TORONTO, Jan. 2, 2020 /CNW/ - Doré Copper Mining Corp.

(the "Corporation" or "Doré Copper") (TSXV: DCMC) is

pleased to announce that it has entered into an option agreement to

acquire a 100% interest in the Joe Mann gold mine ("Joe

Mann") located in Québec. The mine is located approximately

50 km from the Corporation's Copper Rand mill, where

mineralized material from Joe Mann was processed from 2004 until

its closure in 2007, and is accessible by all season roads. Joe

Mann has been privately held since 2008. The Corporation does not

currently consider Joe Mann to be a material property for the

purposes of National Instrument 43-101.

Highlights

- Production of 1.173 million ounces of gold at a grade of 8.26

g/t Au, 607,000 ounces of silver at 5 g/t Ag and 28.7 million

pounds of copper at 0.25% Cu (Source: Technical Report on the Joe

Mann Mining Property dated January 11,

2016, prepared by Geologica Inc.).

- Mineralization remains strong and persistent at depth with Hole

EE-189B intersecting 26.66 g/t Au over 1.8

m and Hole EE-188 intersecting 30.3 g/t Au and 1.3% Cu over

3.02 m extending the Main Zone 170

meters down dip.

- The more recently discovered West Zone, a potential structural

off-set that allows much thicker, higher-grade veins to form,

remains open and is a high priority exploration target with

historic intercepts including 2.44 m

@ 24.62 g/t Au, 3.93 m @ 31.54 g/t

Au, 2.62 m @ 24.28 g/t Au and

3.2 m @ 16.1 g/t Au.

- Exploration potential remains excellent including new parallel

zones identified by recent surface prospecting work that lie just

several hundred meters to the south of the main mine.

- Significant infrastructure in place including power and a shaft

down to the 1,145-meter level.

Ernest Mast, President and CEO of

Doré Copper commented, "Joe Mann was closed during a period of low

gold prices. This is a rare opportunity to secure a significant

high-grade gold underground asset that remains open at depth and

along strike with numerous high priority exploration targets. An

exploration program at Joe Mann will focus on the significant

potential to extend high-grade mineralization at depth as well as

defining new zones of mineralization, all accessible from the

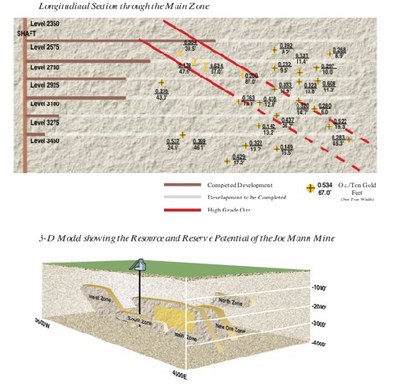

3,775-foot shaft (see Figure 1). We believe Joe Mann may

demonstrate similar potential to Wesdome's Eagle River, Alamos' Island Gold or

Kirkland Lake's Macassa mine where

the high-grade gold deposits not only continue at depth but with

improved grades while yielding new discoveries. Joe Mann fits into

our exploration and development plans, adding another high-grade

gold-copper project to our portfolio to leverage our strategically

located mill."

Joe Mann Property

Joe Mann operated for 27 of the years between 1956 and 2007,

with mineralized material processed at an onsite mill, the

Principale mill, and Doré Copper's Copper Rand mill.

Joe Mann consists of 55 mineral titles comprising 1,990.2

hectares of land. Doré Copper already owns 22 claims in the Joe

Mann area via its 100% owned subsidiary CBAY Minerals Inc. Four of

the 22 claims were recently acquired and are currently being

transferred to CBAY Minerals Inc.

Joe Mann is characterized by E-W striking shear hosted veins

that extend beyond 1,000 m vertically with mineralization

identified over 3 km in strike. Gold mineralization at Joe Mann

occurs within deformed quartz-sulphide veins hosted in high strain

shear zones affecting mafic intrusions and felsic volcanic rocks

metamorphosed to lower-amphibolite assemblages.

Substantial infrastructure remains at Joe Mann

with the shaft down to the 3,775-foot level (1,145 meters).

Significant potential remains at Joe Mann to extend the

mineralization at depth and along strike, including the West Zone

and potential new zones to the North and South. Thick, high-grade

gold mineralization was encountered at depth between the 2750 level

and the 3450 level (see Figure 2). In 2007-2008, after the mine

closed, three holes were drilled from underground to test the depth

extensions of the mine approximately 170

m below the lowest level (3,450 ft below surface). Hole

EE-189B intersected the Main Zone and returned 26.66 g/t Au over

1.8 m and 14.72 g/t Au over

1.2 m. Hole EE-188 intersected the

Main Zone, 30.3 g/t Au and 1.3% Cu over 3.02

m and the South Zone, 9.23 g/t Au over 0.91 m. One of the holes did not reach the Main

Zone. These drill holes show that the mineralization is still

strong and persistent down dip with excellent potential along the

entire untested strike at depth. These holes represent the latest

drilling results on the property.

The plunge of the mineralized body is to the east, with the West

Zone being one of the most promising areas of upside potential for

thick high-grade mineralization because of the limited amount of

drilling and exploration done in that area historically down

dip/plunge of the known mineralization. The West Zone might be an

area of structural off-set (jog) that allows a much thicker,

higher-grade vein to form, with more drilling and study required to

confirm. Historic intercepts include: 2.44

m @ 24.62 g/t Au, 3.93 m @

31.54 g/t Au and 2.62 m @ 24.28 g/t Au (mined) and

5.0 m at 10.3 g/t Au, 3.2 m @ 16.1 g/t Au and 3.3 m @ 10.4 g/t Au (unmined).

