Goldshore Announces Inferred Mineral

Resource Estimate of 6.00Moz

Contained Gold at 1.02 g/t Au within 183.6Mt at the Moss Gold

Project

Shear Domain at the Moss Deposit increases

to 3.35Moz at 1.84 g/t Au within 56.5Mt

VANCOUVER, B.C., Canada -- May 8, 2023 -- InvestorsHub

NewsWire -- Goldshore Resources Inc.

(TSXV:

GSHR /

OTCQB: GSHRF / FWB: 8X00)

(“Goldshore” or the “Company”) is

pleased to announce an updated mineral resource estimate (the

“Moss MRE”) for the Moss deposit

(“Moss” or the “Moss Deposit”)

and a maiden mineral resource estimate (the “East

Coldstream MRE” and, together with the Moss MRE, the

“MRE”) for the East Coldstream deposit

(“East Coldstream” or the “East Coldstream

Deposit”), both located at its 100%-owned Moss Gold

Project in Northwest Ontario, Canada (the “Moss Gold

Project” or the “Project”).

- Moss Gold Project global inferred resource grows 44% to

6.00Moz at 1.02 g/t, within 183.6Mt

- Moss MRE grows with 24% more contained

gold ounces and 32% more tonnes from

4.17Moz Au in 121.7Mt (November 2022 mineral resource estimate) to

5.42Moz Au at 1.03 g/t Au within 163.6Mt (open pit

and underground).

- The shear domain has increased in contained metal and

tonnage from the November 2022 mineral resource estimate by 52% and

63%, respectively, to 3.35M oz

Au at 1.84 g/t Au within 56.5Mt

(open pit only).

