ATW Tech Inc. (the "

Company" or

"

ATW Tech")

(TSX-V:

ATW) is pleased to announce the closing of the private

placement (the "

Private Placement") and the

acquisition of Semeon Analytics Inc. (the

“

Transaction”) previously announced on October 1,

2020.

Pursuant to the Private Placement, ATW Tech

issued 30,000,000 common shares of the Company (the

"Shares") at a price of $0.05 per Share for gross

proceeds of $1,500,000.

The proceeds of the Private Placement will be

used by ATW Tech, for its own benefit and that of its subsidiaries,

to integrate into its structure Semeon Analytics Inc.

("Semeon"), the company acquired in connection

with the Transaction described below; to pay for the costs of the

Semeon acquisition; to develop ATW Tech's and Semeon's products;

and to commercialize Semeon's and ATW Tech's products.

Acquisition of

Semeon Analytics

Inc.

As part of the Transaction, the Company acquired

all of the outstanding shares of Semeon for an aggregate purchase

price of $2,955,000. This price is payable at closing by the

issuance to the vendors of 59,100,000 Shares (the "Purchase

Price").

As Mr. Louis Lessard, a director of the Company,

is also a shareholder of Semeon, the latter is considered to be a

"related party" to ATW Tech within the meaning of

Regulation 61-101 Respecting Protection of Minority Security

Holders in Special Transactions (Multilateral

Instrument 61-101, Protection of Minority Security Holders in

Special Transactions) (“Regulation

61-101”). The Transaction constitutes a “related

party transaction” within the meaning of Regulation 61-101. The

Transaction is exempt from the formal valuation and minority

approval requirements of Regulation 61-101, as neither the

fair market value of the Transaction nor the consideration for the

Transaction regarding Mr. Lessard exceed 25% of the market

capitalization of the Company. The Transaction obtained the

approval of a majority of the Company's shareholders pursuant to

the policies of the TSX Venture Exchange. As part of the

Transaction, Mr. Lessard received, through a holding corporation,

16,019,178 Shares and, following closing, will be the ultimate

shareholder of 8.4% of the outstanding Shares of the Company. In

addition, the Transaction has been approved by the independent

directors of the Company. The investors are not related to or

acting in concert with the vendors of Semeon (the

"Vendors") and the Company. The Vendors deal at

arm's length with the Company, with the exception of Mr. Lessard.

In addition, the Vendors are not acting in concert with each other.

Furthermore, one of the investors in the Private Placement will

have the right to appoint a director for ATW Tech.

Services Conseils Optimista Inc.

("Optimista") received 2,400,000 Shares and

$60,000 as a finder's fee for services rendered in connection with

the Transaction. For services rendered to the Company in connection

with the Private Placement, Optimista receives $60,000. Optimista

deals at arm's length with ATW Tech, the Vendors, Semeon and the

Private Placement investors.

The Shares issued pursuant to the Private

Placement and the Transaction are subject to a period of restricted

trading of four months, in accordance with the applicable

securities legislation. In addition, the Private Placement is

subject to the approval of the TSX Venture Exchange.

The Transaction is subject to the final approval

of the TSX Venture Exchange. Neither the TSX Venture Exchange nor

its regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

SEMEON’S

PROFILE

Semeon is a Quebec-based technology company that

has developed an artificial intelligence technology. Over the past

5 years, Semeon has combined techniques of semantic, sentiment,

intent and statistical analysis with artificial intelligence driven

natural language processing systems to develop a platform capable

of automatically analyzing, classifying and visualizing data from

multiple channels and a powerful workbench suite which permits even

non-experts to customize classification and filtering settings

without the need for cumbersome rule sets. Semeon provides its

clients with a platform for precise text analysis, intelligent and

flexible for decoding, understanding, and summarizing customer

feedback on specific elements. For this purpose, Semeon's natural

language text analysis technology allows to browse through

thousands of customer comments, to extract the concepts expressed,

to classify these as positive, negative or neutral opinions, so

that companies or organizations can adjust their communication and

marketing strategy in an informed and diligent manner.

Whether it is an acceleration of customer

feedback processing, the identification of key parts in a supply

chain or key elements in financial forecasting models, among

others, Semeon ensures gains in analysis speed allowing critical

decision making in hours rather than weeks or months.

ATW TECH'S PROFILE

ATW Tech (TSX-V: ATW) is a financial technology

company ("fintech"), owner of several recognized technology

platforms such as VoxTel, Option.vote and Bloomed. VoxTel

specializes in telephone billing and alternative payment solutions

for fixed and mobile lines. Option.vote offers a customized

multi-method voting system for unions, political parties,

professional associations and anyone looking for a secure way to

reduce their voting costs and improve their participation rate.

Bloomed is a cloud computing platform for managing smart data on

consumers and their behaviors for both business and

consumer-oriented campaigns.

Forward-Looking Statements and

Disclaimer

Certain statements in this press release may be

forward-looking. These statements include those relating to the

Transaction, the closing date of the Transaction, the potential

impact of the acquisition on the Company, the ability of the

Company to raise funds in connection with the private placement and

the use of the proceeds raised in connection with said private

placement. Although the Company believes that such forwardlooking

statements reflect expectations based on reasonable assumptions, it

cannot guarantee that its expectations will be realized. These

assumptions, which may prove to be inaccurate, include, but are not

limited to, the following: (i) The acquisition of Semeon will

enable ATW Tech to realize the anticipated synergies; (ii) ATW

Tech's officers will not set or achieve any other strategic

objectives using the proceeds of the Private Placement; and

(iii) the Company's inability to develop and implement a

business plan in general and for any reason whatsoever. A

description of the risks affecting the Company’s business and

activities appears under the heading "Risks and Uncertainties" on

pages 12 to 13 of ATW Tech's 2019 annual management's

discussion and analysis, which is available on SEDAR at

www.sedar.com. No assurance can be given that any events

anticipated by the forward-looking information in this press

release will transpire or occur, or if any of them do, the benefits

that ATW Tech will derive therefrom. In particular, no assurance

can be given as to the future financial performance of ATW Tech.

ATW Tech disclaims any intention or obligation to update or revise

any forward-looking statements in order to account for any new

information or any other event. The reader is warned against undue

reliance on these forward-looking statements.

Additional information regarding ATW Tech is

available on SEDAR www.sedar.com

SOURCE:

ATW Tech Inc.Michel GuayFounder, president and

CEOTel.: 844.298.5932 ext. 301mguay@atwtech.comwww.atwtech.com

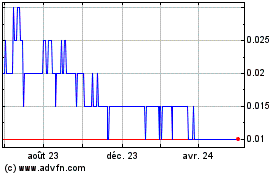

ATW Tech (TSXV:ATW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ATW Tech (TSXV:ATW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025