Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 Octobre 2023 - 7:04PM

Edgar (US Regulatory)

Commission File Number 001-31914

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 of the

Securities Exchange Act of 1934

October 26, 2023

China Life

Insurance Company Limited

(Translation of registrant’s name into English)

16 Financial Street

Xicheng District

Beijing

100033, China

Tel: (86-10) 6363-3333

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Commission File Number 001-31914

China Life Insurance Company Limited issued an announcement on October 26, 2023, a copy of which is

attached as Exhibit 99.1 hereto.

Certain statements contained in this announcement may be viewed as “forward-looking statements” within the

meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other

factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking

statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2022 filed with

the U.S. Securities and Exchange Commission, or SEC, on April 21, 2023 and in the Company’s other filings with the SEC. You should not place undue reliance on these forward-looking statements. All information provided in this announcement

is as of the date of this announcement, unless otherwise stated, and we undertake no duty to update such information, except as required under applicable law. Unless otherwise indicated, the Chinese insurance market information set forth in this

announcement is based on public information released by the National Administration of Financial Regulation.

EXHIBIT LIST

Commission File Number 001-31914

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

China Life Insurance Company Limited

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Li Mingguang |

|

|

|

|

|

|

(Signature) |

| October 26, 2023 |

|

|

|

Name: |

|

Li Mingguang |

|

|

|

|

Title: |

|

Principal Executive Officer and Executive Director |

Commission File Number 001-31914

EXHIBIT 99.1

中國人壽保險股份有限公司

CHINA LIFE INSURANCE COMPANY LIMITED

(A joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 2628)

SUMMARY OF SOLVENCY QUARTERLY REPORT OF

INSURANCE COMPANYNOTE

(THIRD QUARTER OF 2023)

COMPANY

PROFILE AND CONTACT INFORMATION

|

|

|

| Name of the Company in Chinese: |

|

中國人壽保險股份有限公司 |

|

|

| Name of the Company in English: |

|

China Life Insurance Company Limited |

|

|

| Legal Representative: |

|

Bai Tao |

|

|

| Registered Address: |

|

16 Financial Street, Xicheng District, Beijing, P.R. China |

|

|

| Registered Capital

(Working Capital): |

|

RMB28.265 billion |

Note:

This summary of

solvency quarterly report is prepared in accordance with the relevant requirements under the “Solvency Regulatory Rules II for Insurance Companies” issued by the former China Banking and Insurance Regulatory Commission (the “Former

CBIRC”), the “Notice for Defining the Policy of Transitional Period for the Implementation by Life Insurance Companies of the ‘Solvency Regulatory Rules for Insurance Companies No. 15: Public Disclosure of Solvency

Information’ issued by the Solvency Supervision Department of the CBIRC”, and the “Notice for Optimizing the Solvency Regulatory Standards of Insurance Companies” issued by the National Administration of Financial Regulation (the

“NAFR”).

- 1 -

|

|

|

| Corporate License Number of Insurance Institution |

|

|

| (Insurance Business License): |

|

No. 000005 |

|

|

| Business Commencement Date: |

|

June 30, 2003 |

|

|

| Business Scope: |

|

Life, health, accident and other types of personal insurance businesses; reinsurance of the personal insurance businesses; funds management business permitted by national laws and regulations or approved by the State Council;

personal insurance services, consulting and agency businesses; sale of securities investment funds; other businesses approved by the national insurance regulatory departments. |

|

|

| Business Area: |

|

the People’s Republic of China, for the purpose of this report, excluding the Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan region (the “PRC”) |

|

|

| Contact Name: |

|

He Zheng |

|

|

| Contact Office Telephone Number: |

|

010-63631371 |

|

|

| Contact Mobile Phone Number: |

|

13671210021 |

|

|

| Contact Email Address: |

|

c-rossinfo@e-chinalife.com |

- 2 -

| 1. |

STATEMENT BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE MANAGEMENT |

This report has been approved by the Chairman of the Board of Directors of the Company. The Chairman of the Board of Directors and the

management of the Company warrant that the information contained in this report is true, accurate, complete and legally compliant and there are no false representations, misleading statements contained in or material omissions from this report, and

severally and jointly accept legal responsibility for the above.

The statement is hereby given.

- 3 -

| |

(1) |

Shareholding Structure, Shareholders and Their Changes During the Reporting Period

|

| |

1) |

Shareholding structure and its changesNote

|

Unit: Ten thousand shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Category |

|

At the beginning of the period |

|

|

Changes in the number of shares or

shareholding percentage during the period |

|

|

At the end of the

period |

|

| |

Shares or

capital

contribution |

|

|

Percentage

(%) |

|

|

Capital

injection by

shareholders |

|

|

Capital

reserve

transfer and

distribution

of dividend |

|

|

Equity

transfer |

|

|

Sub-total |

|

|

Shares or

capital

contribution |

|

|

Percentage

(%) |

|

| RMB ordinary shares |

|

|

2,082,353 |

|

|

|

73.67 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,082,353 |

|

|

|

73.67 |

|

| Overseas listed foreign shares |

|

|

744,118 |

|

|

|

26.33 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

744,118 |

|

|

|

26.33 |

|

| Total |

|

|

2,826,471 |

|

|

|

100.00 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,826,471 |

|

|

|

100.00 |

|

| |

Note: |

Currently, there is no feature in the shareholders’ information enquiry platform that can track

down the type of shareholders according to the classification of “state-owned shares, corporate legal shares, foreign invested shares and natural person shares”. As such, the above information is presented by the Company based on the

shareholding structure as disclosed in its annual report. |

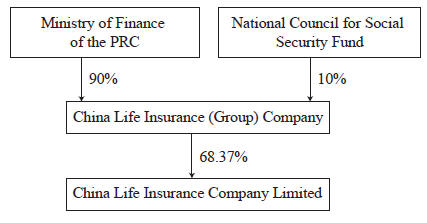

The effective controller of the Company is the Ministry of Finance of the PRC. As at the end of the reporting period, the equity and

controlling relationship between the Company and its effective controller is set out below:

