false

0001527702

0001527702

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November

14, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 2 – Financial

Information

|

Item 2.02 | Results of Operations and Financial Condition. |

We have issued press releases and a shareholder letter concerning our results

of operations and other matters.

The press releases and shareholder letter are furnished with this Current

Report on Form 8-K as Exhibits 99.1-99.3. The information furnished under this Item 2.02 and Item 9.01 of this Current Report on Form

8-K, including Exhibits 99.1-99.3, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in

any registration statement or other filing under the Securities Act of 1933, as amended, regardless of any general incorporation by reference

language in such filing, except as shall be expressly set forth by specific reference in any such filing.

SECTION 9 – Financial

Statements and Exhibits

|

Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date January 6, 2025

IQST - iQSTEL Announces $277 Million Net Revenue

for 2024, Achieves Record-Breaking $96 Million in Q4

January 6, 2025, New York,

NY – iQSTEL Inc. (OTCQX: IQST), a leading-edge multinational enhanced telecommunications and technology corporation,

is thrilled to announce that its net revenue for 2024 reached $277 million, based on preliminary accounting. This figure represents

95% of the annual revenue forecast. This significant achievement underscores iQSTEL’s exceptional growth trajectory and steadfast

commitment to achieving its vision of becoming a $1 billion revenue company by 2027.

Record-Breaking Q4 Performance

The company’s Q4 net

revenue reached an unprecedented $96 million, marking a staggering 77% increase compared to $52 million in Q3. This result

represents the highest quarterly revenue in the company’s history, highlighting the strength of iQSTEL’s commercial

strategy and the growing demand for its innovative solutions.

Achieving Synergy Through Subsidiaries

On a gross revenue basis,

iQSTEL achieved a landmark $300 million based on preliminary accounting, with approximately $23 million attributed to intercompany

transactions. This demonstrates the synergistic collaboration among iQSTEL’s subsidiaries, as intercompany revenue accounted

for over 7.6% of gross revenue, showcasing the teamwork and alignment driving the company’s success.

Unparalleled Annual Growth

Comparing 2024’s preliminary

net revenue of $277 million to 2023’s $144.5 million, iQSTEL achieved a phenomenal 91.6% year-over-year growth.

This pace of expansion solidifies the company’s position as a high-growth leader in the telecommunications and technology

industries.

Leandro Iglesias, CEO of iQSTEL, expressed his enthusiasm:

“We have set an incredible

commercial pace on our path to becoming a $1 billion company by 2027. The $277 million in revenue for 2024, compared to $144.5 million

in 2023, highlights our ability to execute and scale at an amazing rate. Moreover, our record-breaking $96 million revenue in Q4 sets

the bar for what we can achieve in the future. These results validate our business strategy, the strength of our team, and the unwavering

trust of our shareholders.”

Mr. Iglesias added:

“We are laying the groundwork

for our Nasdaq up-listing, showcasing exactly what national markets value: explosive growth. This year, we nearly doubled our revenue,

and this is just the beginning as we progress toward our ambitious goal of becoming a $1 billion revenue company by 2027.”

About iQSTEL:

iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) is a US-based multinational publicly listed company in the final stages of the path to becoming listed on NASDAQ. With

FY2024 revenues of $277 million based on preliminary accounting, iQSTEL is positioning itself for explosive growth. iQSTEL's mission is

to serve basic human needs in today's modern world by making essential tools accessible, regardless of race, ethnicity, religion, socioeconomic

status, or identity. The company recognizes that modern human needs such as physiological, safety, relationship, esteem, and self-actualization

are marginalized without access to ubiquitous communications, financial freedom, clean, affordable mobility, and information.

iQSTEL has been building

a strong business platform with its customers, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin

products across its divisions. iQSTEL is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions,

and high-margin product expansion.

| · | Telecommunications Services Division (Communications):

Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | Fintech Division (Financial Freedom):

Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App. |

| · | Electric Vehicles (EV) Division (Mobility):

Offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

| · | Artificial Intelligence (AI) Services Division (Information

and Content):

Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless

access to services, entertainment, and support in a virtual 3D interface. |

| · | Cybersecurity Services:

Through a new partnership with Cycurion, iQSTEL will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection,

incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients

and beyond. |

iQSTEL has completed 11

acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding its suite

of products and services both organically and through mergers and acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include,

but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information

relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates,

and projections about our business based partly on assumptions made by management. These statements are not guarantees of future performance

and involve risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely

to differ materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking

statements speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement

to reflect events or circumstances after the date of this news release. This press release does not constitute a public offer of any

securities for sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or

sold in the United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

IQST - iQSTEL Sets the Stage for Explosive

Growth with $340 Million Revenue Forecast for 2025

December

18, 2024, New York, NY— iQSTEL Inc. (OTCQX: IQST), a global leader in cutting-edge telecom, fintech, and technology solutions,

is thrilled to announce its ambitious $340 million revenue forecast for 2025. This bold projection underscores the company’s

relentless focus on organic growth, disruptive innovation, and strategic acquisitions poised to reshape its future.

