UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

1-SA

SEMIANNUAL

REPORT PURSUANT TO REGULATION A

For

the fiscal semiannual period ended:

June

30, 2022

UC

Asset, LP

(Exact

name of issuer as specified in its charter)

Delaware |

|

30-0912782 |

State

of other jurisdiction of

incorporation or organization |

|

(I.R.S.

Employer

Identification No.) |

537

Peachtree Street NE, Atlanta GA 30308

(Full

mailing address of principal executive offices)

(470)

475-1035

(Issuer’s

telephone number, including area code)

INFORMATION

TO BE INCLUDED IN REPORT

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

We

make statements in this semiannual report on Form 1-SA (the “Semiannual Report”), that are forward-looking statements within

the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,”

“intend,” “plan,” “seek,” “may,” and similar expressions or statements regarding future

periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties

and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially

from any predictions of future results, performance or achievements that we express or imply in this Semiannual Report or in the information

incorporated by reference into this Semiannual Report.

The

forward-looking statements included in this Semiannual Report are based upon our current expectations, plans, estimates, assumptions

and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among

other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the

forward-looking statements.

Any

of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking

statements included in this Semiannual Report. All forward-looking statements are made as of the date of this Semiannual Report and the

risk that actual results will differ materially from the expectations expressed in this Semiannual Report will increase with the passage

of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking

statements after the date of this Semiannual Report, whether as a result of new information, future events, changed circumstances or

any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Semiannual Report,

the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives

and plans set forth in this Semiannual Report will be achieved.

Item

1. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The

business purpose of our Partnership is to invest for capital appreciation.

Our

business model is to invest in properties that are undervalued or have considerable potential to appreciate in the near future. This

often involves innovative investment models which will either introduce a property to a new niche market, or facilitate new business

relationships surrounding a property, under which the value of the property may reach its maximum potential. It also requires visionary

thinking, to invest in properties before the market situation may experience dramatic change due to the emerge of new technologies, new

economic factors, and/or new regulations.

Since

our approach is innovative, there are usually no pre-defined cycles for our investments. It may take as short as a few weeks, or as long

as several years, before we complete an investment cycle and sell a portfolio property. During our holding period, a property usually

does not produce much cash income, or no cash income at all. Since we are using historic cost as our bookkeeping method, our book will

likely show the property as losing money, until the moment when we sell the property. Only then will we be able to book all the profit

(if any) accumulated over the whole period of investment cycle. This will constantly result in irregularity and volatility of our booked

revenue and profit.

We

will discuss more about the impact of accounting method on our financials in “Critical Accounting Estimate” at the end of

this Item 1.

Material

Changes in Financial Statements

Change

of Revenue

| Six Months Period Ended June 30 | |

2022 | | |

2021 | |

| INCOME | |

| | | |

| | |

| Sales of portfolio properties | |

$ | - | | |

$ | 1,909,644 | |

| Rental income | |

| 7,500 | | |

| 61,242 | |

| Unrealized gain(loss) on marketable securities | |

| (490,000 | ) | |

| - | |

| Interest income | |

| 64,800 | | |

| 93,605 | |

| Total income | |

$ | (417,700 | ) | |

$ | 2,063,951 | |

Our

sales of portfolio properties dropped to zero during the six months period ended June 30, 2022, because we had almost completely sold

our holdings in residential properties in fiscal year 2020 and 2021. We sold no properties for the six months ended June 30, 2022. For

the same period, our rental income also dropped, because we were not holding many residential properties, which generating rental income.

During

the period we also took an unrealized loss on certain marketable securities we held in our portfolio, in the context of the overall bearish

trend of the US stock market.

Our

interest income went down slightly, because, for the first quarter of 2022, we forbore interest on the $950,000 remaining balance on

a note, in exchange for that a third party will buy out the remaining balance. We resumed charging interest after the third party defaulted

in March, 2022.

Change

of operating expenses

Our

operating expenses remained stable in the first half of 2022, compared to the first half of 2021. Professional fees increased slightly,

because we launched a business plan in the beginning of 2022, to work toward a secondary public offering to be combined with an up-listing

to NYSE. That plan was later suspended at the end of first half of 2022.

Our

general and administrative expenses increased by approximately $110,000, from approximately $70,000 for the six months ended June 30,

2021, to approximately $180,000 for the same period in 2022. This was mostly because of the increase in general expenses, which includes

1) the increase of property tax from $0 in the first half of fiscal year 2021, to approximately $33,000 in the first half of fiscal year

2022; 2) the increase in marketing and advertisement costs, from approximately $17,000 in the first half of fiscal year 2021, to approximately

$70,000 in the first half of fiscal year 2022; and 3) the increase of travel expenses, from approximately $2,000 in the first half of

fiscal year 2021, to approximately $20,000 in the first half of fiscal year 2022.