- 4 -

| |

3) |

Top ten shareholders (in the descending order of their shareholding percentage in the Company as at the end

of the period) |

Unit: Ten thousand shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of shareholder |

|

Nature of shareholder |

|

Changes in

the number of

shares held by

the shareholder

or the amount

of capital

contribution

during

the

period |

|

|

Number of

shares held by

the shareholder

or the amount

of capital

contribution

as

at the end of the

period |

|

|

Shareholding

percentage as

at the end of

the period |

|

|

Number

of shares

pledged |

|

|

Number

of shares

frozen |

|

| China Life Insurance (Group) Company |

|

State-owned legal person |

|

|

— |

|

|

|

1,932,353 |

|

|

|

68.37 |

% |

|

|

— |

|

|

|

— |

|

| HKSCC Nominees Limited |

|

Overseas legal person |

|

|

187 |

|

|

|

732,787 |

|

|

|

25.93 |

% |

|

|

— |

|

|

|

— |

|

| China Securities Finance Corporation Limited |

|

State-owned legal person |

|

|

— |

|

|

|

70,824 |

|

|

|

2.51 |

% |

|

|

— |

|

|

|

— |

|

| Central Huijin Asset Management Limited |

|

State-owned legal person |

|

|

— |

|

|

|

11,717 |

|

|

|

0.41 |

% |

|

|

— |

|

|

|

— |

|

| Hong Kong Securities Clearing Company Limited |

|

Overseas legal person |

|

|

-1,135 |

|

|

|

3,726 |

|

|

|

0.13 |

% |

|

|

— |

|

|

|

— |

|

| Industrial and Commercial Bank of China Limited – SSE 50 Exchange Traded Index Securities

Investment Fund |

|

Other |

|

|

162 |

|

|

|

1,598 |

|

|

|

0.06 |

% |

|

|

— |

|

|

|

— |

|

| Guosen Securities Co., Ltd. – Founder Fubon CSI Insurance Theme Index Securities Investment

Fund |

|

Other |

|

|

-132 |

|

|

|

1,323 |

|

|

|

0.05 |

% |

|

|

— |

|

|

|

— |

|

| National Social Security Fund Portfolio 114 |

|

Other |

|

|

-98 |

|

|

|

1,200 |

|

|

|

0.04 |

% |

|

|

— |

|

|

|

— |

|

| Industrial and Commercial Bank of China Limited – Huatai-PineBridge CSI 300 Exchange Traded

Index Securities Investment Fund |

|

Other |

|

|

459 |

|

|

|

1,075 |

|

|

|

0.04 |

% |

|

|

— |

|

|

|

— |

|

| China International Television Corporation |

|

State-owned legal person |

|

|

— |

|

|

|

1,000 |

|

|

|

0.04 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

| Details of

shareholders |

|

1. HKSCC

Nominees Limited is a company that holds shares on behalf of the clients of the Hong Kong stock brokers and other participants of the CCASS system. Since the relevant regulations of the Stock Exchange do not require such persons to declare whether

their shareholdings are pledged or frozen, HKSCC Nominees Limited is unable to calculate or provide the number of shares that are pledged or frozen. |

|

|

|

|

2. Both Industrial and Commercial Bank of China Limited – SSE 50 Exchange

Traded Index Securities Investment Fund and Industrial and Commercial Bank of China Limited – Huatai-PineBridge CSI 300 Exchange Traded Index Securities Investment Fund have Industrial and Commercial Bank of China Limited as their fund

depositary. Save as above, the Company was not aware of any connected relationship and concerted parties as defined by the “Measures for the Administration of the Takeover of Listed Companies” among the top ten shareholders of the

Company. |

- 5 -

| |

4) |

Shareholdings of the Directors, Supervisors and senior management |

No relevant circumstance occurred during the reporting period.

| |

5) |

Equity transfer during the reporting period |

No relevant circumstance required for reporting by the regulatory rules during the reporting period.

| |

(2) |

Directors, Supervisors and Senior Management of the Head Office |

| |

1. |

Basic information of the Directors, Supervisors and senior management of the head office

|

| |

1) |

Basic information of the Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Bai Tao |

|

March 1963 |

|

Doctoral degree in Economics |

|

May 2022 |

|

Chairman of the Board of Directors, Executive Director |

|

Yin Bao Jian Fu (2022) No. 361 |

|

Chairman of the Board of Directors and the Secretary to the Party Committee of China Life Insurance (Group) Company

Chairman of the Board of Directors of China Guangfa Bank Co., Ltd.

Vice Chairman of China Society for Finance and Banking

Vice chairman of China Enterprise Confederation

Vice chairman of China Enterprise Directors Association |

|

Mr. Bai became the Chairman of the Board of Directors of the Company in May 2022. He is the Chairman of the Board of Directors and the Secretary to the Party Committee of China Life Insurance (Group) Company. From September

2016 to July 2018, he served as the Deputy General Manager of China Investment Corporation. From July 2018 to January 2020, Mr. Bai served as the President, an Executive Director and the Vice Chairman of The People’s Insurance Company

(Group) of China Limited. He was the Chairman of State Development & Investment Corp., Ltd. from January 2020 to January 2022. |

- 6 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Li Mingguang |

|

July 1969 |

|

Master’s degree in Economics and EMBA for the senior management |

|

As temporary Person in Charge since August 2023, As Executive Director since August 2019 |

|

Executive Director, Temporary Person in Charge |

|

Jing Yin Bao Jian Fu (2019) No. 635 |

|

Chairman of the Board of Directors of China Life Investment Management Company Limited |

|

Mr. Li became a temporary Person in Charge of the Company in August 2023. He has been an Executive Director of the Company since August 2019. He served as the Chief Actuary of the Company from 2012 to 2023, a Vice President of

the Company from 2014 to 2023, and the Board Secretary of the Company from 2017 to 2023. He served as the Chief Actuary of China Life Pension Company Limited from 2012 to 2022. |

- 7 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Wang Junhui |

|

July 1971 |

|

Doctoral degree in Finance |

|

August 2019 |

|

Non-executive Director |

|

Jing Yin Bao Jian Fu (2019) No. 635 |

|

Secretary to the Party Committee and Chairman of China Life Pension Company Limited (his qualification as such capacities is subject to

approval) Chief Investment Officer of China Life Insurance (Group) Company

Director of China Life Insurance (Overseas) Company Limited

Chairman of China Life AMP Asset Management Company Limited

Director of China United Network Communications Limited

Director of China Shimao Investment Company Limited

Director of China World Trade Center Limited

Chairman of the Insurance Asset Management Association of China

Executive Director of the Insurance Association of China |

|

Mr. Wang became a Non- executive Director of the Company in August 2019. He has been the Chief Investment Officer of China Life Insurance (Group) Company since August 2016. He served as the Secretary to the Party Committee and

