Rockridge Resources Completes Non-Brokered Private Placement Financing

16 Mai 2023 - 11:00PM

Rockridge Resources Ltd. (TSX-V:

ROCK) (OTCQB:

RRRLF)

(Frankfurt: RR0)

(“Rockridge”) (the “Company”) is pleased to announce that, further

to its news release issued May 15, 2023 it has closed a

non-brokered private placement financing for total gross proceeds

of $545,950 (the “Private Placement”). The Company has issued

15,598,571 units (the “Units”) at a price of CAD $0.035 per Unit.

Each Unit is comprised of one common share and

one transferable warrant, each warrant entitling the holder to

purchase one additional common share for a period of thirty-six

months at a price of CAD $0.07. In addition, the Company has paid a

finder's fee of $2,450 and issued 70,000 finder's warrants to an

arm's-length party, with each finder’s warrant entitling the holder

to purchase one common share for a period of thirty-six months at a

price of CAD $0.07. The Company previously announced the closing of

a non-brokered flow-through private placement financing for total

gross proceeds of $472,500 whereby the Company issued 9,450,000

flow-through units (the “FT Units”) at a price of CAD $0.05 per FT

Unit, as per the Company’s news release dated April 12th, 2023.

The Company intends to use the proceeds from

this Private Placement for exploration activities and the upcoming

drilling program at its Raney Gold Project in Ontario, as well as

for general working capital purposes. Other than the usual monthly

consulting fees payable to the Company’s directors and officers,

there are no proposed payments to non-arm’s length parties, to

persons conducting investor relations activities, nor for any

specific use representing 10% or more of the gross proceeds.

The Private Placement is subject to final TSX

Venture Exchange approval, and all securities issued will be

subject to a hold period expiring four months and one day from

issuance.

About Rockridge

Resources Ltd.:

Rockridge Resources is a public mineral

exploration company focused on the acquisition, exploration and

development of mineral resource properties in Canada, specifically

copper and gold. The Company’s 100% owned Knife Lake Project is

located in Saskatchewan which is ranked as a top mining

jurisdiction in the world by the Fraser Institute. The project

hosts the Knife Lake Deposit, which is a VMS, near-surface

Cu-Co-Au-Ag-Zn deposit open along strike and at depth. There is

strong discovery potential in and around the deposit area as well

as at regional targets on the large property package.

Rockridge’s gold asset is its 100% owned Raney

Gold Project, which is a high-grade gold exploration project

located in the same greenstone belt that hosts the world class

Timmins and Kirkland Lake lode gold mining camps. Recently reported

drill hole RN 20-06 intersected 28.0 g/t gold over 6.0 metres at a

shallow vertical level of 95 metres, which is the best result from

the project thus far. Rockridge’s goal is to maximize shareholder

value through new mineral discoveries, committed long-term

partnerships, and the advancement of exploration projects in

geopolitically favourable jurisdictions.

Additional information about Rockridge Resources

and its project portfolio can be found on the Company’s website at

www.rockridgeresourcesltd.com.

Rockridge Resources Ltd.

“Jonathan

Wiesblatt” Jonathan

WiesblattCEO

For further information contact myself or:

Jordan Trimble, President orNicholas Coltura, Corporate

CommunicationsRockridge Resources Ltd.Telephone: 604-558-5847Toll

Free: 800-567-8181Facsimile: 604-687-3119Email:

info@rockridgeresourcesltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

The securities offered have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any U.S. state securities

laws, and may not be offered or sold in the United States or to, or

for the account or benefit of, United States persons absent

registration or an applicable exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This press release does not constitute an offer to

sell or the solicitation of an offer to buy securities in the

United States, nor in any other jurisdiction.

This release includes certain statements that

may be deemed to be "forward-looking statements". All statements in

this release, other than statements of historical facts, that

address events or developments that management of the Company

expects, are forward-looking statements, including the Private

Placement. Although management believes the expectations expressed

in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future

performance, and actual results or developments may differ

materially from those in the forward-looking statements. The

Company undertakes no obligation to update these forward-looking

statements if management's beliefs, estimates or opinions, or other

factors, should change. Factors that could cause actual results to

differ materially from those in forward-looking statements, include

market prices, exploration and development successes, regulatory

approvals, continued availability of capital and financing, and

general economic, market or business conditions. Please see the

public filings of the Company at www.sedar.com for further

information.

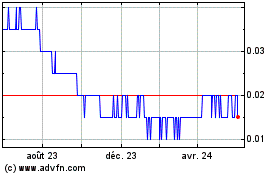

Rockridge Resources (TSXV:ROCK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

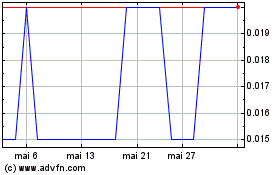

Rockridge Resources (TSXV:ROCK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024