The

latter two categories of general expense increases were mostly the result of our increased marketing and business development campaign

in the first half of 2022, with the business goal to launch a secondary public offering and to do an up-listing to NYSE, and to develop

a $20-50 million investment portfolio of cannabis properties.

Changes

of gross margin and net income

For

the first half of fiscal year of 2021 and 2022, our gross operating profit was $133,496 and negative $417,700 respectively. For the same

period, our net income was negative $151,113 and negative $844,222 respectively. Net income is negative $0.03 per share and negative

$0.15 per share respectively. We started distributing a dividend of $0.10/share in 2022, and distributed $90,206 during the first half

of the year.

| Six Month Period ended June 30 | |

Gross

Profit | | |

Net

Income | | |

Net Income /

Common

Unit | |

| 2021 | |

$ | 133,496 | | |

$ | 151,113 | | |

$ | 0.03 | |

| 2022 | |

$ | 417,700 | | |

$ | 842,222 | | |

$ | 0.15 | |

The

changes of gross margins and net income was mostly the result of changes of our revenue and operating expenses.

Other

Material Changes in Financial Statements

Our

loan to related parties decreased by approximately $330,000 as the result of: 1) one of the related parties paid off its loan upon maturity;

and 2) another one of the related parties continued paying off his advancement of management fees.

Our

loan to third parties increased by approximately $250,0000 as the result of: 1) we lent $200,000 as a pre-IPO bridge loan to a third

party; and 2) accumulation of unpaid interest on our third-party loans.

Liquidity

and Capital Resources

Cash

Flows

As

an investor, we do not manage the daily operation of any of our portfolio properties, except for some insignificant and non-material

operative activities. We intend to form partnerships with third party operators/managers to conduct daily operations. We usually require

the third-party to bear all operating cost, except for capital spending which will increase the value of properties.

Meanwhile

we apply a disciplined investment strategy, under which we will usually make new investments only when we have cash available.

Under

such a business model, we don’t usually have any significant amount of cash commitments, except for 1) management fees and professional

fees, which are usually stable and predictable period-to-period; and 2) amount due on our debt financing.

The

following table shows a summary of cash flows for the periods set forth below.

| | |

6 Months Ended

June 30,

2022 | | |

6 Months Ended

June 30,

2021 | |

| Net cash provided by (used in) operating activities | |

$ | (352,357 | ) | |

$ | (170,440 | ) |

| Net cash provided by (used in) investing activities | |

$ | (516,683 | ) | |

$ | 1,072,119 | |

| Net cash provided by (used in) financing activities | |

$ | - | | |

$ | 400,000 | |

| Cash at beginning of period | |

$ | 1,256,371 | | |

$ | 1,419,710 | |

| Cash at end of period | |

$ | 387,331 | | |

$ | 2,721,469 | |

Change

of Cash Level

Our

cash reserve on June 30,2022 decreased to approximately $387,000, from approximately $2.7 million on June 30, 2021. Management believes

this is a healthier level of cash reserve. As an investment company, we do not want to have a large amount of cash on hands, which will

not yield any return. On the other hand, we always need a cash reserve so that we can invest when a great opportunity presents itself.

Net

Cash (Used in) Provided in Operating Activities

Our

net cash from operating activities decreased to approximately negative $352,000 in the first half of 2022, from a negative $170,000 in

the first half of 2021. This mostly is the result of the increase in general and administrative spendings by approximately $110,000,

and the decrease of our rent income by approximately $54,000.

Net

Cash (Used in) Provided by Investing Activities

Our

net cash provided by investing activities is primarily the result of cash received from divesting our existing portfolio assets (including

properties and loans), reduced by cash used for investing in new portfolio assets.

For

the six months ended June 30, 2022, we did not divest any properties. We invested $235,477 into improvement of portfolio assets, $200,000

in a short term loan, and paid approximately $90,000 of dividends, which resulted in a net negative cashflow of approximately $517,000.

For

the six months ended June 30, 2021, we received approximately $1.91 million from divesting portfolio assets, received $24,000 of loan

repayments, made approximately $768,000 investments in new portfolio assets, and made $100,000 into new loan investments, which resulted

in a net cashflow of approximately $1.07 million.

Net

Cash Provided by Financing Activities

For

the six months ended June 30, 2021, net cash provided by financing activities was primarily the result of a construction loan in the

amount of $400,000.

For

the six months ended June 30, 2022, net cash provided by financing activities was primarily the result of repayment of a related party

loan, and the redemption of 166,667 Series A preferred shares. The two transactions offset each other, resulting in a net cashflow of

zero.

Commitments

and Contingencies

We

pay quarterly management fees to our general partner, UCF Asset LLC. Management fees are calculated at 2.0% of assets under management(AUM)

as of the last day of our preceding fiscal year. According to our bylaw, the value of AUM is determined using fair market value (FMV)

accounting. Management fees for the six months ended June 30, 2021 and 2022 were $90,575 and $90,000, respectively.

