LSL Pharma Group Secures $3.8 Million as the Second and Final Tranche of Its Private Placement of Units

24 Avril 2024 - 1:00PM

LSL PHARMA GROUP INC. (TSXV: LSL) (the

"

Corporation" or "

LSL Pharma"), a

Canadian integrated pharmaceutical company, today announced the

second and final tranche of its private placement financing of

Units (as defined hereafter) for $3.8 million representing the

second closing of the upsized $7.5 million non-brokered private

placement announced on April 11, 2024 (the

“

Financing”). The second tranche follows an

initial first closing of $2.7 million announced on March 19, 2024,

bringing the total gross proceeds from the private placement to

$6.5 million when combined with the previous closing.

Pursuant to the second tranche of the Financing,

the Corporation has issued 9,485,000 units (the

“Units”) at a price of $0.40 per unit for

aggregate gross proceeds of $3,794,000. Each Unit consists of one

class A share of the Corporation (a “Common

Share”) and one Common Share purchase warrant (a

“Warrant”). Each Warrant entitles the holder,

subject to adjustments in certain cases, to purchase one Common

Share (a “Warrant Share”) at a price of $0.70 for

a period of 36 months following the closing of the Financing.

In connection with this Financing, the

Corporation paid to a finder dealing at arm’s length with the

Corporation, finders’ fees for a total of $30,000 in cash and

issued 75,000 finders’ warrants. Each Finder’s Warrant entitles the

holder to purchase one (1) Common Share at a price of $0.70 for a

period of 18 months following the closing of the Financing (the

“Finder’s Warrants”).

Each issued Unit, Common Share, Warrant, Warrant

Share, Finder’s Warrant and Common Share underlying the Finder’s

Warrants will be subject to a four month hold period under the

applicable securities laws. The Financing is subject to the final

approval of the TSX Venture Exchange.

"This successful second tranche of financing

will be used to increase production capacity by adding new

equipment at each of the LSL Laboratories and Steri-Med Pharma

plants, as well as helping to increase our working capital and for

specific strategic purposes" said François Roberge, President and

CEO of the Corporation. "With the conversion in Units of

Corporation’s debts as previously announced on March 19, 2024, our

balance sheet is stronger than ever," added Mr. Roberge.

Within this second tranche of the Financing,

Alfera Pharmaceuticals, LLC, a company controlled by Frank

DellaFera, a director of the Corporation (the

“Subscriber”), has received 1,250,000 Units

pursuant to the Financing for an aggregate subscription price of

$500,000. Its direct or indirect holding, inclusive of Mr.

DellaFera’s holding, on a non-diluted basis, was 0.04% prior to the

Financing and reaches now 1.20% following the Financing while, on a

partially diluted basis, was of 0.32% prior to the Financing and

reaches now 2.57%. The board of directors of the Corporation has

considered the issuance of the Units to the Subscriber as a related

party transaction subject to Regulation 61-101 respecting

Protection of Minority Security Holders in Special Transactions

(the “Regulation 61-101”) and has unanimously

approved the issuance, but excluding Frank DellaFera. This

transaction is exempt from the formal valuation and minority

shareholder approval requirements of Regulation 61-101 as the

Corporation is listed on the TSX Venture Exchange and the fair

market value of any security issued to, or the consideration paid,

does not exceed 25% of the Corporation's market capitalization. LSL

Pharma did not file a material change report pertaining to the

Subscriber's interest more than 21 days prior to the date of the

closing of the Financing, as such interest was not determined at

that time. The board members of the Corporation, but excluding

Frank DellaFera, reviewed its financial conditions and the state of

the financial market and unanimously determined that the terms and

conditions of the Financing, including the issuance to the

Subscriber, were fair and equitable and represented the best

strategic option available. In addition, neither the Corporation

nor the Subscriber have knowledge of any material information

concerning the Corporation or its securities that has not been

generally disclosed.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements as defined under applicable Canadian securities

legislation. Forward-looking statements can generally be identified

by the use of forward-looking terminology such as "may", "will",

"expect", "intend", "estimate", "continue" or similar expressions.

Forward-looking statements are based on a number of assumptions and

are subject to various known and unknown risks and uncertainties,

many of which are beyond the Corporation's ability to control or

predict, that could cause actual results or performance to differ

materially from those expressed or implied in such forward-looking

statements. These risks and uncertainties include, but are not

limited to, those identified in the Corporation's filings with

Canadian securities regulatory authorities, such as legislative or

regulatory developments, increased competition, technological

change, and general economic conditions. All forward-looking

statements made herein should be read in conjunction with such

documents.

Readers are cautioned not to place undue

reliance on forward-looking statements. No assurance can be given

that any of the events referred to in the forward-looking

statements will transpire, and if any of them do, the actual

results, performance or achievements of the Corporation may differ

materially from those expressed or implied by the forward-looking

statements. All forward-looking statements contained in this press

release speak only as of the date of this press release. The

Corporation does not undertake to update these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

ABOUT LSL PHARMA GROUP

INC.

LSL Pharma is an integrated Canadian

pharmaceutical company specializing in the development,

manufacturing and commercialization of high-quality sterile

ophthalmic pharmaceuticals, as well as natural health products in

solid dosage forms. For further information, please visit the

following website www.groupelslpharma.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CONTACT

François Roberge, President and Chief Executive Officer

Telephone: 514-664-7700

E-mail: Investors@groupelslpharma.com

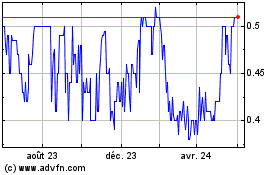

LSL Pharma (TSXV:LSL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

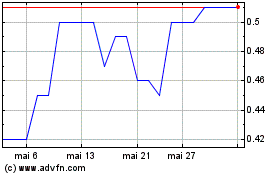

LSL Pharma (TSXV:LSL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025