Spectra7 Announces Private Placement

30 Décembre 2020 - 2:00PM

Business Wire

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR

RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES

(TSXV:SEV) Spectra7 Microsystems Inc. (“Spectra7” or the

“Company”), a leading provider of high-performance analog

semiconductor products for broadband connectivity markets,

announces that it intends to sell, on a non-brokered private

placement basis, in one or more tranches, up to 116,666,667 units

(the “Units”) at a price of $0.03 per Unit for gross

proceeds of up to $3,500,000 (the “Private Placement”). Each

Unit will consist of one common share in the capital of the Company

(each, a “Common Share”) and one-half of one common share

purchase warrant (each whole warrant, a “Warrant”) with each

Warrant being exercisable into one Common Share at an exercise

price of $0.05 for a period of five years from the date of

issuance, subject to adjustment upon certain customary events. The

expiry date of the Warrants can be accelerated by the Company at

any time following the date that is 4 months and one day after

closing of the Private Placement and prior to the expiry date of

the Warrants if the closing price of the Common Shares on the TSX

Venture Exchange is greater than $0.08 for any 10 non-consecutive

trading days.

Spectra7 also announces that it intends to issue up to

11,666,666 Units to settle up to $350,000 owing to certain arm’s

length parties (the “Debt Settlement”).

All dollar amounts in this news release are denominated in

Canadian dollars unless otherwise indicated.

The net proceeds from the Private Placement and the Debt

Settlement are intended to be used for working capital to support

revenue growth, the payment of interest on its outstanding

convertible debentures and for general corporate purposes.

Pursuant to Multilateral Instrument 61-101 Protection of

Minority Security Holders in Special Transactions (“MI

61-101”), the Private Placement constitutes a “related party

transaction” as insiders of the Company are expected to subscribe

for Units. The Company is relying on exemptions from the formal

valuation and minority approval requirements of MI 61-101.

The closing of the Private Placement and the Debt Settlement are

subject to certain conditions including, but not limited to, the

receipt of all necessary approvals including the approval of the

TSX Venture Exchange.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities in the United States

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful. The

securities have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “1933

Act”), or any state securities laws and may not be offered

or sold in the United States unless registered under the 1933 Act

and any applicable securities laws of any state of the United

States or an applicable exemption from the registration

requirements is available.

ABOUT SPECTRA7 MICROSYSTEMS INC.

Spectra7 Microsystems Inc. is a high performance analog

semiconductor company delivering unprecedented bandwidth, speed and

resolution to enable disruptive industrial design for leading

electronics manufacturers in virtual reality, augmented reality,

mixed reality, data centers and other connectivity markets.

Spectra7 is based in San Jose, California with a design center in

Cork, Ireland and technical support location in Dongguan, China.

For more information, please visit www.spectra7.com.

Neither the TSX Venture Exchange nor its regulation services

provided (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTIONARY NOTES

Certain statements contained in this press release constitute

"forward-looking statements". All statements other than statements

of historical fact contained in this press release, including,

without limitation, those regarding the Private Placement and the

Debt Settlement and the intended use of proceeds thereof, and the

Company’s strategy, plans, objectives, goals and targets, and any

statements preceded by, followed by or that include the words

"believe", "expect", "aim", "intend", "plan", "continue", "will",

"may", "would", "anticipate", "estimate", "forecast", "predict",

"project", "seek", "should" or similar expressions or the negative

thereof, are forward-looking statements. These statements are not

historical facts but instead represent only the Company's

expectations, estimates and projections regarding future events.

These statements are not guarantees of future performance and

involve assumptions, risks and uncertainties that are difficult to

predict. Therefore, actual results may differ materially from what

is expressed, implied or forecasted in such forward-looking

statements. Additional factors that could cause actual results,

performance or achievements to differ materially include, but are

not limited to the risk factors discussed in the Company's Annual

Information Form for the year ended December 31, 2019. Management

provides forward-looking statements because it believes they

provide useful information to investors when considering their

investment objectives and cautions investors not to place undue

reliance on forward-looking information. Consequently, all of the

forward-looking statements made in this press release are qualified

by these cautionary statements and other cautionary statements or

factors contained herein, and there can be no assurance that the

actual results or developments will be realized or, even if

substantially realized, that they will have the expected

consequences to, or effects on, the Company. These forward-looking

statements are made as of the date of this press release and the

Company assumes no obligation to update or revise them to reflect

subsequent information, events or circumstances or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201230005035/en/

Spectra7 Microsystems Inc. James Bergeron Investor Relations

289-512-0541 ir@spectra7.com

Spectra7 Microsystems Inc. David Mier Chief Financial Officer

925-858-7011 pr@spectra7.com

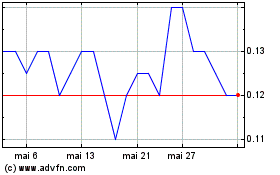

Spectra7 Microsystems (TSXV:SEV)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Spectra7 Microsystems (TSXV:SEV)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025