We

used to lease space from an unaffiliated third party at 2299 Perimeter Park Drive, Suite 120 in Atlanta, GA. We terminated that lease

and had no longer paid any rent since April 2022.

We

have an outstanding construction loan of $400,000 and are paying monthly interest on that debt at an annual rate of 4.25%. The debt matured

in the third quarter of 2022 and was extended for another 12 months.

The

Company is in the process of distributing a dividend of $0.10 per common unit for the year of 2021. The total amount of dividend will

be approximately $548,500 based on the number of common units currently outstanding. Approximately $90,000 was distributed by the end

of June 30, 2022.

Capital

Resources

Since

our inception, we have funded our operations primarily through the sale of limited partner interests sold in private placements. Our

Initial Public Offering pursuant to Regulation A plus was closed on October 12, 2018. The net proceeds of capital raised in the offering

was $1.15 million. On March 02, 2020, we closed a private placement from an accredited investor, pursuant to which the Company raised

a total of $300,000, which was redeemed in June 2022.

The

Company may raise more capital through private or public offering of its partnership units. There are no guarantees, however, that the

Company will be able to do so.

Debt

financing

As

of and by December 31, 2021, our outstanding debt includes a loan facility of $400,000 from a local bank, utilized by our subsidiary

SHOC LLC. It carries an annual interest rate of 4.25%. It matured in the third quarter of 2022 and was extended for another 12 months.

Trend

information

The

following discussion covers some significant trends or uncertainties affecting our business during the reporting period, in our industry

or on macro economy level. These trends might have impacts on our continuing operations, particularly on our portfolio investments.

Expansion

of our portfolio into cannabis properties

On

September 29, 2021, the Company announced that we will expand our portfolio into cannabis properties. On November 15, 2021, we announced

that we will follow similar investment strategies implemented by other public companies, such as Power REIT (NYSE: PW). As of and by

June 30, 2022, we have not made any investment into cannabis properties.

Shifting

of our portfolio investments from residential to income-producing

Our

real estate portfolio used to be only residential properties. Starting from early 2020, we have been exiting our investments in residential

properties, and shifting our investment to income producing properties, including Airbnb properties and office spaces (historic landmarks).

By and as of the end of 2021, residential properties had dropped to less than 50% of our portfolio property investments. By and as of

June 30, 2022, residential properties had dropped to approximately 40% of our portfolio property investments.

Impact

of COVID-19 on national and local real estate markets

The

COVID-19 pandemic has had a huge impact on real estate markets. We have closely followed its impacts. We published a “White Paper”

on February 23, 2021, to outline our major observations, analyses, and conclusions. As of June 30, 2022, we do not believe that there

will be further major impacts on our business from COVID-19 in the foreseeable future.

Application

of blockchain technology (NFT) in real estate industry

In

the beginning of the third quarter of 2021, ALS acquired historical Rufus Rose House in downtown Atlanta through a standard property

purchase deal. It will partner with block-chain technology companies to issue Non-fungible Tokens (“NFT”) based on certain

derivative property rights (For example, the right to use the image of the property for business purpose). As of and by the end of this

reporting period, management has no reasonable ground to determine whether and/or when any of the projected NFT sales will be realized.

Management highlights the fact that ALS acquired Rufus Rose House on the basis of its commercial value as an office building, and any

sales from NFTs will provide extra return on this investment.

US

stock market and concerns of recession on US economy

There

has been an ongoing concern of a possible recession on US economy in the past two years, and it appears to us that the concern grows

stronger in the first half of 2022. The US stock market experienced another downward adjustment, which had negative impact on the marketable

securities we held, resulting in a $490,000 unrealized loss. As and by the end of June 30, 2022, we still hold marketable securities

of a value of $360,000, which is subject to continuous volatility of the stock market.

Critical

accounting estimates

Since

our inception, we have adopted fair market value accounting under ASC (Accounting Standards Codification) 946-10-15. The fair market

value of our portfolio properties is assessed and reassessed each and every year by the end of fiscal year, using one of the following

methods: 1) independent appraisals conducted by licensed and independent third parties; 2) executed contracts which provides definitive

amount of selling a property, discounted to current value; or 3) cost-based valuation when there are no other reasonable methods available.

On

March 22, 2022, the management of UC Asset LP (the “Company”) was notified that the US Security and Exchange Commission (the

“SEC”) objected to the Company’s conclusion that UC Asset LP and its subsidiaries met the criteria to apply fair market

value accounting. As a result, the Company has changed to historical cost accounting for our financial statements, including the financial

statements contained in this filing.

Our

investment strategy is innovative, and there are usually no pre-defined cycles for our investments. It may take as short as a few weeks,

or as long as several years, before we complete an investment cycle and sell a portfolio property. During our holding period, a property

usually does not produce much cash income, or no cash income at all. Since we are using historic cost as our bookkeeping method, our

book will likely show the property as losing money, until the moment when we sell the property. Only then will we be able to book all

the profit (if any) accumulated over the whole period of investment cycle. This will constantly result in irregularity and volatility

of our booked revenue and profit, as long as we still apply historical cost accounting.

