MCAPM, LP and Michael Mork Enter Agreement to Acquire Common Shares of NXT Energy Solutions Inc.

23 Décembre 2022 - 7:25PM

MCAPM, LP and Michael Mork (“the

Morks”) announced

today that they have entered into subscription agreements (the

“

Subscription Agreements”) with NXT Energy

Solutions Inc. TSX: SFD) ("

NXT") pursuant to which

the Morks have agreed to subscribe for an aggregate of 8,750,000

common shares ("

Common Shares") of NXT in a

non-brokered private placement (the “

Private

Placement”) at a price of CAD$0.195 per Common Share for

total consideration of approximately CAD$1.7 million. Closing is

expected to occur in January, 2022 and is subject to certain

conditions, including conditional listing approval of the TSX. The

Morks currently own an aggregate of 6,171,233 Common Shares. On

closing of the Private Placement, the Morks will own 14,921,233

Common Shares, representing approximately 19.38% of the issued and

outstanding Common Shares on a non-diluted basis.

The head office address of NXT is 302 3320 17th

Avenue SW Calgary, Alberta, Canada T3E 0B4. The head office of

MCAPM, LP is 132 Mill Street, #204, Healdsburg California,

95448

This news release is issued pursuant to National

Instrument 62-103 – The Early Warning System and Related Take-Over

Bid and Insider Reporting Issues, which also requires a report to

be filed with regulatory authorities in each of the jurisdictions

in which NXT is a reporting issuer containing information with

respect to the foregoing matters (the "Early Warning

Report"). A copy of the Early Warning Report will be

available under NXT's profile at www.sedar.com or may be obtained

by contacting Mork Capital Management, LLC at (707) 431-1057.

The Morks are acquiring the Common Shares for

investment purposes. The Morks may, from time to time, acquire

additional Common Shares or other securities of NXT or dispose of

some or all of the Common Shares or other securities of NXT that it

owns at such time. The Morks currently have no other plans or

intentions that relate to or would result in any of the following:

the acquisition of additional securities of NXT, or the disposition

of securities of NXT; a corporate transaction, such as a merger,

reorganization or liquidation, involving NXT or any of its

subsidiaries; a sale or transfer of a material amount of the assets

of NXT or any of its subsidiaries; a change in the board of

directors or management of NXT, including any plans or intentions

to change the number or term of directors or to fill any existing

vacancy on the board; a material change in the present

capitalization or dividend policy of NXT; a material change in

NXT’s business or corporate structure; a change in NXT’s charter,

bylaws or similar instruments or another action which might impede

the acquisition of control of NXT by any person or company; a class

of securities of NXT being delisted from, or ceasing to be

authorized to be quoted on, a marketplace; but depending on market

conditions, general economic and industry conditions, trading

prices of NXT’s securities, NXT’s business, financial condition and

prospects and/or other relevant factors, the Morks may develop such

plans or intentions in the future.

Forward-Looking Statements

The information in this news release has been

prepared as at December 22, 2022. Certain statements in this news

release, referred to herein as "forward-looking statements",

constitute "forward-looking information" under the provisions of

Canadian provincial securities laws. These statements can be

identified by the use of words such as "expected", "will" or

similar terms. Forward-looking statements in this news release

include statements relating to the expected closing date of the

Private Placement and the Mork’s ownership interest in NXT upon

closing of the private placement.

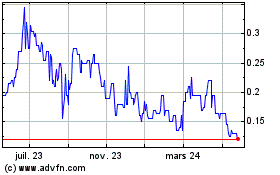

NXT Energy Solutions (TSX:SFD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

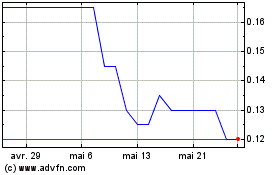

NXT Energy Solutions (TSX:SFD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025