Goldshore

Resources Announces Option Agreement to Earn In to Iris Lake &

Vanguard Properties held by White Metal Resources

Corp.

VANCOUVER,

B.C., July 7, 2022: Goldshore Resources Inc. (TSXV: GSHR / OTCQB: GSHRF / FWB: 8X00) ("Goldshore"

or the "Company"), is pleased to announce it has executed an option agreement

(the "Option

Agreement") with White

Metal Resource Corp. (TSXV:WHM) ("White

Metal") to earn in to

certain mining claims held by White Metal in the Shebandowan

greenstone belt known as the Iris Lake and Vanguard properties (the

"Property" or "Properties").

Key Terms of the Option

Agreement

-

Total cash payments (CAD$) of an aggregate of $110,000 to

White Metal over 3 years, to be paid as follows:

-

$10,000 within five days of July 6,

2022 (the "Effective

Date");

-

an additional $20,000 on or before

the 12-month anniversary of the Effective Date;

-

an additional $30,000 on or before

the 24-month anniversary of the Effective Date; and

-

an additional $50,000 on or before

the 36-month anniversary of the Effective Date;

-

Total share issuance of an aggregate of 1,500,000 common

shares of the Company (each, a "Share") (such Shares to be

subject to resale restrictions) as follows:

-

300,000 Shares within five days of

the Effective Date;

-

an additional 300,000 Shares on or

before the 12-month anniversary of the Effective Date;

-

an additional 400,000 Shares on or

before the 24-month anniversary of the Effective date;

and

-

an additional 500,000 Shares on or

before the 36-month anniversary of the Effective Date;

-

Total incurred expenditures on the Property of not less than

$1,650,000 over 3 years as follows:

-

$100,000 on or before the six-month

anniversary of the Effective Date;

-

an additional $200,000 on or before

the 12-month anniversary of the Effective Date;

-

an additional $600,000 on or before

the 24-month anniversary of the Effective Date; and

-

an additional $750,000 on or before

the 36-month anniversary of the Effective Date.

-

Other non-material administrative and technical matters

guiding the earn in relationship between the Company and White

Metal.

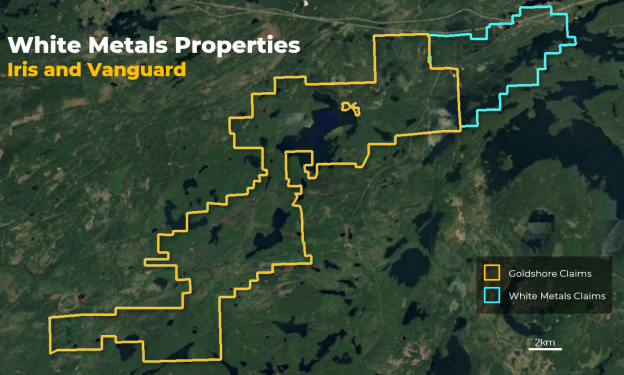

President and CEO Brett Richards

stated: "We

are excited to add on this land package through the Option

Agreement with White Metal. As illustrated in Figure

1.0, the Properties are adjacent to our north-eastern property

claims in the Coldstream and Iris Lake area. As we have suggested in the

past, and with the interpretation of the airborne geo-physical VTEM

survey conducted in 2021; there is a strong correlation through

Coldstream and Iris Lake towards the Properties, that suggest this

strike length is contiguous."

Figure 1 – The

White Metal Resources Corp Iris Lake and Vanguard

properties

For a larger more detailed map of the White

Metal's properties, please refer to:

https://goldshoreresources.com/wp-content/uploads/2022/07/GSH_Claim-Map_2022-May.pdf

Current

Market Conditions

Goldshore has decided to

temporarily scale back its drilling program from 7 rigs to 2 rigs

in an effort to preserve capital in this uncertain and volatile

capital market environment. The Company has also evaluated all possible

cost containment and cost control measures to assist in this

regard, and are reducing costs wherever possible. This decision to

slow drilling production may affect Goldshore's ability to complete

its planned 100,000m drill program in 2022, as previously planned,

but does not change the strategy or management's view on the Moss

Lake Project.

The Company will continue to

monitor all market conditions, as well as its ability to execute on

its objectives going forward.