President of China Life Asset Management Company Limited from August 2016 to July 2023. He has been a Director of China Life Insurance (Overseas) Company Limited since June 2020, the Chairman of China Life Franklin Asset Management Company Limited

since September 2016, and the Chairman of China Life AMP Asset Management Company Limited since December 2016. |

- 8 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and

part-time

jobs held in affiliates and

other entities |

|

Key working experience in

the recent five

years |

| Zhuo Meijuan |

|

July 1964 |

|

Master’s degree in Business Administration |

|

June 2023 |

|

Non-executive Director |

|

Jin Fu (2023) No. 81 |

|

Senior Director of the Strategic Planning Department (General Office for Deepening Reforms)/ Office of the Board of Directors/China Life Institute of Finance of China Life Insurance (Group) Company |

|

Ms. Zhuo became a Non- executive Director of the Company in June 2023. She served as the Deputy General Manager and the General Manager of the Business Management Department of China Life Insurance (Group) Company from 2016 to

August 2023. |

|

|

|

|

|

|

|

|

| Lam Chi Kuen |

|

April 1953 |

|

Higher Diploma in Accounting |

|

June 2021 |

|

Independent Director |

|

Yin Bao Jian Fu (2021) No. 503 |

|

Independent Non-executive Director of China Cinda Asset Management Co., Ltd.

Independent Non-executive Director of Luks Group

(Vietnam Holdings) Company Limited |

|

Mr. Lam became an Independent Director of the Company in June 2021. |

|

|

|

|

|

|

|

|

| Zhai Haitao |

|

January 1969 |

|

Master’s degrees in International Affairs and Business Administration |

|

October 2021 |

|

Independent Director |

|

Yin Bao Jian Fu (2021) No. 778 |

|

President and Founding Partner of Primavera Capital Group

Independent Director of China Everbright Environment Group Limited

Independent Director of China Everbright Water Limited

Independent Director of Lianyin Venture Capital Co., Ltd. (a wholly-owned subsidiary of China UnionPay Group) |

|

Mr. Zhai became an Independent Director of the Company in October 2021. |

- 9 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Huang Yiping |

|

March 1964 |

|

Doctoral degree in Economics |

|

July 2022 |

|

Independent Director |

|

Yin Bao Jian Fu (2022) No. 450 |

|

Jinguang Chair Professor of Finance and Economics and the Associate Dean of the National School of Development of Peking University

Director of the Institute of Digital Finance of Peking University

Deputy Secretary-General of China Society for Finance and Banking

Chairman of the Professional Committee of FinTech Development and Research of the

National Internet Finance Association of China Chairman of the Academic Committee of

China Finance 40 Forum Member of Chinese Economists 50 Forum

Member of the Decision- making Advisory Committee of Guangdong Provincial People’s

Government Director of Shanghai Pu Shan New Finance Development Foundation |

|

Mr. Huang became an Independent Director of the Company in July 2022. |

- 10 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

|

|

|

|

|

|

|

|

|

|

|

|

Invited Expert (Advisor) of the 2nd Fintech Cooperation Committee of Asian Financial Cooperation Association

Vice Chairman of the Professional Committee on the Study of Regional Finance of the

Society of Public Finance of China Executive Director and Vice Chairman of the Ninth

Session of the Board of Directors and member of the Academic Committee of China Institute of Rural Finance

Editor in Chief of China Economic Journal

Deputy Editor in Chief of Asian Economic Policy Review

Independent Director of Ant Group Co., Ltd. |

|

|

- 11 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Chen Jie |

|

April 1970 |

|

Doctoral degree in Civil and Commercial Law |

|

July 2022 |

|

Independent Director |

|

Yin Bao Jian Fu (2022) No. 450 |

|

Director and researcher of the Commercial Law Research Unit of the Institute of Law of Chinese Academy of Social Sciences

Member of Chinese Legal System Committee of China Democratic League

Vice Chairman of China Business Law Society

Executive Director of the Institute of Commercial Law of China Law Society

Executive Director of the Institute of Securities Law of China Law Society

Director of the Institute of Insurance Law of China Law Society

Member of the Securities and Futures Expert Group of the China Securities Regulatory

Commission Member of the Appeal Review Committee of the Shenzhen Stock

Exchange |

|

Ms. Chen became an Independent Director of the Company in July 2022. |

- 12 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

|

|

|

|

|

|

|

|

|

|

|

|

Expert Member on “Holding Shares and Exercising Shareholders’ Rights” of China Securities Investor Services Center

Member of the Expert Advisory Committee of Beijing Financial Court

Arbitrator of Beijing Arbitration Commission/ Beijing International Arbitration

Center Arbitrator of Shenzhen Court of International Arbitration

Arbitrator of China International Economic and Trade Arbitration Commission

Arbitrator of Shanghai International Economic and Trade Arbitration Commission |

|

|

- 13 -

| |

2) |

Basic information of the Supervisors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Cao Weiqing |

|

September 1965 |

|

Master’s degree in Economics |

|

October 2022 |

|

Chairman of the Board of Supervisors |

|

Yin Bao Jian Fu (2022) No. 762 |

|

|

|

Mr. Cao became the Chairman of the Board of Supervisors of the Company in November 2022. He is a member of the Party Committee of the Company. He successively served as the Secretary to the Discipline Inspection Committee, the

