Protect

Pharmaceuticals Shares Could Soar As Merger Date

Approaching

Soon

September 25, 2020 -- InvestorsHub

NewsWire -- via BioResearchAlert --

-

Protect

Pharmaceutical Corp. (PRTT:

OTC) revitalizes farming soil and produces organic, toxin-free

crops to meet the increasing global demand for agricultural

sustainability initiatives

-

PRTT building 2

new production facilities in Europe projected to increase 2021

revenues by $60 million

-

Novgorod is an

international food production company that is ranked as one of

Russia's 50 fastest growing companies with 2019 sales of

$128,913,000 and growth of about 50% per year for past 2

years

-

PRTT announced

Novgorod will acquire controlling interest of PRTT. Upon completion

of merger and Novgorod's reporting to GAAP accounting

standards,the

combined

companies will trade as PRTT

-

Financial reports

due within 60 to 90 days are expected to finalize merger and

trigger higher share prices resulting from dramatic increases in

sales, operations, and assets

About

Protect Pharmaceutical Corp

Under the

umbrella of Protect Pharmaceutical Corp. (PRTT:

OTC), Agropharmacy

provides

sustainable products to revitalize farming soil, and produce more

robust and abundant toxin-free crops in order to meet the

increasing global demand for agricultural sustainability

initiatives.

Aug. 03, 2020

Protect Pharmaceutical announced,

"Protect Pharmaceutical's Agropharm A Fertilizer Was Shown To

Increase Crop Yields By As Much As 30%". "This

shows a very promising trend in Protect Pharmaceutical's plans

to become

Europe's leading bio-fertilizer provider" comments

Angela Savcenco, Director of European

Operations.

July 7, 2020

PRTT announced 2new

installations in 2020. Agropharm organic fertilizer production

sites will be launched in Slovenia and Spain to further develop

our Agropharmacy

program to

increase the quality and quantity of organic food.

Savcenco

commenting

further said,"The

two new

installations will allow the company to supply demand within all

boarders of the European Union. This also signals the transition

from the active testing stage to active marketing. The

installations in Slovenia and Spain will mean that the company

should capture approximately 50 million Euro per year in new

revenues once construction is completed. The company is targeting

the new installations to be fully operational by the beginning of

the 2021 planting."

Protect

Pharmaceutical Corp and Novgorod Merger

September 15,

2020 Protect Pharmaceutical Corp announced an

agreement to be acquired and merged with Novgorod which

specializes in the production and sale of sugar, flour, cereals and

other groceries. Actively successful in the Russian food market for

over 15 years, Novgorod operates with such retail giants as

AO Tander (Magnit), X5 Retail Group,

OOO Lenta, AO Dixy South and others.

Novgorod reported 9.7 Billion (RUB) (US $128,913,000 as of release)

in revenues for 2019. Second quarter 2020 revenues were 3.7 (RUB)

(US $49,173,000.00 as of release).

Under the agreed

terms, Novgorod will acquire control of Protect Pharmaceutical Corp

upon completion of the transition of Novgorod's reporting to GAAP

accounting standards. Protect Pharmaceutical Corp will continue to

operate as a public company and the eventual resulting combined

company will continue to trade under the symbol PRTT.

Protect

Pharmaceutical Corp and Novgorod foresee incredible synergies from

the transaction. Novgorod intends to use Protect Pharmaceutical

products for its own production and

Protect Pharmaceutical Corp will harness the market power of

Novgorod as an incredible opportunity for expansion. "This is an

amazing milestone for Protect Pharmaceutical. We have been

searching for the right partner to expand and grow and in Novgorod

we have found it," states Angela Savcenco.

Current

Market Comps

Five current

market comps were selected and ranked from smaller to larger

companies in similar industries. Average Price (Market Cap) to

Sales Ratio of 16.7 to 1 was calculated and determined for this

group of market comparison companies.

Arcadia

Biosciences – (RKDA:

Nasdaq)

Share price

09/16/2020 - $3.05

2019 Sales -

$1.17 million

Market cap - $33

million

Price to Sales

Ratio – 28.2

Marrone

Bio Innovations

(MBII:

Nasdaq)

Share price

09/16/2020 - $1.20

2019 sales -

$29.4 million

Market cap - $179

million

Price to Sales

Ratio – 6

Precision

BioSciences

(DTIL:

Nasdaq)

Share price

09/16/2020 - $5.93

2019 sales -

$22.23 million

Market cap - $310

million

Price to Sales

Ratio – 14

Beyond Meat

(BYND:

Nasdaq)

Share Price

09/16/2020 - $156.57

2019 sales - $298

million

Market cap - $9.8

billion

Price to Sales

Ratio – 32

FMC Corp

(FMC:

NYSE)

Share Price

09/16/2020 - $110.67

2019 sales - $4.6

billion

Market cap -

$14.7 billion

Price to Sales

Ratio – 3.2

AVERAGE

PRICE TO SALES RATIO = 16.7

Market Comp

PRTT Share Price When Merger is Concluded

Potential PRTT

share price based on current market comps of Price to Sales Ratio

of 16.7 to 1 and combined 2019 sales exceeding $128,913,000 and 55

million shares outstanding is $39.14 per share.