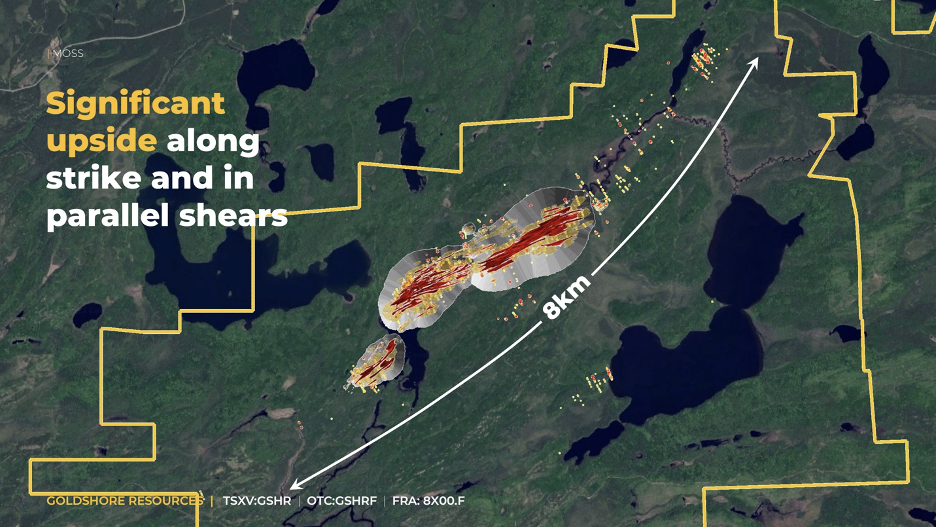

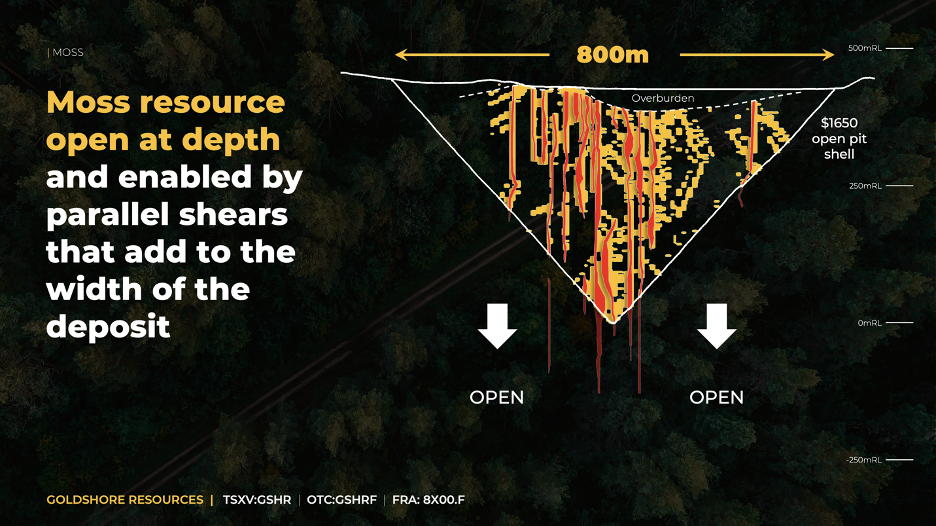

- There is clear expansion potential over the 8km-long

belt through strike extensions (in both directions) and parallel

shears where gold mineralization has been intersected but

is sparsely drilled.

- East Coldstream MRE introduced at 580Koz at 0.91 g/t Au

in 20.0Mt (open pit and underground).

- Implied stripping ratios are 5.2:1 for Moss and 6.4:1

for East Coldstream.

- This resource increase implied by the Moss Gold Project

demonstrates the scale of the project and

the opportunity for a high-grade open-pit gold

project.

- Work is well underway on studies to support a

preliminary economic assessment (“PEA”) planned for later

this year.

- The Moss Gold Project is host to 29 additional targets

over a 35 km trend, which the Company continues to

evaluate, and prioritize for future drill campaigns.

- The Company has incurred discovery costs of

approximately CAD$10 per ounce of inferred Au resource

(all-in) including acquisition costs and overheads. This can also

be measured as approximately 76 ounces Au per meter

drilled (all-in costs included) in the 78,000 meters

drilled to date.

Summary of the MRE

Open-Pit and Underground Constrained Inferred MRE for

the Moss Deposit and East Coldstream Deposit with an Effective Date

of May 5, 2023:

|

Moss Open Pit

|

|

Inferred Resources

|

Tonnes

|

Grade

|

Contained Metal

|

|

(Domains)

|

(Mt)

|

(g/t Au)

|

(Moz Au)

|

|

Shear

|

56.5

|

1.84

|

3.35

|

|

Intrusion

|

104.5

|

0.55

|

1.83

|

|

Total

|

161.0

|

1.00

|

5.18

|

|

Moss Underground

|

|

Inferred Resources

|

Tonnes

|

Grade

|

Contained Metal

|

|

(Domains)

|

(Mt)

|

(g/t Au)

|

(Moz Au)

|

|

All

|

2.6

|

2.90

|

0.24

|

|

Total

|

2.6

|

2.90

|

0.24

|

|

East Coldstream Open Pit

|

|

Inferred Resources

|

Tonnes

|

Grade

|

Contained Metal

|

|

(Domains)

|

(Mt)

|

(g/t Au

|

(Moz Au)

|

|

All

|

19.8

|

0.89

|

0.57

|

|

Total

|

19.8

|

0.89

|

0.57

|

|

East Coldstream Underground

|

|

Inferred Resources

|

Tonnes

|

Grade

|

Contained Metal

|

|

(Domains)

|

(Mt)

|

(g/t Au

|

(Moz Au)

|

|

All

|

0.2

|

2.24

|

0.01

|

|

Total

|

0.2

|

2.24

|

0.01

|

|

Grand Total

|

183.6

|

1.02

|

6.00

|

Note: Based on a US$1,650 per ounce

gold price and economic cut-off grade of 0.35 g/t Au for open pit

and 2.07 g/t Au and 2.00 g/t Au for underground resources (Moss and

East Coldstream, respectively). Please review “Notes to

Accompany Moss MRE” and “Notes to Accompany East Coldstream MRE”

for additional information.

