OppenheimerFunds, Inc. ("OFI") announced today that it filed on SEDAR

(www.sedar.com) the attached Early Warning Report with respect to securities of

ART Advanced Research Technologies Inc. ("ART") held by certain funds managed by

OFI.

OFI is an investment manager registered to provide investment advisory services

under the Investment Advisers Act of 1940 of the United States of America, as

amended. OFI has dispositional and voting authority over certain securities of

ART held by various funds managed by OFI, over which securities OFI exercises

control or direction but not direct ownership.

For further information contact:

OppenheimerFunds, Inc.

Two World Financial Center

225 Liberty Street, 11th Floor

New York, NY 10281

Attention: Jeaneen Pisarra

Tel: +1-212-323-5178

Fax: +1-212-912-6378

EARLY WARNING REPORT

UNDER NATIONAL INSTRUMENT 62-103

1. Name and Address of Offeror:

OppenheimerFunds, Inc. (the "Offeror")

Two World Financial Center

225 Liberty Street

New York, NY 10281

2. The designation and number or principal amount of securities and the

offeror's securityholding percentage in the class of securities of which the

offeror acquired ownership or control in the transaction or occurrence giving

rise to the obligation to file the news release, and whether it was ownership or

control that was acquired in those circumstances:

The Offeror is an investment manager registered to provide investment advisory

services under the Investment Advisers Act of 1940 of the United States of

America, as amended. The Offeror has dispositional and voting authority over

certain securities of ART Advanced Research Technologies Inc. ("ART") held by

various funds ("Funds") managed by OFI, over which securities OFI exercises

control or direction but not direct ownership.

On behalf of these Funds, OFI holds 17,747,058 common shares of ART ("Common

Shares"), representing approximately 18.77% of the issued and outstanding Common

Shares. The Funds owning such securities and the applicable number and

securityholding percentage of such securities are as follows: USAZ Oppenheimer

International Growth Fund ("USAZ") as to 746,900 Common Shares representing

0.79%, Panorama Oppenheimer International Growth Fund/VA ("Pan. Int'l Equity")

as to 1,168,800 Common Shares representing 1.24%, Oppenheimer International

Growth Fund ("OIGAX") as to 9,701,131 Common Shares representing 10.26%,

MassMutual Premier International Equity Fund ("MMPIEF") 5,921,627 Common Shares

representing 6.26%, OFI Institutional International Equity Fund, LP ("OFIIIEF")

as to 72,500 Common Shares representing 0.08% and OFITC International Growth

Fund ("OIGF") as to 136,100 Common Shares representing 0.14%.

On August 26, 2008, OIGAX acquired 8,304,084 series 4 convertible preferred

shares of ART ("series 4 preferred shares") and 7,080,531 series 5 convertible

preferred shares of ART ("series 5 preferred shares"). The series 4 preferred

shares acquired represent 33.38% of the issued and outstanding series 4

preferred shares, and the series 5 preferred shares acquired represent 33.38% of

the issued and outstanding series 5 preferred shares. The series 4 preferred

shares are convertible, on 61 days notice, into Common Shares at a fixed

conversion rate of 0.95 Common Share for each series 4 preferred share. The

series 5 preferred shares became convertible, on 61 days notice, into Common

Shares at a fixed conversion rate of 0.95 per Common Share for each series 5

preferred share, pursuant to the approval of shareholders of ART on May 26,

2009. If all such shares were converted, the Offeror would exercise control or

direction over 14,615,384 Common Shares arising from such conversion

(representing a securityholding percentage of 13.39%, and the Offeror would

exercise control or direction over a total of 32,362,442 Common Shares

(representing a securityholding percentage of 29.65%), and upon such conversion

OIGAX would own 14,615,384 Common Shares arising from such conversion

(representing a securityholding percentage of 13.39%), and OIGAX would own a

total of 24,316,515 Common Shares (representing a securityholding percentage of

22.28%).

