Mr. George Salamis, President and CEO of Edgewater Exploration Ltd. ("Edgewater"

or the "Company") (TSX VENTURE:EDW)(OTCQX:EDWZF) is pleased to announce an

executed Letter of Intent with Pinecrest Resources Ltd. ("Pinecrest")(TSX

VENTURE:PCR) regarding the Enchi Gold Project ("the Project"). The transaction

will have Edgewater sell its 100% interest in Cape Coast Resource Ltd. (the

Company's Ghanaian subsidiary) that holds a 51% interest in the Enchi Gold

Project through a joint venture agreement with Red Back Mining Ghana Limited

(wholly owned by Kinross Gold Corporation) in exchange for shares of Pinecrest

Resources Ltd. Edgewater will distribute the Pinecrest shares pro-rata to the

shareholders of Edgewater in accordance with their share ownership of Edgewater

as a return of capital.

Transaction Terms with Edgewater

Pinecrest has entered into a Letter of Intent ("Edgewater LOI") to acquire

Edgewater's 51% interest(i) in the Enchi Gold Project through the purchase of

Cape Coast Resources Ltd. Details of the terms include;

-- Upon closing of the Transaction, Edgewater will receive one Pinecrest

post-consolidated common share (the "Acquisition Shares") for every five

common shares of Edgewater issued and outstanding on the Closing, which

will represent approximately 40% of the issued common shares of

Pinecrest post-closing of the Transaction. All shares issued to

Edgewater will be subject to resale restrictions as follows; 25% to be

free trading six months and nine months from closing and the remaining

50% twelve months from closing;

-- Edgewater will agree to distribute the Acquisition Shares pro-rata to

its shareholders as soon as reasonably practicable after the closing of

the Transaction;

-- Pinecrest will pay to Edgewater a cash payment of Cdn$150,000

-- The completion of the transactions contemplated by the Edgewater LOI are

subject to the execution of a definitive agreement with Pinecrest and

the concurrent completion of the transactions contemplated by the Red

Back LOI

Additionally, Pinecrest will be acquiring the remaining 49% interest from Red

Back Mining Ghana Limited ("Red Back") a wholly owned subsidiary of Kinross Gold

Corporation ("Kinross"). Pursuant to the completion of the transaction with

Edgewater and Kinross, Pinecrest will own 100% of the Enchi Gold Project and be

a West African precious metals focused exploration and development company.

Transaction Terms with Red Back

Pinecrest has entered into a Letter of Intent ("Red Back LOI") to acquire Red

Back's 49% interest(i) in the Enchi Gold Project. Details of the terms include;

-- Red Back will receive 19.9% of the issued and outstanding common shares

of Pinecrest post-closing of the transaction;

-- Red Back will receive a 2% NSR on the Project with an option for

Pinecrest to acquire 1% of the NSR at any time for US$3.5 Million;

-- Red Back will receive $10/oz on any new NI 43-101 Measured and Indicated

Resource Estimate or any ounce of gold mined whichever occurs first.

Such amount shall be payable in cash or, if agreeable to Pinecrest,

common shares of Pinecrest, at Pinecrest's sole discretion, provided

that, Pinecrest shall not be entitled to elect to pay in common shares

if such issuance would result in Red Back holding more than 20% of the

issued and outstanding shares of Pinecrest;

-- Red Back will have first right to process ore from the Project at its

Chirano Mill if toll processing is considered.

-- Red Back will receive 5,000,000 share purchase warrants priced at

$0.40/warrant exercisable for a five year term from closing of the

Transaction.

(i) The Government of Ghana can exercise the right to own a 10% direct carried

interest in the Project, If this right were exercised it would result in

Pinecrest owning a 90% direct interest in the Project.

The agreements are subject to Pinecrest shareholder approval and TSX Venture

Exchange acceptance.