President and CEO Brett Richards stated: “This announcement

is an important milestone for Goldshore and the Moss Gold

Project. We are pleased with the results of the MRE, as it

illustrates the size, scale, and potential of the Moss Gold Project

that we have been communicating for the past many months. This

important step in the development of the Project will now shift to

commencing a PEA by putting a mining project around the resource

with the goal of understanding the economic outputs.

Today’s MRE is a first step towards understanding a

potential first phase of the Moss Gold Project, as we believe it

represents only a small portion of the mineralization or potential

mineralization on our land package. We still have 29

additional targets to drill test, including several gold targets,

but also 4 interesting base metal and battery mineral

targets.

We will now start to run scenario planning for the PEA with

respect to how we construct a Phase 1 project of a clearly larger

mineral resource, while investigating various leaching

methodologies, including heap leach. When we have a clear

picture of the scope of the PEA, we will guide the market as to

when we believe the results of it will be available to the

market.”

Notes to Accompany Moss MRE

- Numbers have been rounded to reflect the precision of an

inferred mineral resource estimate. Totals may vary due to

rounding.

- Estimation has been completed within the two separate reported

geological domains: a higher-grade shear domain which occurs within

a larger lower-grade intrusive domain; modelling of domain

boundaries has considered both geology and grade.

- Gold cut-off for open pit has been calculated based on a gold

price of US$1,650/oz, mining costs of US$2.70 per tonne, processing

costs of US$12.50 per tonne, and mine-site administration costs of

US$2.50 per tonne processed. Metallurgical recoveries of 92.5% are

based on prior metallurgical test work.

- Gold cut-off for underground MSO shapes have been calculated

based on a gold price of US$1,650/oz, mining costs of US$86.25 per

tonne, processing costs of US$12.50 per tonne, and mine-site

administration costs of US$2.50 per tonne processed. Metallurgical

recoveries of 92.5% are based on prior metallurgical test

work.

- An economic cut-off grade of 0.35 g/t Au was applied to

mineralized rock in the optimized open pit for processing

determination.

- Mineral Resources conform to NI 43-101, and the 2019 CIM

Estimation of Mineral Resources & Mineral Reserves Best

Practice Guidelines and 2014 CIM Definition Standards for Mineral

Resources & Mineral Reserves.

- Neither the qualified person nor the Company are aware of any

environmental, permitting, legal, title, taxation, socio-economic,

marketing, or political factors that might materially affect the

Moss MRE.

- Mineral resources are not mineral reserves as they do not have

demonstrated economic viability. The quantity and grade of reported

inferred resources in the MRE are uncertain in nature and there has

been insufficient exploration to define these inferred resources as

indicated and/or measured resources. The Company will continue

exploration intended to upgrade the inferred mineral resources to

indicated mineral resources.

Notes to Accompany East Coldstream MRE

- Numbers have been rounded to reflect the precision of the

inferred mineral resource estimates. Totals may vary due to

rounding.

- Estimation has been completed within two geological zones: a

strongly altered higher-grade shear zone surrounded by a

lower-grade domain; modelling of domain boundaries has considered

both geology and grade.

- Gold cut-off has been calculated based on a gold price of

US$1,650/oz, mining costs of US$2.70 per tonne, processing costs of

US$12.50 per tonne, and mine-site administration costs of US$2.50

per tonne processed. Metallurgical recoveries of 96.5% are based on

prior metallurgical test work.

- Gold cut-off for underground MSO shapes have been calculated

based on a gold price of US$1,650/oz, mining costs of US$86.25 per

tonne, processing costs of US$12.50 per tonne, and mine-site

administration costs of US$2.50 per tonne processed. Metallurgical

recoveries of 96.5% are based on prior metallurgical test

work.

- An economic cut-off grade of 0.35 g/t Au was applied to

mineralized rock in the optimized open pit for processing

determination.

- Mineral Resources conform to NI 43-101, and the 2019 CIM

Estimation of Mineral Resources & Mineral Reserves Best

Practice Guidelines and 2014 CIM Definition Standards for Mineral

Resources & Mineral Reserves.

- Neither the qualified person nor the Company are aware of any

environmental, permitting, legal, title, taxation, socio-economic,

marketing, or political factors that might materially affect the

East Coldstream MRE.

