Sangoma Technologies Corporation (TSX: STC; Nasdaq: SANG)

(“Sangoma” or the “Company”), a trusted leader in delivering

cloud-based Communications as a Service solutions for companies of

all sizes, today announced its third quarter financial results and

unaudited condensed consolidated interim financial statements for

the third quarter ended March 31, 2023.

Revenue for the third quarter of fiscal 2023 was

$62.76 million, an increase from the prior year of 18%.

|

US $000 |

Q3 FY2023 |

Q3 FY2022 |

Change |

Q2 FY2023 |

Change |

|

Sales |

$62,764 |

$53,366 |

18% |

$62,035 |

1% |

|

Gross profit |

$44,424 |

$37,201 |

19% |

$42,789 |

4% |

|

Operating expenses1 |

$43,368 |

$40,137 |

8% |

$44,258 |

(2)% |

|

Net loss |

$(685) |

$(6,755) |

|

$(2,735) |

|

|

Net loss per share (fully diluted) |

$(0.02) |

$(0.21) |

|

$(0.08) |

|

|

Adjusted EBITDA2 |

$12,243 |

$10,469 |

17% |

$10,550 |

16% |

“Our third quarter brought significant changes

to Sangoma. While change can be very difficult at times, I am proud

of our team for remaining focused on delivering excellent results

for our customers and shareholders," said Norm Worthington, Interim

Executive Chairman. “It is an exciting time for Sangoma to continue

to see our team's hard work drive our transition to a more SaaS

focused business. In the third quarter our Services revenue

increased by 2.25% sequentially from the prior quarter, again

equivalent to an annualized organic growth rate of 10%. Services

also represented 81% of our total sales this quarter, up from 80%

last quarter and 69% in the same quarter of last year. And while

our Services business continues to grow and compound, our Product

revenue slightly declined this quarter as it remains impacted by

macro conditions resulting in continued sensitivity to capex

purchases. While our increase in revenue quarter over quarter was

modest we delivered an Adjusted EBITDA2 for the quarter of over

$12.24 million, representing about 20% of revenue and a 16%

increase from last quarter."

Revenue for the fiscal third quarter was $62.76

million, up from $53.37 million in the third quarter last year by

18%, and up by approximately 1% from the immediately preceding

second quarter of fiscal 2023. Services revenue increased

sequentially by over $1 million or by 2.25% from the previous

quarter, representing 81% of total sales. The growth in Services

revenue is the second consecutive quarter supporting an annualized

10% organic growth rate, as was discussed in our second quarter

results.

Gross profit for the quarter was $44.42 million,

up from $37.20 million in the same period last year. Gross margin

at 71% of revenue for the quarter was slightly above the 69% in the

second quarter of fiscal 2023, due at least in part to increased

sales of higher margin offerings such as cloud services. While

gross margin will naturally fluctuate slightly from quarter to

quarter, fiscal third quarter gross margin landed on the higher end

of that expected range.

Operating Expenses1 were $43.37 million for the

quarter compared to $40.14 million in the third quarter of fiscal

year 2022. The year over year increase reflects the added costs

associated with the NetFortris acquisition, a decrease of just

under $1 million from the immediately prior quarter.

Adjusted EBITDA2 was $12.24 million in the third

fiscal quarter of 2023, up from the $10.47 million for the same

period of the prior year, and was approximately 20% of sales. The

increase in Adjusted EBITDA2 in the third quarter also represents a

3% increase as a percentage of revenue when compared to our second

quarter results.

Net loss for the third quarter was $0.69 million

as compared to $6.76 million for the third quarter of fiscal

2022.

Sangoma continues to generate positive Adjusted

Cash Flow2 and maintain a healthy balance sheet, finishing the

quarter with a cash balance of $8.01 million on March 31, 2023 and

remains comfortably within its debt covenants.

As previously disclosed in its press release of

March 29, 2023, Sangoma filed a resale registration statement on

Form F-3 (the "Resale Registration Statement") with the Securities

and Exchange Commission (the "SEC") for the registration of

12,271,637 of its common shares previously issued or to be issued

pursuant to the terms of that certain stock purchase agreement

previously entered into by Sangoma in connection with the

acquisition of StarBlue Inc. on March 31, 2021 (the "StarBlue

Acquisition"). The Resale Registration Statement was declared

effective by the SEC on April 12, 2023, and the remaining 9,142,856

common shares that were to be issued on a quarterly basis over the

next three years pursuant to the StarBlue Acquisition were all

issued on May 9, 2023.

Outlook for fiscal year

2023Given the results for the first three quarters

of fiscal 2023 and in light of the items below including global

economics, the Company is narrowing its revenue guidance from $250-

$260 million to $250 - $254 million and its Adjusted EBITDA2

guidance from $46 - $49 million to $46 - $48 million.