President and CEO, George Salamis, stated; "We believe this transaction with

Pinecrest is a catalyst to unlocking the value of the Enchi gold project for

Edgewater shareholders. We aim to achieve this through the creation of a

separately listed public company, the majority of which will be owned by

Edgewater shareholders and Red Back, with Pinecrest owning an effective 100%

interest in the Project. The goal of this Transaction is to create a singularly

focused and separately funded West African advanced-stage gold company,

leveraging off of the previous exploration successes of the Edgewater team in

one of the most prolific gold districts in the world. This transaction will

allow Edgewater to focus on our 100% owned Corcoesto gold project in Spain as

well as have the Enchi project funded and advanced without further equity

dilution to our shareholders. Edgewater recently announced an updated NI 43-101

Inferred Resource demonstrating over one million ounces of shallow gold

resources (at a cut-off of 0.5 g/t gold). Our team is of the view that some of

the gold resources defined within the near-surface oxidized portions are

potentially amenable to heap-leaching and lower cost open pit mining. As such,

with 100% ownership, Pinecrest's near-term value proposition is linked to

completing a Preliminary Economic Assessment focused on the potential economics

of heap-leaching at Enchi, while also testing the upside potential of the

currently open-ended gold resources."

Summary of the Enchi Gold Project

The Enchi Gold Project located in south-west Ghana, West Africa covers a 50

kilometre strike length of the Bibiani Shear Zone a regional scale structure

that hosts a number of major gold mines and deposits including Kinross' Chirano

Gold Mine located 70 km north-east of the Project and the Bibiani Gold Deposit

located 90 km north-east of the Project. The Enchi Gold Project is comprised of

ten licenses totalling 696 km2 located 290 km west of the capital city of Accra.

Access to the Project is on sealed roads via the regional port city of Takoradi

or the mining centre of Tarkwa and then on gravel roads to Enchi (population

9,270). Good road access exists throughout the project licenses.

May 12, 2014 Edgewater Exploration announced an updated NI 43-101 Inferred

Resource Estimate at a cut-off grade of 0.7 g/t Gold as follows:

Enchi Gold Project, Ghana

2014 Inferred Mineral Resource Summary

============================================================================

Cut-off Zone Tonnes Grade Contained Gold

Au (g/t) Au (g/t) (ounces)

============================================================================

0.7 Boin 9,551,000 1.20 368,500

0.7 Nyam 3,716,000 1.13 135,000

0.7 Sewum 7,549,000 1.09 264,500

------------------------------------------------------

TOTAL 20,816,000 1.15 768,000

============================================================================

1. CIM definition standards were followed for the resource estimate.

2. The 2014 resource models used ordinary kriging (OK) grade estimation

within a three-dimensional block model with mineralized zones defined by

wireframed solids.

3. A base cut-off grade of 0.7 g/t Au was used for reporting resources with

a capping of gold grades at 18 g/t.

4. A US$1,300/ounce gold price, open pit with heap leach operation was used

to determine the cut-off grade.

5. A density of 2.45 g/cm3was applied.

6. Numbers may not add exactly due to rounding.

7. Mineral Resources that are not mineral reserves do not have economic

viability

A technical report is being prepared by independent qualified person Todd

McCracken, P. Geo. of WSP Canada Inc. ("WSP") and will be filed within 45 days

of the announcement in the Edgewater Exploration Ltd. news release dated May 12,

2014.

The resource estimate also evaluated the Enchi Project at a range of cut off

grades between 0.3 and 2.0 g/t Au. Results are as follows;

============================================================================

Cut-off Tonnes Au g/t Ounces

============================================================================

0.3 72,611,000 0.65 1,526,065

0.4 53,366,000 0.76 1,304,918

0.5 37,357,000 0.90 1,078,702

0.7 20,816,000 1.15 767,988

0.9 12,993,000 1.36 569,879

1.0 10,127,000 1.49 484,388

1.2 6,446,000 1.70 352,779

1.5 3,011,000 2.11 204,549

1.7 2,041,000 2.36 154,976

1.9 1,554,000 2.54 126,727

2.0 1,174,000 2.73 102,909

============================================================================

The 2014 Mineral Resource estimate was based on 52,385 metres of diamond and RC

drilling in 646 holes as well as data from 13,799 metres in 102 surface

trenches. The drilling is generally spaced at 25 to 50 metre intervals.