About

Goldshore

Goldshore is an emerging junior

gold development company, and owns the Moss Lake Gold Project located in

Ontario. Wesdome is currently a strategic shareholder of Goldshore with an

approximate 27% equity position in the Company. Well-financed and supported by an industry-leading management group,

board of directors and advisory

board, Goldshore is

positioned to advance the Moss Lake Gold Project through the next stages of exploration and

development.

About

the Moss Lake Gold Project

The Moss Lake Gold Project is

located approximately 100 km west of the city of Thunder Bay,

Ontario. It is accessed via Highway 11 which passes within 1 km of

the property boundary to the north. The Moss Lake Gold Project covers 14,292

hectares and consists of 282 unpatented and patented mining

claims.

Moss Lake hosts a

number of gold and base metal rich deposits including the Moss Lake

Deposit, the East Coldstream Deposit (Table 1), the historically

producing North Coldstream Mine (Table 2), and the Hamlin Zone, all

of which occur over a mineralized trend exceeding 20 km in length.

A historical preliminary economic assessment was completed on Moss

Lake in 2013 and published by Moss Lake Gold1.

A historical mineral resource estimate was completed on the East

Coldstream Deposit in 2011 by Foundation Resources

Inc2,3.

In addition to these zones, the Moss Lake Gold Project also hosts a

number of under-explored mineral occurrences which are reported to

exist both at surface and in historically drilled

holes. The Moss Lake Deposit is a

shear-hosted disseminated-style gold deposit which outcrops at

surface. It has been drilled over a 2.5 km length and to depths of

300 m with 376 holes completed between 1983 and 2017. The last

drilling program conducted in 2016 and 2017 by Wesdome, which

consisted of widely spaced holes along the strike extension of the

deposit was successful in expanding the mineralized footprint and

hydrothermal system 1.6 km to the northeast. Additionally, the

deposit remains largely open to depth. In 2017, Wesdome completed

an induced polarization survey which traced the potential

extensions of pyrite mineralization associated with the Moss Lake

Deposit over a total strike length of 8 km and spanning the entire

extent of the survey grids.

The East Coldstream Deposit is a

shear-hosted disseminated-style gold deposit which locally outcrops

at surface. It has been drilled over a 1.3 km length and to depths

of 200 m with 138 holes completed between 1988 and 2017. The

deposit remains largely open at depth and may have the potential

for expansion along strike. Historic drill hole highlights from the East

Coldstream Deposit include 4.86 g/t Au over 27.3 m in

C-10-15.

The historically producing North

Coldstream Mine is reported to have produced significant amounts of

copper, gold and silver4

from mineralization with potential

iron-oxide-copper-gold deposit style affinity. The exploration

potential immediately surrounding the historic mining area is not

currently well understood and historic data compilation is

required.

The Hamlin Zone is a significant

occurrence of copper and gold mineralization, and also of potential

iron-oxide-copper-gold deposit style affinity. Between 2008 and

2011, Glencore tested Hamlin with 24 drill holes which successfully

outlined a broad and intermittently mineralized zone over a strike

length of 900 m. Historic drill hole highlights from the Hamlin

Zone include 0.9 g/t Au and 0.35% Cu over 150.7 m in

HAM-11-75.

The Moss Lake, East Coldstream and

North Coldstream deposits sit on a mineral trend marked by a

regionally significant deformation zone locally referred to as the

Wawiag Fault Zone in the area of the Moss Lake Deposit. This

deformation zone occurs over a length of approximately 20 km on the

Moss Lake Gold Project and there is an area spanning approximately

7 km between the Moss Lake and East Coldstream deposits that is

significantly underexplored.

Table 1:

Historical Mineral Resources1,2,3

|

|

INDICATED

|

INFERRED

|

|

Deposit

|

Tonnes

|

Au

g/t

|

Au

oz

|

Tonnes

|

Au

g/t

|

Au

oz

|

|

Moss Lake

Deposit1

(2013 resource

estimate)

|

|

Open Pit Potential

|

39,795,000

|

1.1

|

1,377,300

|

48,904,000

|

1.0

|

1,616,300

|

|

Underground Potential

|

-

|

-

|

-

|

1,461,100

|

2.9

|

135,400

|

|

Moss Lake

Total

|

39,795,000

|

1.1

|

1,377,300

|

50,364,000

|

1.1

|

1,751,600

|

|

East Coldstream

Deposit2

(2011 resource

estimate)

|

|

East Coldstream

Total

|

3,516,700

|

0.85

|

96,400

|

30,533,000

|

0.78

|

763,276

|

|

Combined

Total

|

43,311,700

|

1.08

|

1,473,700

|

80,897,000

|

0.98

|

2,514,876

|

Notes:

(1) Source:

Poirier, S., Patrick, G.A., Richard, P.L., and Palich, J., 2013.

