Savaria Announces $16,250,000 Bought-Deal Private Placement

26 Mars 2014 - 12:53PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Savaria Corporation ("Savaria") (TSX:SIS), North America's leader in the

accessibility industry, today announced that it has entered into an agreement

with Laurentian Bank Securities Inc. pursuant to which Laurentian Bank

Securities has agreed to purchase, on a bought-deal private-placement basis,

5,000,000 units of Savaria (the "Units") at a price of $3.25 per Unit for gross

proceeds to Savaria of $16,250,000 (the "Offering"). Each Unit will be comprised

of one common share and one-half of a common share purchase warrant of Savaria.

Each full warrant will entitle its holder to subscribe for one additional common

share of Savaria at an exercise price of $4.25 for 36 months from the closing

date of the Offering. The Offering will be effected pursuant to prospectus

exemptions under applicable securities legislation. The pricing of the Offering

is the result of arm's-length negotiations between Savaria and Laurentian Bank

Securities. The issue price of the Units represents a discount of approximately

8% to the current market price of Savaria's common shares and the exercise of

the warrants comprised in the Units represents a premium of approximately 21% to

such market price.

Savaria has also granted an option to Laurentian Bank Securities to purchase up

to 750,000 additional Units at the issue price of $3.25 per Unit (the "Option"),

which if exercised in full would result in total gross proceeds of $18,687,500

to Savaria from the Offering. The Option is exercisable in whole or in part at

any time until 5:00 p.m. on the second business day preceding the closing of the

Offering.

The net proceeds of the Offering will be used by Savaria for product

development, working capital and general corporate purposes.

Mr. Marcel Bourassa, President and Chief Executive Officer of Savaria, and Mr.

Jean-Marie Bourassa, Chief Financial Officer of Savaria, have committed to

acquire through a holding company owned by them in equal proportions, an

aggregate of 1,000,000 Units, or 20% of the Units to be issued pursuant to the

Offering. After giving effect to the issuance of the common shares comprised in

these Units and those issuable further to the exercise of the warrants comprised

therein, but without giving effect to the Option, an aggregate of 1,500,000

common shares, representing approximately 6.3% of the current number of issued

and outstanding common shares, will be issued to such executives. Savaria will

not pay any commission in respect of their subscription for Units.

The Offering is expected to close on or about April 15, 2014 and is subject to

certain conditions, including the receipt of all necessary regulatory approvals.

The securities issued by Savaria in the Offering will be subject to a hold

period of four months and one day in Canada calculated from the closing date of

the Offering.

The Offering represents the possible issuance of up to 8,625,000 common shares

(assuming the exercise in full of the Option and after giving effect to the

issuance of the common shares issuable upon exercise of the warrants comprised

in the Units), which represents approximately 36% of the 23,804,614 common

shares issued and outstanding as of the date hereof. Savaria does not anticipate

that the completion of the Offering will have a material effect on its control

or result in the creation of any new holder of 10% or more of the common shares.

Pursuant to the rules of the Toronto Stock Exchange (the "TSX"), shareholder

approval must be obtained for private placements for an aggregate number of

listed securities which is greater than 25% of the number of securities of the

listed issuer which are outstanding, on a non-diluted basis, prior to the date

of closing of the transaction if the price per security is less than the market

price. As the aggregate number of common shares comprised in the Units and

issuable further to the exercise of the warrants comprised in the Units exceeds

25% of the current number of issued and outstanding common shares, Savaria

intends to obtain the requisite shareholder approval by way of written consent

in lieu of holding a shareholders' meeting as permitted by Section 604d) of the

TSX Company Manual. Savaria has been advised that Messrs. Marcel Bourassa and

Jean-Marie Bourassa, who together currently control, directly or indirectly,

approximately 58.9% of the outstanding the common shares, will consent to the

issuance of common shares pursuant to the Offering.

This news release is intended for distribution in Canada only and is not

intended for distribution to United States newswire services or dissemination in

the United States. The securities being offered have not been, nor will they be,

registered under the United States Securities Act of 1933, as amended, and may

not be offered or sold within the United States or to, or for the account or

benefit of, U.S. persons absent U.S. registration or an applicable exemption

from the U.S. registration requirements. This release does not constitute an

offer for sale of securities in the United States.

About Savaria

Savaria (www.savaria.com) is North America's leader in the accessibility

industry focused on meeting the needs of people with mobility challenges.

Savaria designs, manufactures, installs and distributes primarily elevators for

home and commercial use, as well as stairlifts and vertical and inclined

platform lifts. In addition, it converts and adapts wheelchair accessible

automotive vehicles. The diversity of its product line, one of the world's most

comprehensive, enables Savaria to stand out by proposing an integrated and

customized solution for its customers' mobility needs. Its operations in China

have substantially grown and the collaboration with Savaria's other Canadian

facilities increases its competitive edge in the market place. Savaria records

some 60% of its revenue outside Canada, primarily in the United States. It has a

sales network of some 600 retailers in North America and employs some 360 people

at its head office in Laval and at its plants and sales offices in Montreal

(Quebec), Brampton and London (Ontario), Calgary (Alberta) and Huizhou (China).

Forward-Looking Statements

This news release contains forward-looking statements and other statements that

are not historical facts, including statements about the proposed closing of the

Offering and the intended use of the proceeds therefrom. Such forward-looking

statements are subject to known and unknown risks, uncertainties and assumptions

that could cause actual results to vary materially from target results and the

results or events predicted in these forward-looking statements. As a result,

investors are cautioned not to place undue reliance on these forward-looking

statements.

The forward-looking statements contained in this news release are made as of the

date of this release. Except as required by applicable law, Savaria disclaims

any intention and assumes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Forward-looking information reflects the current expectations or belief of

Savaria based on information currently available and such information is subject

to a number of assumptions, risks and uncertainties, including risks related to

the state of the capital markets, the ability of Savaria to implement its growth

strategy, to develop new products, to have access to additional financing and

capital, to obtain regulatory approvals, to protect and maintain its

intellectual property, unexpected product safety or efficacy concerns, new

legislation or regulatory requirements, reliance on third parties for supply and

manufacture of products, quarterly fluctuations in sales, product pricing

regulation, concentration of credit risks and other risks associated with being

an accessibility industry company.

www.savaria.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Helene Bernier, CPA, CA

Vice-President, Finance

1-800-931-5655, ext. 248

helene.bernier@savaria.com

Marcel Bourassa

President and Chief Executive Officer

1-800-661-5112

marcel.bourassa@savaria.com

www.savaria.com

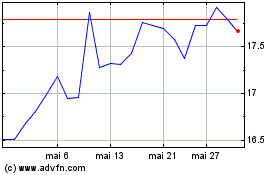

Savaria (TSX:SIS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

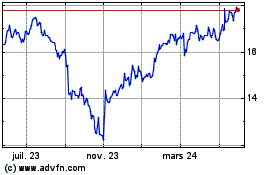

Savaria (TSX:SIS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024