A two phase success contingent work program has been recommended by WSP. The

first phase consists of metallurgical testing, and the completion of a

Preliminary Economic Assessment ("PEA"). The second phase, contingent on the

success of phase one, consists of additional drilling, detailed metallurgical

testing, further technical studies and a pre-feasibility study.

The three gold zones in the inferred resource estimate, Boin, Nyam and Sewum

have been drilled to an approximate vertical depth of 75-100m and approximately

60-70% of the inferred resource consists of oxide mineralization. Pinecrest

Resources sees opportunities to expand resources at all zones both laterally and

to depth.

Edgewater, Red Back and previous operators have discovered and identified

numerous gold mineralized zones on the Enchi Project characterised as

structurally-controlled, mesothermal quartz vein style gold deposits. This style

of gold mineralization is the most common type of gold occurrence in West

Africa.

Further potential on the Enchi Project is evidenced by results of a regional

airborne study consisting of a heliborne VTEM, magnetics and radiometric survey

which was flown over the Enchi Project. A total of 2,084 line km at 200m spacing

were flown covering an area of 568 square kilometres. The airborne geophysical

survey at Enchi indicated that; 1) Several structures correlate to known

mineralization, while many other similar structures remain untested and 2)

Interpretation work pin pointed several additional drill targets and combined

with soil geochemistry this data is a strong tool for identification of new

discoveries

Additional zones exists within the Enchi Project including several with

successful first pass drilling but not part of the current resource including;

Eradi; 27m grading 0.60 g/t Au including 10m grading 1.3 g/t Au, Kojina Hill; 68

m grading 1.14 g/t Au, 59m grading 0.77 g/t Au including 28m grading 1.22 g/t

Au, and Boin NW; 7.0m grading 0.95 g/t Au and 3.0m grading 0.67 g/t Au.

Further high priority targets which warrant additional detailed exploration have

been defined by trenching and auger drilling in 2012 and 2013 including; Boin

Northwest; 10m grading 1.64 g/t and 2m grading 2.74 g/t Au, Sewum-Tokosea Trend;

31m grading 0.31 g/t Au and 5m grading 0.68 g/t Au, and Achimfo; 24m grading

0.84 g/t Au and 22m grading 0.62 g/t Au.

Sample analyses have been conducted at independent commercial facilities SGS and

Intertek Labs in Tarkwa Ghana. All sample analyses was completed using industry

standard geochemical and fire assay practices and included a rigorous Quality

Assurance / Quality Control (QA/QC) program consisting of the insertion of

standards, blanks and duplicate samples randomly into the sample stream. A

review of the QA/QC results shows no significant bias and all results are

considered highly reliable.

Mr. Gregory Smith, P.Geo, the Vice-President of Exploration of the Company, is

the Qualified Person as defined by NI 43-101 and has prepared and approved the

technical data and information in this news release.

Financing

Pinecrest will complete a non-brokered private placement (the "Private

Placement") financing, issuing 15 million subscription receipts (each a

"Subscription Receipt") at a purchase price of CDN$0.20 per Subscription Receipt

to raise aggregate gross proceeds of CDN$3,000,000. Each Subscription Receipt

will entitle the holder to acquire one post-consolidated unit (each a "Unit") of

Pinecrest for no additional consideration upon the closing of the Transaction.

Each Unit will consist of one post-consolidated common share ("Common Share") in

the capital of Pinecrest and one post-consolidated common share purchase warrant

(each whole warrant a "Warrant"). Each Warrant will entitle the holder to

acquire one post-consolidated common share of Pinecrest at a post-consolidated

exercise price of CDN$0.30 for a period of 24 months from the completion of the

Private Placement.

None of the securities sold in connection with the Private Placement will be

registered under the U.S. Securities Act of 1993, as amended, and may not be

offered or sold in the United States absent registration or an applicable

exemption from the registration requirements. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

A Finder's Fee of 6.0% of the gross proceeds raised under the Private Placement

will be paid in cash or at the election of the Finder in post-consolidated

common shares of Pinecrest on the closing of the Transaction.