With additional

sales from the 2 new production facilities coming on line at the

beginning of the 2021 planting season, sales are expected to

increase by $60 million annually which could further increase

PRTT share price

by $18.21 per share to $57.34 sometime in Q2/Q3 2022 when a full

year sales is reported for the new production

facilities.

The trend to

lower Sales to Price Ratio for larger companies suggests that as

PRTT grows, the ratio will decrease accordingly and share price

expectations will be adjusted accordingly.

When the PRTT and

Novgorod reverse merger is concluded as announced and when Novgorod

sales are combined with PRTT, then the potential and likelihood for

substantially higher PRTT share prices approaching the current

market comp of 16.7 to 1 is current market guidance based on

actual comps.

Fair Market Value

should not be expected to be achieved immediately upon the close of

the merger, but will likely take some time for investors to learn

about this compelling story. The time to realize full Fair Market

Value is never known exactly and can be influenced by many factors

outside the world of PRTT. That time is greatly determined by

visibility in the investment world or in other words by "Investor

Awareness."

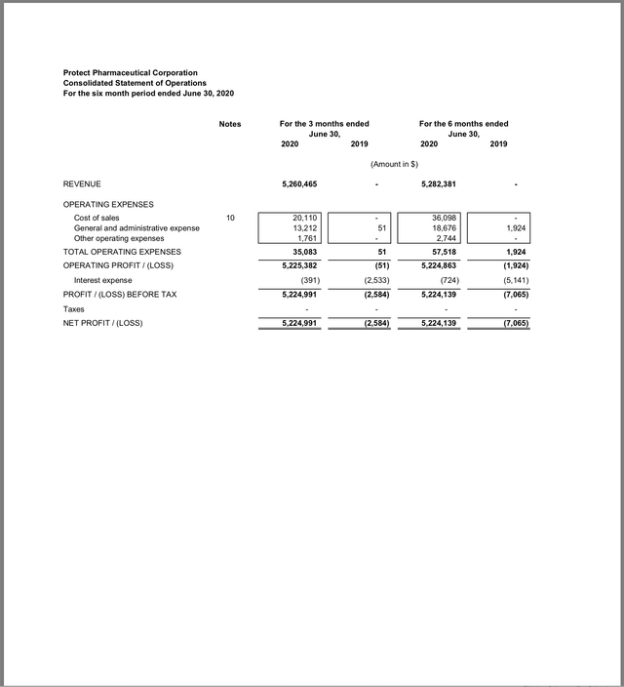

Most Recent

Protect Pharmaceuticals Filings

Until

Audited Financials are Released Q4 2020

Based on existing

operations and growth of Protect Pharmaceuticals Corp combined with

the announced reverse merger of Novgorod into PRTT, current shares

of PRTT appear to be an outstanding bargain for astute investors.

The most notable risk is the exposure to the merger not

materializing as planned. With the merger announcement already made

and the current auditing of financials underway, the risk seems low

and the reward seems exceptionally high.

Forward-Looking

Statements: This press release contains "forward-looking

statements" within the meaning of Section 21E of the Securities

Exchange Act of 1934. Except for historical matters contained

herein, statements made in this press release are forward-looking

statements. Without limiting the generality of the foregoing, words

such as "may", "will", "to", "plan", "expect", "believe",

"anticipate", "intend", "could", "would", "estimate," or

"continue", or the negative other variations thereof or comparable

terminology are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risk,

uncertainties and other factors which may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Also, forward-looking statements

represent our management's beliefs and assumptions only as of the

date hereof. Additional information regarding the factors that may

cause actual results to differ materially from these

forward-looking statements is available in the Company's filings

with OTC Markets. Except as required by law, we assume no

obligation to update these forward-looking statements publicly or

to update the reasons actual results could differ materially from

those anticipated in these forward-looking statements, even if new

information becomes available in the future.

SOURCE: BioResearchAlert