New parallel zones have been identified by recent surface

prospecting work that lie just several hundred meters to the south

of the main mine.

A high-grade core was identified from the 2750

level down to the 3450 level including 18.4 g/t Au over 7.5 meters

(0.537 oz/t over 24.6 feet) and 9.70 g/t Au over 18.1 meters (0.283

oz/t over 45.3 feet). The drill holes from 2007 to 2008 intersected

the vein 170 m below the lowest level

shown and indicated that the high-grade mineralization continues

down dip. The shaft that was deepened in 2001 goes to a depth of

1,145 meters.

In 2017 a high resolution airborne magnetic survey was completed

and several magnetic anomalies of moderate to strong amplitudes

were identified. In addition to Joe Mann being open along strike

and at depth, Joe Mann was poorly explored to the south, and the

magnetic survey has identified numerous high-priority exploration

targets at Joe Mann.

Terms of Option Agreement

The Corporation has entered into an option agreement with the

owners of Joe Mann, Ressources Jessie Inc. ("Ressources

Jessie") and Legault Metals Inc. ("Legault"), to acquire

a 100% interest in Joe Mann on the following terms:

- A cash payment of $1,000,000 to

Ressources Jessie and 400,000 common shares of Doré Copper

("Doré Copper Shares") to be issued to Legault at a deemed

price of $1.25 per share on the

effective date of the option agreement ("Effective

Date").

- A cash payment of $250,000 to

Ressources Jessie and $500,000 in

Doré Copper Shares to be issued to Legault on the first anniversary

of the Effective Date.

- A cash payment of $1,000,000 to

Ressources Jessie upon completion of 5,000 meters of drilling at

Joe Mann or on the earlier of the second anniversary of the

Effective Date or 18 months from the commencement of drilling.

- A cash payment of $500,000 to

Ressources Jessie and $500,000 in

Doré Copper Shares to be issued to Legault on the second

anniversary of the Effective Date.

- A cash payment of $1,500,000 to

Ressources Jessie and $1,000,000 in

Doré Copper Shares to be issued to Legault on the third anniversary

of the Effective Date.

- Spending $2,500,000 in qualifying

exploration expenditures before the third anniversary of the

Effective Date.

- A cash payment of $1,000,000 to

Ressources Jessie and $1,500,000 in

Doré Copper Shares to be issued to Legault upon the commencement of

commercial production at Joe Mann.

- A 2% net smelter return royalty will be granted to Ressources

Jessie and the Corporation will hold the option to buy back 1% for

$2,000,000 and buy back a further

0.5% for $4,000,000.

The terms and conditions of the option agreement are subject to

approval from applicable regulatory authorities, including the TSX

Venture Exchange.

The historical technical information disclosed in this news

release about Joe Mann was taken from the Technical Report on the

Joe Mann Mining Property dated January 11,

2016, prepared by Geologica Inc., Alain-Jean Beauregard, P. Geo, OGQ.

Andrey Rinta, P.Geo., the

Exploration Manager of the Corporation and a "Qualified Person"

within the meaning of National Instrument 43-101, has reviewed and

approved the technical information contained in this news

release.

About Doré Copper Mining Corp.

Doré Copper is engaged in the acquisition, exploration and

evaluation of mineral properties. Doré Copper completed a

qualifying transaction on December 13,

2019 establishing itself as a copper – gold explorer and

developer in the Chibougamau area

of Québec, Canada. Doré Copper,

through its wholly-owned subsidiary CBAY Minerals Inc., holds a

100% interest in the exploration-stage Corner Bay Project and the

exploration-stage Cedar Bay Project, both located in the vicinity

of Chibougamau, Québec, as well as

the 2,700-tpd Copper Rand mill. Doré Copper has an option to earn a

100% interest in the Joe Mann property.

For further information regarding Doré Copper, please visit the

Corporation's website at www.dorecopper.com or refer to Doré

Copper's SEDAR filings at www.sedar.com.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking

statements" under applicable Canadian securities legislation.

Forward-looking statements include predictions, projections and

forecasts and are often, but not always, identified by the use of

words such as "seek", "anticipate", "believe", "plan", "estimate",

"forecast", "expect", "potential", "project", "target", "schedule",

"budget" and "intend" and statements that an event or result "may",

"will", "should", "could" or "might" occur or be achieved and other

similar expressions and includes the negatives thereof. All

statements other than statements of historical fact included in

this release, including, without limitation, statements regarding

the timing and ability of the Corporation to receive necessary

regulatory approvals, and the plans, operations and prospects of

the Corporation and its properties are forward-looking statements.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties and other factors

which may cause actual results and future events to differ

materially from those expressed or implied by such forward-looking

statements. Such factors include, but are not limited to, actual

exploration results, changes in project parameters as plans

continue to be refined, future metal prices, availability of

capital and financing on acceptable terms, general economic, market

or business conditions, uninsured risks, regulatory changes, delays

or inability to receive required regulatory approvals, and other

exploration or other risks detailed herein and from time to time in

the filings made by the Corporation with securities regulators.

Although the Corporation has attempted to identify important

factors that could cause actual actions, events or results to

differ from those described in forward-looking statements, there

may be other factors that cause such actions, events or results to

differ materially from those anticipated. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Corporation disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

SOURCE Doré Copper Mining Corp.