(TSXV: AEL.H) Exploration Amseco Ltd (“Amseco” or the “Company”) is

pleased to announce that the Company has entered into a letter of

intent dated November 2, 2020 (the “LOI”) with LithiumBank

Resources Corp. (“LithiumBank”) pursuant to which Amseco proposes

to acquire all of the issued and outstanding shares of LithiumBank

(the “Transaction”) in exchange for common shares of New

LithiumBank (as defined below) to be issued on a post-Share

Consolidation (as defined below) basis. The Transaction will

constitute a “Reverse Takeover” of Amseco within the meaning of the

policies of the TSX Venture Exchange (the “TSXV”) and will be

completed on an arm’s length basis.

Proposed Terms of the

Transaction

Under the terms of the LOI, it is anticipated

that Amseco and LithiumBank, and if required depending on the

structure of the Transaction to be confirmed by the parties at a

later date, the securityholders of LithiumBank, will enter into a

binding agreement (the “Definitive Agreement”)

pursuant to which Amseco will acquire all of the issued and

outstanding securities of LithiumBank in consideration for the

issuance (on post-Share Consolidation basis) of 20,950,000 common

shares of Amseco (New LithiumBank) at a deemed price of $0.40 per

share (for a total deemed consideration of $8,380,000) and

the issuance by Amseco (New LithiumBank) of 2,095,000 stock

options, subject to the Company’s stock option plan and the

policies of the TSXV.

Concurrent Financing

In connection with the Transaction, Amseco will

complete a financing, either by way of prospectus or on a private

placement basis, of a minimum of 3,750,000 common shares at an

anticipated price of $0.40 per share (on post-Share Consolidation

basis), for minimum proceeds of $1,500,000 (the “Offering”). The

share price and maximum amount of the Offering will be confirmed at

a later date in the context of the market. The Offering may be

structured as a placement of subscription receipts with closing to

occur prior to the closing of the Transaction.

Share Consolidation (Amseco)

Prior to the closing of the Transaction, Amseco

will effect a consolidation of its shares, on the basis of one new

common share of Amseco for every 5 old common shares of Amseco

issued and outstanding (the “Share Consolidation”), so that

approximately 2,595,775 common shares of Amseco will be outstanding

on a post-Share Consolidation basis immediately prior to the

closing of the Transaction. At the same time, Amseco will make

equivalent adjustments to its outstanding stock options in

accordance with their respective terms, so that there will be

approximately 97,700 stock options outstanding on a post-Share

Consolidation basis immediately prior to the closing of the

Transaction.

Sponsorship

The Transaction is subject to the sponsorship

requirements of the TSXV, unless an exemption from the sponsorship

requirement is available or a waiver is granted. The Company

intends to apply for an exemption to the sponsorship requirement.

There is no assurance that an exemption from this requirement will

be obtained.

Conditions of the Transaction

Completion of the proposed Transaction is

subject to a number of conditions including, but not limited to:

(i) completion of mutually satisfactory due diligence reviews; (ii)

execution of the Definitive Agreement; (iii) requisite shareholder

approvals for the Share Consolidation and Name Change (as defined

below); (iv) completion of the Offering; (v) completion by Amseco

of shares for debt arrangements with existing creditors resulting

in the issuance of up to 835,383 common shares of Amseco on a

pre-Share Consolidation basis; and (vi) receipt of all requisite

regulatory approvals relating to the Transaction, including,

without limitation, the TSXV.

Closing of the Transaction is expected to occur

on or before January 29, 2021. The LOI may be terminated by either

party if a Definitive Agreement is not entered into by December 17,

2020.

The company resulting from the transaction (“New

LithiumBank”) will be a mining exploration company to be named

“LithiumBank Resources Corp.” or such other similar corporate name

as shall be mutually agreed upon by LithiumBank and Amseco so as to

reflect the Transaction (the “Name Change”).