The above outlook and guidance constitute

forward-looking information and are based on the Company’s

assessment of many material assumptions, including:

- The Company’s ability to manage

current supply chain constraints, including our ability to secure

electronic components and parts, manufacturers being able to

deliver ongoing quantities of finished products on schedule, no

further material increases in cost for electronic components, and

no significant delay or material increases in cost for

shipping

- The revenue trends the Company

experienced in fiscal year 2022 and fiscal 2023 to-date, the trends

we expect going forward in fiscal 2023, and the impact of growing

economic headwinds globally

- The continuing recovery of the

global economy from the impact of COVID-19, including decreased

government restrictions and increased customer demand, all of which

would not be materially negatively affected by more recent macro

factors such as inflation, interest rates, or recessions

- There being continuing growth in

the global UCaaS and cloud communications markets more

generally

- There being continuing demand and

subscriber growth for our Services and continuing demand as

anticipated for our Products

- The impact of changes in global

exchange rates on the demand for the Company’s Products and

Services

- The ability of the Company’s

customers to continue their business operations without any

material impact on their requirements for the Company’s Products

and Services

- The Company’s forecasted revenue

from its internal sales teams and via channel partners will meet

expectations, which is based on certain management assumptions,

including continuing demand for the Company’s products and

services, no material delays in receipt of products from its

contract manufacturers, no further material increase to the

Company’s manufacturing, labour or shipping costs

- There are no additional revenue

reclassifications

- The Company is able to remediate

the material weaknesses identified in its internal control over

financial reporting

- That the Company is able to attract

and retain the employees needed to maintain the current

momentum

Conference callSangoma will

host a conference call on Thursday, May 11, 2023, at 5:30 pm ET to

discuss these results. The dial-in number for the call is

1-800-319-4610 (International 1-604-638-5340). Participants are

requested to dial in 5 minutes before the scheduled start time and

ask to join the Sangoma call.

1 Operating Expenses consist of sales and

marketing, research and development, general and administration and

foreign exchange (gain) loss. 2 Adjusted EBITDA and Adjusted Cash

Flow are non-IFRS financial measures used by the Company to monitor

its performance and definitions of these terms along with

reconciliation to the closest IFRS measure may be found in the

accompanying MD&A on pages 17, and 19 posted today at

www.sedar.com and www.sec.gov.

About Sangoma Technologies

CorporationSangoma is a trusted leader in delivering

value-based Communications as a Service (CaaS) solutions for

businesses of all sizes. Sangoma simplifies communications by

providing businesses with the industry’s most comprehensive suite

of cloud-native communications solutions, which work together

seamlessly to streamline business processes. Sangoma provides

businesses with a complete solution, including cloud software,

endpoints, and connectivity – all delivered and supported by

Sangoma’s expert team. One provider and one contact ease vendor

management and save time. For more information, visit

www.sangoma.com.

Cautionary Statement Regarding Forward

Looking StatementsThis press release contains

forward-looking statements, including statements regarding the

expected fiscal 2023 financial results and the future success of

our business, development strategies and future opportunities.

Forward-looking statements are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future and readers are

cautioned that such statements may not be appropriate for other

purposes. Forward-looking statements include, but are not limited

to, statements relating to management’s guidance on revenue and

Adjusted EBITDA, and other statements which are not historical

facts. When used in this document, the words such as "could",

"plan", "estimate", "expect", "intend", "may", "potential",

"should" and similar expressions indicate forward-looking

statements.

Although Sangoma believes that its expectations

reflected in these forward-looking statements are reasonable, such

statements involve inherent risks and uncertainties and no

assurance can be given that actual results will be consistent with

these forward-looking statements, if at all. Forward-looking

statements are based on the opinions and estimates of management at

the date that the statements are made, and are subject to a variety

of risks and uncertainties and other factors that could cause

actual events or results to differ materially from those projected,

estimated or anticipated in forward-looking statements.

Readers are cautioned not to place undue

reliance on forward-looking statements, as there can be no

assurance that the plans, intentions or expectations upon which

they are based will occur. By their nature, forward-looking

statements involve numerous assumptions, known and unknown risks

and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and

other events contemplated by the forward-looking statements will

not occur. Although Sangoma believes that the expectations

represented by such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be

correct as these expectations are, therefore, inherently subject to

business, economic and competitive uncertainties and contingencies.

Some of the risks and other factors which could cause actual

results to differ materially from those expressed or implied in the

forward- looking statements contained in its management's

discussion and analysis, annual information form and management

information circular (each available on www.sedar.com and

www.sec.gov) include, but are not limited to, risks and

uncertainties associated with the integration of NetFortris, the

remediation of material weaknesses, the impact of the continuing

COVID-19 pandemic, changes in exchange rate between the United

States dollar and other currencies, expectations regarding the

amount of frequency of impairment losses, including as a result of

the write-down of intangible assets, including goodwill, delay in

project deliveries, changes in technology, changes in the business

climate, changes to macroeconomic conditions, including rising

interest rates and the occurrence of (or fears of an impending)

economic recession, risks related to the COVID-19 (coronavirus)

pandemic, changes in the regulatory environment, the imposition of

tariffs, the decline in the importance of the PSTN (as hereinafter

defined), impairment of goodwill and new competitive pressures, and

acts of terrorism and war, hostilities and conflicts, including,

but not limited to, Russia’s invasion of Ukraine in February 2022.

The forward-looking statements contained in this press release are

expressly qualified by this cautionary statement. Sangoma

undertakes no obligation to update forward-looking statements if

circumstances or management's estimates or opinions should change

except as required by law.

Sangoma Technologies CorporationLarry StockChief

Financial Officerinvestorrelations@sangoma.com

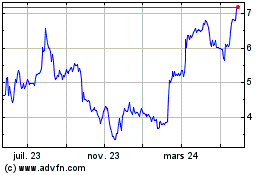

Sangoma Technologies (TSX:STC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

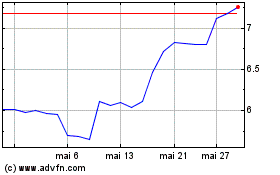

Sangoma Technologies (TSX:STC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025