Breaking Records, Building Momentum

iQSTEL has a track record

of exceeding revenue expectations by strategically revising its forecasts mid-year based on real-time market momentum. This proven approach

has built unwavering trust among investors and positioned the company as a rising star in the tech-driven market.

“Our $1 billion revenue

target for 2027 isn’t just a goal—it’s our roadmap,” stated Leandro Iglesias, CEO of iQSTEL. “With robust

organic expansion and a transformative acquisition on the horizon post-Nasdaq listing, we are ready to redefine market leadership.”

A Historic Q4 2024 Performance

The company is on track

to report its highest quarterly revenue ever in Q4 2024, breaking the previous record of $78.6 million set in Q2 2024. With this exceptional

performance, iQSTEL is working to achieve its $290 million revenue target for FY-2024.

Revenue Per Share Milestone: A New Era

“Our Telecom Division

continues to deliver unparalleled year-over-year growth,” Iglesias emphasized. “Crossing the one-third billion-dollar revenue

mark organically in 2025 is a testament to our team’s relentless dedication.”

He added: “We closed

FY-2023 with a Revenue Per Share (RPS) of $0.84. As of today, we’ve already exceeded $1.32 in Revenue Per Share (RPS) based

on preliminary figures—and the fiscal year isn’t over yet.”

Accelerating Into the Future

iQSTEL remains laser-focused

on scaling its operations, enhancing its high-margin product portfolio, and unlocking new opportunities in fintech, cybersecurity, and

AI-powered solutions. With a clear path toward its $1 billion revenue target by 2027, the company’s growth story is just

beginning.

About iQSTEL:

iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) is a US-based multinational publicly listed company in the final stages of the path to becoming listed on NASDAQ. With

FY2023 revenues of $144 million and a forecasted $290 million in revenue, alongside positive operating income of seven digits in our Telecom

Division for FY-2024, iQSTEL is positioning itself for explosive growth. iQSTEL's mission is to serve basic human needs in today's modern

world by making essential tools accessible, regardless of race, ethnicity, religion, socioeconomic status, or identity. The company recognizes

that modern human needs such as physiological, safety, relationship, esteem, and self-actualization are marginalized without access to

ubiquitous communications, financial freedom, clean, affordable mobility, and information.

iQSTEL has been building

a strong business platform with its customers, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin

products across its divisions. iQSTEL is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions,

and high-margin product expansion.

| · | Telecommunications Services Division (Communications):

Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | Fintech Division (Financial Freedom):

Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App. |

| · | Electric Vehicles (EV) Division (Mobility):

Offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

| · | Artificial Intelligence (AI) Services Division (Information

and Content):

Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless

access to services, entertainment, and support in a virtual 3D interface. |

| · | Cybersecurity Services:

Through a new partnership with Cycurion, iQSTEL will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection,

incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients

and beyond. |

iQSTEL has completed 11

acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding its suite

of products and services both organically and through mergers and acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

IQST - iQSTEL Releases Q3 FY-2024 Shareholder Letter Highlighting

Record Growth, Strategic Expansion, and Nasdaq Uplisting Progress

November 14th, 2024, New York, NY

– iQSTEL Inc. (OTCQX: IQST), a leading innovator in telecommunications and technology, proudly announces the release of its Q3 FY-2024

Shareholder Letter, coinciding with the SEC filing of its 10-Q for the Q3. This letter showcases an extraordinary quarter marked by strategic

growth, robust financial performance, and significant advancements toward iQSTEL’s long-term vision, including preparations for

a Nasdaq uplisting.

The Shareholder Letter covers key highlights

for the nine-month period ended September 30, 2024, showcasing iQSTEL’s rapid revenue growth, profitability in its core Telecom

Division, and ongoing advancements in high-margin, cutting-edge products including AI and cybersecurity solutions.

“We’re exceptionally proud

of our achievements this quarter, and we believe our performance confirms the strength of iQSTEL’s strategy and position in the

market,” said Leandro Jose Iglesias, CEO of iQSTEL. “With record-breaking growth, innovative new offerings, and solid progress

toward our Nasdaq uplisting, iQSTEL is positioned for unprecedented success as we look ahead to 2025 and beyond.”