Shareholder Approval

Amseco will hold an annual and special meeting

of its shareholders (the “Meeting”) for purposes of obtaining

shareholder approval for various matters related to the

Transaction, including the Share Consolidation and Name Change, as

required by the applicable policies of the TSXV and the Canada

Business Corporations Act. The date and time of the Meeting will be

confirmed at a later date by the Company.

In connection with the Transaction, the Company

believes that no shareholder approval will be required to be

obtained at the Meeting given that (i) the Transaction is not a

“Related Party Transaction” within the meaning of the TSXV

Corporate Finance Manual and as at the date hereof, no other

circumstances exist which may compromise the independence of the

Company or other interested parties involved; (ii) the common

shares are currently listed on NEX; (iii) the Company is not and

will not be subject to a cease trade order and will not otherwise

be suspended from trading on completion of the transaction; and

(iv) shareholder approval of any aspect of the Transaction is not

required under applicable corporate laws and is not required under

applicable securities laws. As such, the Company is of the opinion

that it meets the conditions for the exemption to obtain

shareholder approval under Section 4.1 of Policy 5.2 of the TSXV

Corporate Finance Manual. The Company will seek confirmation from

the TSXV of this applicable exemption to the Company concurrently

with the conduct of its due diligence review on LithiumBank and its

assets.

Information on

LithiumBank

LithiumBank is a private company constituted

under the Business Corporations Act (British Columbia). As at the

date hereof, LithiumBank has 20,950,000 common shares issued and

outstanding, no common share purchase warrants and 2,095,000 stock

options outstanding.

LithiumBank’s objective is to develop a top tier

strategic battery lithium resource in Alberta, and acquire and

consolidate high quality lithium exploration projects that have had

meaningful capital invested during the “Electric Vehicle 1.0” bull

market. LithiumBank owns multiple projects over 1M acres of the

most prospective permits for lithium brines in Alberta. Its main

goal is to establish a maiden inferred resource(s) on the Sturgeon

Lake Property, located in west-central Alberta, directly south and

west of the Town of Valleyview, approximately 85 km east of the

City of Grande Prairie and 270 km northwest of the City of

Edmonton.

The Sturgeon Lake Property is comprised of 12 Alberta Metallic

and Industrial Mineral Permits (9 approved permits and 3 permits in

application) that collectively form a contiguous package of land

that totals 105,419.3 ha. The permits were acquired directly from

the Government of Alberta through the Provinces on-line mineral

tenure system. LithiumBank has a 100% ownership of the mineral

rights at the Sturgeon Lake Property.

The management team of LithiumBank is comprised

of the following persons:

Gianni KovacevicFOUNDER, CHAIRMAN, DIRECTOR

Gianni Kovacevic is the

founder of LithiumBank and an investor in the energy and commodity

sectors. A graduate of electrical studies from the British Columbia

Institute of Technology, he is an expert in the analysis of the

global energy matrix and the impact technology and renewable

energy are having on every aspect of society. Fluent in English,

German, Italian, and Croatian, he makes his home in Vancouver.

Robert ShewchukPRESIDENT, CEO

Robert Shewchuk is an Alberta

based investor with 25 years experience in the Capital Markets

including Chairman of Standard Securities Capital Corp and Managing

Director of Wolverton Securities Ltd acquired by PI Financial Corp

in 2016. Rob currently serves on the Board of Directors of Graphene

Manufacturing Group Pty Ltd and Spectre Capital Corp.

Kevin PiepgrassVP OPERATIONS

Kevin

Piepgrass graduated from the University of Alberta

in 2005 and is a Professional Geologist, registered at APEGBC. He

has 15 years of experience managing the exploration and development

of multiple commodities including gold, silver, copper, lithium and

rare earth elements. Mr. Piepgrass is a Qualified Person pursuant

to National Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Jon LaMotheSR. GEOLOGIST

Jon LaMothe

holds a Bachelor of Science degree in Geology from the University

of Alberta and a MSc in Geology from the University of Alberta.

Jon’s ability has led to the discovery and capture of several

fields with over two billion dollars spent to date on targets he

has identified. He helped bring Black Swan Energy from no

production making Black Swan Energy the 4th largest private

producer of oil and gas in Canada.

