TDb Split Corp: Financial Results to May 31, 2009

29 Juillet 2009 - 10:56PM

Marketwired Canada

TDb Split Corp. ("TDb Split") announces semi-annual financial results for the

six months ending May 31, 2009.

The six month period ending May 31, 2009 was one of the most tumultuous periods

in financial market history. The Company's only underlying equity holding of TD

Bank common stock hit a low of $32.37 on February 20, 2009 (a decline of 53.1%

since the inception date of the Company) which required the Company to further

reduce the Company's holding of TD Bank Financial common stock and use the

proceeds to increase fixed income instruments held under the Priority Equity

Protection Plan as required under the prospectus. The objective of the Priority

Equity Protection Plan is to provide repayment of the original $10 par value of

the Priority Equity shares. As at May 31, 2009, the net asset value of the

Company was $11.35 per unit (a unit consisting of one Priority Equity share and

one Class A share). As a result of the cumulative liquidation of a portion of

the TD Bank common shares to facilitate the requirements of the Priority Equity

Portfolio Protection Plan, the Company had 62.8% in TD Bank Financial common

stock and the remaining 37.2% in fixed income securities (plus cash) as at May

31, 2009.

The portfolio is continually rebalanced and adjusted based on the market price

of TD Bank common shares. The Company may buy or sell additional shares of TD

Bank, write covered call options, and /or increase or decrease fixed income

securities in the Priority Equity Protection Plan based on market conditions and

provided that the Company remains in compliance with the Priority Equity

Protection Plan.

TDb Split invests in common shares of TD Bank, a leading Canadian financial

institution.

Selected Financial Information from the Statement of Financial Operations:

For six months ending May 31, 2009

($ Millions)

Income 0.372

Expenses (0.140)

-------

Net investment income 0.232

Realized option premiums and gain (loss) on sale of investments (8.334)

Change in unrealized appreciation of investments 8.484

-------

Increase in net assets from operations before distributions 0.382

Comparative financial information is available in documents filed on www.sedar.com.

TDb Split (TSX:XTD)

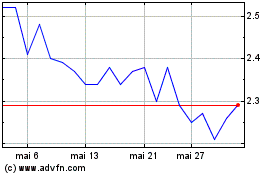

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

TDb Split (TSX:XTD)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024