,800.6 1,745.4 1,698.3

Adjusted EBITDA(1) 229.7 212.5 215.6 203.0

Net earnings 100.5 130.0 129.6 121.8

Acquisition costs(2) 6.1 - - -

Restructuring costs(2) 22.6 - - -

Other costs(2) - - - -

Adjusted net earnings(3) 129.2 130.0 129.6 121.8

Attributable to:

Shareholders of Saputo

Inc. 129.2 130.0 129.6 121.8

Non-controlling interest - - - -

------------------------------------------------

129.2 130.0 129.6 121.8

------------------------------------------------

Per Share

Adjusted net earnings(3)

Basic 0.65 0.66 0.66 0.61

Diluted 0.65 0.65 0.65 0.60

Net earnings

Basic 0.51 0.66 0.66 0.61

Diluted 0.51 0.65 0.65 0.60

----------------------------------------------------------------------------

1. Adjusted EBITDA is a non-IFRS measure and is defined as earnings before

interest, income taxes, depreciation, amortization, acquisition,

restructuring and other costs. Refer to "Measurements not in accordance

with International Financial Reporting Standards" on page 6 of the

Management's Discussion and Analysis, included in the Company's 2014

Annual Report, for the definition of this term.

2. Net of income taxes.

3. Adjusted net earnings and adjusted earnings per share (basic and

diluted) are non-IFRS measures. Adjusted net earnings is defined as net

earnings prior to the inclusion of acquisition, restructuring, and other

costs, net of applicable income taxes, if any. Adjusted earnings per

share is defined as adjusted net earnings attributable to shareholders

of Saputo Inc. per basic and diluted common share. Refer to

"Measurements not in accordance with International Financial Reporting

Standards" on page 6 of the Management's Discussion and Analysis,

included in the Company's 2014 Annual Report, for the definition of

these terms.

SELECTED FACTORS POSITIVELY (NEGATIVELY) AFFECTING EBITDA

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal year 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Market factors(1, 2) 16 9 (17) 12

US currency exchange(1) 9 5 4 1

----------------------------------------------------------------------------

1. As compared to the same quarter of the last fiscal year.

2. Market factors include the average block market per pound of cheese and

its effect on the absorption of fixed costs and on the realization of

inventories, the effect of the relationship between the average block

market per pound of cheese and the cost of milk as raw material as well

as market pricing impact related to sales of dairy ingredients.

INFORMATION BY SECTOR

Canada Sector

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 881.4 955.6 920.5 896.0

EBITDA 108.9 116.1 116.7 115.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 856.0 937.9 892.2 891.9

EBITDA 119.1 123.2 116.2 118.0

----------------------------------------------------------------------------

The Canada Sector includes the Dairy Division (Canada) and the Bakery Division.

USA Sector

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 1,220.0 1,138.0 1,078.6 1,053.3

EBITDA 128.2 121.1 107.9 112.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 971.3 663.6 632.7 581.5

EBITDA 103.1 81.0 89.1 70.8

----------------------------------------------------------------------------

Selected factors positively (negatively) affecting EBITDA

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Market factors(1, 2) 16 9 (17) 12

US currency exchange(1) 9 5 4 1

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Market factors(1, 2) 5 8 10 (14)

US currency exchange(1) - (3) 2 3

----------------------------------------------------------------------------

1. As compared to the previous fiscal year.

2. Market factors include the average block market per pound of cheese and

its effect on the absorption of fixed costs and on the realization of

inventories, the effect of the relationship between the average block

market per pound of cheese and the cost of milk as raw material as well

as market pricing impact related to sales of dairy ingredients.