Item

2. Other Information

Not

applicable for the reporting period.

Item

3. Financial Statements

INDEX

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

UC

ASSET, LP

Condensed

Consolidated Balance Sheets

| | |

June 30,

2022 | | |

December 31,

2021 | |

| ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 387,331 | | |

$ | 1,256,371 | |

| Marketable equity securities held for sale | |

| 360,000 | | |

| 850,000 | |

| Real estate held for sale | |

| 672,399 | | |

| 657,188 | |

| Real estate held for renovation/remodel | |

| 2,563,461 | | |

| 2,383,475 | |

| Real estate held for rental, net of accumulated depreciation | |

| 448,977 | | |

| 420,638 | |

| Loans to third parties | |

| 1,771,815 | | |

| 1,519,815 | |

| Loans to related parties | |

| 24,876 | | |

| 357,675 | |

| Property and equipment, net | |

| 1,833 | | |

| 2,833 | |

| Prepaid expenses and other assets | |

| 14,488 | | |

| 31,614 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 6,245,180 | | |

$ | 7,479,609 | |

| | |

| | | |

| | |

| LIABILITIES AND PARTNERS’ CAPITAL | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 1,213 | | |

$ | 1,214 | |

| Mortgage loan | |

| 400,000 | | |

| 400,000 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 401,213 | | |

| 401,214 | |

| | |

| | | |

| | |

| Partners’ Capital: | |

| | | |

| | |

Series A preferred units, 0 and 166,667 issued and outstanding at June 30, 2022

and December 31,2021 | |

| - | | |

| 300,000 | |

Common units 5,485,025 issued and outstanding at June 30, 2022 and

December 31,2021 | |

| 5,843,967 | | |

| 6,778,395 | |

| | |

| | | |

| | |

| Total Partner’s Capital | |

| 5,843,967 | | |

| 7,078,395 | |

| | |

| | | |

| | |

| Total Liabilities and Partners’ Capital | |

$ | 6,245,180 | | |

$ | 7,479,609 | |

UC

ASSET, LP

Condensed

Consolidated Statements of Operations

Six

months ended June 30,

(unaudited)

| | |

2022 | | |

2021 | |

| INCOME | |

| | |

| |

| Sales of homes | |

$ | - | | |

$ | 1,909,644 | |

| Unrealized loss on marketable equity securities | |

| (490,000 | ) | |

| | |

| Rental income | |

| 7,500 | | |

| 61,242 | |

| Interest income | |

| 64,800 | | |

| 93,065 | |

| | |

| | | |

| | |

| Total income | |

| (417,700 | ) | |

| 2,063,951 | |

| | |

| | | |

| | |

| COST OF SALES | |

| | | |

| | |

| Cost of sales | |

| - | | |

| 1,930,455 | |

| | |

| | | |

| | |

| Total cost of sales | |

| - | | |

| 1,930,455 | |

| | |

| | | |

| | |

| Gross Margin | |

| (417,700 | ) | |

| 133,496 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Management fees | |

| 90,000 | | |

| 90,575 | |

| Professional fees | |

| 100,134 | | |

| 79,701 | |

| Other general and administrative | |

| 179,876 | | |

| 69,926 | |

| Interest expense | |

| 8,973 | | |

| - | |

| Loss on disposal of asset | |

| 39,100 | | |

| - | |

| Depreciation | |

| 8,439 | | |

| 44,407 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 426,522 | | |

| 284,609 | |

| | |

| | | |

| | |

| Net increase (decrease) in net assets from operations | |

$ | (844,222 | ) | |

$ | (151,113 | ) |

| | |

| | | |

| | |

| Net increase in net assets per unit | |

$ | (0.15 | ) | |

$ | (0.03 | ) |

| Weighted average units outstanding | |

| 5,485,025 | | |

| 5,635,306 | |

UC ASSET, LP

Condensed Consolidated Statement of Partners’ Capital

For the six months ended June 30, 2022

(unaudited)

| | |

Limited

Partners

Common

Units | | |

Limited

Partners

Preferred A

Units | | |

Limited

Partners

Common

Units

Amount | | |

Limited

Partners

Preferred A

Units

Amount | | |

Total Partners’ Equity | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE, January 1, 2022

| |

| 5,485,025 | | |

| 166,667 | | |

$ | 6,778,395 | | |

$ | 300,000 | | |

$ | 7,078,395 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cancellation of Preferred Series A units | |

| - | | |

| (166,667 | ) | |

| - | | |

| (300,000 | ) | |

| (300,000 | ) |

| Dividend distribution | |

| - | | |

| - | | |

| (90,206 | ) | |

| - | | |

| (90,206 | ) |

| Net loss | |

| - | | |

| - | | |

| (844,222 | ) | |

| - | | |

| (844,222 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, June 30, 2022 | |

