Stratabound Minerals Corp. (TSXV:SB) (“Stratabound”) and California

Gold Mining Inc. (CSE:CGM) (“California Gold”) are pleased to

announce that the companies have entered into a definitive

arrangement agreement (the “Arrangement Agreement”), pursuant to

which Stratabound has agreed to acquire all of the issued and

outstanding shares of California Gold by way of a court-approved

plan of arrangement under the Business Corporations Act (Ontario)

(the "Arrangement").

California Gold shareholders will receive one

(1.000) Stratabound common share (each, a “Stratabound Share”) for

each California Gold share (each, a “California Gold Share”). The

exchange ratio implies a consideration of $0.223 per California

Gold common share, based on the 20-day volume weighted average

price (“VWAP”) of the Stratabound common shares on the TSX Venture

Exchange (“TSXV”) for the period ending April 20, 2021. This

represents a 104.8% premium to the 20-day VWAP of California Gold

common shares on the Canadian Securities Exchange (“CSE”) and a

premium of 72.7% based on the closing prices of both companies

common shares on April 20, 2021. Pursuant to the

Arrangement, Stratabound anticipates that it will issue

approximately 65,108,269 shares to California Gold

shareholders.

The transaction is be carried out by way of a

plan of arrangement and California Gold shareholders will be asked

to vote on the transaction at a special meeting of shareholders

(the “California Gold Meeting”) with closing expected to take place

by July 2021. The Arrangement is subject to the approval of the

Ontario Superior Court of Justice (Commercial List), approval by at

least two-thirds of the votes cast by California Gold shareholders

at the California Gold Meeting, and, if required, minority

approval after excluding the votes cast by persons whose votes may

not be included in determining minority approval of a business

combination pursuant to Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special

Transactions.

R. Kim Tyler, Stratabound’s President, Chief

Executive Officer, and Director, stated:

“We are extremely pleased to welcome California

Gold shareholders to our register and anxious to get to work

advancing the Fremont Gold Project towards production. Fremont

provides a tremendous opportunity to build well beyond its current

gold resources, is complimentary to our existing early-stage assets

and a powerful catalyst of growth for both our shareholders. Our

strong cash position, concentrated long-term investor base, and

team in place will allow us to immediately unlock value on this

mutually beneficial transaction.”

Larry Phillips, California Gold’s Interim

President, Chief Executive Officer, and Director, commented:

“This is an attractive offer for California Gold

Shareholders with the pro forma company being well-capitalized with

a strong net cash position, shareholder base and team in place to

advance the flagship Fremont Gold project for the benefit of both

Stratabound and California Gold shareholders.”

The California Gold Meeting is currently

expected to be held in June 2021. No shareholder vote is required

by Stratabound shareholders.

In addition to the aforementioned approvals,

completion of the Arrangement is subject to other customary

conditions, including the receipt of all necessary regulatory and

stock exchange approvals. The Arrangement is expected to close by

July 2021.

The Arrangement Agreement contains customary

terms and conditions which include a break fee payable to

Stratabound in the event California Gold does not proceed.

The transaction has the full endorsement of both

the Boards of California Gold and Stratabound. On December 8, 2020

California Gold announced that it had retained Red Cloud Securities

Inc. to initiate a strategic process to explore, review and

evaluate a broad range of potential alternatives focused on

maximizing shareholder value, including a potential sale or merger

of the company. The board of directors of California Gold formed a

special committee (the “Special Committee”) to oversee the process

and have evaluated the transaction with Stratabound in the context

of that process. The Special Committee, following a review of the

terms and conditions of the agreement with Stratabound and

consideration of a number of factors, unanimously recommended that

the California Gold Board approve the transaction. After receiving

the recommendation of the Special Committee and advice from its

advisors, including a fairness opinion, the California Gold Board

has unanimously determined that the transaction is in the best

interests of California Gold and will recommend that California

Gold shareholders vote in favour of the transaction. Patrick Cronin

and Vishal Gupta resigned from the Board of Directors of California

Gold immediately prior to the meeting to approve the Arrangement

Agreement.