Other pertinent information

(in US dollars, except for average exchange rate)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Average block market per

pound of cheese 2.178 1.836 1.735 1.779

Closing block price(1) per

pound of cheese 2.385 2.000 1.765 1.638

Average whey market price(2)

per pound 0.620 0.570 0.580 0.580

Spread(3) 0.012 0.044 0.041 0.046

US average exchange rate to

Canadian dollar(4) 1.104 1.042 1.039 1.023

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Average block market per

pound of cheese 1.668 1.955 1.750 1.539

Closing block price(1) per

pound of cheese 1.693 1.760 2.075 1.650

Average whey market price(2)

per pound 0.580 0.620 0.550 0.500

Spread(3) 0.017 0.028 0.060 0.072

US average exchange rate to

Canadian dollar(4) 1.009 0.991 0.995 1.010

----------------------------------------------------------------------------

1. Closing block price is the price of a 40 pound block of cheddar traded

on the Chicago Mercantile Exchange (CME) on the last business day of the

fiscal year.

2. Average whey powder market price is based on Dairy Market News published

information.

3. Spread is the average block market per pound of cheese less the result

of the average cost per hundredweight of Class III and/or Class 4b milk

price divided by 10.

4. Based on Bank of Canada published information.

The USA Sector includes the Cheese Division (USA) and the Dairy Foods Division

(USA).

International Sector

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 384.5 249.5 231.2 224.2

EBITDA 40.8 22.8 15.8 13.8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Revenues 226.0 199.1 220.5 225.0

EBITDA 7.5 8.3 10.3 14.2

----------------------------------------------------------------------------

Selected factors positively (negatively) affecting EBITDA

(in millions of CDN dollars)

----------------------------------------------------------------------------

Fiscal years 2014

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Inventory write-down - - - -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal years 2013

Q4 Q3 Q2 Q1

----------------------------------------------------------------------------

Inventory write-down - - - (3)

----------------------------------------------------------------------------

The International Sector includes the Dairy Division (Argentina), the Dairy

Division (Australia) and the Dairy Ingredients Division. The Dairy Ingredients

Division includes national and export ingredients sales from the North American

divisions, as well as cheese exports from these same divisions. The Dairy

Division (Europe) ceased operations in the first quarter of fiscal 2014, as

announced in late fiscal 2013, and its results are included in the comparative

figures.

Consolidated revenues for the quarter ended March 31, 2014 amounted to $2.486

billion, an increase of $432.6 million or 21.1% compared to $2.053 billion for

the same quarter last fiscal year.

The USA Sector revenues increased by approximately $249 million as compared to

the corresponding quarter last fiscal year. A more favourable average block

market per pound of cheese in the fourth quarter of US$2.18 compared to US$1.67

during the same quarter of fiscal 2013 increased revenues by approximately $106

million. Contributing to the increase was an increase in sales volumes as well

as higher selling prices. The weakening of the Canadian dollar versus the US

dollar added approximately $91 million in revenues as compared to the same

quarter last fiscal year.

In the Canada Sector, revenues increased by approximately $25 million in the

fourth quarter as compared to last fiscal year. Higher selling prices relating

to the cost of milk as raw material, in addition to increases in sales volumes

in both the retail and foodservice segments in Canada were the primary reasons

for the increase as compared to last fiscal year. Sales volumes of traditional

milk and cheese categories were higher, while value-added milk and butter

categories experienced a decrease in sales volumes.

Revenues from the International Sector increased by approximately $159 million

as compared to the corresponding quarter last fiscal year. The Sector benefitted

from the contribution of the Dairy Division (Australia) since January 21, 2014.

Additionally, selling price increases relating to the cost of milk as raw

material in Argentina as well as price increases in dairy ingredients in the

international market added to revenues. Sales volume increases in Argentina and

a more favourable dairy ingredients product mix offset lower sales volumes in

the Dairy Ingredients Division. The Dairy Division (Europe) ceased operations in

the first quarter of fiscal 2014, and as a result negatively impacted revenues

by approximately $15 million when compared to last fiscal year.

Consolidated adjusted earnings before interest, income taxes, depreciation,

amortization, acquisition, restructuring, and other costs (adjusted EBITDA(1))

totalled $277.8 million for the quarter ended March 31, 2014, an increase of

$48.1 million or 20.9% compared to the $229.7 million for the same quarter last

fiscal year.