| 5,485,025 | | |

| - | | |

$ | 5,843,967 | | |

$ | - | | |

$ | 5,843,967 | |

UC ASSET, LP

Condensed Consolidated Statement of Partners’ Capital

For the six months ended June 30, 2021

(unaudited)

| | |

Limited Partners Common Units | | |

Limited

Partners

Preferred A

Units | | |

Limited

Partners

Common

Units

Amount | | |

Limited

Partners

Preferred A

Units

Amount | | |

Total Partners’ Equity | |

| | |

| | |

| | |

| | |

| | |

| |

| BALANCE, January 1, 2021 | |

| 5,635,306 | | |

| 166,667 | | |

$ | 8,622,529 | | |

$ | 300,000 | | |

$ | 8,922,529 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net change in net assets from operations | |

| - | | |

| - | | |

| (257,426 | ) | |

| - | | |

| (257,426 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, June 30, 2021 | |

| 5,635,306 | | |

| 166,667 | | |

$ | 8,365,103 | | |

$ | 300,000 | | |

$ | 8,665,103 | |

UC

ASSET, LP

Condensed

Consolidated Statements of Cash Flows

Six

months ended June 30,

(unaudited)

| | |

2022 | | |

2021 | |

| CASH

FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net

decrease in net assets from operations | |

$ | (844,222 | ) | |

$ | (151,113 | ) |

Adjustments

to reconcile net decrease in net assets from operations to net

cash provided by (used in) operating activities: | |

| | | |

| | |

| Net

unrealized loss on marketable equity securities | |

| 490,000 | | |

| - | |

| Loss

on asset disposal | |

| 39,100 | | |

| - | |

| Amortization

of prepaid expense | |

| 17,126 | | |

| 26,939 | |

| Depreciation | |

| 8,439 | | |

| 44,407 | |

| Changes

in working capital items | |

| | | |

| | |

| Accrued

interest receivable | |

| (62,800 | ) | |

| (90,411 | ) |

| Deposits

and other assets | |

| - | | |

| (262 | ) |

| | |

| | | |

| | |

| Net

cash used in operating activities | |

| (352,357 | ) | |

| (170,440 | ) |

| | |

| | | |

| | |

| CASH

FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Investment

in portfolio properties | |

| (235,477 | ) | |

| (768,321 | ) |

| Sale

of portfolio properties | |

| - | | |

| 1,909,643 | |

| Investments

in portfolio loans | |

| (200,000 | ) | |

| (100,000 | ) |

| Repayments

of portfolio loans | |

| - | | |

| 24,000 | |

| Dividend

payment | |

| (90,206 | ) | |

| - | |

| Repayments

of portfolio loans, related party | |

| 9,000 | | |

| 6,877 | |

| | |

| | | |

| | |

| Net

cash provided by investing activities | |

| (516,683 | ) | |

| 1,072,199 | |

| | |

| | | |

| | |

| CASH

FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Cash

received from mortgage loan on portfolio property | |

| - | | |

| 400,000 | |

| | |

| | | |

| | |

| Net

cash provided by financing activities | |

| - | | |

| 400,000 | |

| | |

| | | |

| | |

| Net

increase in cash and cash equivalents | |

| (869,040 | ) | |

| 1,301,759 | |

| | |

| | | |

| | |

| Cash

and cash equivalents, beginning of period | |

| 1,256,371 | | |

| 1,419,710 | |

| | |

| | | |

| | |

| Cash

and cash equivalents, end of period | |

$ | 387,331 | | |

$ | 2,721,469 | |

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Information

as to the six months ended June 30, 2022 is unaudited)

NOTE

1 - ORGANIZATION AND NATURE OF OPERATIONS

UC

Asset, LP (the “Partnership”) is a Delaware Limited Partnership formed for the purpose of making capital investments with

a focus on growth-equity investments and real estate. The Partnership was formed on February 1, 2016.

The

Partnership is managed by its General Partner, UCF Asset LLC.

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a)

Basis of accounting The Partnership prepares its financial statements on the accrual basis in accordance with accounting principles

generally accepted in the United States. Purchases and sales of investments are recorded upon the closing of the transaction. Investments

are recorded at fair value with unrealized gains and losses reflected in the statement of changes in net assets.

The

accompanying unaudited condensed interim financial statements have been prepared in accordance with Generally Accepted Accounting Principles

("GAAP") in the United States of America ("U.S.") as promulgated by the Financial Accounting Standards Board ("FASB")

Accounting Standards Codification ("ASC") and with the rules and regulations of the U.S. Securities and Exchange Commission

("SEC"). In our opinion, the accompanying unaudited interim financial statements contain all adjustments (which are of a normal

recurring nature) necessary for a fair presentation. Operating results for the six months ended June 30, 2022 are not necessarily indicative

of the results that may be expected for the year ending December 31, 2022

(b)

Principles of Consolidation The Partnership’s consolidated financial statements include the financial statements of UC Asset,

LP and its wholly owned subsidiaries: Atlanta Landsight, LLC, SHOC Holdings LLC, Hotal Service LLC and OK4ZO Properties LLC. All intercompany

balances and transactions have been eliminated.

