By Nick Kostov and Suzanne Vranica

The world's biggest marketers are taking aggressive steps to

change how they buy ads, triggering upheaval across the advertising

industry.

Consumer products giant Procter & Gamble Co. said Thursday

that it slashed spending on digital advertising by more than $200

million last year, after a recent push for more transparency had

revealed such spending to be largely wasteful.

The cut is a sliver of P&G's overall annual ad spending,

which was $7.1 billion in the fiscal year that ended in July, but

it represents an important shift after years of marketers raising

digital ad spending almost reflexively.

Meanwhile, WPP PLC, the world's largest ad agency company, on

Thursday logged its worst performance since the financial crisis,

posting a decline in net sales for the year and projecting no

growth in 2018. Among the reasons: Big clients like P&G and

Unilever PLC have been stepping up their campaigns to cut ad agency

costs.

The developments highlight the fallout as marketers reassess

their relationships with ad agencies and big tech companies like

Facebook Inc. and Alphabet Inc.'s Google in an increasingly complex

media environment.

WPP shares tumbled 8.2% in London, and the news affected rivals

including Publicis Groupe SA, which fell 3.4% in Paris.

Marketers aren't cutting their ad spending overall. Global ad

spending is projected to rise 4.3% this year, according to GroupM.

But, as they contend with pressures on their businesses, marketers

are focusing on how to rein in costs paid to agencies, limit the

number of agencies they work with, and make ad spending more

efficient. They are also bringing in-house some creative and

ad-buying functions once handled by agencies.

"It's time to disrupt this archaic 'Mad Men' model,'" P&G

Chief Brand Officer Marc Pritchard said Thursday at an ad industry

event.

Mr. Pritchard has been pushing digital giants including Google

and Facebook to improve safeguards to keep ads from appearing

around controversial content, and to allow independent verification

of the data they release on the reach of ad campaigns.

He said the companies have done much of what he asked, including

providing better metrics. But in part thanks to the enhanced

measurement data and transparency, P&G realized some people

were seeing the same ads far too many times, and that the average

view time for a mobile ad in a platform like Facebook was only 1.7

seconds.

"Once we got transparency, it illuminated what reality was,"

said Mr. Pritchard. P&G then took matters into its owns hands

and voted with its dollars, he said.

P&G, whose brands include Tide, Pampers and Crest, has said

that it is looking to cut an additional $400 million over three

years in agency and production costs, having already saved around a

combined $750 million in recent years.

Mr. Pritchard didn't specify which digital companies P&G had

reduced spending with, but one of the biggest reductions was with

Google's YouTube. P&G suspended advertising on the popular

online video service a year ago after ads appeared alongside

objectionable videos.

YouTube has added more human reviewers and given marketers more

control over where ads appear, while Facebook's recent newsfeed

algorithm changes helped address concerns over the quality of

content, including news, on its platform.

"P&G is a great partner to Facebook," Facebook said in a

statement. "We're proud of the work we've done together,

particularly in the areas of third-party verification and brand

safety."

Google declined to comment.

P&G said it hasn't reduced its overall spending, but has

shifted those digital dollars into other areas.

For their part, big ad agency companies that have traditionally

bought advertising space on behalf of marketing clients are under

pressure to reinvent themselves to remain relevant as the industry

changes. Advertisers are demanding that their agency partners be

more transparent about media-buying, so it is clear that agencies

are getting the best possible deal for the clients and aren't

receiving rebates from sellers.

Advertisers also want agency-holding companies like WPP to

streamline their complicated organizations -- alphabet soups of

agencies that were assembled through years of acquisitions. Mr.

Pritchard called for companies to combine their creative and media

operations to foster better collaboration.

The ad giants haven't made that bold of a move yet, but are

working to come up with ways for clients to work with advertising

staff that was previously siloed.

"We have to alter our model," WPP Chairman and Chief Executive

Martin Sorrell said in an interview.

"We're clear on the destination," he added. "The changes that

are taking place are pushing us to do it faster."

This year alone, WPP has announced the merger of its

public-relations firms Burson-Marsteller and Cohn & Wolfe and

said that it would consolidate five of its branding agencies into

one. In 2017, it combined its media agencies Maxus and MEC to form

Wavemaker; moved its digital agency Possible into its

customer-relationship marketing business Wunderman; and created WPP

Health & Wellness out of its four large health-care

agencies.

WPP executives often refer to this approach as "horizontality,"

while rival Publicis is trying to unite its operations in a

restructuring dubbed "The Power of One." Omnicom Group Inc. has

also been pushing to simplify areas like customer relationship

management, national brand advertising and public relations.

WPP's results Thursday showed that the changes so far haven't

been enough to counter the industry's headwinds. Investors expected

sales to be broadly flat after the company had cut its forecast

three times, so they were spooked by the year-over-year decline.

The firm also said it is setting budgets for 2018 on the assumption

of no growth in revenue and net sales.

In the fourth quarter, organic net sales were down 3.4% in North

America, 2.6% in Western Continental Europe and 3% in Asia Pacific.

The bright spot was the U.K., which rose 9.1%.

"2017 for us was not a pretty year," Mr. Sorrell said.

--Stacy Meichtry contributed to this article.

Write to Nick Kostov at Nick.Kostov@wsj.com and Suzanne Vranica

at suzanne.vranica@wsj.com

(END) Dow Jones Newswires

March 01, 2018 18:51 ET (23:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

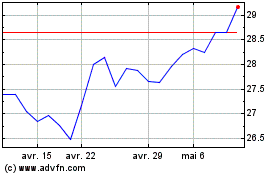

Publicis Groupe (QX) (USOTC:PUBGY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Publicis Groupe (QX) (USOTC:PUBGY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024