WSP Announces Q4 and Fiscal 2013 Results in Line With Outlook and Advances Date and Time of its Conference Call

12 Mars 2014 - 8:25PM

Marketwired Canada

WSP Global Inc. (TSX:WSP) ("WSP" or the "Company") today announced its financial

and operating results for the fourth quarter and fiscal year ended December 31,

2013. The fourth quarter results cover the period from September 29, 2013 to

December 31, 2013.

2013 FOURTH QUARTER HIGHLIGHTS

-- Revenues and net revenues of $530.4 million and $436.1 million, up 2.7%

and 5.9%, respectively.

-- EBITDA of $44.9 million or, $49.2 million, excluding restructuring

charges. This represents EBITDA margins of 10.3% and 11.3% of net

revenues, respectively. For the quarter, the Company incurred

restructuring charges of $4.3 million.

-- Net earnings attributable to shareholders excluding amortization of

intangible assets related to acquisitions (net of income taxes) at $21.6

million, or $0.41 per share.

-- Net earnings attributable to shareholders of $17.9 million, or $0.34 per

share. Excluding restructuring charges, net earnings at $21.1 million or

$0.40 per share.

-- Backlog stood at $1,496.8 million and approximately 8.9 months of

revenues, up $76.2 million or 5.4%, year over year.

-- DSO stood at 91 days; a decrease of 6 days compared to 2012.

-- Net debt to trailing twelve month EBITDA ratio at 0.6x; the lowest since

the acquisition of WSP Group plc.

FISCAL 2013 HIGHLIGHTS

-- Revenues and net revenues of $2,016.0 million and $1,677.2 million, up

60.3% and 64.4%, respectively.

-- EBITDA of $171.1 million or, $180.6 million, excluding restructuring

charges. This represents EBITDA margins of 10.2% and 10.8% of net

revenues, respectively. For the year, the Company incurred restructuring

charges of $9.5 million.

-- Net earnings attributable to shareholders excluding amortization of

intangible assets related to acquisitions (net of income taxes) at $87.2

million, or $1.68 per share, up $28.1 million (47.5%) or $0.21 per share

(14.3%).

-- Net earnings attributable to shareholders of $71.7 million, or $1.38 per

share, up $25.4 million (54.9%) or $0.23 per share (20.0%). Excluding

restructuring charges, net earnings at $78.8 million or $1.52 per share.

-- Funds from operations and free cash flow at $123.9 million and $91.1

million, both up 34.1% and 19.2%, respectively. Free cash flow stood at

129.8% of net earnings.

"As we met the targets set out in our 2013 outlook, we are pleased with the

overall performance of our operations in the fourth quarter and full fiscal

year. We would like to thank all our employees for their contribution and

dedication," said Pierre Shoiry, President and Chief Executive Officer of WSP.

"These results demonstrate the strength of our diversified business model and

the fundamentals of our industry. With the successful completion of our

previously announced reorganization and rebranding, we will now focus on the

future and continue to strive towards the growth objectives set out in our 2015

Strategic plan, as one global WSP."

DIVIDEND

The Board of WSP declared a dividend of $0.375 per share. This dividend will be

payable on or about April 15, 2014, to shareholders of record at the close of

business on March 31, 2014.

FINANCIAL REPORT

This release includes, by reference, our 2013 financial reports, including the

audited consolidated financial statements and Management's Discussion and

Analysis ("MD&A") of the Company.

For a copy of our 2013 financial results, including the MD&A and the audited

consolidated financial statements, please visit our website at www.wspgroup.com.

CONFERENCE CALL INFORMATION

As a result of today's announcement, WSP's conference call previously scheduled

to be held on March 13, 2014 has been advanced. WSP will host a conference call

to discuss its financial results on March 12, 2014 at 4:00 p.m. (Eastern

Daylight Time). The call will be accessible by telephone at 1-877-223-4471

(Toll-Free dial-in number) or 1-647-788-4922 (International dial-in number),

pass code: 6846257. An audio replay of the conference call will be available

until March 19, 2014 at 11:59 pm (Eastern Daylight Time). To access the replay,

dial 1-800-585-8367 or 1-416-621-4642, and enter the pass code: 6846257.

The replay of the conference call will also be available in the Investor section

of the Website under Presentations & Events, in the days following the event.