The fairness opinion was prepared by INFOR

Financial and will be included in the management information

circular (the “Circular”) to be mailed to

California Gold shareholders in connection with the California Gold

Meeting. Prior to the execution of the Arrangement Agreement, INFOR

provided a verbal opinion that, based upon and subject to the

assumptions, limitations and qualifications in such opinion, the

consideration to be received by California Gold shareholders is

fair, from a financial point of view, to California Gold

shareholders. All California Gold shareholders will be treated on

the same basis and no additional consideration or benefit is

available to any California Gold shareholder. In connection with

the Arrangement, all exercise period for outstanding options of

California Gold will be accelerated, and the outstanding common

share purchase warrants of California Gold will be exchanged for

replacement warrants of Stratabound exercisable to acquire that

number of Stratabound Shares as is equal to 1.0 multiplied by the

number of California Gold Shares that the holders of the warrants

so transferred and assigned would have acquired if such holders had

exercised such warrants immediately prior to the effective time of

the Arrangement.

All directors of California Gold (representing

approximately 16.4% of the currently outstanding California common

shares) have entered into customary support agreements with

Stratabound to vote their shares in favour of the transaction. In

addition, Romspen Investment Corporation and R.W. Tomlinson Ltd.

have consented to the transaction under their respective loan

agreements with California Gold and have entered into customary

support agreements with Stratabound to vote their shares

(representing approximately 15.3% of the currently outstanding

California common shares) in favour of the transaction.

Details of the transaction and the Arrangement

Agreement will be set out in the Circular that will be prepared and

mailed to California Gold shareholders in connection with the

California Gold Meeting. As well, additional information regarding

the terms of the definitive Arrangement Agreement, the background

to the transaction, the rationale for the recommendations made by

the Special Committee of the California Gold Board and how

shareholders can participate in and vote at the California Gold

Meeting will be provided in the Circular.

Subject to the conditions precedent being met;

the transaction is expected to close by July 2021.

Transaction Highlights:

Benefits to Stratabound Shareholders:

- Immediate

acquisition of NI 43-101 mineral resource 515,000 ounces grading

1.71 g/t gold in the Indicated category, and an additional 364,000

ounces grading 1.44 g/t gold in the Inferred category* of an

advanced gold project with excellent exploration upside plus

development potential at an attractive valuation;

- Bulked-up

capital markets profile in a larger entity with exposure to a more

diverse group of institutional and retail investors; and

- Creation of a

stronger asset and market profile platform to accelerate the

company’s stated goal of becoming a gold production company.

Benefits to California Gold Shareholders:

- Continued

exposure to the Fremont Gold project with access to an experienced

technical team that intend to take the project on as a flagship

asset;

- Strengthened

balance sheet with a meaningful cash position and greater access to

capital in a larger pro forma entity; and

- Greater trading

liquidity, providing exposure to a larger and more diverse group of

institutional and retail investors.

If the Arrangement is completed, the California

Gold Shares will be delisted from the CSE.

A copy of the Arrangement Agreement is available

through California Gold’s and Stratabound’s filings with the

securities regulatory authorities in Canada in SEDAR at

www.sedar.com.

None of the securities to be issued pursuant to

the Arrangement Agreement have been or will be registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), or any state securities laws, and any

securities issued in the Arrangement are anticipated to be issued

in reliance upon available exemptions from such registration

requirements pursuant to Section 3(a)(10) of the U.S. Securities

Act and applicable exemptions under state securities laws. This

news release does not constitute an offer to sell or the

solicitation of an offer to buy any securities.

Stratabound will file an updated early warning

report in connection with entering into the Arrangement Agreement

and the Support Agreements. A copy of the report will be available

under California Gold’s profile at www.sedar.com, or by contacting

R. Kim Tyler, the Chief Executive Officer of Stratabound at 1 (416)

915-4157.

ADVISORS

Red Cloud Securities Inc. and INFOR Financial

are acting as the financial advisors to California Gold in

connection with the Arrangement. Norton Rose Fulbright Canada LLP

is acting as legal counsel to California Gold and Dentons LLP is

acting as legal counsel to Stratabound in connection with the

Arrangement.

ABOUT STRATABOUND

Stratabound Minerals Corp. is a well-funded

Canadian exploration and development company focused on gold

exploration at its flagship Golden Culvert Project, Yukon Territory

and its new McIntyre Brook Project, New Brunswick, Canada. The

Company also holds a significant land position that hosts three

base metals deposits in the Bathurst base metals camp of New

Brunswick featuring the Captain Copper-Cobalt-Gold Deposit that

hosts an NI 43-101 Measured and Indicated Resource.