On behalf of the Funds, the Offeror also holds 6,341,982 series 1 preferred

shares of ART ("series 1 preferred shares"), representing 100% of the issued and

outstanding series 1 preferred shares. The Funds owning such securities are as

follows: USAZ as to 160,422 of such securities, Pan. Int'l Equity as to 360,333

of such securities, OIGAX as to 3,124,013 of such securities, MMPIEF as to

2,653,076 of such securities, OFIIIEF as to 44,138 of such securities and OIGF

does not own any of such securities. The series 1 preferred shares are

convertible at any time into Common Shares at a fixed conversion rate of 0.9036

common shares for each series 1 preferred share. If all such series 1 preferred

shares were converted the Offeror would exercise control or direction over

5,730,615 Common Shares arising from such conversion (representing a

securityholding percentage of 5.72%, and the Offeror would exercise control or

direction over a total of 23,477,673 Common Shares (representing a

securityholding percentage of 23.41%). Upon such conversion the total ownership

of Common Shares and the applicable securityholding percentage by each Fund

would be as follows: USAZ as to 891,857 Common Shares (representing a

securityholding percentage of 0.89%), Pan. Int'l Equity as to 1,494,397 Common

Shares (representing a securityholding percentage of 1.49%), OIGAX as to

12,523,989 Common Shares (representing a securityholding percentage of 12.49%),

MMPIEF as to 8,318,946 Common Shares (representing a securityholding percentage

of 8.30%), OFIIIEF as to 112,383 Common Shares (representing a securityholding

percentage of 0.11%) and OIGF as to 136,100 Common Shares (representing a

securityholding percentage of 0.14%).

On behalf of the Funds, the Offeror also holds 2,000,000 series 2 preferred

shares of ART ("series 2 preferred shares"), representing 100% of the issued and

outstanding series 2 preferred shares. The Funds owning such securities are as

follows: USAZ as to 50,591 of such securities, Pan. Int'l Equity as to 113,634

of such securities, OIGAX as to 976,420 of such securities, MMPIEF as to 836,671

of such securities, OFIIIEF as to 13,919 of such securities and OIGF as to 8,765

of such securities. The series 2 preferred shares are convertible at any time

into Common Shares at a fixed conversion rate of 1.0556 common shares for each

series 2 preferred share. If all such series 2 preferred shares were converted

the Offeror would exercise control or direction over 2,111,200 Common Shares

arising from such conversion (representing a securityholding percentage of

2.18%, and the Offeror would exercise control or direction over a total of

19,858,258 Common Shares (representing a securityholding percentage of 20.55%).

Upon such conversion the total ownership of Common Shares and the applicable

securityholding percentage by each Fund would be as follows: USAZ as to 800,304

Common Shares (representing a securityholding percentage of 0.83%), Pan. Int'l

Equity as to 1,288,752 Common Shares (representing a securityholding percentage

of 1.33%), OIGAX as to 10,731,840 Common Shares (representing a securityholding

percentage of 11.10%), MMPIEF as to 6,804,817 Common Shares (representing a

securityholding percentage of 7.04%), OFIIIEF as to 87,193 Common Shares

(representing a securityholding percentage of 0.09%) and OIGF as to 145,352

Common Shares (representing a securityholding percentage of 0.15%).

3. The designation and number or principal amount of securities and the

offeror's securityholding percentage in the class of securities immediately

after the transaction or occurrence giving rise to the obligation to file the

news release:

See paragraph #2 above

4. The designation and number or principal amount of securities and the

percentage of outstanding securities of the class of securities referred to in

paragraph 3 over which

(i) the offeror, either alone or together with any joint actors, has ownership

and control:

Not applicable.

(ii) the offeror, either alone or together with any joint actors, has ownership

but control is held by other persons or companies other than the offeror or any

joint actor:

Not applicable.

(iii) the offeror, either alone or together with any joint actors, has exclusive

or shared control but does not have ownership:

See paragraph #2 above

5. The name of the market in which the transaction or occurrence that gave rise

to the news release took place:

The Offeror acquired the securities primarily from ART through private

placements and prospectus offerings. In certain instances, a de minimis number

of securities were acquired or disposed of through the facilities of the Toronto

Stock Exchange ("TSX").

6. The value, in Canadian dollars, of any consideration offered per security if

the offeror acquired ownership of a security in the transaction or occurrence

giving rise to the obligation to file a news release:

C$0.13 per series 4 preferred share

C$0.13 per series 5 preferred share

C$1.14 per series 1 preferred share.

C$1.14 per series 2 preferred share.

From C$0.16 to C$6.00 per Common Share.

7. The purpose of the offeror and any joint actors in effecting the transaction

or occurrence that gave rise to the news release, including any future intention

to acquire ownership of, or control over, additional securities of the reporting

issuer:

The securities referred to above held by the Offeror on behalf of the Funds are

for investment purposes. These investments will be reviewed on a continuing

basis and such holdings may be increased or decreased in the future.

8. The general nature and the material terms of any agreement, other than

lending arrangements, with respect to securities of the reporting issuer entered

into by the offeror, or any joint actor, and the issuer of the securities or any

other entity in connection with the transaction or occurrence giving rise to the

news release, including agreements with respect to the acquisition, holding,

disposition or voting of any of the securities:

The series 4 preferred shares and series 5 preferred shares were acquired

pursuant to a US$6,000,000 private placement completed on August 26, 2008 at a

price of C$0.13 per series 4 preferred share and C$0.13 per series 5 preferred

share.