- Mineral resources are not mineral reserves as they do not have

demonstrated economic viability. The quantity and grade of reported

inferred resources in the East Coldstream MRE are uncertain in

nature and there has been insufficient exploration to define these

inferred resources as Indicated and/or measured resources. The

Company will continue exploration intended to upgrade the inferred

mineral resources to indicated mineral resources.

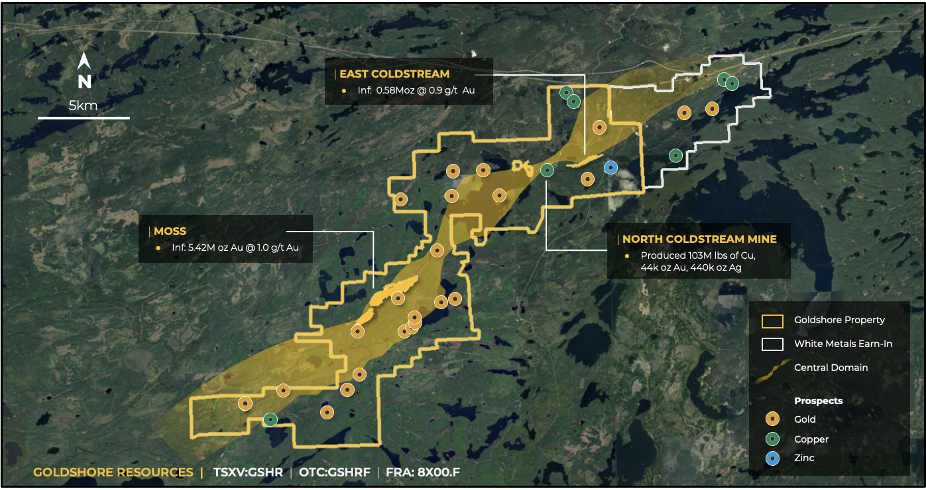

Figure 1: Location of Moss Deposit

and East Coldstream Deposit in the Moss Gold Project

Technical Overview

Details of the MRE will be provided in a technical report with

an effective date of May 5, 2023, prepared in accordance with

National Instrument 43-101 (“NI 43-101”)

standards, which will be filed under the Company’s SEDAR profile

within 45 days of this news release. The MRE was prepared by

independent mining consulting firm CSA Global Canada (“CSA

Global”), a division of ERM Consultants Canada Ltd., in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum (“CIM”) Definition Standards on Mineral

Resources and Reserves (2014).