Mr. R. Kim Tyler, P.Geo., President and CEO of

Stratabound, and a “Qualified Person” for the purpose of NI 43-101,

has reviewed and approved the contents of this news release.

ABOUT CALIFORNIA GOLD

California Gold Mining Inc.’s flagship Fremont

gold project located in Mariposa County, California lies within

California’s prolific Mother Lode Gold Belt. The Fremont Project

hosts a NI 43-101 mineral resource of 515,000 ounces grading 1.71

g/t gold in the Indicated category, and an additional 364,000

ounces grading 1.44 g/t gold in the Inferred category, currently

encompassing only the Pine Tree-Josephine zone, (*TECHNICAL REPORT

ON THE FREMONT PROJECT, MARIPOSA COUNTY, STATE OF CALIFORNIA,

U.S.A., Roscoe Postle Associates Inc. (RPA), 2016). The Project

hosts two historical underground gold mines across approximately

one kilometre out of a total four kilometres of strike along the

regional Mother Lode Shear Zone extending across and beyond the

Property.

FORWARD-LOOKING INFORMATION

Certain information contained in this news

release constitutes forward-looking information. All information

other than information of historical fact is forward-looking

information. The use of any of the words “intend”, “anticipate”,

“plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”,

“should”, “would”, “believe”, “predict” and “potential” and similar

expressions are intended to identify forward-looking information.

This information involves known and unknown risks, uncertainties

and other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

information. No assurance can be given that this information will

prove to be correct, and such forward-looking information included

in this news release should not be unduly relied upon.

The forward-looking information provided in this

news release is based upon a number of material factors and

assumptions including, without limitation: (a) that the Arrangement

will be completed in the timelines and on the terms currently

anticipated, if at all; (b) that all necessary CSE, TSXV, court and

regulatory approvals will be obtained on the timelines and in the

manner currently anticipated; (c) that all necessary California

Gold shareholder approvals will be obtained; and (d) general

assumptions respecting the business and operations of both

Stratabound and California Gold, including that each business will

continue to operate in a manner consistent with past practice and

pursuant to certain industry and market conditions.

Forward-looking information is subject to a

number of risks and other factors that could cause actual results

and events to vary materially from that anticipated by such

forward-looking information. In particular, the completion of the

Arrangement is subject to a number of risks including, without

limitation: (a) CSE, TSXV, court and regulatory approvals may not

be obtained in the timelines or on the terms currently anticipated

or at all; (b) necessary California Gold shareholder approvals may

not be obtained; (c) the Arrangement is subject to a number of

closing conditions and no assurance can be given that all such

conditions will be met or will be met in the timelines required by

the Arrangement Agreement; and (d) the business, operational and/or

financial performance or achievements of Stratabound or California

Gold may be materially different from that currently anticipated.

In particular, the benefits anticipated in respect of the

Arrangement are based on the current business, operational and

financial position of each of Stratabound and California Gold,

which are subject to a number of risks and uncertainties. Readers

are cautioned that the foregoing list of risks, uncertainties and

assumptions are not exhaustive.

The forward-looking information included in this

news release is expressly qualified by this cautionary statement

and is made as of the date of this news release. Neither

Stratabound nor California Gold undertake any obligation to

publicly update or revise any forward-looking information except as

required by applicable securities laws.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

FURTHER INFORMATION

|

StrataboundR. Kim

TylerPresident, CEO(416)

915-4157info@stratabound.com |

California GoldLarry

PhillipsPresident, CEO(647)

977-9267 x 333lphillips@caligold.ca |

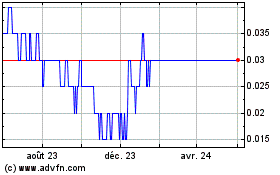

Stratabound Minerals (TSXV:SB)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

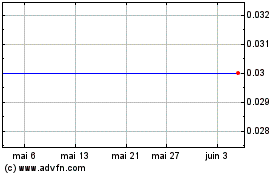

Stratabound Minerals (TSXV:SB)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025