Chairman of the Board of Supervisors and a Vice President of China Life Asset Management Company Limited from 2016 to 2022. |

|

|

|

|

|

|

|

|

| Niu Kailong |

|

September 1974 |

|

Doctoral degree in Economics |

|

October 2021 |

|

Non-Employee Representative Supervisor |

|

Yin Bao Jian Fu (2021) No. 778 |

|

General Manager and President of the Strategic Planning Department (General Office for Deepening Reforms)/ Office of the Board of Directors/China Life Institute of Finance of China Life Insurance (Group) Company |

|

Mr. Niu became a Supervisor of the Company in October 2021. |

|

|

|

|

|

|

|

|

| Lai Jun |

|

May 1964 |

|

Bachelor’s degree |

|

October 2021 |

|

Employee Representative Supervisor |

|

Yin Bao Jian Fu (2021) No. 778 |

|

|

|

Mr. Lai became a Supervisor of the Company in October 2021. He has been the General Manager of the Human Resources Department of the Company since May 2021. From 2015 to 2021, he successively served as the Person in Charge, the

Deputy General Manager (responsible for daily operations) and the General Manager of Hainan Branch, as well as the General Manager of Xinjiang Branch of the Company. |

- 14 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Ye Yinglan |

|

October 1974 |

|

Doctoral degree in Economics |

|

June 2023 |

|

Employee Representative Supervisor |

|

Jin Fu (2023) No. 82 |

|

|

|

Ms. Ye became an Employee Representative Supervisor of the Company in June 2023. She has been the General Manager of the Comprehensive Finance Department of the Company since July 2023. She successively served as an Assistant

to the General Manager and the Deputy General Manager of the Finance Department, the Deputy General Manager, the Deputy General Manager (responsible for daily operations) and the General Manager of the Finance Management Department, and the General

Manager of the Fund Sales Management Department of the Company from 2009 to 2023. |

- 15 -

| |

3) |

Basic information of the senior management of the head office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Liu Hui |

|

February 1970 |

|

Master’s degree in Business Administration |

|

July 2023 |

|

Vice President |

|

Jin Fu (2023) No. 158 |

|

Director of China Life Asset Management Company Limited

Director of China Life Franklin Asset Management Company Limited

Director of Wonders Information Co., Ltd. |

|

Ms. Liu became a Vice President of the Company in July 2023. She has been a Director of China Life Asset Management Company Limited since August 2023, a Director of Wonders Information Co., Ltd. since July 2023, and a Director

of China Life Franklin Asset Management Company Limited since April 2023. From 2014 to 2022, she successively served as a Vice President of China Life Investment Holding Company Limited, and an Executive Director and Vice President of China Life

Investment Management Company Limited, and concurrently served as an Executive Director and Vice President of Sino-Ocean Group Holding Limited, the President and Chairman of China Life Capital Investment Company Limited, and an Executive Director

and the General Manager of China Life Real Estate Co., Limited. |

- 16 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Ruan Qi |

|

July 1966 |

|

EMBA for the senior management |

|

April 2018 |

|

Vice President, Chief Risk Officer |

|

Yin Bao Jian Xu Ke (2018) No. 63 |

|

Director of China Life Ecommerce Company Limited

Chairman of Wonders Information Co., Ltd. |

|

Mr. Ruan became a Vice President of the Company in April 2018. He has been the Chief Risk Officer of the Company since December 2022, and the Chairman of Wonders Information Co., Ltd. since July 2023. He successively served as

the General Manager (at the general manager level of the provincial branches) of the Information Technology Department and the Chief Information Technology Officer of the Company from 2016 to 2018. |

|

|

|

|

|

|

|

|

| Yang Hong |

|

February 1967 |

|

EMBA for the senior management |

|

July 2019 |

|

Vice President |

|

Jing Yin Bao Jian Fu (2019)

No. 493 |

|

|

|

Ms. Yang became a Vice President of the Company in July 2019. She served as the Operation Director of the Company from March 2018 to July 2019, and the General Manager of the Operation and Service Center of the Company from

January 2018 to August 2019. She successively served as the Deputy General Manager (responsible for daily operations) and General Manager of the Research and Development Center, the General Manager (at the general manager level of the provincial

branches) of the Business Management Department, and the General Manager (at the general manager level of the provincial branches) of the Process and Operation Management Department of the Company from 2011 to 2018. |

- 17 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Zhao Guodong |

|

November 1967 |

|

Bachelor’s degree |

|

October 2019 |

|

Vice President, Board Secretary |

|

Yin Bao Jian Fu (2023) No. 83 |

|

|

|

Mr. Zhao became a Vice President of the Company in August 2023. He has been the Board Secretary of the Company since February 2023. He served as an Assistant to the President of the Company from 2019 to 2023. During the period

from 2016 to 2022, he successively served as the Deputy General Manager (responsible for daily operations) and the General Manager of Chongqing Branch, the General Manager of Hunan Branch, and the General Manager of Jiangsu Branch of the

Company. |

|

|

|

|

|

|

|

|

| Bai Kai |

|

June 1974 |

|

Postgraduate |

|

April 2022 |

|

Vice President |

|

|

|

|

|

Mr. Bai became a Vice President of the Company in August 2023. He served as an Assistant to the President of the Company from 2022 to 2023. During the period from 2017 to 2022, he successively served as the Deputy General

Manager, the Deputy General Manager (responsible for daily operations) and General Manager of Hubei Branch of the Company. |

|

|

|

|

|

|

|

|

| Xu Chongmiao |

|

October 1969 |

|

Doctoral degree in Law |

|

July 2018 |

|

Compliance Officer |

|

Yin Bao Jian Xu Ke (2018) No. 593 |

|

|

|

Mr. Xu became the Compliance Officer of the Company in July 2018. He has been the General Manager of the Legal and Compliance Department and the Legal Officer of the Company since September 2014. |

- 18 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Hu Jin |

|

November 1971 |

|

Master’s degree in Economics |

|

February 2023 |

|

Person in Charge of Finance |

|

Yin Bao Jian Fu (2023) No. 82 |

|

|

|

Ms. Hu became the Person in Charge of Finance of the Company in February 2023. She has been the General Manager of the Finance Department of the Company since June 2020. From October 2022 to February 2023, she served as a

temporary Person in Charge of Finance of the Company. From June 2020 to March 2021, she served as the General Manager of the Shared Service Center (Financial Segment) of the Company. From August 2019 to June 2020, she served as the Deputy General

Manager (responsible for daily operations) of the Finance Department and concurrently acted as the Deputy General Manager of the Shared Service Center (Financial Segment) of the Company. From 2013 to 2019, she successively served as the Deputy