The series 4 preferred shares and series 5 preferred shares are entitled to a

cumulative dividend of 7% of the issue price per preferred share, payable as and

when declared by the directors of ART. At the option of ART, the series 4

preferred shares and series 5 preferred shares are redeemable at the issue price

plus the accrued but unpaid dividends on the preferred shares. The series 4

preferred shares are convertible, on 61 days notice, into Common Shares at a

fixed conversion rate of 0.95 common share for each preferred share. Pursuant to

the approval of shareholders of ART on May 26, 2009, the series 5 preferred

shares are convertible, on 61 days notice, into Common Shares at a fixed

conversion rate of 0.95 common share for each preferred share. For both, the

series 4 preferred shares and the series 5 preferred shares, ART is entitled to

force the conversion of the preferred shares into Common Shares at the same

conversion rate upon the occurrence of certain events or the achievement of

certain milestones.

The series 1 preferred shares were acquired pursuant to a private placement

completed on July 11, 2005 at a price of CS1.14 per series 1 preferred share. As

part of this private placement, the Offeror also received the option,

exercisable for a period of twelve months, to purchase an additional 2,000,000

series 2 preferred shares at a price of C$1.14 per series 2 preferred share. On

April 19, 2006, the Offeror exercised this option and purchased 2,000,000 series

2 preferred shares.

The series 1 preferred shares and series 2 preferred shares are entitled to a

cumulative dividend of 7% of the issue price per preferred share, payable as and

when declared by the directors of ART. At the option of ART, the series 1

preferred shares and series 2 preferred shares are redeemable at the issue price

plus the accrued but unpaid dividends on the preferred shares. The series 1

preferred shares are convertible at any time into Common Shares at a fixed

conversion rate of 0.9036 common share for each series 1 preferred share, and

ART is entitled to force the conversion of the preferred shares into Common

Shares at the same conversion rate upon the occurrence of certain events or the

achievement of certain milestones. The series 2 preferred shares are convertible

at any time into Common Shares at a fixed conversion rate of 1.0556 common share

for each series 2 preferred share, and ART is entitled to force the conversion

of the preferred shares into Common Shares at the same conversion rate upon the

occurrence of certain events or the achievement of certain milestones.

The Offeror acquired 1,901,125 Common Shares at C$6.00 per Common Share pursuant

to a private placement completed on June 19, 2001.

The Offeror acquired 1,832,027 Common Shares at C$2.17 per Common Share pursuant

to a private placement completed on November 6, 2002.

The Offeror acquired 820,000 Common Shares at C$2.00 per Common Share pursuant

to a prospectus offering completed on March 3, 2004.

The Offeror acquired 2,666,700 Common Shares at C$0.75 per Common Share pursuant

to a prospectus offering completed on May 16, 2006.

The Offeror acquired 10,483,806 Common Shares at C$0.16 per Common Share

pursuant to a prospectus offering completed on November 21, 2007.

The Common Shares currently held were acquired primarily through private

placements and prospectus offerings described above. De minimus amounts of

Common Shares at prices ranging from $0.55 to $2.1075 were acquired or disposed

of through the facilities of the TSX.

Dispositional and voting authority over the Common Shares is held by the Offeror

pursuant to various investment advisory agreements between the Offeror and the

Funds.

9. The names of any joint actors in connection with the disclosure required by

this report:

See paragraph #2 above

10. In the case of a transaction or occurrence that did not take place on a

stock exchange or other market that represents a published market for the

securities, including an issuance from treasury, the nature and value, in

Canadian dollars of the consideration paid by the offeror:

See paragraphs #2, 5 and 7 above

11. If applicable, a description of any change in any material fact set out in a

previous report by the entity under the early warning requirements or Part 4 of

National Instrument 62-103 in respect of the reporting issuer's securities:

Not applicable.

12. If applicable, a description of the exemption from securities legislation

being relied on by the offeror and the facts supporting that reliance:

Not applicable.

Dated July 29, 2009.

OPPENHEIMERFUNDS, INC.

Brian Dvorak, Authorized Signing Officer

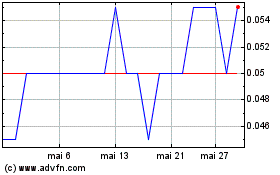

Arht Media (TSXV:ART)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Arht Media (TSXV:ART)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024