LSL PHARMA GROUP INC. (TSXV: LSL) (the

"

Corporation" or "

LSL Pharma "),

a Canadian integrated pharmaceutical company, today reported its

financial results for the first quarter of fiscal year 2024 ended

on March 31, 2024.

“During the quarter, LSL Pharma kept

implementing its operating and strategic plan. We continued to

invest in our plants to take advantage of strong demand for our

products and services. We took additional steps to advance our

ophthalmic ointment product development pipeline. We also entered

into an agreement to acquire a profitable competitor to be

integrated into our contract manufacturing activities. Finally, we

successfully completed a series of financial transactions aimed at

strengthening and deleveraging our balance sheet,” commented

Francois Roberge, President and Chief Executive Officer.

Commenting on the Q1-24 financial results, Luc

Mainville, Executive Vice-President and Chief Financial Officer

said, “So far in 2024, our operating units have delivered record

revenues and margins. We look forward to solid quarters ahead,

including the positive impact of the acquisition which we hope to

complete before the end of the second quarter.”

Q1-24 Financial

- The Corporation

achieved record revenues in Q1-24, at $4.2 million, up 106%

compared to Q1-23. Same as for Q4-23, revenues continued to be

positively impacted by strong sales of Erythromycin ophthalmic

ointment in the US market following a product shortage. LSL Pharma

successfully secured (via its US partner – Fera) a temporary

licence granted by the FDA to sell our Canadian labelled product to

US hospitals. The license expires in June 2024. In Q1-24, our CDMO

business have started to take advantage of the increased capacity

that followed the site expansion/relocation last year.

- Record gross

margins for Q1-24 totaled $1.1 million compared to $0.4 million for

Q1-23. Similar to our revenues, our gross margins have been

positively impacted with sales of our Erythromycin product into the

US. Also, the margins have been impacted by the increase of

production levels at both plants.

- Adjusted Gross

margins for Q1-24 stood at a record level of $1.6 million, a 141%

increase over Q1-23. Adjusted gross margin % was also up at 39%,

compared to 36% for Q1-23.

- Adjusted EBITDA for

Q1-24 was a $0.65 million profit compared to nil for Q1-23.

- Net loss for the

Q1-24 was $0.3 million a strong performance compared to the $5.4

million loss in Q1-23.

Q1-24 Business Highlights

On March 19,

2024, the Corporation announced the closing of a

non-brokered private placements for $6.4 million. Pursuant to the

Financing, the Corporation issued 16,086,893 units (the “Units”) at

a price of $0.40 per unit. Each Unit consists of one class A share

of the Corporation (a “Common Share”) and one Common Share purchase

warrant (a “Warrant”). Each Warrant entitles the holder, subject to

adjustments in certain cases, to purchase one Common Share (a

“Warrant Share”) at a price of $0.70 for a period of 36 months

following the closing of the Financing. The Financing included $2.7

million in cash proceeds, and the conversion of $3.7 million of the

Corporation’s debts in Units.

Subsequent Events

On April 23, 2024, LSL Pharma

announced the addition of Ms. Diane Beaudry and Mario Paradis, as

new members to its Board of Directors. Ms. Diane Beaudry is a

Certified Professional Accountant and Certified Director by the

Institute of Corporate Director, and has extensive experience in

the field of finance and boards of directors. Mario Paradis is

actually the interim CFO of EXFO Inc. Prior to this, he was Vice

President and Chief Financial Officer of Neptune Wellness Solutions

from 2015 to 2019. Prior to 2015, he was Vice President and Chief

Financial Officer at Atrium Innovations.

On April 24, 2024, the LSL

Pharma Group announced the second and final tranche of its

non-brokered private placement financing of Units for $3.8

million.

On May 6, 2024, the Corporation

announced the signing of a binding agreement to acquire a

profitable privately held Quebec-based competing CDMO offering

complementary manufacturing capabilities and providing important

synergies with its existing operations (the “Target”). The $2.5

million purchase price which will be funded by the proceeds from

March/April 2024 private placements, includes a fully operational

manufacturing plant. The transaction is expected to boost LSL

Group’s revenues by 15-20% on an annual basis. LSL Pharma

anticipates closing the transaction by the end of Q2-24.

On May 22, 2024, the

Corporation announced that the Convertible Debentures issued

pursuant to a $3.3 million brokered private placement completed in

tranches on November 1, 2023 and December 8, 2023 had been approved

for listing on the TSXV under the symbol “LSL.DB” and began trading

on May 24, 2024. The Debentures which may be redeemable by the

Corporation, have a maturity date of October 31, 2028 (the

“Maturity Date “), and accrue interest at the rate of 11% per

annum. For additional details, please refer to the Debenture

Indenture dated November 1, 2023, available under LSL Pharma’s

issuer profile on www.sedarplus.ca.

Financial Statements and

MD&A

LSL Pharma Group’s financial statements and

Management’s Discussion and Analysis for the first quarter of

fiscal year 2024 are available on SEDAR+ at www.sedarplus.ca and on

the Corporation website.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements as defined under applicable Canadian securities

legislation. Forward-looking statements can generally be identified

by the use of forward-looking terminology such as "may", "will",

"expect", "intend", "estimate", "continue" or similar expressions.

Forward-looking statements are based on a number of assumptions and

are subject to various known and unknown risks and uncertainties,

many of which are beyond the Corporation's ability to control or

predict, that could cause actual results or performance to differ

materially from those expressed or implied in such forward-looking

statements. These risks and uncertainties include, but are not

limited to, those identified in the Corporation's filings with

Canadian securities regulatory authorities, such as legislative or

regulatory developments, increased competition, technological

change and general economic conditions. All forward-looking

statements made herein should be read in conjunction with such

documents.

Readers are cautioned not to place undue

reliance on forward-looking statements. No assurance can be given

that any of the events referred to in the forward-looking

statements will transpire, and if any of them do, the actual

results, performance or achievements of the Corporation may differ

materially from those expressed or implied by the forward-looking

statements. All forward-looking statements contained in this press

release speak only as of the date of this press release. The

Corporation does not undertake to update these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

ABOUT LSL PHARMA GROUP

INC.

LSL Pharma Group Inc. is an integrated Canadian

pharmaceutical company specializing in the development,

manufacturing, and commercialization of high-quality sterile

ophthalmic pharmaceuticals, as well as natural health products in

solid dosage forms. For further information, please visit the

following website www.groupelslpharma.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CONTACT :

François Roberge

President and Chief Executive Officer

(514) 664-7700

E-mail: Investors@groupelslpharma.com

Luc Mainville

Executive VP & Chief Financial Officer

(514) 664-7700 ext.: 301

E-mail : lmainville@groupelslpharma.com

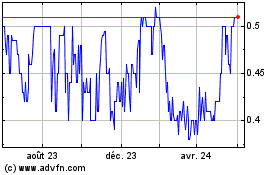

LSL Pharma (TSXV:LSL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

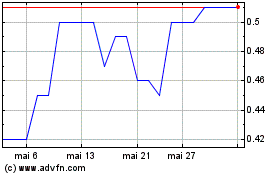

LSL Pharma (TSXV:LSL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024