In connection with the Transaction and as noted

above, the Transaction is subject to the completion of a mutually

satisfactory due diligence review by each party. The LOI

contemplates a delay of 45 days from signature to complete such due

diligence. Upon the completion of such review to the Company’s

satisfaction, further information on LithiumBank and its assets,

the Definitive Agreement, the Offering and New LithiumBank will be

disclosed in an updating news release.

New

LithiumBank - Board of Directors, Officers

and Consulting Services Agreement

At the closing of the Transaction, the current

directors of Amseco will resign (with the exception of Roger

Bourgault) and the directors of LithiumBank will be appointed to

the board of directors of New LithiumBank. Furthermore, the current

officers of Amseco will also resign and the officers of LithiumBank

will be appointed as officers of New LithiumBank.

Jean Desmarais (CEO of Amseco) and François

LeComte (Director of Amseco) will remain as consultants of New

LithiumBank for a minimum of 1 year pursuant to consulting services

agreements to be executed at the closing of the Transaction.

Trading of the New

LithiumBank Shares

Trading in the shares of Amseco has been halted

as a result of the announcement of the Transaction. The Company

expects that trading will remain halted pending closing of the

Transaction, subject to the earlier resumption upon TSXV acceptance

of the Transaction and the filing of required materials in

accordance with TSXV policies.

Upon successful completion of the Transaction,

it is anticipated that New LithiumBank will be listed as a Tier 2

Mining issuer.

Filing Statement

In connection with the Transaction and pursuant

to TSXV requirements, Amseco will file a filing statement on SEDAR,

which will contain details regarding the Transaction, the

Definitive Agreement, the Offering, the Company, LithiumBank and

New LithiumBank.

FOR FURTHER INFORMATION PLEASE CONTACT:

François LeComteDirector2159 Mackay Suite 200Montréal, Québec

H3G 2J2lecomte.amseco@gmail.comCompletion of the Transaction is

subject to a number of conditions, including but not limited to,

TSXV acceptance and if applicable, disinterested shareholder

approval. Where applicable, the Transaction cannot close until the

required shareholder approval is obtained. There can be no

assurance that the Transaction will be completed as proposed or at

all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the Transaction, any

information released or received with respect to the Transaction

may not be accurate or complete and should not be relied upon.

Trading in the securities of Exploration Amseco Ltd. should be

considered highly speculative.

The TSX Venture Exchange Inc. has in no way

passed upon the merits of the proposed Transaction and has neither

approved nor disapproved the contents of this news release.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release.

Cautionary Statements Regarding Forward Looking

Information

Some statements in this release may contain

forward-looking information. All statements, other than of

historical fact, that address activities, events or developments

that the Company believes, expects or anticipates will or may occur

in the future (including, without limitation, statements regarding

potential mineralization) are forward-looking statements.

Forward-looking statements are generally identifiable by use of the

words “may”, “will”, “should”, “continue”, “expect”, “anticipate”,

“estimate”, “believe”, “intend”, “plan” or “project” or the

negative of these words or other variations on these words or

comparable terminology. Forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond the

Company’s ability to control or predict, that may cause the actual

results of the Company to differ materially from those discussed in

the forward-looking statements. Factors that could cause actual

results or events to differ materially from current expectations

include, among other things, without limitation, failure by the

parties to complete the proposed transaction, the possibility that

future exploration results will not be consistent with the

Company's expectations, changes in world lithium markets or markets

for other commodities, and other risks disclosed in the Company’s

public disclosure record on file with the relevant securities

regulatory authorities. Any forward-looking statement speaks only

as of the date on which it is made and except as may be required by

applicable securities laws, the Company disclaims any intent or

obligation to update any forward-looking statement.

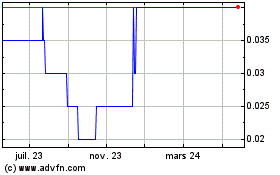

Amseco Exploration (TSXV:AEL.H)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Amseco Exploration (TSXV:AEL.H)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025