WSP Closes $207 Million Public Offering and $86 Million Concurrent Private Placement of Common Shares

31 Mars 2014 - 3:15PM

Marketwired Canada

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO THE UNITED STATES OF

AMERICA OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA,

ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT

OF COLUMBIA.

WSP Global Inc. (TSX:WSP) ("WSP" or the "Corporation") is pleased to announce

that it has completed today its previously announced bought-deal and private

placement common share financings for aggregate gross proceeds of approximately

$293 million.

The Corporation issued 6,132,950 common shares, including the 799,950 common

shares issued as a result of the exercise of the over-allotment option granted

to the underwriters from treasury at a price of $33.75 per common share, on a

bought-deal basis, for aggregate gross proceeds of $206,987,063, through a

syndicate of underwriters co-led by CIBC, Raymond James Ltd., BMO Capital

Markets and National Bank Financial Inc., with CIBC and Raymond James Ltd.

acting as joint book-runners (the "Offering"). In addition, the Corporation

issued 2,547,750 common shares from treasury at a price of $33.75 per common

share by way of a private placement with Canada Pension Plan Investment Board

("CPPIB") and the Caisse de depot et placement du Quebec (the "Caisse"), for

aggregate gross proceeds of $85,986,563 (the "Concurrent Private Placement"). A

total of 1,185,000 and 1,362,750 common shares were issued to CPPIB and the

Caisse, respectively.

WSP intends to use the proceeds of the Offering and the Concurrent Private

Placement, together with the funds drawn under an existing credit facility, to

fund a portion of the purchase price and related transaction costs payable in

connection with the previously announced acquisition (the "Acquisition") of all

of the issued and outstanding shares of Focus Group Holding Inc. to be completed

through a plan of arrangement. The Acquisition is expected to become effective

on or about April 15, 2014, subject to customary closing conditions.

Alternatively, in the event the Acquisition is not completed, the net proceeds

from the Offering and the Concurrent Private Placement will be used to pay down

amounts outstanding under the Corporation's existing credit facility and for

general corporate purposes. WSP intends to make acquisitions from time to time

as part of its strategy to grow its business. The Corporation is currently in

the process of evaluating several potential acquisitions but has not entered

into any definitive agreements with respect to such acquisitions. If the

proposed Acquisition is not completed and the Corporation ultimately proceeds

with another acquisition, a portion of the net proceeds of the Offering and the

Concurrent Private Placement may be used for the purposes of financing the

purchase price of such acquisition.

The holders of newly issued common shares under the Offering, as well as CPPIB

and the Caisse, will be entitled to receive the previously declared dividend of

$0.375 per common share that will be payable on or about April 15, 2014.

Legal advice is being provided to WSP by Stikeman Elliott L.L.P. and to the

underwriters by Fasken Martineau DuMoulin L.L.P. CPPIB and the Caisse are being

represented by Blake, Cassels & Graydon L.L.P. and Lavery, de Billy L.L.P.,

respectively.

Availability of Documents

Copies of related documents, such as the final prospectus, the underwriting

agreement, the subscription agreements and the arrangement agreement regarding

the Acquisition are available on SEDAR's website at www.sedar.com, as part of

the public filings of WSP and on WSP's website at www.wspgroup.com.

Forward-looking information

Certain information regarding WSP contained herein may constitute

forward-looking statements. Forward-looking statements may include statements

with respect to, among other things, the use of proceeds from the Offering or

the Concurrent Private Placement, the consummation of the Acquisition and the

timing thereof, estimates, plans, expectations, opinions, forecasts,

projections, guidance or other statements that are not statements of fact.

Although WSP believes that the expectations reflected in such forward-looking

statements are reasonable, it can give no assurance that such expectations will

prove to have been correct. These statements are subject to certain risks and

uncertainties and may be based on assumptions that could cause actual results to

differ materially from those anticipated or implied in the forward-looking

statements. WSP's forward-looking statements are expressly qualified in their

entirety by this cautionary statement. The forward-looking statements contained

in this press release are made as of the date hereof and WSP does not assume any

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise unless expressly required

by applicable securities laws.

This news release is not an offer of securities for sale in the United States

and is not an offer to sell or solicitation of an offer to buy any securities of

WSP, nor shall it form the basis of, or be relied upon in connection with any

contract for purchase or subscription. The common shares will only be offered in

certain provinces of Canada by means of the prospectus referred to above.

Securities may not be offered or sold in the United States absent registration

under the U.S. Securities Act of 1933 (the "securities act") or an exemption

from registration thereunder. These securities have not been and will not be

registered under the securities act or the securities laws of any state and may

not be offered or sold in the United States absent registration under the

securities act and applicable state securities laws or pursuant to an applicable

exemption therefrom.

ABOUT WSP

WSP is one of the world's leading professional services firms, working with

governments, businesses, architects and planners and providing integrated

solutions across many disciplines. The firm provides services to transform the

built environment and restore the natural environment, and its expertise ranges

from environmental remediation to urban planning, from engineering iconic

buildings to designing sustainable transport networks, and from developing the

energy sources of the future to enabling new ways of extracting essential

resources. It has approximately 15,000 employees, mainly engineers, technicians,

scientists, architects, planners, surveyors, other design professionals, as well

as various environmental experts, based in more than 300 offices, across 30

countries, on 5 continents. www.wspgroup.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Alexandre L'Heureux

Chief Financial Officer

WSP Global Inc.

(514) 340-0046 x.5310

alexandre.lheureux@wspgroup.com

Isabelle Adjahi

Director, Communications and Investor Relations

WSP Global Inc.

(514) 340-0046 x.5648

Isabelle.adjahi@wspgroup.com

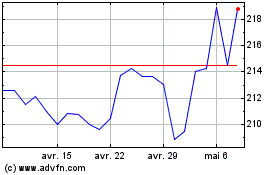

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024