The EBITDA of the USA Sector increased by approximately $25 million in the

fourth quarter compared to the same quarter last fiscal year. An increase in the

average block market per pound of cheese to US$2.18 in the fourth quarter, as

compared to US$1.67 in the same quarter last fiscal year, positively affected

the absorption of fixed costs. During the quarter, the block price opened at

US$2.00 and closed at US$2.39, an increase of US$0.39, compared to opening at

US$1.76 and closing at US$1.69, a decrease of US$0.07 for the same period last

fiscal year. This positive difference had a favourable impact on the realization

of inventories. The relationship between the average block market per pound of

cheese and the cost of milk as raw material was unfavourable as compared to the

same quarter last fiscal year. These combined market factors, including

unfavourable margins associated with higher commodity prices in the Dairy Foods

Division, increased EBITDA by approximately $16 million, as compared to the same

period last fiscal year. Increased sales volumes and lower promotional costs

were offset by higher ingredients, fuel and conversion costs as compared to the

same period of the prior fiscal year, negatively affecting EBITDA. The weakening

of the Canadian dollar versus the US dollar added approximately $10 million in

EBITDA as compared to the same quarter last fiscal year.

EBITDA for the Canada Sector decreased by approximately $10 million in

comparison to the same quarter last fiscal year. Higher ingredients and

operational costs in the Dairy Division (Canada) offset increased sales volumes,

in both retail and foodservice segments.

The EBITDA of the International Sector increased by approximately $33 million

for the quarter ended March 31, 2014 in comparison to the same quarter last

fiscal year. Contributing to this increase is the inclusion of EBITDA from the

Dairy Division (Australia) since January 21, 2014. EBITDA of the Dairy Division

(Argentina) increased, as compared to the corresponding period last fiscal year,

mainly due to higher selling prices in the export market. This increase was

slightly offset by an increase in operational costs.

Depreciation and amortization for the quarter ended March 31, 2014 totalled

$39.5 million, an increase of $3.9 million compared to $35.6 million for the

same quarter last fiscal year. The increase is mainly due to the inclusion of

Dairy Division (Australia)'s results beginning on January 21, 2014.

In the fourth quarter of fiscal 2014, the Company incurred acquisition costs

relating to the Warrnambool Acquisition, which closed on February 12, 2014, and

the Scotsburn Acquisition, finalized on April 14, 2014, totalling $9.5 million

($9.2 million after tax), restructuring costs in relation to plant closures in

the United States and Canada totalling $30.7 million ($19.9 million after tax),

as well as other costs totalling $5.5 million ($3.9 million after tax) relating

to amendments to pension plans for executive officers. In connection with the

restructuring costs, the Company has incurred $7.8 million in severance costs,

$0.8 million in other closure costs and $22.1 million in impairment charges to

property, plant and equipment.

In the last quarter of fiscal 2013, the Company incurred acquisition costs

relating to the Morningstar Acquisition, totalling $9.6 million ($6.1 million

after tax), as well as restructuring costs in relation to plant closures in

Europe and Canada totalling $32.6 million ($22.6 million after tax). In

connection with the restructuring costs, the Company had incurred $7.8 million

in severance costs, $2.8 million in other closure costs, $21.7 million in

impairment charges to property, plant and equipment, and $0.3 million in other

charges.

Net interest expense increased to $19.3 million compared to $14.9 million for

the corresponding period last fiscal year. The increase is mainly attributed to

a higher level of debt resulting from the Warrnambool Acquisition, as well as a

general increase in interest rates in Argentina, as compared to the same quarter

last fiscal year.

With respect to income taxes, the effective tax rate for the current quarter was

30.2% compared to 27.9% for the same quarter last fiscal year, excluding

acquisition, restructuring and other costs in fiscal 2014 and restructuring and

acquisition costs in fiscal 2013. The income tax rate varies and could increase

or decrease based on the amount of taxable income derived and from which source,

any amendments to tax laws and income tax rates and changes in assumptions and

estimates used for tax assets and liabilities by the Company and its affiliates.

Net earnings amounted to $119.8 million for the quarter ended March 31, 2014, an

increase of $19.3 million compared to the net earnings of $100.5 million for the

same quarter last fiscal year. This is due to the factors mentioned above.