In alignment with its commitment to becoming

a $1 billion revenue company by 2027, iQSTEL has developed a comprehensive business plan supported by its newly established corporate

financial planning department. This department will work closely with our subsidiaries on a monthly basis to drive bottom-line improvements,

setting the stage for significant profitability gains beginning in FY-2025.

Additionally, iQSTEL’s Independent

Board of Directors and dedicated investor base continue to demonstrate strong support for the company’s vision and growth strategy,

underscoring our shared commitment to building a premier, high-growth technology powerhouse.

The Q3 Shareholder Letter highlights the following key developments:

- Record

Revenue Growth: Revenue for the first nine months reached $184 million, an impressive 89% year-over-year increase.

- Ambitious

FY-2024 Revenue Target: iQSTEL aims for a record $290 million in revenue for FY-2024, with strong expectations for Q4, driven by

its subsidiary QXTEL.

- Profitability

in Telecom Division: The Telecom Division achieved solid profitability, generating $548,274 in profit for Q3 alone.

- Strategic

Cost Savings: A consolidation strategy within the Telecom Division is expected to save up to $2 million annually.

- Nasdaq

Uplisting Progress: iQSTEL’s stockholders’ equity has met Nasdaq’s minimum requirements, with final investment

bank selection underway to guide the uplisting process.

- Global

Reach: iQSTEL now operates with 100 employees across 20 countries, with six offices providing 24/7 support across 17 time zones.

- Launch

of High-Tech, High-Margin Products: The company has introduced AI-driven AIRWEB.ai and preparing to launch a cybersecurity solution

in Q1 FY-2025.

The Shareholder Letter concludes with an optimistic outlook

for iQSTEL’s trajectory as the company continues to pursue its $1 billion revenue goal by 2027.

The full Shareholder Letter can be found below:

Dear Shareholders,

We are thrilled to present our Q3 FY-2024 results, which highlight

an extraordinary period of growth and strategic advancement for iQSTEL. This quarter has firmly positioned us on a path to unprecedented

success, and we’re eager to share the positive progress we’re making.

1. Revenue and Profitability

Outstanding Nine-Month Revenue Growth

For the nine months ending September 30, 2024, iQSTEL’s revenue skyrocketed to $184 million—nearly double last year’s

$97 million, reflecting a remarkable 89% increase. This powerful growth underscores strong market demand and our strategic expansion,

especially in our Telecom Division, which remains our primary driver of profitability and success.

Ambitious Full-Year Revenue Target

Our goal for FY-2024 is $290 million in revenue. With a gap of $106 million remaining to reach this target, we are mobilizing every

resource to close it. Historically, Q4 has been our strongest quarter, and with QXTEL leading our international business, we are confident

we will achieve our projections and finish the year on a high note.

Robust Gross Profit Base

Our gross profit reflects our ability to grow efficiently and sustainably:

- Nine Months:

Gross profit surged to $5.6 million, up from $3 million in 2023.

- Quarterly:

Q3 gross profit doubled to $2 million, establishing a consistent quarterly profit foundation.

Our stable business platform now enables us to generate $2

million in gross profit per quarter, paving the way for further bottom-line improvements through consolidation and the migration to

a unified telecom platform.

Notably, in FY-2024, our gross margin has shown consistent

improvement, increasing from 2.68% in Q1 to 3.72% in Q3, a remarkable 39% increase within the year. This progress

underscores our focus on efficiency and profitability as we scale.

Consolidated Operating Income

- Nine Months:

Our operating loss was $535,952, mainly due to QXTEL integration expenses.

- Quarterly:

In Q3, our operating loss narrowed to $56,553, bringing us closer to the profitability threshold. Our Telecom Division continues

to be a robust profit engine, effectively covering the company’s core expenses.

Telecom Division Profitability and Consolidation Strategy

Our Telecom Division generated $548,274 in profit for Q3, confirming its role as a steady revenue source. We’ve launched

a consolidation strategy within this division, with potential important savings. Recent actions in Q4 with SwissLink and QGlobal SMS are

completely aligned with this strategy, and we are planning to begin to show its effects as early as Q4 of this year.

2. Interest Expense

Interest expenses rose to $1.5 million for the nine

months, primarily due to strategic debt used for growth. We remain committed to maintaining long-term shareholder value by absorbing these

interest costs instead of opting for equity dilution. Our outstanding share count remains below 187 million shares, which represents

an increase less than 9% versus Dec 31, 2023. Notably, our investors have recently demonstrated their support by extending the maturity

of our convertible notes by 12 months, with all notes now set to mature in Q1 FY-2026.

3. Assets and Liabilities

- Asset Growth:

Total assets rose to $32.4 million, up from $22.2 million in 2023, bolstered by QXTEL goodwill and increased accounts receivable.