(c)

Use of estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclose

contingent assets and liabilities at the date of the financial statements and report amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

(d)

Fair value measurements The Partnership records and carries its investments at fair value, defined as the price the Partnership would

receive to sell the asset in an orderly transaction with a market participant at the balance sheet date. In the absence of active markets

for the identical assets, such measurements involve the development of assumptions based on market observable data and, in the absence

of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs

at the balance sheet date.

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

(d)

Fair value measurements, continued

Observable

inputs reflect market data obtained from independent sources, while unobservable inputs reflect management’s market assumptions.

Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level

1: Quoted prices in active markets for identical assets or liabilities.

Level

2: Quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not

active, and model derived valuations whose inputs are observable or whose significant value drivers are observable

Level

3: Significant inputs to the valuation model are unobservable

The

General Partner maintains policies and procedures to value instruments using the best and most relevant data available. In addition,

The General partner reviews valuations, including independent price validation for certain instruments. Further, in other instances,

independent pricing vendors are obtained to assist in valuing certain instruments.

(e)

Cash and equivalents The Partnership considers all highly liquid debt instruments with original maturities of three (3) months or

less to be cash equivalents.

(f)

Investments The Partnership’s core activity is to make investments in real estate properties. Excess funds are held in financial

institutions.

Investments

in short term loans are recorded at fair value, which are their stated amount due to their short-term maturity and modest interest rates.

Portfolio investments are recorded at their estimated fair value, as determined in good faith by the General Partner of the Partnership.

Unrealized gains and losses are recognized in earnings.

The

estimated fair value of investments as determined by the General Partner was $7,436,461 and $8,523,230 representing 87.98% and 93.53%

of partners’ capital at June 30, 2022 and December 31, 2021, whose values have been estimated by the General Partner in the absence

of readily ascertainable market values. Due to the inherent uncertainty of valuation, the General Partner’s determination of values

may differ significantly from values that would have been realized had a ready market for the investments existed, and the differences

could be material. The 100 million shares of Puration Inc. common stock received to settle accrued interest on the $1.2 million note

are valued on a mark to market basis as they are held for sale.

(g)

Federal Income taxes As a limited partnership, the Partnership is not a taxpaying entity for federal or state income tax purposes;

accordingly, a provision for income taxes has not been recorded in the accompanying financial statements. Partnership income or losses

are reflected in the partners’ individual or corporate tax returns in accordance with their ownership percentages.

As

defined by Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 740, Income Taxes, no provision or liability

for materially uncertain tax positions was deemed necessary by management. Therefore, no provision or liability for uncertain tax positions

has been included in these financial statements. Generally, the Partnerships tax returns remain open for three years for federal income

tax examination.

(h)

Income Interest income from portfolio investments is recorded as accrued.

(i)

Reclassification Certain prior period items have been reclassified to conform with the current period presentation.

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

(j)

Recent Accounting Pronouncements Partnership management does not believe that any recently issued, but not yet effective accounting

pronouncements, if adopted, would have a material effect on the accompanying financial statements.

NOTE

3 - LIQUIDITY AND GOING CONCERN CONSIDERATIONS

The

Partnership’s consolidated financial statements have been prepared on a going concern basis, which contemplates the realization

of assets and the settlement of liabilities and commitments in the normal course of business. The Partnership sustained a net operating

loss of approximately $844,222 and cash use of $352,357 from operations for the six months ended June 30, 2022. These conditions raise

substantial doubt about our ability to continue as a going concern. The accompanying condensed consolidated financial statements do not

include any adjustments that might be necessary if we are unable to continue as a going concern.

NOTE

4 - FAIR VALUE OF FINANCIAL INSTRUMENTS

(a)

Cash and Cash Equivalents The fair value of financial instruments that are short-term and that have little or no risk are considered

to have a fair value equal to book value.

(b)

Unsecured Loan Investments The fair value of short-term unsecured loans are considered to have a fair value equal to book value due

to the short-term nature and market rate of interest commensurate with the level of credit risk. At June 30, 2022 and December 31, 2021,

there were $600,000 and $700,000 in loans, respectively.

(c)

Portfolio Investments The portfolio investments consist of member equity interests which are not publicly traded. The General Partner

(“GP”) uses the investee entity’s real estate valuation reports as a basis for valuation when there is limited, or

no, relevant market activity for a specific instrument or for other instruments that share similar characteristics. Portfolio investments

priced by reference to valuation reports are included in Level 3. The GP conducts internal reviews of pricing to ensure reasonableness

of valuations used. Based on the information available, management believes that the fair values provided are representative of prices

that would be received to sell the individual assets at the measurement date (exit prices).