RESULTS OF OPERATIONS

------------------------------------------------

Fourth quarter

------------------------------------------------

2012

without

Unusual

2013 Items(i) 2012

------------------------------------------------

FOR THE FOR THE FOR THE

IN MILLIONS OF DOLLARS, PERIOD FROM PERIOD FROM PERIOD FROM

EXCEPT NUMBER OF SHARES AND SEPTEMBER 29 SEPTEMBER 30 SEPTEMBER 30

PER SHARE DATA TO DECEMBER 31 TO DECEMBER 31 TO DECEMBER 31

----------------------------------------------------------------------------

Revenues $530.4 $516.5 $516.5

Less: Subconsultants and

direct costs $94.3 $104.6 $104.6

----------------------------------------------------------------------------

Net revenues(ii) $436.1 $411.9 $411.9

----------------------------------------------------------------------------

Personnel costs $326.0 $308.4 $311.5

Other operational costs(1) $67.7 $60.5 $61.9

Restructuring costs - - -

Share of income of

associates ($2.5) ($2.3) ($2.3)

----------------------------------------------------------------------------

EBITDA(ii) $44.9 $45.3 $40.8

----------------------------------------------------------------------------

Amortization of intangible

assets $8.7 $8.6 $8.6

Depreciation of property,

plant and equipment $6.4 $6.4 $6.4

Financial expenses $4.1 $3.9 $3.9

Share of depreciation of

associates $0.5 $0.7 $0.7

----------------------------------------------------------------------------

Earnings before income taxes $25.2 $25.7 $21.2

----------------------------------------------------------------------------

Income tax expenses $6.9 ($1.2) ($2.2)

Share of tax of associates $0.7 $0.4 $0.4

----------------------------------------------------------------------------

Net earnings $17.6 $23.0

Attributable to:

- Shareholders $17.9 $23.1

- Non-controlling

interests ($0.3) ($0.1)

----------------------------------------------------------------------------

Basic and diluted net

earnings per share $0.34 $0.45

----------------------------------------------------------------------------

Basic and diluted weighted

average number of shares 52,322,916 51,000,772 51,000,772

----------------------------------------------------------------------------

------------------------------------------------

Year-to-date

------------------------------------------------

2012

without

Unusual

2013 Items(i) 2012

------------------------------------------------

FOR THE FOR THE FOR THE

IN MILLIONS OF DOLLARS, PERIOD FROM PERIOD FROM PERIOD FROM

EXCEPT NUMBER OF SHARES AND JANUARY 1 TO JANUARY 1 TO JANUARY 1 TO

PER SHARE DATA DECEMBER 31 DECEMBER 31 DECEMBER 31

----------------------------------------------------------------------------

Revenues $2,016.0 $1,257.5 $1,257.5

Less: Subconsultants and

direct costs $338.8 $237.4 $237.4

----------------------------------------------------------------------------

Net revenues(ii) $1,677.2 $1,020.1 $1,020.1

----------------------------------------------------------------------------

Personnel costs $1,252.6 $750.4 $753.5

Other operational costs(1) $262.6 $147.6 $161.3

Restructuring costs - - -

Share of income of

associates ($9.1) ($3.3) ($3.3)

----------------------------------------------------------------------------

EBITDA(ii) $171.1 $125.4 $108.6

----------------------------------------------------------------------------

Amortization of intangible

assets $34.0 $24.6 $24.6

Depreciation of property,

plant and equipment $24.7 $16.2 $16.2

Financial expenses $15.1 $9.4 $9.4

Share of depreciation of

associates $2.7 $0.7 $0.7

----------------------------------------------------------------------------

Earnings before income taxes $94.6 $74.5 $57.7

----------------------------------------------------------------------------

Income tax expenses $22.3 $12.4 $10.7

Share of tax of associates $2.1 $0.7 $0.7

----------------------------------------------------------------------------

Net earnings $70.2 $46.3

Attributable to:

- Shareholders $71.7 $46.3

- Non-controlling

interests ($1.5) -

----------------------------------------------------------------------------

Basic and diluted net

earnings per share $1.38 $1.15

----------------------------------------------------------------------------

Basic and diluted weighted

average number of shares 51,843,140 40,312,474 40,312,474

----------------------------------------------------------------------------

(i) The financial results are presented before the impact of unusual items

amounting of $4.5 (for the quarter) and $16.8 (year-to-date), net of

income taxes of $1.0 (for the quarter) and $1.7 (year-to-date)

pertaining to the acquisition of the WSP Group plc.

(ii) Non-IFRS measures as described in the 'Glossary' section

(1) The Other operational costs included operation exchange loss or gain

and interest income

NON-IFRS MESURES

The Company uses non-IFRS measures that are considered by companies as

indicators of financial performance measures which are not recognized under IFRS

and may differ from similar computations as reported by other similar entities

and, accordingly, may not be comparable. We believe these measures provide

useful supplemental information that may assist investors in assessing an

investment in the Company's shares.

Non-IFRS measures used by the Company are net revenues; EBITDA; EBITDA per

share; EBITDA margin; net earnings (loss) excluding amortization of intangible

assets related to acquisitions (net of income taxes); net earnings (loss)

excluding amortization of intangible assets related to acquisitions (net of

income taxes) per share; backlog; funds from operations; funds from operations

per share; free cash flow; free cash flow per share, and DSO.

Net revenues

Net revenues are defined as revenues from professional consulting services less

direct costs for subconsultants and other direct expenses that are recoverable

directly from the clients. Net revenues is not an IFRS measure and does not have

a standardized definition within IFRS. Therefore, net revenues may not be

comparable to similar measures presented by other issuers. Investors are advised

that net revenues should not be construed as an alternative to revenues for the

period (as determined in accordance with IFRS) as an indicator of the Company's

performance.