General Manager of the Finance Department, the Deputy General Manager of the Accounting Department and the Deputy General Manager (responsible for daily operations) of the Accounting Department of the Company. |

- 19 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Month and

year of birth |

|

Academic

qualification

(degree) |

|

Month and

year of

commencement |

|

Position |

|

Approval

document

No. for

job

qualification |

|

Positions and part-time

jobs held in affiliates and

other

entities |

|

Key working experience in

the recent five

years |

| Hu Zhijun |

|

July 1971 |

|

Master’s degree in Management |

|

August 2023 |

|

Temporary Person in Charge of Audit |

|

|

|

|

|

Ms. Hu became a temporary Person in Charge of Audit of the Company in August 2023. She has been the General Manager of the Audit Department of the Company since October 2022. She served as a Supervisor of the Company from 2022

to 2023, and the General Manager of the Asset Management Department of the Company from 2014 to 2022. |

|

|

|

|

|

|

|

|

| Hou Jin |

|

January 1980 |

|

Master’s degree in Economics |

|

August 2023 |

|

Temporary Chief Actuary |

|

|

|

|

|

Ms. Hou became a temporary Chief Actuary of the Company in August 2023. She has been the Deputy General Manager of the Actuarial Department of the Company since December 2019. She was an Assistant to the General Manager of the

Actuarial Department of the Company from 2018 to 2019, and a senior actuary (Grade III) of the Actuarial Department of the Company from 2017 to 2018. |

All information set forth in the table 1) – 3) is as at the end of the reporting period, and this

table only provides the basic information of the senior management officers of the Head Office who are not Directors or Supervisors. For details of other senior management officers of the Head Office, please refer to the tables under the basic

information of the Directors and Supervisors.

- 20 -

| |

2. |

The changes of the Directors, Supervisors and senior management during the reporting period and as at the

disclosure date of the summary of this report: |

| |

1) |

Due to the adjustment of work arrangements, Mr. Li Mingguang tendered his resignation to the Company from

his role as the Chief Actuary of the Company on August 4, 2023, which took effect on the same date. On August 4, 2023, as considered and approved at the 27th meeting of the seventh session of the Board of Directors of the Company, Mr. Li

Mingguang was appointed as the President of the Company, and his qualification as the President of the Company is still subject to the approval of the NAFR. Before the grant of approval, the Board of Directors has designated Mr. Li Mingguang as

a temporary person in charge of the Company. |

| |

2) |

On August 4, 2023, as considered and approved at the 27th meeting of the seventh session of the Board of

Directors of the Company, Ms. Hu Zhijun was appointed as the Person in Charge of Audit of the Company, and her qualification as the Person in Charge of Audit of the Company is still subject to the approval of the NAFR. Before the grant of

approval, the Board of Directors has designated Ms. Hu Zhijun as a temporary Person in Charge of Audit of the Company. Mr. Liu Fengji ceased to be the Person in Charge of Audit of the Company. |

| |

3) |

Ms. Liu Hui has been a Vice President of the Company since July 27, 2023. |

| |

4) |

Due to the adjustment of work arrangements, Mr. Zhao Peng tendered his resignation to the Company from his

roles as the President, an Executive Director and a member of the Strategy and Assets and Liabilities Management Committee of the Company on August 4, 2023, which took effect on the same date. |

| |

5) |

On August 4, 2023, as considered and approved at the 27th meeting of the seventh session of the Board of

Directors of the Company, Ms. Hou Jin was appointed as the Chief Actuary of the Company, and her qualification as the Chief Actuary of the Company is still subject to the approval of the NAFR. Before the grant of approval, the Board of

Directors has designated Ms. Hou Jin as the temporary Chief Actuary of the Company. |

| |

6) |

Mr. Zhao Guodong has been a Vice President of the Company since August 4, 2023. |

| |

7) |

Mr. Bai Kai has been a Vice President of the Company since August 4, 2023. |

- 21 -

| |

(3) |

Subsidiaries, Joint Ventures and Associated Corporations |

Unit: RMB million

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| No. |

|

Company name |

|

Type of

company |

|

Number of shares held or cost |

|

|

Shareholding percentage |

|

| |

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

|

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

| 1 |

|

China Life Asset Management Company Limited |

|

Subsidiary |

|

|

1,680 |

|

|

|

1,680 |

|

|

|

— |

|

|

|

60.00 |

% |

|

|

60.00 |

% |

|

|

— |

|

| 2 |

|

China Life Pension Company Limited |

|

Subsidiary |

|

|

2,626 |

|

|

|

2,626 |

|

|

|

— |

|

|

|

70.74 |

% |

|

|

70.74 |

% |

|

|

— |

|

| 3 |

|

China Life Nianfeng Insurance Agency Co., Ltd. |

|

Subsidiary |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

90.81 |

% |

|

|

90.81 |

% |

|

|

— |

|

| 4 |

|

New Aldgate Limited |

|

Subsidiary |

|

|

1,168 |

|

|

|

1,168 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 5 |

|

Wuhu Yuanxiang Tianyi Investment Management Partnership (Limited Partnership) |

|

Subsidiary |

|

|

502 |

|

|

|

502 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 6 |

|

Wuhu Yuanxiang Tianfu Investment Management Partnership (Limited Partnership) |

|

Subsidiary |

|

|

502 |

|

|

|

502 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 7 |

|

Shanghai Yuan Shu Yuan Pin Investment Management Partnership (Limited Partnership) |

|

Subsidiary |

|

|

521 |

|

|

|

521 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 8 |

|

Shanghai Yuan Shu Yuan Jiu Investment Management Partnership (Limited Partnership) |

|

Subsidiary |

|

|

521 |

|

|

|

521 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 9 |

|

Shanghai Wansheng Industry Partnership (Limited Partnership) |

|

Subsidiary |

|

|

4,048 |

|

|

|

4,048 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 10 |

|

Shanghai Rui Chong Investment Co., Limited |

|

Subsidiary |

|

|

6,100 |

|

|

|

6,100 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 11 |

|

Ningbo Meishan Bonded Port Area Guo Yang Guo Sheng Investment Partnership (Limited