Adjusted net earnings(1) amounted to $152.8 million for the quarter ended March

31, 2014, an increase of $23.6 million compared to the same quarter last fiscal

year. This increase is due to the factors mentioned above, without considering

acquisition, restructuring and other costs.

During the quarter, the Company added approximately $80 million in property,

plant and equipment, issued shares for a cash consideration of $17.7 million as

part of the stock option plan and paid out $44.8 million in dividends to its

shareholders. For the same quarter, the Company generated net cash from

operating activities of $144.6 million, a decrease from the $160.1 million

generated for the corresponding period last fiscal year.

1. Adjusted EBITDA and adjusted net earnings represent non-IFRS measures.

Refer to "Measurement of Results not in Accordance with International

Financial Reporting Standards" on page 6 of the Management's Discussion

and Analysis, included in the Company's 2014 Annual Report, for the

definition of these terms.

OUTLOOK

In fiscal 2015, the Company intends to continue to improve its efficiencies,

while remaining committed to producing quality products, innovation and internal

growth. It will continue to analyze its activities, invest in capital projects

and identify opportunities. The Company's flexible capital structure and low

debt levels allow it to actively evaluate and pursue strategic acquisition

opportunities, with the goal of expanding its presence in key markets.

Fiscal 2015 will bring another year of continuous challenges in Canada due to

the competitive nature of the market. Despite these difficult conditions, the

Dairy Division (Canada) will continue to pursue volume growth in commodity and

specialty-type cheeses and in the fluid milk category. The Division will seek

opportunities in the value-added milk category, which offers growth potential,

and one in which the Company is well-positioned. The Dairy Division (Canada)

will pursue investments in product categories such as specialty cheeses, for

which the intention is to maximize exposure across Canada, with coast-to-coast

distribution capabilities.

The Dairy Division (Canada) will complete, in the first quarter of fiscal 2015,

the project to consolidate distribution activities of the Greater Montreal area

into one distribution center located in Saint-Laurent, Quebec. This initiative

was announced in fiscal 2013 and is a result of the Company's ongoing evaluation

of activities aimed at cost reduction and productivity enhancements.

The recent Scotsburn Acquisition will enable the Dairy Division (Canada) to

increase its presence in Atlantic Canada. The Division will evaluate

opportunities and possible synergies in an effort to improve and expand its

product offerings to all customers.

In fiscal 2015, the Company will close three facilities, as announced in fiscal

2013 and 2014. These measures are part of the Company's continual effort to

pursue additional efficiencies and decrease costs. Annual after tax savings

should be approximately $8 million, of which approximately $6 million should

commence in fiscal 2015.

Innovation has always been a priority, enabling the Company to offer products

that meet the needs of today's consumers. Accordingly, resources were allocated

to product innovation allowing it to forge and secure long-term relationships

with both customers and consumers.

In fiscal 2015, the Company will continue the integration of the Dairy Foods

Division (USA) and will focus on implementing the Company's processes and

systems. The USA Sector intends to capitalize on the Division's national

manufacturing and distribution footprint and benefit from possible synergies. An

analysis of administrative and information technology will be done in order to

effectively integrate central functions, streamline systems, and adopt an

efficient working environment.

Additionally, in fiscal 2015, the Company will attempt to recuperate lost

volumes in the Cheese Division (USA) and should also benefit from the effort of

the International Sector, towards growing the export sales market.

The Cheese Division (USA) plans to continue to gain distribution and market

share for its premium lines of snack cheeses and flavoured blue cheese

offerings.

The closure of two plants in the US in fiscal 2015, which was announced in March

2014, is in line with the Company's continual review of operations in order to

maximize return on capital and seek additional efficiencies. Annual after tax

savings should be approximately $3 million.

The USA Sector will continue to evaluate opportunities to improve efficiencies

in both manufacturing and distribution facilities across the US. The Sector will

also continue to monitor fluctuations in dairy markets and take appropriate

decisions to mitigate the impact on operations.