All securities issued in connection with the Private Placement will be subject

to a statutory hold period of four months plus one day from the closing date of

the Private Placement. The Private Placement is subject to Exchange acceptance.

The offer and sale of the securities offered in the Private Placement has not

been and will not be registered under the U.S. Securities Act of 1933, as

amended, or any state securities laws, and such securities may not be offered or

sold in the United States absent registration or an applicable exemption from

such registration requirements. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, sale or solicitation would be

unlawful.

Post-Transaction Capital Structure

On completion of the Consolidation, the Private Placement and the closing of the

Transaction, Pinecrest will have approximately 51,163,887 common shares issued

and outstanding and 74,906,387 shares common on a fully diluted basis. The

proposed equity ownership of Pinecrest is anticipated to be as outlined below:

Holder Percentage Ownership

Red Back 19.9%

Edgewater 39.6%(i)

Original Pinecrest shareholders 11.2%

New Capital (Private Placement) 29.3%

----------------------------------------------------------------------------

100.0%

(i) The Acquisition Shares are to be distributed by Edgewater to its

shareholders on a pro rata basis as soon as reasonably practicable after the

closing of the Transaction.

Resale Restrictions for Pinecrest Shares Issued to Edgewater Shareholders

The Pinecrest common shares issued to Edgewater shareholders will be subject to

resale restrictions and will be released according to the following schedule

from the closing date of the Transaction:

6 months 25% release

9 months 25% release

12 months 50% release

Further updates on the status of the Transaction will be provided by future

press releases as matters progress.

The closing of the transactions contemplated by the Red Back LOI and the

Edgewater LOI are subject to a number of conditions, including but not limited

to the execution of separate definitive agreements; normal conditions precedent

for transactions such as these, including the delivery of title and corporate

opinions and the completion of satisfactory due diligence, approval of the

shareholders of Pinecrest to the proposed change of control of Pinecrest, the

acceptance of the Exchange, the completion of a consolidation of the common

shares of Pinecrest, as described below, and the completion by Pinecrest of a

financing to raise not less than CDN$3,000,000. There can be no assurance that

the Transaction will be completed as proposed or at all.

About Edgewater Exploration Ltd.

Edgewater is a mineral development and exploration company focused on the

development of precious metal properties. Edgewater has an experienced mine

building and operating team with a track record of success. The Company is

currently developing the Corcoesto Gold Project in northwest Spain.

On behalf of the board of

EDGEWATER EXPLORATION LTD.

George Salamis, President and CEO

This news release contains certain forward-looking statements, including

statements regarding the proposed transactions with Pinecrest, the proposed

Private Placement and Consolidation of the Pinecrest share capital and the

closing of the transactions contemplated thereby, the use of net proceeds of the

Private Placement, future plans and objectives of the Company and the business

of the Company.

Any statements that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future

events or performance (often, but not always, using words or phrases such as

"expects" or "does not expect", "is expected", anticipates" or "does not

anticipate" "plans", "estimates" or "intends" or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be taken, occur or

be achieved) are not statements of historical fact and may be "forward-looking

statements". Forward-looking statements are subject to a variety of risks and

uncertainties which could cause actual events or results to materially differ

from those reflected in the forward-looking statements.

Safe Harbor Statement under the United States Private Securities Litigation

Reform Act of 1995: Except for the statements of historical fact contained

herein, the information presented constitutes "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements including but not limited to those with respect to

the price of gold, potential mineralization, reserve and resource determination,

exploration results, and future plans and objectives of the Company involve

known and unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievement of Atlas to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements. There can be no assurance that such statements

will prove to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly, readers

should not place undue reliance on forward-looking statements.

"Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release."

FOR FURTHER INFORMATION PLEASE CONTACT:

Edgewater Exploration Ltd.

Ryan King

Vice President

(604) 628-1012

rking@edgewaterx.com

WSP Global (TSX:WSP)

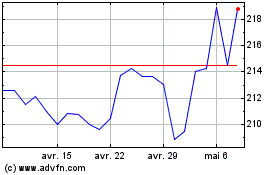

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024