Additional Exploration Potential

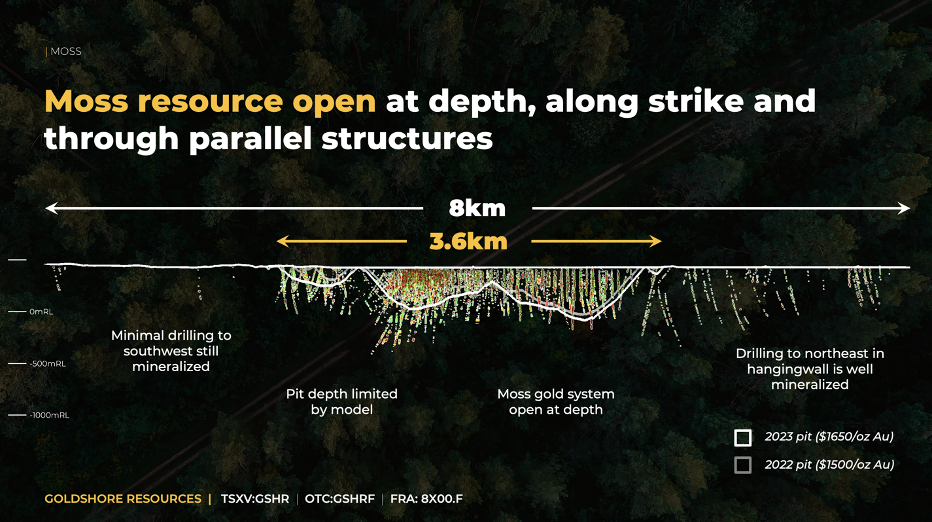

The modelled shear and intrusion domains extend to much greater

depth below the optimized open pit constraining the reported Moss

MRE. The shears are also open along strike, beyond the modelled

strike length of 3.6 km. Historical drilling has intercepted gold

mineralization over a total strike length of 8 km, which has been a

focus of Goldshore’s summer soil geochemistry and structural

mapping programs. Furthermore, there remains potential for

additional parallel shears with gold mineralization in historical

drill holes 500 m to the southeast of the Moss Deposit.

Figure 2: Upside along strike and

through parallel shears at the Moss Deposit

Figure 3: Long section at the Moss

Deposit showing gold mineralization in drillholes along strike and

at depth looking northwest

Moss Deposit Geology and Model

The Moss Deposit is a structurally controlled gold deposit

within the greenstone terrain of the Archean Superior Province.

Mineralization is localized where the major NE-trending Wawiag

Fault Zone cuts a dioritic to granodioritic intrusion complex. The

deposit is defined by a series of anastomosing centimeter- to

meter-scale NE-trending shear zones carrying higher-grade gold

mineralization, and lower-grade gold mineralization associated with

weaker shearing and a more brittle-style deformation and veining in

the intrusion rock mass and adjacent wall rocks between the shear

zones. Mineralization is associated with pyrite, sericite and

chlorite alteration and millimeter- to centimeter-scale irregular

quartz-carbonate veinlets.

Detailed geological logging and multi-element geochemical

analysis of drill core from 120 new holes total 68,802m from the

2021-23 drilling has supported modelling of discrete shear domains

within the larger altered and variably mineralized intrusion

domain, which includes adjacent volcanic wall rocks. The shear

domains have a different higher-grade gold population to the

low-grade intrusion domain and these domains have been estimated

separately using different search parameters. Importantly, this

allows a more accurate representation of the true grade variability

within the deposit than has been achieved in previous

estimates.

CSA Global was provided with the wireframes for resource

estimation by Goldshore. Goldshore modelled the shear zones domain

using a combination of geological features, including core

orientation data, and raw assay values above 1 g/t Au using

explicit digitizing methods in Micromine 3D geological modelling

software. CSA Global modelled the intrusion domain using implicit

modelling techniques in Leapfrog using a cut-off grade of 0.20 g/t

Au in 15-meter downhole composites. Statistical and

geostatistical assessment of 1 m composites confirmed that the

shear domains should be estimated within hard boundaries separating

them from the intrusion domain. Statistical analysis was used to

determine high-grade capping for each shear zone wireframe and

ranged from 30 to 60 g/t Au.

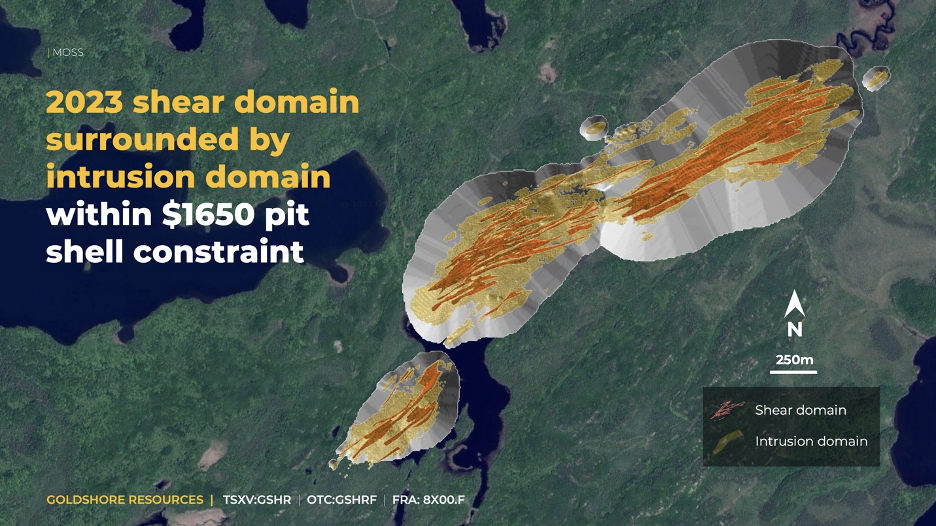

The Moss MRE was estimated with a block size of 9 x 9 x 3 m

utilizing subblocks and constrained within wireframes with a

minimum width of 3 x 3 x 1 m. Gold content was estimated using

ordinary kriging methods using dynamic anisotropy variogram models.