Partnership) |

|

Subsidiary |

|

|

2,835 |

|

|

|

2,835 |

|

|

|

— |

|

|

|

90.00 |

% |

|

|

90.00 |

% |

|

|

— |

|

| 12 |

|

Ningbo Meishan Bonded Port Area Bai Ning Investment Partnership (Limited Partnership) |

|

Subsidiary |

|

|

1,680 |

|

|

|

1,680 |

|

|

|

— |

|

|

|

99.98 |

% |

|

|

99.98 |

% |

|

|

— |

|

| 13 |

|

Golden Phoenix Tree Limited |

|

Subsidiary |

|

|

264 |

|

|

|

264 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 14 |

|

Glorious Fortune Forever Limited |

|

Subsidiary |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 15 |

|

China Life Qihang Phase I (Tianjin) Equity Investment Fund Partnership (Limited

Partnership) |

|

Subsidiary |

|

|

6,916 |

|

|

|

6,973 |

|

|

|

57 |

|

|

|

99.99 |

% |

|

|

99.99 |

% |

|

|

— |

|

| 16 |

|

China Life Guangde (Tianjin) Equity Investment Fund Partnership (Limited Partnership) |

|

Subsidiary |

|

|

1,316 |

|

|

|

1,436 |

|

|

|

120 |

|

|

|

99.95 |

% |

|

|

99.95 |

% |

|

|

— |

|

| 17 |

|

China Life (Suzhou) Pension and Retirement Investment Company Limited |

|

Subsidiary |

|

|

2,181 |

|

|

|

2,181 |

|

|

|

— |

|

|

|

67.39 |

% |

|

|

67.39 |

% |

|

|

— |

|

| 18 |

|

China Life (Beijing) Health Management Company Limited |

|

Subsidiary |

|

|

1,530 |

|

|

|

1,530 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 19 |

|

Beijing China Life Pension Industry Investment Fund (Limited Partnership) |

|

Subsidiary |

|

|

3,771 |

|

|

|

3,771 |

|

|

|

— |

|

|

|

99.90 |

% |

|

|

99.90 |

% |

|

|

— |

|

| 20 |

|

Sunny Bamboo Limited |

|

Subsidiary |

|

|

2,359 |

|

|

|

2,359 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

- 22 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Number of shares held or cost |

|

|

Shareholding percentage |

|

| No. |

|

Company name |

|

Type of

company |

|

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

|

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

| 21 |

|

Golden Bamboo Limited |

|

Subsidiary |

|

|

3,101 |

|

|

|

3,101 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 22 |

|

Fortune Bamboo Limited |

|

Subsidiary |

|

|

2,435 |

|

|

|

2,435 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 23 |

|

CL Hotel Investor, L.P. |

|

Subsidiary |

|

|

285 |

|

|

|

285 |

|

|

|

— |

|

|

|

100.00 |

% |

|

|

100.00 |

% |

|

|

— |

|

| 24 |

|

CBRE Global Investors U.S. Investment I, LLC |

|

Subsidiary |

|

|

4,111 |

|

|

|

4,111 |

|

|

|

— |

|

|

|

99.99 |

% |

|

|

99.99 |

% |

|

|

— |

|

| 25 |

|

COFCO Futures Company Limited |

|

Associated

corporation |

|

|

1,339 |

|

|

|

1,339 |

|

|

|

— |

|

|

|

35.00 |

% |

|

|

35.00 |

% |

|

|

— |

|

| 26 |

|

CCB Trust Sharing No. 9 Urbanization Investment Private Equity Fund |

|

Associated

corporation |

|

|

1,223 |

|

|

|

1,223 |

|

|

|

— |

|

|

|

30.57 |

% |

|

|

30.57 |

% |

|

|

— |

|

| 27 |

|

AVIC Investment Holding Limited |

|

Associated

corporation |

|

|

6,000 |

|

|

|

6,000 |

|

|

|

— |

|

|

|

16.70 |

% |

|

|

16.70 |

% |

|

|

— |

|

| 28 |

|

China Life Property and Casualty Insurance Company Limited |

|

Associated

corporation |

|

|

9,600 |

|

|

|

9,600 |

|

|

|

— |

|

|

|

40.00 |

% |

|

|

40.00 |

% |

|

|

— |

|

| 29 |

|

China United Network Communications Limited |

|

Associated

corporation |

|

|

21,801 |

|

|

|

21,801 |

|

|

|

— |

|

|

|

10.03 |

% |

|

|

10.03 |

% |

|

|

— |

|

| 30 |

|

Wonders Information Co., Ltd. |

|

Associated

corporation |

|

|

3,898 |

|

|

|

3,898 |

|

|

|

— |

|

|

|

20.32 |

% |

|

|

20.32 |

% |

|

|

— |

|

| 31 |

|

Shanghai Jinshida Winning Software Technology Co., Limited |

|

Associated

corporation |

|

|

192 |

|

|

|

192 |

|

|

|

— |

|

|

|

16.84 |

% |

|

|

16.84 |

% |

|

|

— |

|

| 32 |

|

GLP Guoyi (Zhuhai) Acquisitions Fund (Limited Partnership) |

|

Associated

corporation |

|

|

7,301 |

|

|

|

7,301 |

|

|

|

— |

|

|

|

81.63 |

% |

|

|

81.63 |

% |

|

|

— |

|

| 33 |

|

Sinopec Sichuan to East China Gas Pipeline Co., Ltd. |

|

Associated

corporation |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

— |

|

|

|

43.86 |

% |

|

|

43.86 |

% |

|

|

— |

|

| 34 |

|

China Power Investment Nuclear Power Co., Ltd. |

|

Associated

corporation |

|

|

8,000 |

|

|

|

8,000 |

|

|

|

— |

|

|

|

26.76 |

% |

|

|

26.76 |

% |

|

|

— |

|

| 35 |

|

China Guangfa Bank Co., Ltd. |

|

Associated

corporation |

|

|

53,199 |

|

|

|

53,199 |

|

|

|

— |

|

|

|

43.69 |

% |

|

|

43.69 |

% |

|

|

— |

|

| 36 |

|

Annoroad Gene Technology (Beijing) Co., Ltd. |

|

Associated

corporation |

|

|

250 |

|

|

|

250 |

|

|

|

— |

|

|

|

13.09 |

% |

|

|

13.09 |

% |

|

|

— |

|

| 37 |

|

Sino-Ocean Group Holding Limited |

|

Associated

corporation |

|

|

11,246 |

|

|

|

11,246 |

|

|

|

— |

|

|

|

29.59 |

% |

|

|

29.59 |

% |

|

|

— |

|

| 38 |

|

Nanning China Life Shenrun Investment Development Fund

Partnership (Limited

Partnership) |

|

Joint venture |

|

|

3,780 |

|

|

|

3,780 |

|

|

|

— |

|

|

|

60.00 |

% |

|

|

60.00 |

% |

|

|

— |

|

| 39 |

|

Jiangsu China Life Jiequan Equity Investment Center (Limited Partnership) |

|

Joint venture |

|

|

2,361 |

|

|

|

2,431 |

|

|

|

70 |

|

|

|

60.00 |

% |

|

|

60.00 |

% |

|

|

— |

|

- 23 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Number of shares held or cost |

