Aton Announces Closing of Debt Settlement

26 Avril 2021 - 2:30PM

Aton Resources Inc. (AAN: TSX-V) ("Aton" or the "Corporation") is

pleased to announce that, further to its news release of April 12,

2021, it has settled a total of CAD$116,348.49 in debt (the “Debt”)

to directors and employees in exchange for 484,785 common shares

(the “Shares”) at a price of $0.24 per Share (the “Shares for Debt

Transaction”).

Certain of the Shares for Debt Transactions are

“related party transactions” under applicable securities laws, as

directors Bill Koutsouras, Tonno Vahk, and Anthony Clements, and

former director David Laing (collectively the “Insiders”),

participated in the Shares for Debt Transaction. Each of the

Insiders abstained from voting on the resolution approving the

Shares for Debt Transaction that related to him. Each of these

Shares for Debt Transactions is exempt from the formal valuation

and minority approval requirements under Multilateral Instrument

61-101, as neither the value of the shares issued to, nor the

aggregate debt settled with respect to, any directors of the

Company in connection with the Shares for Debt Transactions will

exceed 25% of the Company’s market capitalization on the date

hereof.

All Shares issued will be subject to a

four-month hold period, expiring August 24, 2021, and no new

control person will be created as a result of the Shares for Debt

Transactions.

About Aton Resources Inc. Aton

Resources Inc. (AAN: TSX-V) is focused on its 100% owned Abu

Marawat Concession (“Abu Marawat”), located in Egypt’s

Arabian-Nubian Shield, approximately 200 km north of Centamin’s

world-class Sukari gold mine. Aton has identified numerous gold and

base metal exploration targets at Abu Marawat, including the Hamama

deposit in the west, the Abu Marawat deposit in the northeast, and

the advanced Rodruin exploration prospect in the south of the

Concession. Two historic British gold mines are also located on the

Concession at Sir Bakis and Semna. Aton has identified several

distinct geological trends within Abu Marawat, which display

potential for the development of a variety of styles of precious

and base metal mineralisation. Abu Marawat is 447.7 km2 in size and

is located in an area of excellent infrastructure; a four-lane

highway, a 220kV power line, and a water pipeline are in close

proximity, as are the international airports at Hurghada and

Luxor.For further information regarding Aton Resources Inc., please

visit us at www.atonresources.com or contact:BILL KOUTSOURASInterim

CEO Tel: +1 345 525 2512Email: info@atonresources.com

Note Regarding Forward-Looking

Statements Some of the statements contained in this

release are forward-looking statements. Since forward-looking

statements address future events and conditions; by their very

nature they involve inherent risks and uncertainties. Actual

results in each case could differ materially from those currently

anticipated in such statements. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

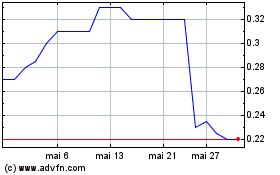

Aton Resources (TSXV:AAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Aton Resources (TSXV:AAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025