Technical Report and Preliminary Economic Assessment for the Moss

Lake Project, 43-101 technical report prepared for Moss Lake Gold

Mines Ltd. Moss Lake Deposit resource estimate is based on 0.5 g/t

Au cut-off grade for open pit and 2.0 g/t Au cut-off grade for

underground resources.

(2) Source:

McCracken, T., 2011. Technical Report and Resource Estimate on the

Osmani Gold Deposit, Coldstream Property, Northwestern Ontario,

43-101 technical report prepared for Foundation Resources Inc. and

Alto Ventures Ltd. East Coldstream Deposit resource estimate is

based on a 0.4 g/t Au cut-off grade.

(3) The

reader is cautioned that the above referenced "historical mineral

resource" estimates are considered historical in nature and as such

is based on prior data and reports prepared by previous property

owners. A qualified person has not done sufficient work to classify

the historical estimates as current resources and Goldshore is not

treating the historical estimates as current

resources.

Significant data compilation,

re-drilling, re-sampling and data verification may be required by a

qualified person before the historical estimate on the Moss Lake

Gold Project can be classified as a current resource.

There can be no assurance that any of the

historical mineral resources, in whole or in part, will ever become

economically viable. In addition, mineral resources are not mineral

reserves and do not have demonstrated economic

viability.

Even if classified as a current

resource, there is no certainty as to whether further exploration

will result in any inferred mineral resources being upgraded to an

indicated or measured mineral resource category.

Table 2:

Reported Historical Production from the North Coldstream

Deposit4

|

Deposit

|

Tonnes

|

Cu

%

|

Au

g/t

|

Ag

|

Cu

lbs

|

Au

oz

|

Ag

oz

|

|

Historical Production

|

2,700,0000

|

1.89

|

0.56

|

5.59

|

102,000,000

|

44,000

|

440,000

|

Note::

(4) Source:

Schlanka, R., 1969. Copper, Nickel, Lead and Zinc Deposits of

Ontario, Mineral Resources Circular No. 12, Ontario Geological

Survey, pp. 314-316.

Peter Flindell, MAusIMM, MAIG, Vice

President – Exploration of the Company, a qualified person under NI

43-101 has approved the scientific and technical information

contained in this news release.

Neither the TSXV

nor its Regulation Services Provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

For More

Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer

and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes

| LinkedIn: goldshoreres

Cautionary Note

Regarding Forward-Looking Statements

This news release contains

statements that constitute "forward-looking statements." Such

forward looking statements involve known and unknown risks,

uncertainties and other factors that may cause the Company's actual

results, performance or achievements, or developments to differ

materially from the anticipated results, performance or

achievements expressed or implied by such forward-looking

statements.

Forward looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words "expects," "plans," "anticipates,"

"believes," "intends," "estimates," "projects," "potential" and

similar expressions, or that events or conditions "will," "would,"

"may," "could" or "should" occur.

Forward-looking statements in this

news release include, among others, statements relating to

expectations regarding the exploration and development of the Moss

Lake Gold Project or the Properties, an update to the historical

resource at the Moss Lake Gold Project, and other statements that

are not historical facts. By their nature, forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance or

achievements, or other future events, to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such factors and risks

include, among others: the Company may require additional financing

from time to time in order to continue its operations which may not

be available when needed or on acceptable terms and conditions

acceptable; compliance with extensive government regulation;

domestic and foreign laws and regulations could adversely affect

the Company's business and results of operations; the stock markets

have experienced volatility that often has been unrelated to the

performance of companies and these fluctuations may adversely

affect the price of the Company's securities, regardless of its

operating performance; and the impact of COVID-19.

The forward-looking information

contained in this news release represents the expectations of the

Company as of the date of this news release and, accordingly, is

subject to change after such date. Readers should not place undue

importance on forward-looking information and should not rely upon

this information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors,

should change.

Goldshore Resources (QB) (USOTC:GSHRF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goldshore Resources (QB) (USOTC:GSHRF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024