Mineral resources are presented as undiluted and in situ. The

historical underground voids from Noranda’s 1980’s exploration

program have been removed from the geological model.

Figure 4: Moss Deposit resource

model within the US$1650 pit shell

Figure 5: Typical cross section

through the Moss Deposit

East Coldstream Deposit Geology and Model

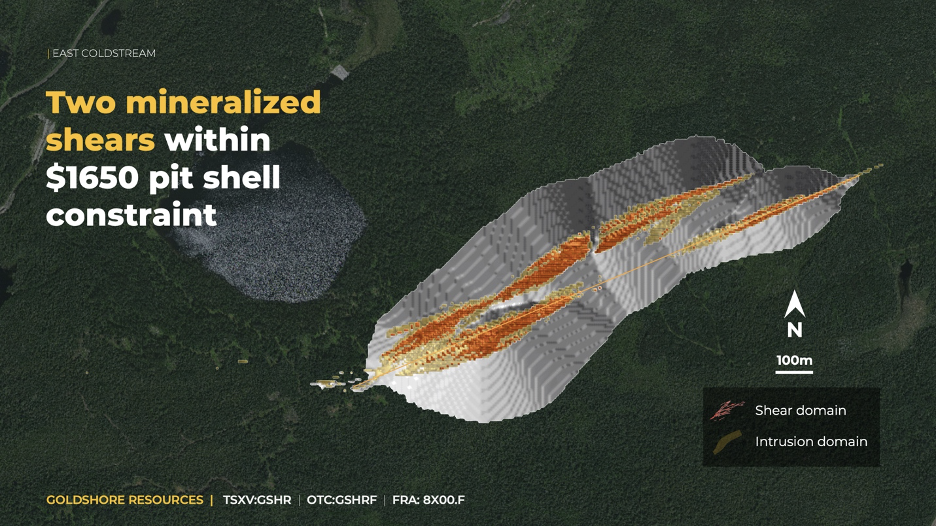

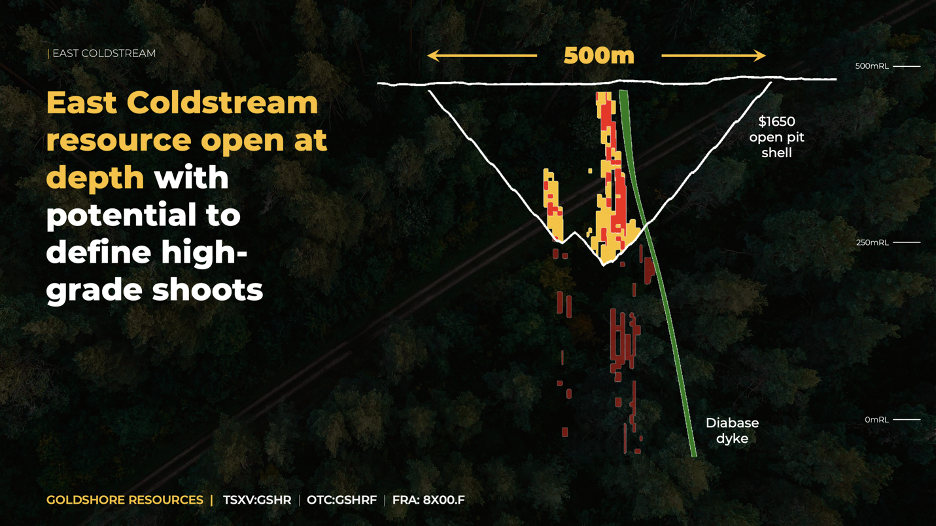

The East Coldstream Deposit is a structurally controlled gold

deposit located approximately 15 km northeast of the Moss Deposit

within the Moss Gold Project area. The East Coldstream Deposit’s

mineralized zones are located on the south margin of a shear zone

which separates a gabbroic intrusion to the north from a

mafic-intermediate volcanic suite to the south. Mineralization is

found within sheared volcanic units, proximal to sills of quartz

and quartz-feldspar porphyries and distinctive, brick-red syenites.

