Sylogist Announces Intention to Make a Normal Course Issuer Bid

17 Novembre 2023 - 1:30PM

Sylogist Ltd. (“Sylogist” or the “Company”) -

(TSX

:SYZ), a leading public

sector SaaS company, announced today that the Toronto Stock

Exchange (“

TSX”) has accepted its Notice of

Intention to make a Normal Course Issuer Bid

(“

NCIB”) in place effective November 21, 2023.

Sylogist believes that from time to time the market price of the

Sylogist Common Shares may not reflect their underlying or

intrinsic value and that, at such times, the purchase of Common

Shares for cancellation will increase the proportionate interest

of, and be advantageous to, all remaining holders of Common Shares.

As of November 13, 2023, there are 23,573,677

Common Shares issued and outstanding, 22,734,092 of which shares

constitute the public float. Under the NCIB, Sylogist is permitted

to purchase up to 2,273,409 Common Shares, which is 10% of the

public float. The average daily trading volume

(“ADTV”) for the six months prior to date of the

NCIB (being May-October 2023) was 29,510 Common Shares and the

daily purchase limit under the NCIB (being 25% of the ADTV) will be

7,377 Common Shares. Sylogist, through its broker at BMO Nesbitt

Burns, will purchase the Common Shares on the open market through

the facilities of the TSX and/or alternative Canadian trading

systems. The price which Sylogist will pay for any Common Shares

purchased will be the prevailing market price of such Common Shares

at the time of purchase. Decisions regarding purchases of Common

Shares pursuant to the NCIB will be made by Sylogist. The Common

Shares acquired pursuant to the NCIB will be cancelled. The NCIB,

if approved, will terminate on the earlier of: (i) November 20,

2024; or (ii) when permitted purchases thereunder are completed.

Sylogist may otherwise elect to terminate the NCIB at any time.

The NCIB follows the expiration of Sylogist’s

previous normal course issuer bid, under which Sylogist had

approval from the TSX to purchase up to 2,281,177 Common Shares,

and which was effective from November 17, 2022 and expired on

November 16, 2023. Under Sylogist’s previous normal course issuer

bid and as of the date of November 16, 2023, Sylogist completed the

purchase of 342,200 Common Shares on the TSX at a weighted average

price of $5.78 per share.

About Sylogist

Sylogist provides mission-critical SaaS

solutions to over 2,000 public sector customers globally across the

government, nonprofit, and education verticals. The Company’s stock

is traded on the Toronto Stock Exchange under the symbol SYZ.

Information about Sylogist, inclusive of full financial statements

together with Management’s Discussion and Analysis, can be found at

www.sylogist.com.

This press release is not for

distribution to United States Newswire Services or for

dissemination in the United States.

Forward-looking Statements

Certain statements in this news release may be

forward-looking statements within the meaning of applicable

securities laws and regulations. These statements typically use

words such as will, expect, believe, estimate, project, anticipate,

plan, may, should, could and would, or the negative of these terms,

variations thereof or similar terminology. By their very nature,

forward-looking statements are based on assumptions and involve

inherent risks and uncertainties, both general and specific in

nature. It is therefore possible that the beliefs and plans and

other forward-looking expectations expressed herein will not be

achieved or will prove inaccurate. Although Sylogist believes that

the expectations reflected in these forward-looking statements are

reasonable, it provides no assurance that these expectations will

prove to have been correct. Forward-looking information involves

risks, uncertainties and other factors that could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward-looking information in this news release

includes statements with respect to purchase and cancellation of

the Common Shares, payment of prevailing market price for such

Common Shares at the time of purchase, the termination of the NCIB,

how from time to time the market price of the Sylogist Common

Shares may not reflect their underlying or intrinsic value and

that, at such times, the purchase of Common Shares for cancellation

will increase the proportionate interest of, and be advantageous

to, all remaining holders of Common Shares. Material assumptions

and factors that could cause actual results to differ materially

from such forward-looking information include Sylogist’s ability to

attract and retain customers and to realize on its investments.

Although Sylogist believes that the material assumptions and

factors used in preparing the forward-looking information in this

news release are reasonable, undue reliance should not be placed on

such information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur.

Sylogist disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

Certain information set out herein may be

considered as “financial outlook” within the meaning of applicable

securities laws. The purpose of this financial outlook is to

provide readers with disclosure regarding Sylogist’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

For further information contact:

Sujeet Kini, Chief Financial Officer Sylogist

Ltd.

Jennifer Smith, Investor Relations LodeRock

Advisors

(416) 491-8004 ir@sylogist.com

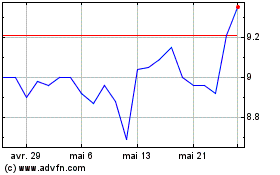

Sylogist (TSX:SYZ)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sylogist (TSX:SYZ)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025