EBITDA and EBITDA per share

EBITDA is defined as earnings before financial expenses, income tax expenses,

depreciation and amortization. EBITDA is not an IFRS measure and does not have a

standardized definition within IFRS. Investors are cautioned that EBITDA should

not be considered an alternative to net earnings for the period (as determined

in accordance with IFRS) as an indicator of the Company's performance, or an

alternative to cash flows from operating, financing and investing activities as

a measure of the liquidity and cash flows. The Company's method of calculating

EBITDA may differ from the methods used by other issuers and, accordingly, the

Company's EBITDA may not be comparable to similar measures used by other

issuers.

EBITDA per share is calculated using the basic weighted average number of shares.

EBITDA margin

EBITDA margin is defined as EBITDA expressed as a percentage of net revenues.

EBITDA margin is not an IFRS measure.

Net earnings (loss) excluding amortization of intangible assets related to

acquisitions (net of income taxes) and net earnings (loss) excluding

amortization of intangible assets related to acquisitions (net of income taxes)

per share

Net earnings (loss) excluding amortization of intangible assets related to

acquisitions (net of income taxes) is not an IFRS measure. It provides a

comparative measure of Company performance in a context of significant business

combinations. This measure is defined as net earnings attributable to

shareholders/(loss) excluding the amortization expense of backlogs, customer

relationships and non-competition agreements accounted for in business

combinations and the income tax effects related to this amortization.

Net earnings (loss) excluding amortization of intangible assets related to

acquisitions (net of income taxes) per share is calculated using the basic

weighted average number of shares.

Backlog

Backlog is not an IFRS measure. It represents future revenues stemming from

existing signed contracts to be completed. The Company's method of calculating

backlog may differ from the methods used by other issuers and, accordingly, may

not be comparable to similar measures used by other issuers.

Funds from operations and funds from operations per share

Funds from operations is not an IFRS measure. It provides Management and

investors with a proxy for the amount of cash generated from operating

activities before changes in non-cash working capital items.

Funds from operations per share is calculated using the basic weighted average

number of shares.

Free cash flow and free cash flow per share

Free cash flow is not an IFRS measure. It provides a consistent and comparable

measurement of free cash flow generated from operations and is used as an

indicator of financial strength and performance. Free cash flow is defined as

cash flows from operating activities as reported in accordance with IFRS, less

maintenance capital expenditures.

Free cash flow per share is calculated using the basic weighted average number

of shares.

Days Sales Outstanding ("DSO")

DSO is not an IFRS measure. It represents the average number of days to convert

our trade receivables and costs and anticipated profits in excess of billings

into cash. The Company's method of calculating DSO may differ from the methods

used by other issuers and, accordingly, may not be comparable to similar

measures used by other issuers.

Net debt to EBITDA

Net debt to EBITDA is not an IFRS measure. It is a measure of our level of

financial leverage net of our cash and cash equivalents and is calculated on our

trailing twelvemonth EBITDA.

ABOUT WSP

WSP is one of the world's leading professional services firms, working with

governments, businesses, architects and planners and providing integrated

solutions across many disciplines. The firm provides services to transform the

built environment and restore the natural environment, and its expertise ranges

from environmental remediation to urban planning, from engineering iconic

buildings to designing sustainable transport networks, and from developing the

energy sources of the future to enabling new ways of extracting essential

resources. It has approximately 15,000 employees, mainly engineers, technicians,

scientists, architects, planners, surveyors, other design professionals, as well

as various environmental experts, based in more than 300 offices, across 30

countries, on 5 continents. www.wspgroup.com

Forward-looking statements

Certain information regarding WSP contained herein may constitute

forward-looking statements. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or other

statements that are not statements of fact. Although WSP believes that the

expectations reflected in such forward-looking statements are reasonable, it can

give no assurance that such expectations will prove to have been correct. These

statements are subject to certain risks and uncertainties and may be based on

assumptions that could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. WSP's forward-looking

statements are expressly qualified in their entirety by this cautionary

statement. The complete version of the cautionary note regarding forward-looking

statements as well as a description of the relevant assumptions and risk factors

likely to affect WSP's actual or projected results are included in the

Management Discussion and Analysis for the fourth quarter and year ended

December 31, 2013, which are available on SEDAR at www.sedar.com. The

forward-looking statements contained in this press release are made as of the

date hereof and WSP does not assume any obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise unless expressly required by applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Alexandre L'Heureux

Chief Financial Officer

WSP Global Inc.

514-340-0046, ext. 5310

alexandre.lheureux@wspgroup.com

Isabelle Adjahi

Director, Communications and Investor Relations

WSP Global Inc.

514-340-0046, ext. 5648

isabelle.adjahi@wspgroup.com

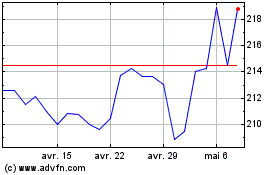

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024