The mineralized zones show silica, carbonate, and hematite

alteration. Mineralization consists of fine disseminations of

pyrite and lesser chalcopyrite throughout the silica-hematite zones

as well as within quartz-carbonate veinlets. Iron carbonate is

present in areas proximal to strong silicification. The two main

mineralized zones have been cut by a north-south-trending diabase

dike.

Sixteen new drill holes, totaling 7,973 m, were drilled in the

East Coldstream Deposit to gather the required geological

understanding of the deposit. Mineralization was modeled by CSA

Global guided by alteration wireframes provided by Goldshore.

Implicit modelling techniques were utilized in wireframing a

NE-trending shear zones carrying higher-grade gold mineralization

which is subdivided into two parallel domains (Z-2 and Z-4), and

two satellite subparallel lenses (Z-1 and Z-3). A lower grade

wireframe was developed surrounding the shear zone domains

representing mineralization associated with more brittle-style

veining in the felsic to intermediate metavolcanic rocks, gabbros,

and porphyries between the main shear zones.

Exploratory data analysis was used to determine high-grade

capping for composites of two of the shear zones, with top cuts

ranging from 13 to 15 g/t Au. The East Coldstream MRE was estimated

with a block size of 6 x 6 x 6 m utilizing sub-blocks and

constrained within wireframes with a minimum width of 3 x 3 x 3

m. Gold content was estimated using ordinary kriging methods

using dynamic anisotropy and informed by variogram models. Mineral

Resources are presented as undiluted and in situ.

Figure 6: East Coldstream Deposit

resource within the US$1650 open pit shell

Figure 7: Typical cross section

through East Coldstream Deposit

Drill Hole Data and QA/QC

Procedures

The Moss Deposit has been evaluated by several diamond drill

programs since the 1970s and earlier. The greatest number of drill

holes were completed between 1986 and early 1992 by Tandem/Storimin

and Noranda Inc. (311 drill holes for 86,196 meters). A smaller

drilling program in 2008 served to validate the older data and lead

to the completion of the historical resource estimate by Moss Gold

Mines Ltd. in 2013.

The East Coldstream Deposit has been evaluated by several

diamond drill programs since 1987. Most of the historic drilling

was conducted between 2010 and 2011 by Foundation Resources who

completed total of 66 diamond drillholes in the Coldstream deposit,

totaling 16,988 m.

There are little documented QA/QC procedures or data available

for programs prior to 2008.

The ongoing Goldshore drilling program utilizes full

industry-standard survey control and QAQC programs and is designed

to systematically redrill the deposits and validate as much of the

historical drilling as possible through collar surveys, re-logging,

and re-sampling.

Mineral Resource Classification

The Moss MRE has been classified as an inferred mineral

resource. This resource classification reflects the fact that much

of the drill hole data used for the resource estimate is

historical, and no QA/QC data or reports exist for the majority of

these drill holes. Statistical assessment of historical data and

recent data provided some support for the historical data, but also

included some inconsistencies. Goldshore’s planned program of

infill and confirmatory drilling is expected to support

classification of indicated mineral resource in subsequent mineral

resource updates.

Reasonable Prospects for Eventual Economic

Extraction

To support reasonable prospects for eventual economic extraction

for the MRE, CSA Global used the estimated block model to generate

an optimized open pit using Datamine NPV Scheduler software and the

following assumptions: a gold price of US$1,650/oz, plant recovery

of 92.5% and 96.5% for Moss Deposit and the East Coldstream

Deposit, respectively; processing costs of US$12.50/tonne,

mine-site general and administration costs of US$2.50/tonne

processed, mining costs of US$2.70/tonne moved, and an overall pit

slope angle of 50 degrees. NPV Scheduler Software is widely used by

mining engineers to apply the Lerchs-Grossman algorithm to block

models in order to generate optimized pit shells upon which

economic open pit mine designs may be based.