- Liabilities:

Current liabilities grew to $24.1 million, a level we are strategically managing to support continued growth.

4. Cash Flow and Liquidity

Our financing activities generated $6.2 million in cash

over the nine months, supporting our acquisition and expansion strategies. We ended the quarter with a steady $2.1 million in

cash, demonstrating effective liquidity management as we scale.

5. Stockholders’ Equity and Nasdaq Uplisting Readiness

iQSTEL’s stockholders’ equity rose to $8.1

million, surpassing the minimum requirement of $5 million for a Nasdaq uplisting. We are in the final stages of selecting an investment

bank to support us in this pivotal move. Our goal is to position iQSTEL as a $1 billion revenue company by 2027, and uplisting

to Nasdaq is a crucial step toward achieving this vision.

6. Global Presence, Operational Reach, and branding

Our global reach now spans 100 employees across 20 countries

and 17 time zones with six offices worldwide, providing 24/7 service from California to Melbourne. This global presence enables us

to effectively serve clients around the world, reinforcing our position as a leading global player. As part of our Telecom Division’s

consolidation, we are optimizing our global network and operations to maximize efficiency.

The company has been collaborating with ONAR, a marketing

agency, to develop a comprehensive branding strategy for iQSTEL. Management recognizes that achieving our vision of becoming a $1 billion

revenue corporation requires establishing strong brand recognition as a cornerstone of our growth.

7. Innovation in High-Tech, High-Margin Products

- High Margin

Strategy: iQSTEL has built connections with some of the world’s largest telecommunications companies, generating millions in

annual revenue. With these robust relationships, we’re poised to expand our offerings, focusing on high-tech, high-margin products.

- Cybersecurity:

We’re collaborating with Cycurion.com to launch a telecom-targeted cybersecurity service in Q1 FY-2025.

- AI Solutions:

Our recent launch of AIRWEB.ai has exceeded expectations, attracting strong interest with its free plan and positioning us as

a leader in AI-enhanced telecom services.

Summary

iQSTEL’s financial and operational results for Q3 and

the first nine months of 2024 reflect transformative growth and strategic expansion. With a profitable Telecom Division, a successful

QXTEL acquisition, and a solid equity foundation, we are well-prepared for our Nasdaq uplisting, a long-awaited goal of our 22,000 shareholders.

Our newly established corporate financial planning department

is set to work closely with our subsidiaries on a monthly basis, implementing a robust plan to drive bottom-line results starting in FY-2025.

With a steadfast commitment from our Independent Board of Directors and strong investor support, iQSTEL is on an accelerated path to becoming

a $1 billion revenue powerhouse by 2027.

The future is bright, and we are deeply grateful for your

continued support and belief in our journey. Together, let’s make this vision a reality.

Thank you for your continued support.

Sincerely,

Leandro Jose Iglesias

President & CEO, iQSTEL

About iQSTEL (Updated Oct. 2024):

iQSTEL Inc. (OTC-QX: IQST)

(www.iQSTEL.com) is a US-based multinational publicly listed company in the final stages of the path to becoming listed on NASDAQ. With

FY2023 revenues of $144 million and a forecasted $290 million in revenue, alongside positive operating income of seven digits for FY-2024,

iQSTEL is positioning itself for explosive growth. iQSTEL's mission is to serve basic human needs in today's modern world by making essential

tools accessible, regardless of race, ethnicity, religion, socioeconomic status, or identity. The company recognizes that modern human

needs such as physiological, safety, relationship, esteem, and self-actualization are marginalized without access to ubiquitous communications,

financial freedom, clean, affordable mobility, and information.

iQSTEL has been building

a strong business platform with its customers, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin

products across its divisions. iQSTEL is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions,

and high-margin product expansion.

| · | Telecommunications Services Division (Communications):

Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | Fintech Division (Financial Freedom):

Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App. |

| · | Electric Vehicles (EV) Division (Mobility):

Offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

| · | Artificial Intelligence (AI) Services Division (Information

and Content):

Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless

access to services, entertainment, and support in a virtual 3D interface. |

| · | Cybersecurity Services:

Through a new partnership with Cycurion, iQSTEL will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection,

incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients

and beyond. |

iQSTEL has completed 11

acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding its suite

of products and services both organically and through mergers and acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

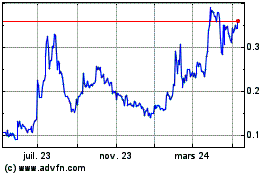

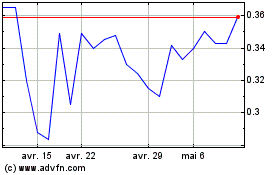

iQSTEL (QX) (USOTC:IQST)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

iQSTEL (QX) (USOTC:IQST)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025