|

|

Shareholding percentage |

|

| No. |

|

Company name |

|

Type of

company |

|

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

|

At the

beginning

of the

period |

|

|

At the

end of

the

period |

|

|

Change

in

amount |

|

| 40 |

|

China Life Vanke No. 1 (Jiaxing) Health Pension Industrial Investment Partnership (Limited

Partnership) |

|

Joint venture |

|

|

195 |

|

|

|

195 |

|

|

|

— |

|

|

|

59.82 |

% |

|

|

59.82 |

% |

|

|

— |

|

| 41 |

|

China Life Vanke No. 2 (Jiaxing) Health Pension Industrial Investment Partnership (Limited

Partnership) |

|

Joint venture |

|

|

195 |

|

|

|

195 |

|

|

|

— |

|

|

|

59.82 |

% |

|

|

59.82 |

% |

|

|

— |

|

| 42 |

|

China Life Qiaocheng (Shenzhen) Investment Partnership (Limited Partnership) |

|

Joint venture |

|

|

8,451 |

|

|

|

8,451 |

|

|

|

— |

|

|

|

84.99 |

% |

|

|

84.99 |

% |

|

|

— |

|

| 43 |

|

China Life Beautiful Village (Danjiangkou) Industrial Fund Partnership (Limited

Partnership) |

|

Joint venture |

|

|

33 |

|

|

|

33 |

|

|

|

— |

|

|

|

39.50 |

% |

|

|

39.50 |

% |

|

|

— |

|

| 44 |

|

China Life Haikong (Hainan) Healthy Investment Co., Ltd. |

|

Joint venture |

|

|

230 |

|

|

|

230 |

|

|

|

— |

|

|

|

51.00 |

% |

|

|

51.00 |

% |

|

|

— |

|

| 45 |

|

China Life (Sanya) Health Investments Co., Ltd. |

|

Joint venture |

|

|

306 |

|

|

|

306 |

|

|

|

— |

|

|

|

51.00 |

% |

|

|

51.00 |

% |

|

|

— |

|

| 46 |

|

Beijing China Life Communications Construction City Development Investment Fund (Limited

Partnership) |

|

Joint venture |

|

|

15,627 |

|

|

|

15,627 |

|

|

|

— |

|

|

|

50.00 |

% |

|

|

50.00 |

% |

|

|

— |

|

| 47 |

|

RXR 1285 Holdings JV LLC |

|

Joint venture |

|

|

1,215 |

|

|

|

1,215 |

|

|

|

— |

|

|

|

51.55 |

% |

|

|

51.55 |

% |

|

|

— |

|

|

|

|

|

|

| |

|

Note: |

|

The figures shown in the “Number of shares held or cost” column in this table refer to the amount of investment cost. |

- 24 -

| |

(4) |

Violation of Laws and Regulations |

| |

1) |

Administrative punishments imposed on the Company by financial regulators and other governmental departments

during the reporting period: |

During the reporting period, 14 administrative punishments were imposed on the divisions

of the Company at all levels, with an amount of penalty totaling RMB1.969 million. Such punishments included, among others, warning and penalty. For specific information, please logon to the official website of the Company (www.e-chinalife.com, route query: Home Page – Public Information Disclosure – Information of Significant Events) for inspection.

| |

2) |

Administrative punishments imposed on the Directors, Supervisors and senior management of the Head Office of

the Company by financial regulators and other governmental departments during the reporting period: |

No relevant

circumstance occurred during the reporting period.

| |

3) |

Violation of laws by the Directors, Supervisors, management officers at the departmental level of the Head

Office or above and senior management officers of the provincial branches of the Company during the reporting period that resulted in them being transferred to judicial authorities: |

No relevant circumstance occurred during the reporting period.

| |

4) |

Regulatory measures adopted by the NAFR (the Former CBIRC) against the Company during the reporting period:

|

During the reporting period, no regulatory measure was adopted by the NAFR and its local offices against the Head

Office of the Company and there were 40 regulatory measures against its branches at the provincial level and below.

- 25 -

| |

(1) |

Solvency Ratio Indicators |

Unit: RMB million

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items |

|

Figures of

the Current

Quarter |

|

|

Figures of

the Preceding

Quarter |

|

|

Predicted

figures of the

Following

Quarter

under the

Basic Scenario |

|

| Admitted assets |

|

|

5,649,227 |

|

|

|

5,537,686 |

|

|

|

5,666,497 |

|

| Admitted liabilities |

|

|

4,626,474 |

|

|

|

4,505,868 |

|

|

|

4,621,117 |

|

| Actual capital |

|

|

1,022,753 |

|

|

|

1,031,818 |

|

|

|

1,045,380 |

|

| Core Tier 1 capital |

|

|

643,740 |

|

|

|

666,207 |

|

|

|

660,999 |

|

| Core Tier 2 capital |

|

|

65,034 |

|

|

|

43,316 |

|

|

|

65,735 |

|

| Supplementary Tier 1 capital |

|

|

311,570 |

|

|

|

319,502 |

|

|

|

316,210 |

|

| Supplementary Tier 2 capital |

|

|

2,409 |

|

|

|

2,793 |

|

|

|

2,436 |

|

| Minimum capital for quantitative risk |

|

|

446,647 |

|

|

|

513,396 |

|

|

|

450,439 |

|

| Minimum capital for control risk |

|

|

-7,101 |

|

|

|

-8,163 |

|

|

|

-7,162 |

|

| Additional minimum capital |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Minimum capital |