The

fair values of the investee entity’s assets are determined in part by placing reliance on third-party valuations of the properties

and/or third party approved internally prepared analyses of recent offers or prices on comparable properties in the proximate vicinity.

The third-party valuations and internally developed analyses are significantly impacted by the local market economy, market supply and

demand, competitive conditions and prices on comparable properties, adjusted for anticipated date of sale, location, property size, and

other factors. Each property is unique and is analyzed in the context of the particular market where the property is located. In order

to establish the significant assumptions for a particular property, the GP analyzes historical trends, including trends achieved by the

GP's operations, if applicable, and current trends in the market and economy impacting the property. These methods use unobservable inputs

to develop fair value for the GP’s properties. Due to the volume and variance of unobservable inputs, resulting from the uniqueness

of each of the GP's properties, the GP does not use a standard range of unobservable inputs with respect to its evaluation of properties.

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

4 - FAIR VALUE OF FINANCIAL INSTRUMENTS, continued

(c)

Portfolio Investments, continued

Changes

in economic factors, consumer demand and market conditions, among other things, could materially impact estimates used in the third-party

valuations and/or internally prepared analyses of recent offers or prices on comparable properties. Thus, estimates can differ significantly

from the amounts ultimately realized by the investee segment from disposition of these assets.

The

following tables present the fair values of assets and liabilities measured on a recurring basis:

| At June

30, 2022 | |

| | |

Fair

Value Measurement at Reporting Date Using | |

| | |

Fair

Value | | |

Quoted

Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1) | | |

Significant

Other

Observable

Inputs

(Level 2) | | |

Significant

Unobservable

Inputs

(Level 3) | |

| Atlanta Landsight,

LLC | |

$ | 5,557,667 | | |

$ | - | | |

$ | - | | |

$ | 5,557,667 | |

| SHOC Holdings LLC | |

| 1,500,000 | | |

| - | | |

| - | | |

| 1,500,000 | |

| Short

term loans | |

| 665,148 | | |

| - | | |

| - | | |

| 665,148 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total

Assets | |

$ | 7,722,815 | | |

$ | - | | |

$ | - | | |

$ | 7,722,815 | |

| At December

31, 2021 | |

| | |

Fair

Value Measurement at Reporting Date Using | |

| | |

Fair

Value | | |

Quoted

Prices in

Active Markets

for Identical

Assets/Liabilities

(Level 1) | | |

Significant

Other

Observable

Inputs

(Level 2) | | |

Significant

Unobservable

Inputs

(Level 3) | |

| Atlanta

Landsight, LLC | |

$ | 6,009,667 | | |

$ | - | | |

$ | - | | |

$ | 6,009,667 | |

| SHOC Holdings

LLC | |

| 1,500,000 | | |

| - | | |

| - | | |

| 1,500,000 | |

| Short

term loans | |

| 779,448 | | |

| - | | |

| - | | |

| 779,448 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total

Assets | |

$ | 8,289,115 | | |

$ | - | | |

$ | - | | |

$ | 8,289,115 | |

The

fair value measurements are subjective in nature, involve uncertainties and matters of significant judgment; therefore, the results cannot

be determined with precision, substantiated by comparison to independent markets and may not be realized in an actual sale or immediate

settlement of the instruments.

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

4 - FAIR VALUE OF FINANCIAL INSTRUMENTS, continued

(c)

Portfolio Investments, continued

There

may be inherent weaknesses in any calculation technique, and changes in the underlying assumptions used, including discount rates and

estimates of future cash flows, could significantly affect the results. For all of these reasons, the aggregation of the fair value calculations

presented herein do not represent, and should not be construed to represent, the underlying value of the Partnership.

Generally,

the fair value of the Atlanta investee’s properties is not sensitive to changes in unobservable inputs since generally the properties

are held for less than six months. Generally such changes in unobservable inputs take longer than six months to have an appreciable effect

of more than 1 to 2% on these properties fair value. The Dallas investee’s property is more sensitive to changes in unobservable

inputs because this property was acquired with a longer time horizon due to the nature of its size and undeveloped status.

The

following table presents the changes in Level 3 instruments measured on a recurring basis:

| Six Months Ended June 30, 2022 | |

Portfolio Investments | |

| January 1, 2022 | |

$ | 8,289,115 | |

| Total gains or losses (realized/unrealized): | |

| | |

| Included

in earnings | |

| (39,100 | ) |

| Included

in other comprehensive income | |

| - | |

| Purchases, issuance and settlements | |

| (527,200 | ) |

| Transfers in/out of Level 3

| |

| - | |

| | |

| | |

| March 31, 2021 | |

$ | 7,722,815 | |

| Year Ended December 31, 2021 | |

Portfolio Investments | |

| January 1, 2021 | |

$ | 7,434,296 | |

| Total gains or losses (realized/unrealized): | |

| | |

| Included

in earnings | |

| 1,149,594 | |

| Included

in other comprehensive income | |

| - | |

| Purchases, issuance and settlements | |

| (294,775 | ) |

| Transfers

in/out of Level 3 | |

| - | |

| | |

| | |

| December 31, 2021 | |

$ | 8,289,115 | |

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

5 - CONCENTRATIONS OF CREDIT RISK

a)

Cash Funds held by the Partnership are guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000.