The International Sector will continue to pursue sales volume growth in existing

markets, as well as develop additional international markets from its operations

in Argentina for which capacity was increased over the last two years. Also, the

Company will pursue growth of cheese export sales volumes out of the Cheese

Division (USA). The inclusion of the Dairy Division (Australia) has given the

International Sector an additional platform and will be key for the long-term

growth of this Sector as a dairy player on a global scale. The Company intends

to accelerate growth in Australia, by making necessary capital investments and

devoting resources to increase manufacturing capacity, grow milk intake and

create new opportunities. The International Sector will continue to evaluate

overall activities in an effort to improve efficiencies.

Additional Information

For more information on the results of fiscal 2014 and the fourth quarter of

fiscal 2014, reference is made to the audited consolidated financial statements,

the notes thereto and to the Management's Discussion and Analysis for the fiscal

year ended March 31, 2014. These documents can be obtained on SEDAR at

www.sedar.com and in the "Investors and Media" section of the Company's website,

at www.saputo.com.

Caution Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of

securities laws. These statements are based, among other things, on Saputo's

assumptions, expectations, estimates, objectives, plans and intentions as of the

date hereof regarding projected revenues and expenses, the economic, industry,

competitive and regulatory environments in which the Company operates or which

could affect its activities, its ability to attract and retain customers and

consumers, as well as the availability and cost of milk and other raw materials

and energy supplies, its operating costs and the pricing of its finished

products on the various markets in which it carries on business.

These forward-looking statements include, among others, statements with respect

to the Company's short and medium term objectives, outlook, business projects

and strategies to achieve those objectives, as well as statements with respect

to the Company's beliefs, plans, objectives and expectations. The words "may",

"should", "will", "would", "believe", "plan", "expect", "intend", "anticipate",

"estimate", "foresee", "objective", "continue", "propose" or "target", or the

negative of these terms or variations of them, the use of conditional tense or

words and expressions of similar nature, are intended to identify

forward-looking statements.

By their nature, forward-looking statements are subject to a number of inherent

risks and uncertainties. Actual results could differ materially from the

conclusion, forecast or projection stated in such forward-looking statements. As

a result, the Company cannot guarantee that any forward-looking statements will

materialize. Assumptions, expectations and estimates made in the preparation of

forward-looking statements and risks that could cause actual results to differ

materially from current expectations are discussed in the Company's materials

filed with the Canadian securities regulatory authorities from time to time,

including the "Risks and Uncertainties" section of the Management's Discussion

and Analysis included in the Company's 2014 Annual Report.

Forward-looking statements are based on Management's current estimates,

expectations and assumptions, which Management believes are reasonable as of the

date hereof, and, accordingly, are subject to changes after such date. You

should not place undue importance on forward-looking statements and should not

rely upon this information as of any other date.

Except as required under applicable securities legislation, Saputo does not

undertake to update or revise these forward-looking statements, whether written

or verbal, that may be made from time to time by itself or on its behalf,

whether as a result of new information, future events or otherwise.

Dividends

The Board of Directors approved a dividend of $0.23 per share, payable on July

17, 2014, to common shareholders of record on July 7, 2014.

Conference Call

A conference call to discuss the fourth quarter and year-end results for fiscal

2014 will be held on Thursday, June 5, 2014 at 2:30 p.m. Eastern Daylight Time.

To participate in the conference call, dial 1-800-732-8470. To ensure your

participation, please dial in approximately five minutes before the call.

To listen to this call on the Web, please enter www.gowebcasting.com/5544 in

your Web browser.

For those unable to participate, a replay of the conference will be available

until 11:59 p.m., Thursday, June 12, 2014. To access the replay, dial

1-800-558-5253, ID number 21716568. A webcast will also be archived on

www.saputo.com, in the "Investors and Media" section, under News Releases.