|

|

439,546 |

|

|

|

505,233 |

|

|

|

443,277 |

|

| Core solvency surplus |

|

|

269,228 |

|

|

|

204,290 |

|

|

|

283,457 |

|

| Comprehensive solvency surplus |

|

|

583,207 |

|

|

|

526,585 |

|

|

|

602,103 |

|

| Core solvency ratio |

|

|

161.25 |

% |

|

|

140.43 |

% |

|

|

163.95 |

% |

| Comprehensive solvency ratio |

|

|

232.68 |

% |

|

|

204.23 |

% |

|

|

235.83 |

% |

- 26 -

| |

(2) |

Regulatory and Monitoring Indicators of Liquidity Risk |

Unit: RMB million

|

|

|

|

|

|

|

|

|

| Name of Indicators |

|

Figures of

the Current

Quarter |

|

|

Figures of

the Preceding

Quarter |

|

| Liquidity coverage ratio |

|

|

|

|

|

|

|

|

| Overall liquidity coverage ratio of the Company under the basic scenario1 (LCR1) |

|

|

|

|

|

|

|

|

| within 3 months |

|

|

164 |

% |

|

|

185 |

% |

| within 12 months |

|

|

112 |

% |

|

|

115 |

% |

| Overall liquidity coverage ratio of the Company under the required testing stressed scenario2 (LCR2) |

|

|

|

|

|

|

|

|

| within 3 months |

|

|

543 |

% |

|

|

584 |

% |

| within 12 months |

|

|

179 |

% |

|

|

185 |

% |

| Liquidity coverage ratio without considering asset realization under the required testing stressed

scenario3 (LCR3) |

|

|

|

|

|

|

|

|

| within 3 months |

|

|

104 |

% |

|

|

109 |

% |

| within 12 months |

|

|

87 |

% |

|

|

87 |

% |

| Overall liquidity coverage ratio of the Company under the self-testing stressed scenario2 (LCR2) |

|

|

|

|

|

|

|

|

| within 3 months |

|

|

2275 |

% |

|

|

2196 |

% |

| within 12 months |

|

|

681 |

% |

|

|

675 |

% |

| Liquidity coverage ratio without considering asset realization under the self-testing stressed

scenario3 (LCR3) |

|

|

|

|

|

|

|

|

| within 3 months |

|

|

485 |

% |

|

|

460 |

% |

| within 12 months |

|

|

367 |

% |

|

|

351 |

% |

| Backtracking adverse deviation rate of net cash flow from operating activities4 |

|

|

153 |

% |

|

|

89 |

% |

| Cumulative net cash flow of the current year |

|

|

23,588 |

|

|

|

62,924 |

|

| Net cash flow of the preceding fiscal year |

|

|

65,443 |

|

|

|

65,443 |

|

| Net cash flow of the fiscal year prior to the preceding fiscal year |

|

|

2,901 |

|

|

|

2,901 |

|

| Net cash flow from operating

activities5 |

|

|

336,446 |

|

|

|

256,919 |

|

| Net cash flow from operating activities of participating account6 |

|

|

-7,522 |

|

|

|

-14,516 |

|

| Net cash flow from operating activities of universal account7 |

|

|

84,279 |

|

|

|

65,822 |

|

| Proportion of cash and liquidity management

tools8 |

|

|

3.01 |

% |

|

|

4.35 |

% |

| Quarterly average of financing leverage

ratio9 |

|

|

2.12 |

% |

|

|

1.86 |

% |

| Proportion of domestic fixed-income assets under (including) class AA10 |

|

|

0.22 |

% |

|

|

0.21 |

% |

| Proportion of listed stock investment with a shareholding of over 5%11 |

|

|

0.50 |

% |

|

|

0.61 |

% |

| Proportion of receivables12 |

|

|

0.77 |

% |

|

|

0.98 |

% |

| Proportion of holding related-party

assets13 |

|

|

0.88 |

% |

|

|

1.80 |

% |

- 27 -

Notes:

| |

1. |

Overall liquidity coverage ratio of the Company under the basic scenario = (Cash inflows of the Company under

the basic scenario + Book value of cash and cash equivalents at the valuation date) ÷ Cash outflows of the Company under the basic scenario × 100% |

| |

2. |

Overall liquidity coverage ratio of the Company under the stressed scenario = (Cash inflows of the Company

under the stressed scenario + Book value of cash and cash equivalents at the valuation date + the amount of realizable liquid asset reserves) ÷ Cash outflows of the Company under the stressed scenario × 100% |

| |

3. |

Liquidity coverage ratio without considering asset realization under the stressed scenario = (Cash inflows of

the Company under the stressed scenario + Book value of cash and cash equivalents at the valuation date) ÷ Cash outflows of the Company under the stressed scenario × 100% |

| |

4. |

Backtracking adverse deviation rate of net cash flow from operating activities = (Actual value of net cash flow

from operating activities – Predicted value of net cash flow from operating activities) ÷ Absolute value of the predicted value of net cash flow from operating activities |

| |

5. |

Net cash flow from operating activities = Cumulative cash inflows from operating activities of the current year

– Cumulative cash outflows from operating activities of the current year |

| |

6. |

Net cash flow from operating activities of participating account = Cumulative cash inflows from operating

activities of participating account of the current year – Cumulative cash outflows from operating activities of participating account of the current year |

| |

7. |

Net cash flow from operating activities of universal account = Cumulative cash inflows from operating

activities of universal account of the current year – Cumulative cash outflows from operating activities of universal account of the current year |

| |

8. |

Proportion of cash and liquidity management tools = Book value of cash and liquidity management tools at the

end of the period ÷ Ending balance of total assets after deducting the balance of bonds sold under agreements to repurchase and assets held in separate accounts × 100% |

| |

9. |

Quarterly average of financing leverage ratio = Arithmetic average of total balance of inter-bank lending and

bonds sold under agreements to repurchase at the end of each month within a quarter ÷ Ending balance of total assets × 100% |

| |

10. |

Proportion of domestic fixed-income assets under (including) class AA = Book value of domestic fixed-income