The MRE is are constrained within the selected optimized pit

shells which reach a maximum depth of approximately 450m and 250m

in the Moss Deposit and East Coldstream Deposit, respectively.

Next Steps

In late 2022, Goldshore commenced an extensive program of

relogging and resampling of all historical drill holes whose

collars have been located and accurately surveyed. Where possible,

these drill holes are also being surveyed using modern downhole

surveying equipment. Resampling of historical drill core is

ongoing, although most core blocks are now illegible rendering

resampling impossible.

Pete Flindell, VP Exploration for Goldshore, said “this MRE

has highlighted the larger scale of gold mineralization on the Moss

Gold Project. It remains conservative in many areas because of the

concerns over historical drill data and we look forward to updating

the quality and quantity of the mineral resource inventory

following a comprehensive infill drill program. In the meantime,

our field programs continue to develop our better exploration

targets with the potential to add significantly to our resource

base. At the same time, we will be working on the PEA, which will

optimize and evaluate the many mining and milling options available

to us. These include a high recovery flotation-regrind-leach mill

process, potential heap leaching of low-grade mineralization and

mining at different scales to maximize gold grades fed to the

mill.”

Qualified Person Statements

Dr. Matthew Field (Pr. Sci. Nat), Manager – Resources at CSA

Global is an independent “qualified person” under NI 43-101 and

responsible for the MRE. Dr. Field has prepared and approved the

scientific and technical information related to the MRE contained

in this news release.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President –

Exploration of the Company, and a “qualified person” under NI

43-101 has also reviewed and approved the scientific and technical

information contained in this news release.

About Goldshore

Goldshore is an emerging junior gold development company, and

owns the Moss Gold Project located in Ontario. Wesdome Gold Mines

Ltd. is currently a large shareholder of Goldshore. Supported

by an industry-leading management group, board of directors and

advisory board, Goldshore is positioned to advance the Moss Gold

Project through the next stages of exploration and development.

Neither the TSXV nor its Regulation Services Provider (as

that term is defined in the policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this

release.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288

4416

M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes |

Twitter: GoldShoreRes |

LinkedIn: goldshoreres

Cautionary Note Regarding Forward-Looking

Statements

This news release contains statements that constitute

“forward-looking statements.” Such forward looking statements

involve known and unknown risks, uncertainties and other factors

that may cause the Company’s actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Forward looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words “expects,”

“plans,” “anticipates,” “believes,” “intends,” “estimates,”

“projects,” “potential” and similar expressions, or that events or

conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among

others, statements relating to expectations regarding the

exploration and development of the Project, the filing of a

technical report supporting the MRE, commencement of a preliminary

economic assessment and prefeasibility study, and other statements

that are not historical facts. By their nature, forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance or

achievements, or other future events, to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such factors and risks

include, among others: the Company may require additional financing

from time to time in order to continue its operations which may not

be available when needed or on acceptable terms and conditions

acceptable; compliance with extensive government regulation;

domestic and foreign laws and regulations could adversely affect

the Company’s business and results of operations; the stock markets

have experienced volatility that often has been unrelated to the

performance of companies and these fluctuations may adversely

affect the price of the Company’s securities, regardless of its

operating performance; the impact of COVID-19; the ongoing military

conflict in Ukraine; and other risk factors outlined in the

Company’s public disclosure documents.

The forward-looking information contained in this news release

represents the expectations of the Company as of the date of this

news release and, accordingly, is subject to change after such

date. Readers should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. The Company undertakes no obligation to update these

forward-looking statements in the event that management's beliefs,

estimates or opinions, or other factors, should change.

Goldshore Resources (QB) (USOTC:GSHRF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goldshore Resources (QB) (USOTC:GSHRF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024