The Partnership’s cash balance was in excess of FDIC insured limits by $137,332 and $933,224 at June 30, 2022 and December 31,

2021.

NOTE

6 - CAPITAL

The

Partnerships capital structure consists of one General Partner and 81 limited partners. The Partnerships total contributed capital was

$5,843,967 and $7,078,395, at June 30, 2022 and December 31, 2021, respectively. The limited partner common units are 5,485,025 at June

30, 2022 and December 31, 2021. The limited partner preferred Series A units are zero and 166,667 at June 30, 2022 and December 31, 2021.

The

Preferred Units carry the following rights and privileges:

| - | annual

dividend of $0.09 per unit, not to exceed the audited annual net increase to net assets from

operations |

| | | |

| - | carry

no voting rights |

| | | |

| - | preference

for dividends and in liquidation |

| | | |

| - | 12

months post issuance, redeemable at $0.50 per unit, if the market price of the common units

falls below $0.50 per unit for 20 consecutive trading days |

| | | |

| - | 12

months post issuance, convertible into common units on a variable conversion ratio 1.0:1.0

(if the lowest closing price of the common units is $1.80 or more for the 5 trading days

prior to conversion), up to 1.125:1.0 (if the lowest closing price of the common units is

$1.60 or less for the 5 trading days prior to conversion) |

| | | |

| - | conversion

and redemption price shall not be lower than the book value per common unit based on the

last audited book value per unit |

In

June 2022, the Partnership exchanged a Note receivable of $300,000 principal with $39,100 of accrued interest for the 166,667shares of

preferred Series A units, which were subsequently cancelled.

b)

Allocations of Profits and Losses The net profit of the Partnership is allocated to the Limited Partners in proportion to each partner’s

respective capital contribution on all liquidated portfolio investments made by the Partnership. Losses are allocated to all partners

in proportion to each partner’s respective capital contribution, provided that, to the extent profits had been previously allocated

in a manner other than in proportion to capital contributions, losses are allocated in the reverse order as such profits were previously

allocated.

The

GP participates in the profits of the Partnership at a rate of 20% above a 10% annualized return to the Limited Partners. Beginning January

1, 2020, the GP participates in the profits of the Partnership at a rate of 20% above an 8% annualized return to the Limited Partners.

NOTE

7 - MANAGEMENT FEES - RELATED PARTY

The

Partnership pays annual management fees to UCF Asset LLC. Management fees are calculated at 2.0% of audited book value on the first day

of the fiscal year, payable quarterly. Management fees were $90,000 and $90,5758 for the six months ended June 30, 2022 and 2021, respectively.

UC

ASSET, LP

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

8 - SUBSEQUENT EVENTS

(a)

Portfolio Investments In September 2022, the partnership, through its wholly owned subsidiary Atlanta Landsight LLC, repurchased

the land in Texas in exchange for the promissory note held by ALS in the amount of $950,000 with accrued interest of $147,250 and $252,750

in cash. This note was secured by the land.

(b)

Short-Term Debt In August 2022, the partnership issued a promissory note in exchange for $100,000 in cash. This note carries a maturity

date of November 29, 2022 and a 12% annual interest rate.

SIGNATURES

Pursuant

to the requirements of Regulation A, the Issuer has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

UC

Asset, LP

| By (Signature and Title) |

|

| |

|

| UCF Asset, LLC |

|

| |

|

| /s/ Gregory Bankston |

|

| Name: |

Gregory Bankston |

|

| Title: |

Managing Member |

|

| Date: |

October 11, 2022 |

|

Pursuant

to the requirements of Regulation A, this Report has been signed below by the following persons on behalf of the Issuer and in the capacities

and on the dates indicated.

| By (Signature and Title) |

|

| |

|

| /s/

Gregory Bankston, |

|

| Managing Member |

|

| UCF Asset, LLC |

|

| Date: |

October 11, 2022 |

|

| By (Signature and Title) |

|

| |

|

| /s/ Xianghong Wu, |

|

| Member of Majority Interest |

|

| UCF Asset, LLC |

|

| Date: |

October 11, 2022 |

|

7

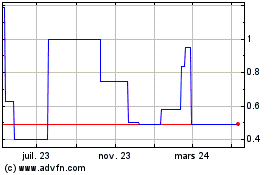

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025