About Saputo

Saputo produces, markets, and distributes a wide array of dairy products of the

utmost quality, including cheese, fluid milk, extended shelf-life milk and cream

products, cultured products and dairy ingredients. We are one of the top ten

dairy processors in the world, the largest in Canada, the third in Argentina and

the fourth in Australia. In the US, the Company ranks among the top three cheese

producers and is one of the largest producers of extended shelf-life and

cultured dairy products. Our products are sold in more than 40 countries under

well-known brand names such as Saputo, Alexis de Portneuf, Armstrong, Baxter,

Dairyland, Dragone, DuVillage 1860, Friendship, Frigo Cheese Heads, Great

Midwest, King's Choice, Kingsey, La Paulina, Milk2Go, Neilson, Nutrilait,

Ricrem, Salemville, Scotsburn, Stella, Sungold and Treasure Cave. Saputo Inc. is

a publicly traded company whose shares are listed on the Toronto Stock Exchange

under the symbol "SAP".

CONSOLIDATED STATEMENTS OF EARNINGS

(in thousands of CDN dollars, except per share amounts)

----------------------------------------------------------------------------

For the three-month For the years ended

periods ended March 31 March 31

(unaudited) (audited)

2014 2013 2014 2013

----------------------------------------------------------------------------

Revenues $ 2,485,864 $ 2,053,326 $ 9,232,889 $ 7,297,677

Operating costs excluding

depreciation, amortization,

acquisition, restructuring

and other costs 2,208,041 1,823,646 8,212,544 6,436,905

----------------------------------------------------------------------------

Earnings before interest,

depreciation, amortization,

acquisition, restructuring,

other costs and income

taxes 277,823 229,680 1,020,345 860,772

Depreciation and

amortization 39,451 35,568 146,607 116,629

Acquisition costs 9,459 9,646 9,459 9,646

Restructuring costs 30,739 32,631 30,739 32,631

Other costs 5,465 - 5,465 -

Interest on long-term debt 14,355 12,515 53,239 29,896

Other financial charges 4,942 2,345 15,846 4,203

----------------------------------------------------------------------------

Earnings before income taxes 173,412 136,975 758,990 667,767

Income taxes 53,626 36,506 225,024 185,846

----------------------------------------------------------------------------

Net earnings $ 119,786 $ 100,469 $ 533,966 $ 481,921

----------------------------------------------------------------------------

Attributable to:

Shareholders of Saputo

Inc. 118,917 100,469 533,097 481,921

Non-controlling interest 869 - 869 -

----------------------------------------------------------------------------

$ 119,786 $ 100,469 $ 533,966 $ 481,921

----------------------------------------------------------------------------

Earnings per share

Net earnings

Basic $ 0.61 $ 0.51 $ 2.73 $ 2.44

Diluted $ 0.61 $ 0.51 $ 2.70 $ 2.41

----------------------------------------------------------------------------

Note: These financial statements should be read in conjunction with the

Company's audited consolidated financial statements, the notes thereto and with

the Management's Discussion and Analysis for the fiscal year ended March 31,

2014, included in the Company's 2014 Annual Report. These documents can be

obtained on SEDAR at www.sedar.com and in the "Investors and Media" section of

the Company's website, at www.saputo.com.

CONSOLIDATED BALANCE SHEETS

(in thousands of CDN dollars)

(audited)

----------------------------------------------------------------------------

As at March 31, 2014 March 31, 2013

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 39,346 $ 43,177

Receivables 807,409 624,553

Inventories 933,232 770,158

Income taxes 30,867 2,786

Prepaid expenses and other assets 84,992 71,882

----------------------------------------------------------------------------

1,895,846 1,512,556

Property, plant and equipment 1,928,761 1,617,195

Goodwill 1,954,691 1,569,592

Trademarks and other intangibles 484,830 454,876

Other assets 79,968 29,962

Deferred income taxes 12,796 9,459

----------------------------------------------------------------------------

Total assets $ 6,356,892 $ 5,193,640

----------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank loans $ 310,066 $ 181,865

Accounts payable and accrued liabilities 897,222 748,318

Income taxes 124,206 144,064

Current portion of long-term debt 393,600 152,400

----------------------------------------------------------------------------

1,725,094 1,226,647

Long-term debt 1,395,694 1,395,900

Other liabilities 48,396 74,101

Deferred income taxes 348,548 191,320

----------------------------------------------------------------------------

Total Liabilities $ 3,517,732 $ 2,887,968

----------------------------------------------------------------------------

EQUITY

Share capital 703,111 663,275

Reserves 242,282 38,049

Retained earnings 1,830,911 1,604,348

----------------------------------------------------------------------------

Equity attributable to shareholders of

Saputo Inc. 2,776,304 2,305,672

Non-controlling interest 62,856 -

----------------------------------------------------------------------------

Total equity $ 2,839,160 $ 2,305,672

----------------------------------------------------------------------------

Total liabilities and equity $ 6,356,892 $ 5,193,640

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of CDN dollars)

----------------------------------------------------------------------------

For the three-month For the twelve-month

periods periods

ended March 31 ended March 31

(unaudited) (audited)

2014 2013 2014 2013

----------------------------------------------------------------------------

Cash flows related to the

following activities:

Operating

Net earnings $ 119,786 $ 100,469 $ 533,966 $ 481,921

Adjustments for:

Stock-based

compensation 6,137 3,611 22,084 17,537

Interest and other

financial charges 19,297 14,860 69,085 34,099

Income tax expense 53,626 36,506 225,024 185,846

Depreciation and

amortization 39,451 35,568 146,607 116,629

Gain on disposal of

property, plant and

equipment 122 (12) (122) (53)

Restructuring charges

related to plant

closures 22,096 23,820 22,096 23,820

Share of joint venture

earnings (1,406) - (1,406) -

Funding of employee

plans in excess of

costs 2,687 (4,030) (6,486) (12,485)

----------------------------------------------------------------------------

261,796 210,792 1,010,848 847,314

Changes in non-cash

operating working

capital items (76,459) (3,744) (129,363) (4,425)

----------------------------------------------------------------------------

Cash generated from

operating activities 185,337 207,048 881,485 842,889

Interest and other

financial charges paid (10,880) (9,859) (65,837) (34,953)

Income taxes paid (29,830) (37,138) (159,338) (162,144)

----------------------------------------------------------------------------

Net cash generated from

operating activities 144,627 160,051 656,310 645,792

----------------------------------------------------------------------------

Investing

Business acquisition (449,578) (1,433,945) (449,578) (1,433,945)

Portfolio investment 4,088 - - -

Additions to property,

plant and equipment (79,989) (81,582) (223,624) (178,237)

Proceeds on disposal of

property, plant and

equipment (208) 76 253 901

Other (124) (11,038) 803 (13,719)

----------------------------------------------------------------------------

(525,811) (1,526,489) (672,146) (1,625,000)

----------------------------------------------------------------------------

Financing

Bank loans 26,668 51,754 77,810 21,884

Proceeds from issuance

of long-term debt 390,000 1,198,565 390,000 1,198,565

Repayment of long-term

debt (57,081) (38,100) (175,045) (38,100)

Issuance of share

capital 17,749 12,504 41,861 38,468

Repurchase of share

capital - (58,173) (154,371) (190,404)

Dividends (44,812) (41,326) (175,321) (161,651)

----------------------------------------------------------------------------

332,524 1,125,224 4,934 868,762

----------------------------------------------------------------------------

Decrease in cash and cash

equivalents (48,660) (241,214) (10,902) (110,446)

Effect of exchange rate

changes on cash and cash

equivalents 3,138 10,327 7,071 9,486

Cash and cash equivalents,

beginning of year 84,868 274,064 43,177 144,137

----------------------------------------------------------------------------

Cash and cash equivalents,

end of year $ 39,346 $ 43,177 $ 39,346 $ 43,177

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Media and Investor Relations

Sandy Vassiadis

Director, Corporate Communications

514-328-3347

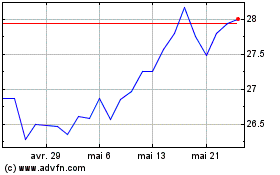

Saputo (TSX:SAP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Saputo (TSX:SAP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024